Over the past six months, Hubbell’s stock price fell to $398.72. Shareholders have lost 6.6% of their capital, which is disappointing considering the S&P 500 has climbed by 1.1%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is this a buying opportunity for HUBB? Find out in our full research report, it’s free.

Why Does Hubbell Spark Debate?

A respected player in the electrical segment, Hubbell (NYSE: HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

Two Things to Like:

1. Operating Margin Rising, Profits Up

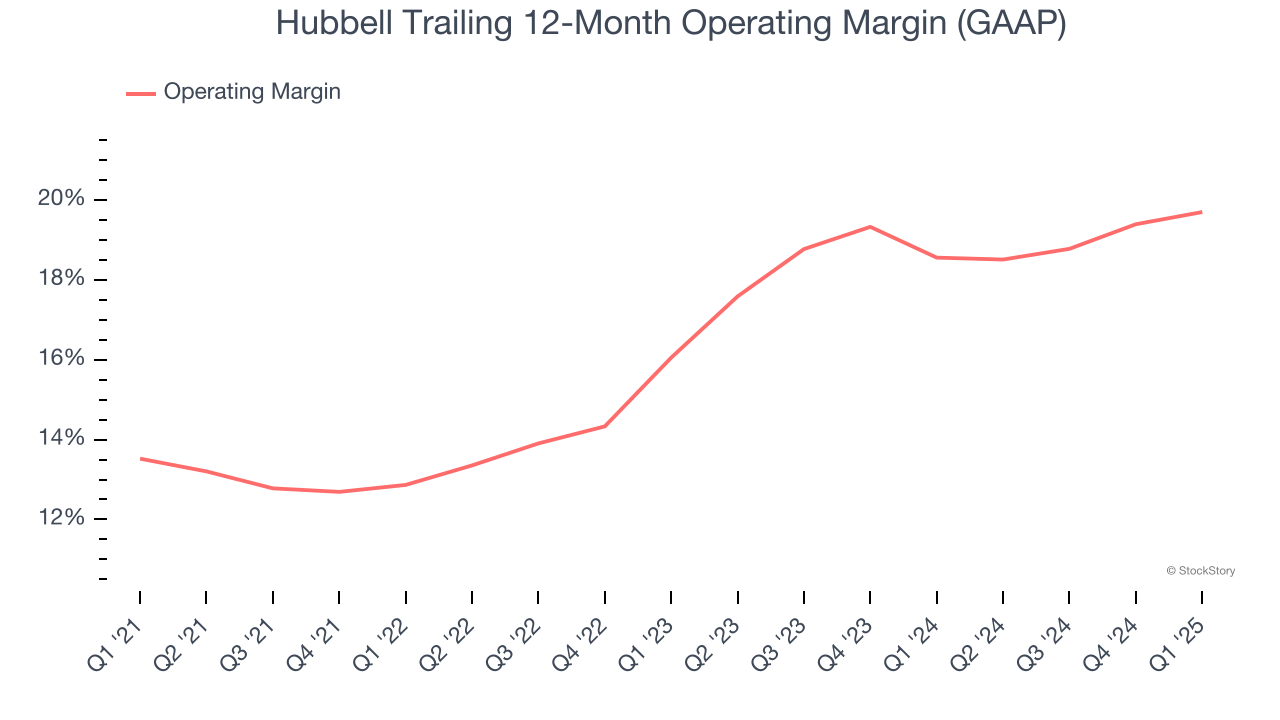

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, Hubbell’s operating margin rose by 6.2 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 19.7%.

