Wrapping up Q3 earnings, we look at the numbers and key takeaways for the consumer internet stocks, including Skillz (NYSE: SKLZ) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 47 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

While some consumer internet stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.8% since the latest earnings results.

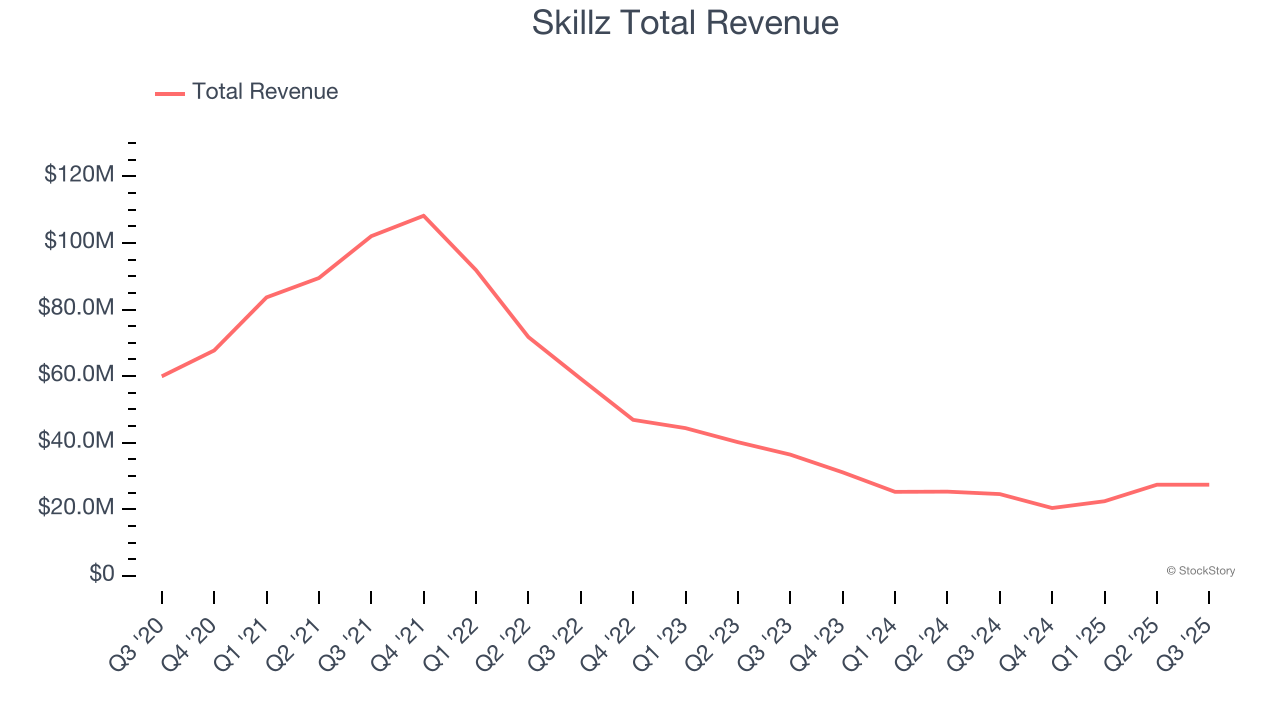

Skillz (NYSE: SKLZ)

Taking a new twist at video gaming, Skillz (NYSE: SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $27.37 million, up 11.4% year on year. This print fell short of analysts’ expectations by 5.8%. Overall, it was a slower quarter for the company with a significant miss of analysts’ revenue and EBITDA estimates.

“Skillz’s third quarter results reflect continued progress toward our goal of delivering consistent top-line growth and positive Adjusted EBITDA,” said Andrew Paradise, Chief Executive Officer of Skillz.

Skillz delivered the weakest performance against analyst estimates of the whole group. The company reported 155,000 monthly active users, up 28.1% year on year. Unsurprisingly, the stock is down 12.6% since reporting and currently trades at $5.56.

Read our full report on Skillz here, it’s free for active Edge members.

