Intuitive Machines, LLC (“Intuitive Machines” or the “Company”), a leading space exploration, infrastructure, and services company, and Japan-based robotics company, Dymon Co., Ltd. (“Dymon”), have signed an agreement to fly Dymon’s Yaoki rover on Intuitive Machines’ second mission to the Moon.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230105005396/en/

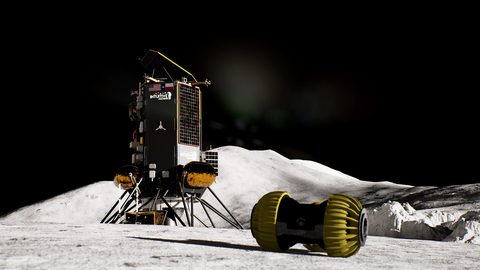

Intuitive Machines, LLC, a leading space exploration, infrastructure, and services company, and Japan-based robotics company, Dymon Co., Ltd., have signed an agreement to fly Dymon’s Yaoki rover on Intuitive Machines’ second mission to the Moon. (Photo: Intuitive Machines)

Yaoki is expected to be flown to the lunar south pole on board Intuitive Machines’ Nova-C lunar lander in the second half of 2023. After landing, Yaoki is expected to deploy from Nova-C to demonstrate Dymon’s lunar mobility technology designed by its Founder and Chief Executive Officer, Shin-ichiro Nakajima.

The agreement with Dymon leverages Intuitive Machines’ Lunar Access Services and Lunar Data Services business segments to land the Yaoki rover on the Moon and control it via secure lunar communications.

“The commercial demand for lunar access is growing with each of Intuitive Machines’ four planned missions,” said Steve Altemus, Co-Founder, President, and Chief Executive Officer of Intuitive Machines. “The addition of Dymon’s Yaoki rover is another critical step towards Intuitive Machines participating in the creation and definition of the lunar economy.”

As previously announced on September 16, 2022, Intuitive Machines signed a definitive business combination agreement with Inflection Point Acquisition Corp. (Nasdaq: IPAX, IPAXU, IPAXW) (“Inflection Point”), a publicly traded special purpose acquisition company, that is expected to result in Intuitive Machines becoming publicly listed. Completion of the transaction is subject to approval by Inflection Point’s shareholders, the registration statement on Form S-4 (the “Registration Statement”) being declared effective by the Securities and Exchange Commission (the “SEC”), and other customary closing conditions.

About Intuitive Machines

Intuitive Machines is a diversified space company focused on space exploration. Intuitive Machines supplies space products and services to support sustained robotic and human exploration to the Moon, Mars, and beyond. Intuitive Machines’ products and services are offered through our four business units: Lunar Access Services, Orbital Services, Lunar Data Services, and Space Products and Infrastructure. For more information, please visit intuitivemachines.com.

About Inflection Point

Inflection Point is a blank check company formed for the purpose of identifying and partnering with North American and European businesses in the consumer and technology sectors. Inflection Point’s financial sponsor is an affiliate of Kingstown Capital Management, LP, an investment firm. For more information, please visit inflectionpointacquisition.com.

Additional Information and Where to Find It

This press release relates to a proposed transaction between Intuitive Machines and Inflection Point (the “Business Combination”). In connection with the Business Combination, Inflection Point has filed a Registration Statement with the SEC (as amended by Amendment No. 1 to the Registration Statement, filed on December 1, 2022), which includes a preliminary proxy statement/prospectus to be distributed to holders of Inflection Point’s ordinary shares in connection with Inflection Point’s solicitation of proxies for the vote by Inflection Point’s shareholders with respect to the Business Combination and other matters as described in the Registration Statement, as well as a prospectus relating to the offer of securities to be issued to Intuitive Machines equity holders in connection with the Business Combination. After the Registration Statement has been declared effective, Inflection Point will mail a copy of the definitive proxy statement/prospectus, when available, to its shareholders. The Registration Statement includes information regarding the persons who may, under the SEC rules, be deemed participants in the solicitation of proxies to Inflection Point’s shareholders in connection with the Business Combination. Inflection Point will also file other documents regarding the Business Combination with the SEC. Before making any voting decision, investors and security holders of Inflection Point and Intuitive Machines are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant documents filed or that will be filed with the SEC in connection with the Business Combination as they become available because they will contain important information about the Business Combination.

