Building materials company Builders FirstSource (NYSE:BLDR) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 6.7% year on year to $4.23 billion. The company’s full-year revenue guidance of $16.4 billion at the midpoint came in 2.7% below analysts’ estimates. Its non-GAAP profit of $3.07 per share was 1.7% above analysts’ consensus estimates.

Is now the time to buy Builders FirstSource? Find out by accessing our full research report, it’s free.

Builders FirstSource (BLDR) Q3 CY2024 Highlights:

- Revenue: $4.23 billion vs analyst estimates of $4.45 billion (4.8% miss)

- Adjusted EPS: $3.07 vs analyst estimates of $3.02 (1.7% beat)

- EBITDA: $626.5 million vs analyst estimates of $608.9 million (2.9% beat)

- The company dropped its revenue guidance for the full year to $16.4 billion at the midpoint from $16.8 billion, a 2.4% decrease

- EBITDA guidance for the full year is $2.3 billion at the midpoint, below analyst estimates of $2.32 billion

- Gross Margin (GAAP): 32.8%, down from 34.9% in the same quarter last year

- Operating Margin: 10.1%, down from 14.2% in the same quarter last year

- EBITDA Margin: 14.8%, down from 17.9% in the same quarter last year

- Free Cash Flow Margin: 14.9%, up from 11.1% in the same quarter last year

- Market Capitalization: $20.08 billion

“I'm proud of our resilient third quarter performance as we maintained a mid-teens EBITDA margin by leveraging our distinct competitive advantages and differentiated business model,” commented Dave Rush, CEO of Builders FirstSource.

Company Overview

Headquartered in Irving, TX, Builders FirstSource (NYSE:BLDR) is a construction materials manufacturer that offers a variety of lumber and lumber-related building products.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

