Healthcare services provider AdaptHealth Corp. (NASDAQ: AHCO) beat Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 1.8% year on year to $777.9 million. On the other hand, the company’s full-year revenue guidance of $3.25 billion at the midpoint came in 0.5% below analysts’ estimates. Its GAAP loss of $0.05 per share was significantly below analysts’ consensus estimates.

Is now the time to buy AdaptHealth? Find out by accessing our full research report, it’s free.

AdaptHealth (AHCO) Q1 CY2025 Highlights:

- Revenue: $777.9 million vs analyst estimates of $764.8 million (1.8% year-on-year decline, 1.7% beat)

- EPS (GAAP): -$0.05 vs analyst estimates of $0.03 (significant miss)

- Adjusted EBITDA: $127.9 million vs analyst estimates of $127.3 million (16.4% margin, in line)

- The company dropped its revenue guidance for the full year to $3.25 billion at the midpoint from $3.29 billion, a 1.2% decrease

- EBITDA guidance for the full year is $685 million at the midpoint, in line with analyst expectations

- Operating Margin: 3%, down from 6.4% in the same quarter last year

- Free Cash Flow was -$58,000 compared to -$38.86 million in the same quarter last year

- Market Capitalization: $1.17 billion

“Amid elevated uncertainty in the external environment, we at AdaptHealth have stayed the course, with a relentless focus on improving our business and providing exceptional service to the 4.2 million patients that depend on us,” said Suzanne Foster, Chief Executive Officer of AdaptHealth.

Company Overview

With a network of approximately 680 locations serving patients across all 50 states, AdaptHealth (NASDAQ: AHCO) provides home medical equipment, supplies, and related services to patients with chronic conditions like sleep apnea, diabetes, and respiratory disorders.