2. Stellar ROIC Showcases Lucrative Growth Opportunities

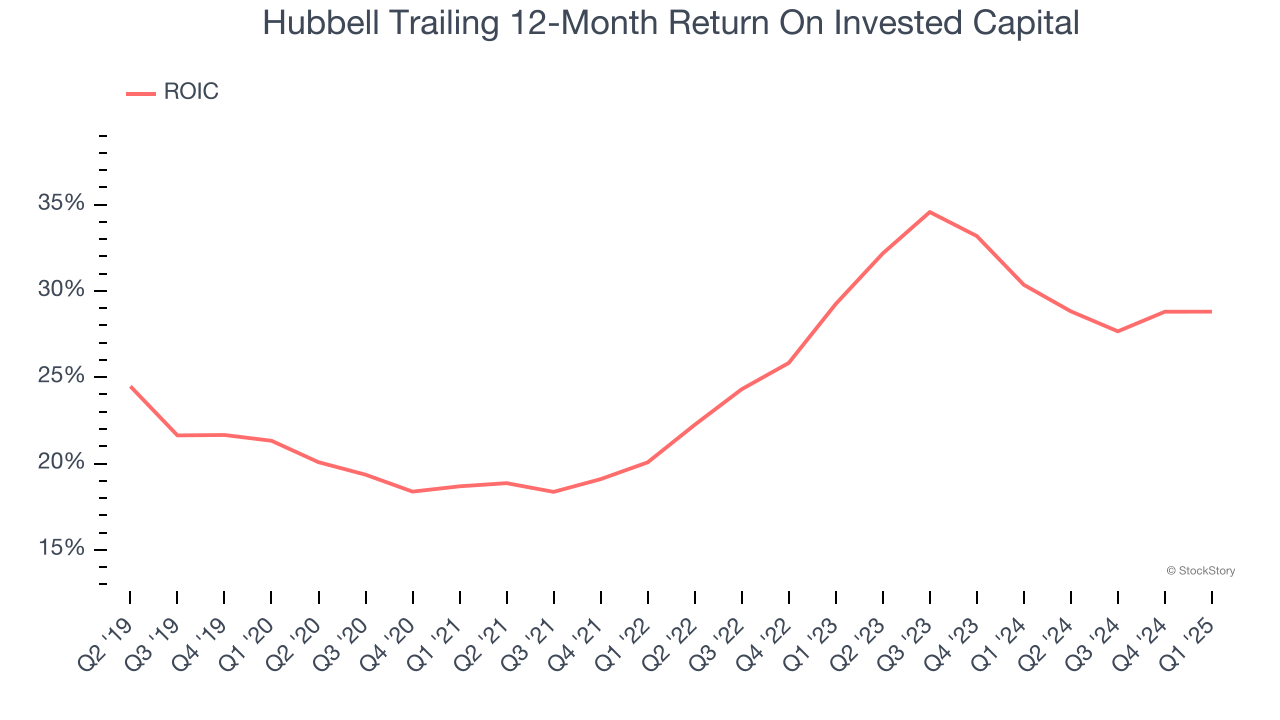

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Hubbell’s five-year average ROIC was 25.4%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

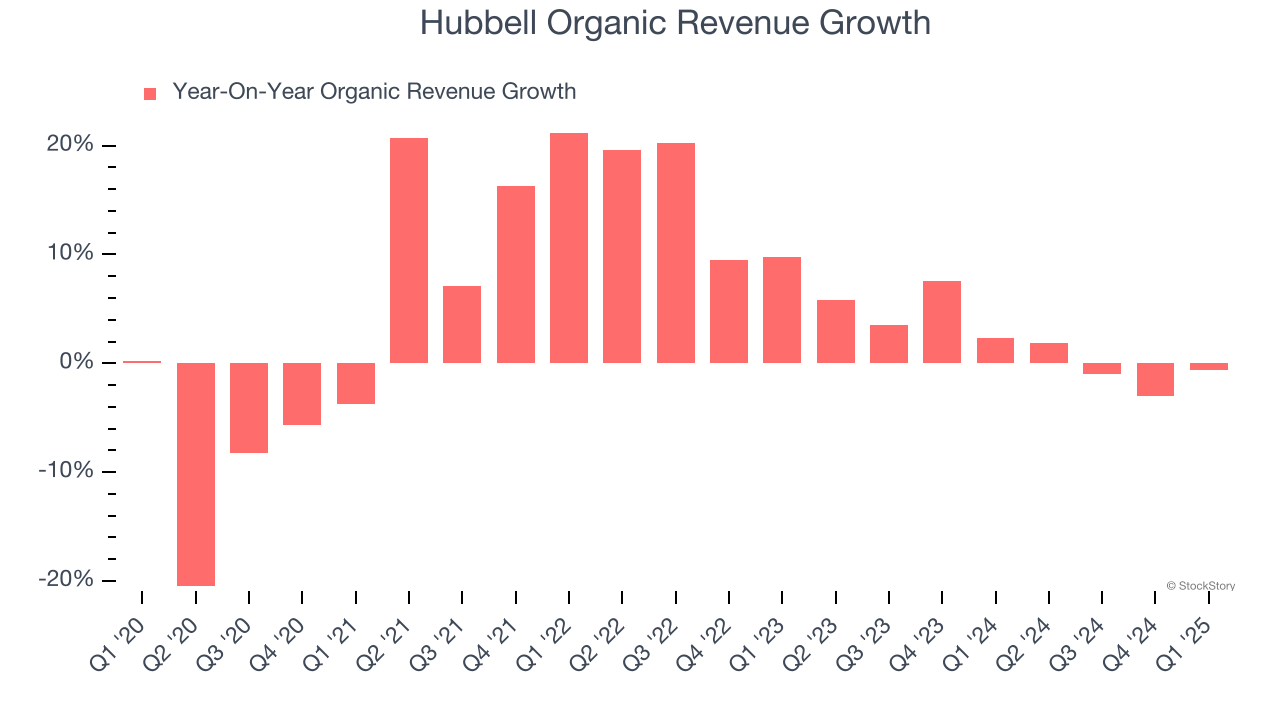

In addition to reported revenue, organic revenue is a useful data point for analyzing Electrical Systems companies. This metric gives visibility into Hubbell’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Hubbell’s organic revenue averaged 2.1% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Hubbell’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 22.3× forward P/E (or $398.72 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Hubbell

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.