Assurant, Inc. (AIZ) in New York City is a global leader in business services supporting, protecting, and connecting major consumer transactions. Assurant is a Fortune 300 company with operations in 21 countries. It contributes to the advancement of the connected world by collaborating with the world's leading brands to develop innovative solutions and provide an enhanced customer experience via mobile device solutions, extended service contracts, vehicle protection services, renters insurance, lender-placed insurance products, and other specialty products.

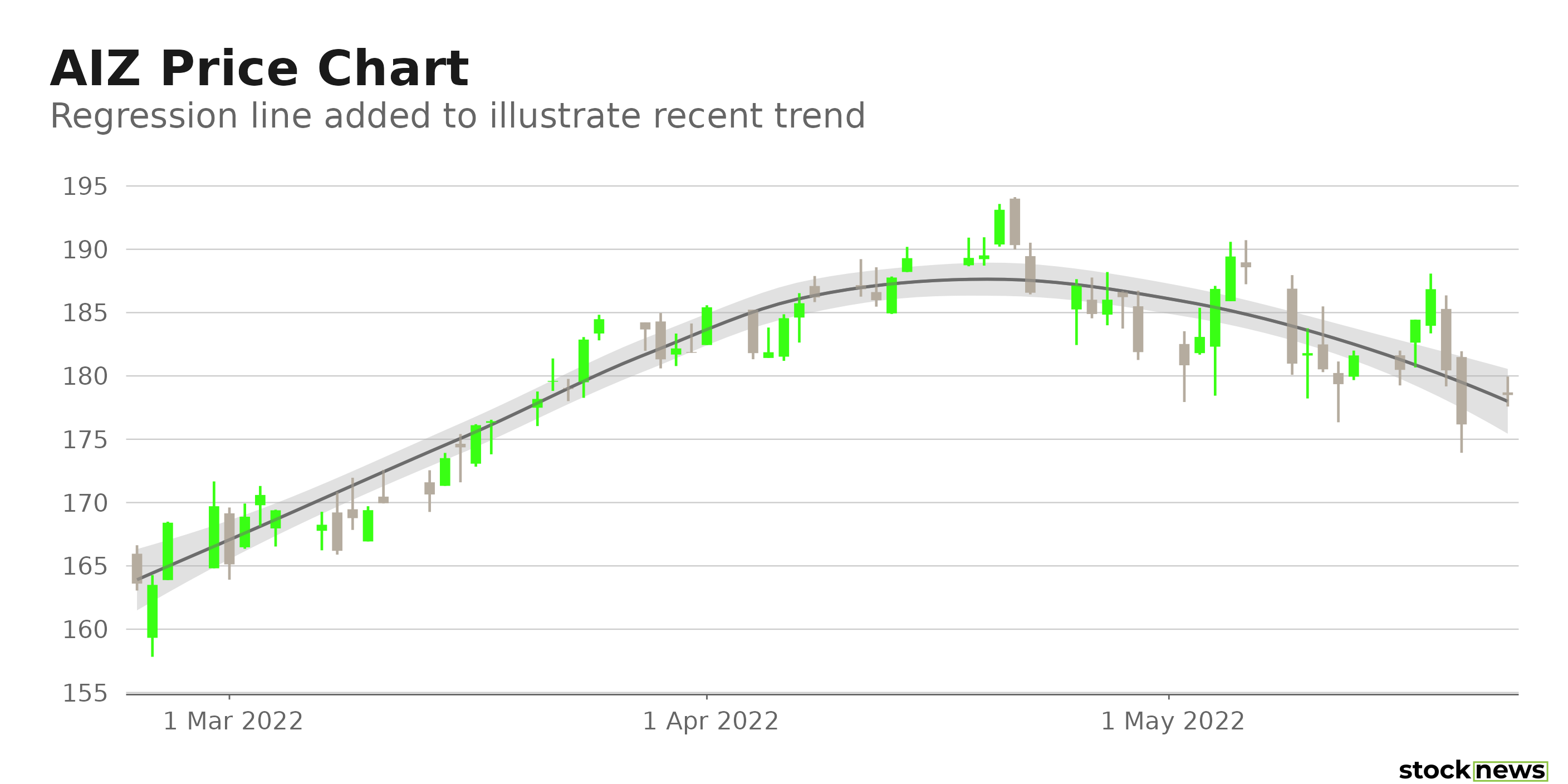

The stock has gained 12.3% in price over the past year and 14.5% year-to-date to close yesterday's trading session at $178.49. Also, the stock has outperformed the benchmark S&P 500 index's 18.1% decline year-to-date. AIZ recorded net operating income per share of $3.75 in the first quarter of 2022. Its revenues have climbed by 4.6% year-over-year to $2.5 billion. Its net investment income increased 13.1% from the prior-year quarter to $86.3 million. And its adjusted EBITDA increased 13% year-over-year to $217.4 million due to solid performance in the Connected Living and Global Automotive segment.

With a proven track record of making high-return, strategic investments in its companies, and a longstanding history of returning capital to its shareholders, the company is projected to grow.

Here is what could shape AIZ's performance in the near term:

Strategic Partnerships

In March, Polly, the premier insurance marketplace for automotive retailers, announced a strategic partnership with AIZ, a prominent worldwide provider of lifestyle and housing solutions that support, safeguard, and link important consumer purchases, such as automobiles. The Polly platform (previously known as the DealerPolicy platform) is the most recent addition to Assurant's array of digital retailing technologies that is designed to enhance consumer automobile purchase journeys while efficiently merging the sale of financing and insurance (F&I) products. The collaboration should increase revenue per vehicle retail (PVR) and F&I product penetration for Assurant and its dealer partners.

Impressive Growth Prospects

The Street expects AIZ's revenues and EPS to rise 3.1% and 36%, respectively, year-over-year to $10.5 billion and $12.73 in its fiscal year 2022. In addition, AIZ's EPS is expected to rise at a 17.2% CAGR over the next five years. Furthermore, the company has an impressive earnings surprise history; it topped the Street’s EPS estimates in three of the trailing four quarters.

Consensus Rating and Price Target Indicate Potential Upside

Each of the three Wall Street analysts that rated AIZ rated it Buy. The 12-month median price target of $213.33 indicates a 19.5% potential upside. The price targets range from a low of $205.00 to a high of $220.00.

POWR Ratings Reflect Solid Prospects

AIZ has an overall B grade, which equates to a Buy rating in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. AIZ has a B grade for Sentiment, which is justified given the favorable analysts' rating and price targets.

Of the nine stocks in the D-rated Insurance – Accident & Supplemental industry, AIZ is ranked #2.

Beyond what I stated above, we have graded AIZ for Growth, Value, Quality, Stability, and Momentum. Get all AIZ ratings here.

Bottom Line

AIZ has exhibited robust financial performance in the last reported quarter, thanks to increased lender-placed insurance values and robust performance by the Connected Living and Global Automotive businesses. In addition, given favorable analysts' sentiments and the company's impressive growth prospects, the stock could deliver solid shareholder gains in the near term. So, we think the stock could be a great bet now.

How Does Assurant Inc. (AIZ) Stack Up Against its Peers?

AIZ has an overall POWR Rating of B, which equates to a Buy rating. This rating is superior to its peers within the same industry, such as Greenlight Reinsurance Ltd. (GLRE), AFLAC Incorporated (AFL), and Employers Holdings Inc. (EIG), which all are rated C (neutral).

AIZ shares were unchanged in premarket trading Tuesday. Year-to-date, AIZ has gained 15.00%, versus a -16.17% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Assurant: An Outperforming Insurance Stock That Has More Room to Run appeared first on StockNews.com