Sales Growth

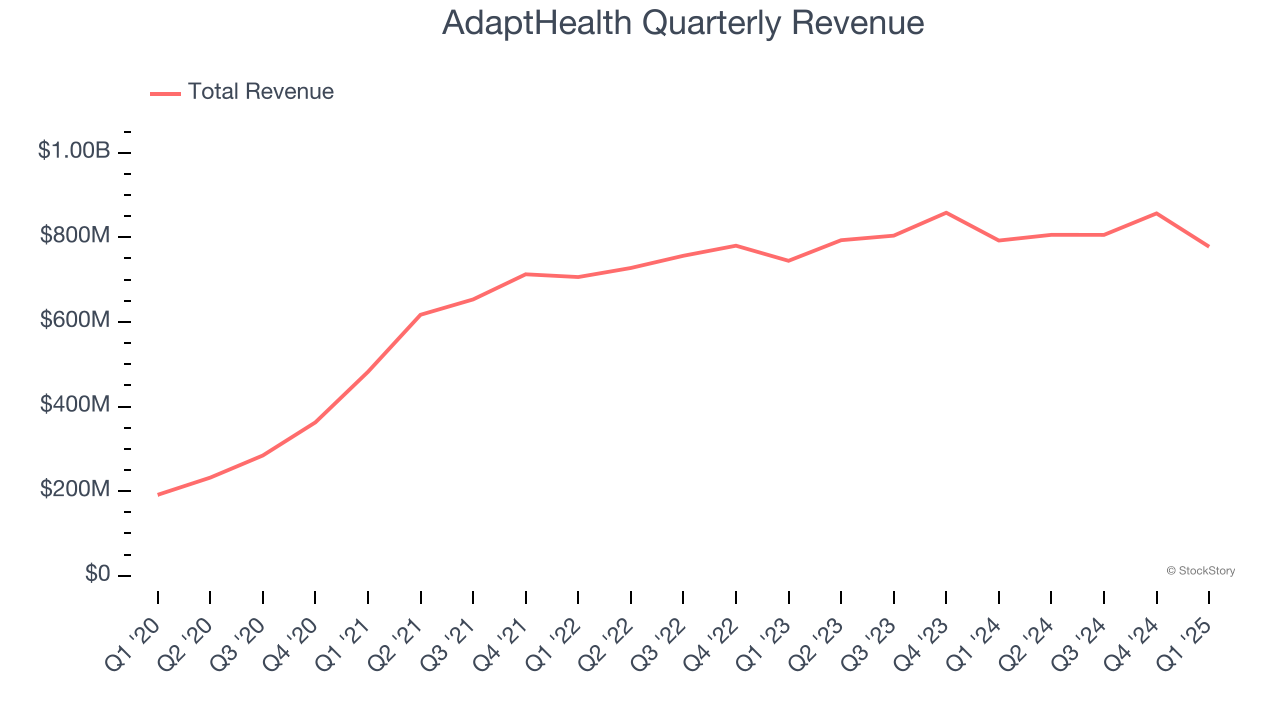

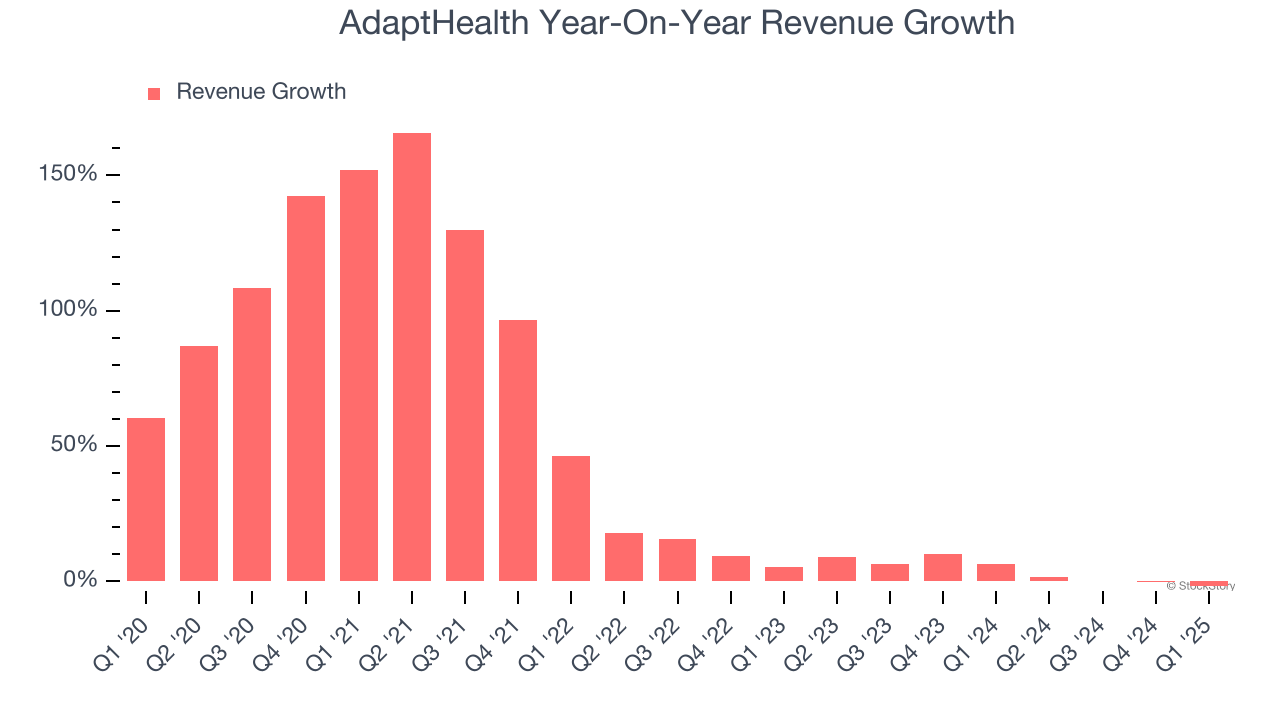

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, AdaptHealth’s 40.1% annualized revenue growth over the last five years was incredible. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. AdaptHealth’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.9% over the last two years was well below its five-year trend.

This quarter, AdaptHealth’s revenue fell by 1.8% year on year to $777.9 million but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