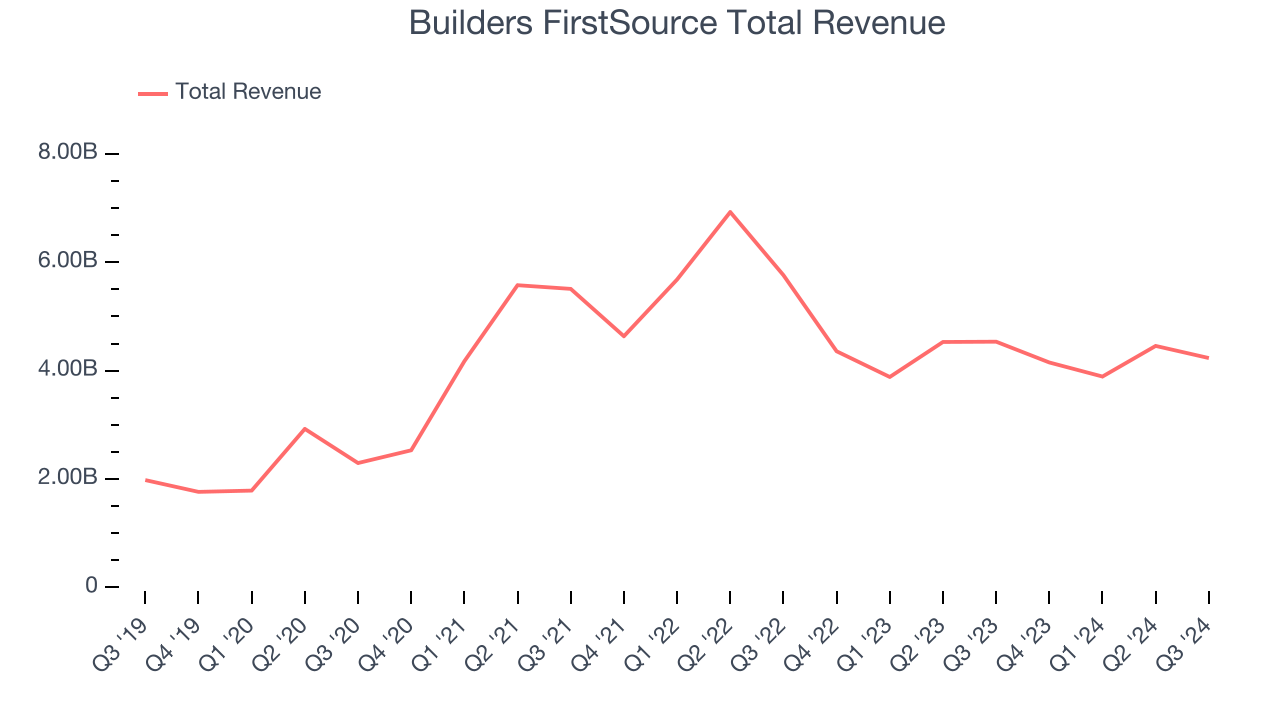

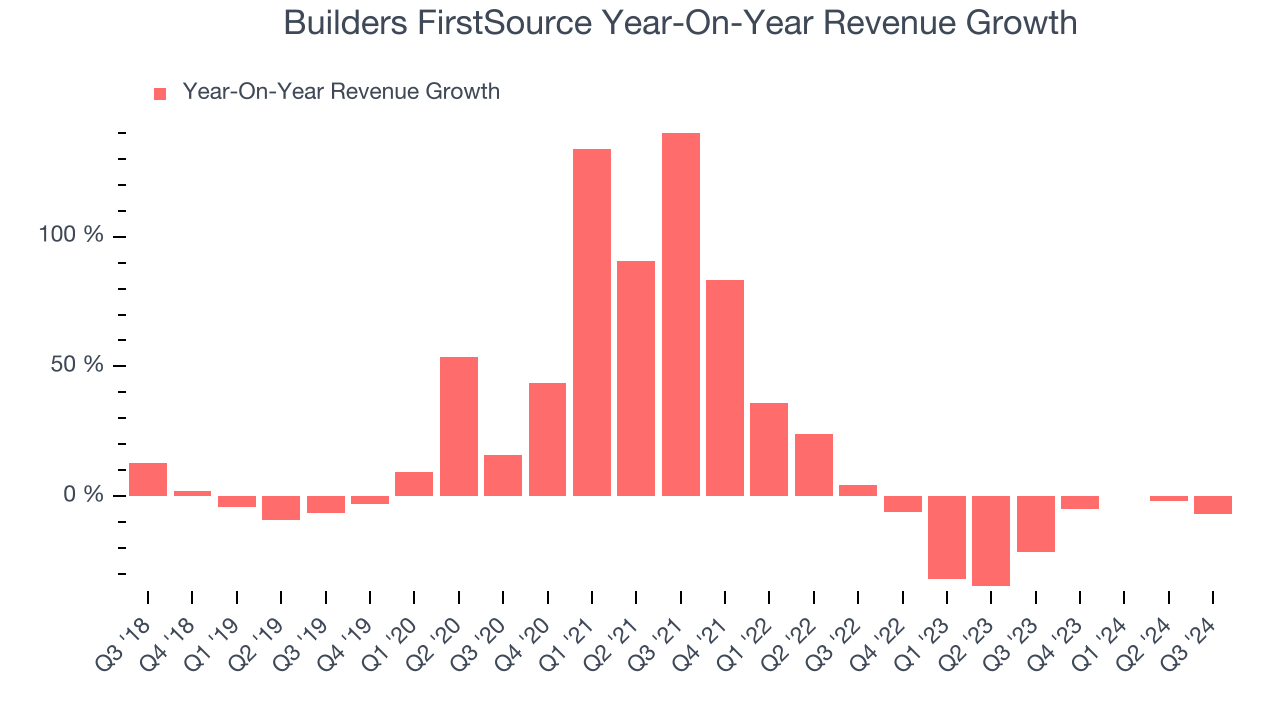

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Builders FirstSource grew its sales at an incredible 17.9% compounded annual growth rate. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Builders FirstSource’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 14.7% over the last two years.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Manufactured products and Windows, doors & millwork , which are 23.6% and 25.6% of revenue. Over the last two years, Builders FirstSource’s Manufactured products revenue (floors, wall panels, and engineered wood) averaged 14.4% year-on-year declines while its Windows, doors & millwork revenue (self explanatory) averaged 1.1% declines.