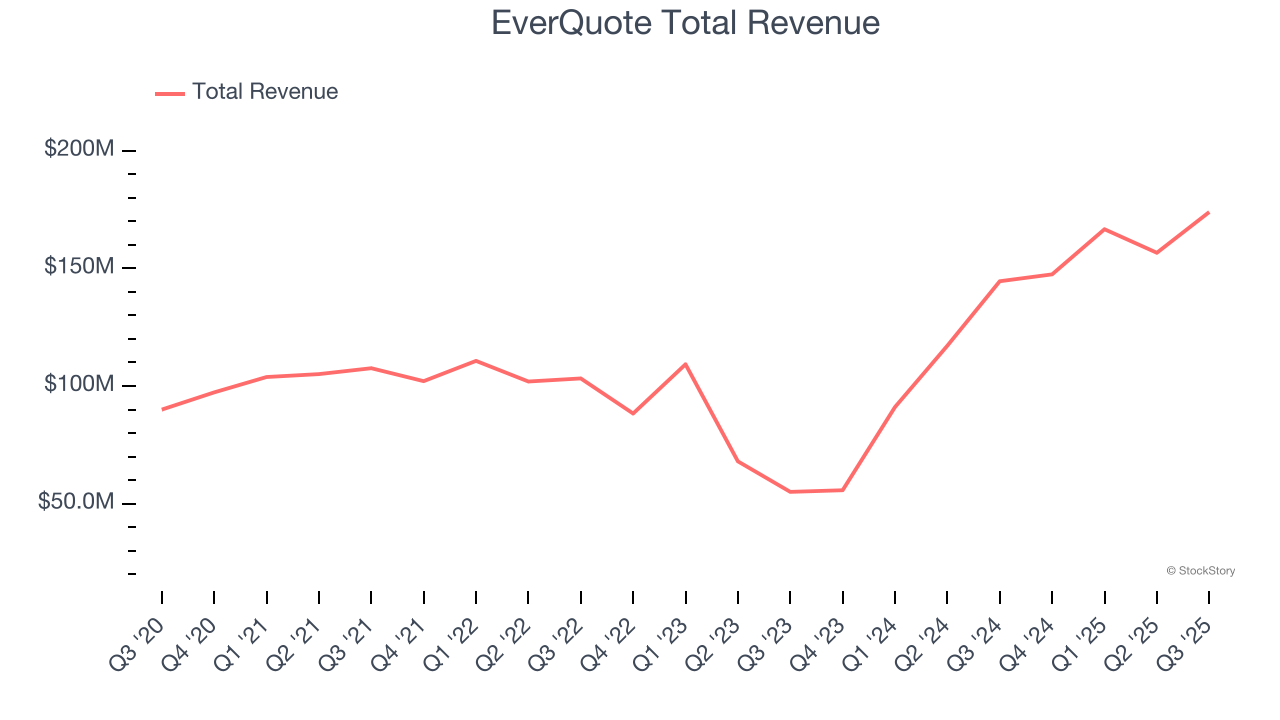

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $173.9 million, up 20.3% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 23.9% since reporting. It currently trades at $27.77.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: ACV Auctions (NYSE: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $199.6 million, up 16.5% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance slightly missing analysts’ expectations and full-year EBITDA guidance missing analysts’ expectations significantly.

As expected, the stock is down 3.1% since the results and currently trades at $7.90.

Read our full analysis of ACV Auctions’s results here.

Roku (NASDAQ: ROKU)

With a name meaning six in Japanese because it was the founder's sixth company that he started, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $1.21 billion, up 14% year on year. This print was in line with analysts’ expectations. Overall, it was a strong quarter as it also produced EBITDA guidance for next quarter exceeding analysts’ expectations and full-year EBITDA guidance exceeding analysts’ expectations.

The company reported 36.5 billion monthly active users, up 14.1% year on year. The stock is flat since reporting and currently trades at $94.78.

Read our full, actionable report on Roku here, it’s free for active Edge members.

Etsy (NASDAQ: ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $678 million, up 2.4% year on year. This number topped analysts’ expectations by 3.3%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

The company reported 93.16 million active buyers, down 3.7% year on year. The stock is down 30.5% since reporting and currently trades at $51.95.

Read our full, actionable report on Etsy here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.