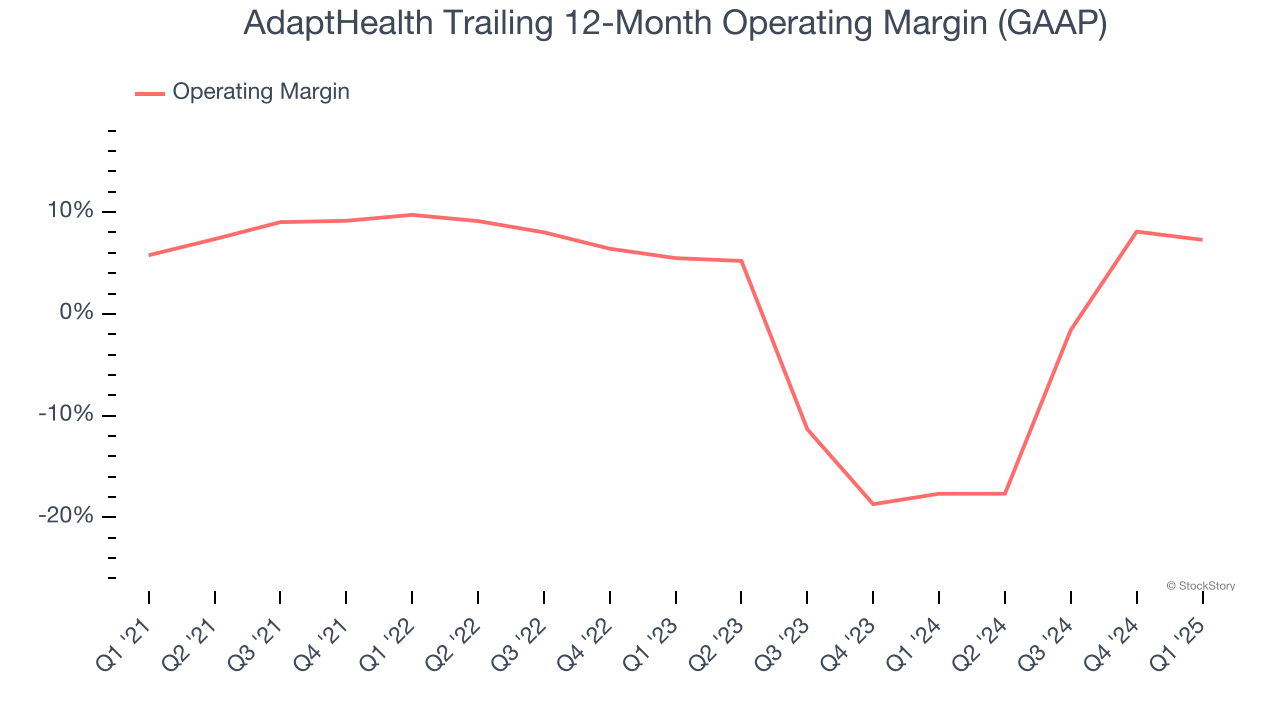

AdaptHealth was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.2% was weak for a healthcare business.

On the plus side, AdaptHealth’s operating margin rose by 1.5 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

This quarter, AdaptHealth generated an operating profit margin of 3%, down 3.4 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

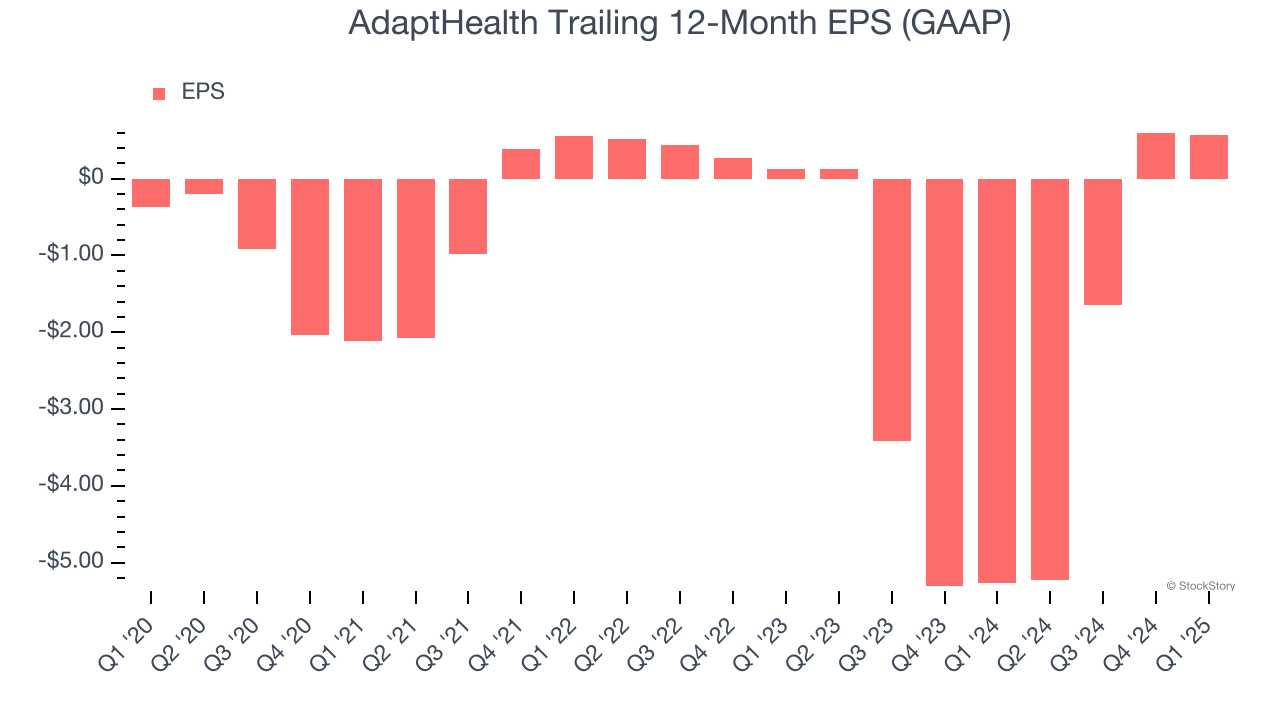

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AdaptHealth’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, AdaptHealth reported EPS at negative $0.05, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects AdaptHealth’s full-year EPS of $0.57 to grow 79.6%.

Key Takeaways from AdaptHealth’s Q1 Results

It was encouraging to see AdaptHealth beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed significantly and it lowered its full-year revenue guidance. Overall, this was a softer quarter, but the stock traded up 13.2% to $9.85 immediately following the results.

Is AdaptHealth an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.