This quarter, Builders FirstSource missed Wall Street’s estimates and reported a rather uninspiring 6.7% year-on-year revenue decline, generating $4.23 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, an improvement versus the last two years. Although this projection shows the market believes its newer products and services will catalyze better performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

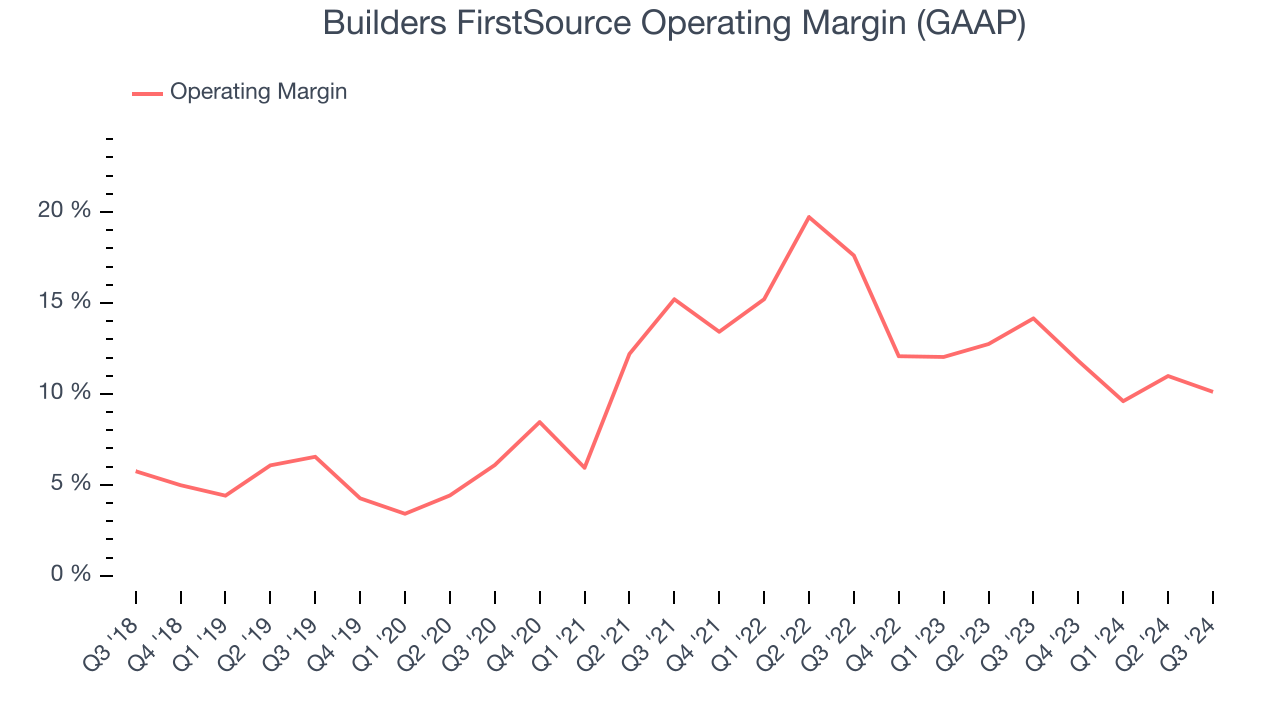

Builders FirstSource has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.3%.