Investors and security holders will be able to obtain free copies of the Registration Statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Inflection Point through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Inflection Point may be obtained free of charge from Inflection Point’s website at www.inflectionpointacquisition.com or by written request to Inflection Point at Inflection Point Acquisition Corp., 34 East 51st Street, 5th Floor, New York, NY 10022

No Offer or Solicitation

This press release is for informational purposes only and shall neither constitute an offer to sell nor the solicitation of an offer to buy any securities, nor a solicitation of a proxy, vote, consent or approval in any jurisdiction in connection with the Business Combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdictions. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom.

Forward Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws with respect to the Business Combination. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of Inflection Point’s securities, (ii) the risk that the Business Combination may not be completed by Inflection Point’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Inflection Point, (iii) the failure to satisfy the conditions to the consummation of the Business Combination, including the receipt of the requisite approvals of Inflection Point’s shareholders and Intuitive Machines’ equity holders, respectively, and the receipt of certain governmental and regulatory approvals, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement, (v) the effect of the announcement or pendency of the Business Combination on Intuitive Machines’ business relationships, performance, and business generally, (vi) risks that the Business Combination disrupts current plans of Intuitive Machines and potential difficulties in Intuitive Machines employee retention as a result of the Business Combination, (vii) the outcome of any legal proceedings that may be instituted against Intuitive Machines or against Inflection Point related to the agreement and plan of merger or the Business Combination, (viii) the ability to maintain the listing of Inflection Point’s securities on Nasdaq, (ix) the price of Inflection Point’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Intuitive Machines plans to operate, variations in performance across competitors, changes in laws and regulations affecting Intuitive Machines’ business and changes in the combined capital structure, (x) the ability to implement business plans, forecasts, and other expectations after the completion of the Business Combination and identify and realize additional opportunities, (xi) the impact of the global COVID-19 pandemic, (xii) the market for commercial human spaceflight has not been established with precision, it is still emerging and may not achieve the growth potential Intuitive Machines expects or may grow more slowly than expected, (xiii) space is a harsh and unpredictable environment where Intuitive Machines’ products and service offerings are exposed to a wide and unique range of environmental risks, which could adversely affect Intuitive Machines’ launch vehicle and spacecraft performance, (xiv) Intuitive Machines’ business with various governmental entities is subject to the policies, priorities, regulations, mandates and funding levels of such governmental entities and may be negatively or positively impacted by any change thereto, (xv) Intuitive Machines’ limited operating history makes it difficult to evaluate its future prospects and the risks and challenges they may encounter and (xvi) other risks and uncertainties described in Inflection Point’s registration statement on Form S-1 (File No. 333-253963), which was originally filed with the SEC on September 21, 2021 (the “Form S-1”), in its Annual Report on Form 10-K for the year ended 2021 and its subsequent Quarterly Reports on Form 10-Q, the Registration Statement and Amendment No. 1 to the Registration Statement filed with the SEC on December 1, 2022, the proxy statement/prospectus contained therein, and any other documents filed by Inflection Point from time to time with the SEC. The foregoing list of factors is not exhaustive. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Form S-1, the Annual Report on Form 10-K for the year ended 2021, the Quarterly Reports on Form 10-Q, the Registration Statement, the proxy statement/prospectus contained therein, and the other documents filed by Inflection Point from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These risks and uncertainties may be amplified by the COVID-19 pandemic, which has caused significant economic uncertainty. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Intuitive Machines and Inflection Point assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities and other applicable laws. Neither Intuitive Machines nor Inflection Point gives any assurance that either Intuitive Machines or Inflection Point, respectively, will achieve its expectations.

Participants in the Solicitation

Inflection Point and Intuitive Machines and their respective directors and officers may be deemed to be participants in the solicitation of proxies from Inflection Point’s shareholders in connection with the Business Combination. Information about Inflection Point’s directors and executive officers and their ownership of Inflection Point’s securities is set forth in Inflection Point’s filings with the SEC. To the extent that holdings of Inflection Point’s securities have changed since the amounts printed in Inflection Point’s Annual Report on Form 10-K for the year ended 2021, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the Business Combination may be obtained by reading the proxy statement/prospectus regarding the Business Combination when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230105005396/en/

Contacts

For investor inquiries:

investors@intuitivemachines.com

For media inquiries:

press@intuitivemachines.com