Looking at the trend in its profitability, Builders FirstSource’s annual operating margin rose by 6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Builders FirstSource generated an operating profit margin of 10.1%, down 4 percentage points year on year. Since Builders FirstSource’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

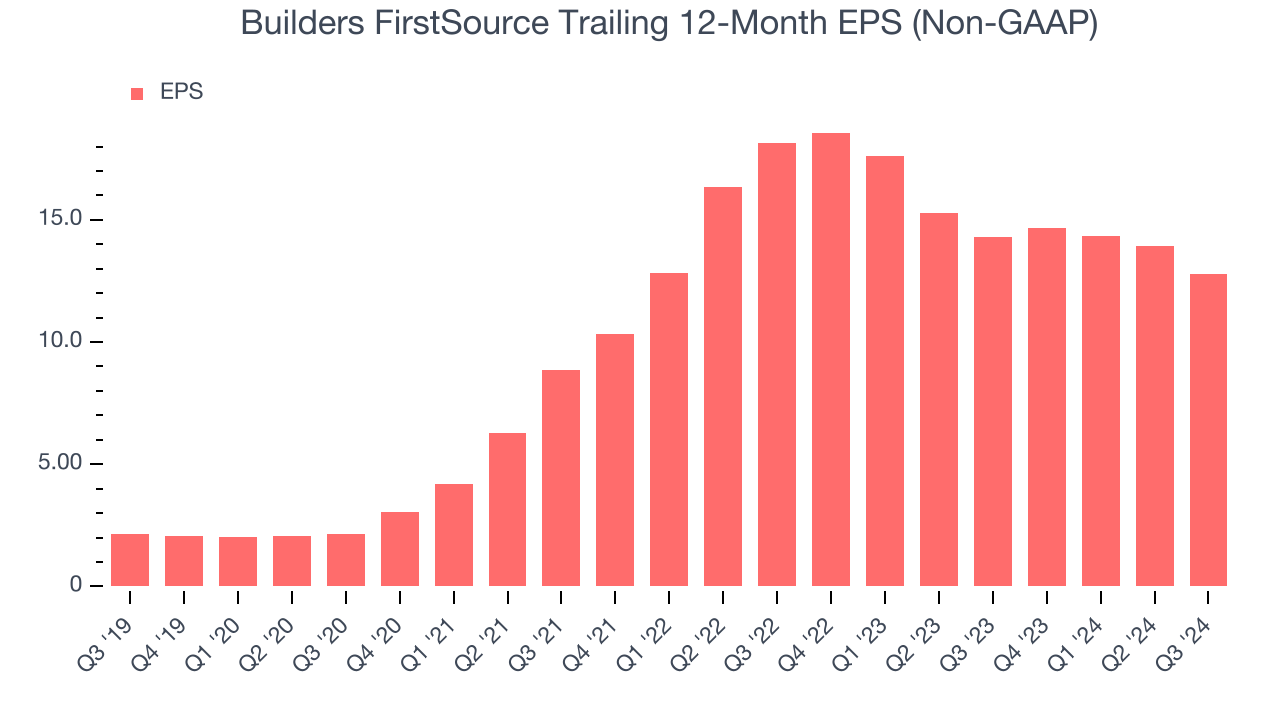

Builders FirstSource’s EPS grew at an astounding 42.8% compounded annual growth rate over the last five years, higher than its 17.9% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into Builders FirstSource’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Builders FirstSource’s operating margin declined this quarter but expanded by 6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Builders FirstSource, its two-year annual EPS declines of 16.1% mark a reversal from its (seemingly) healthy five-year trend. We hope Builders FirstSource can return to earnings growth in the future.In Q3, Builders FirstSource reported EPS at $3.07, down from $4.24 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects Builders FirstSource’s full-year EPS of $12.77 to shrink by 8.5%.

Key Takeaways from Builders FirstSource’s Q3 Results

It was good to see Builders FirstSource beat analysts’ EBITDA expectations this quarter. On the other hand, its revenue missed and its Windows, doors & millwork revenue fell short of Wall Street’s estimates. The company also lowered its full year revenue guidance, which is a big negative. Overall, this quarter could have been better. The stock remained flat at $171 immediately after reporting.

Big picture, is Builders FirstSource a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.