All News about Total Bond Market ETF Vanguard

Do Treasury Yields Rise During Economic Expansions?

November 30, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

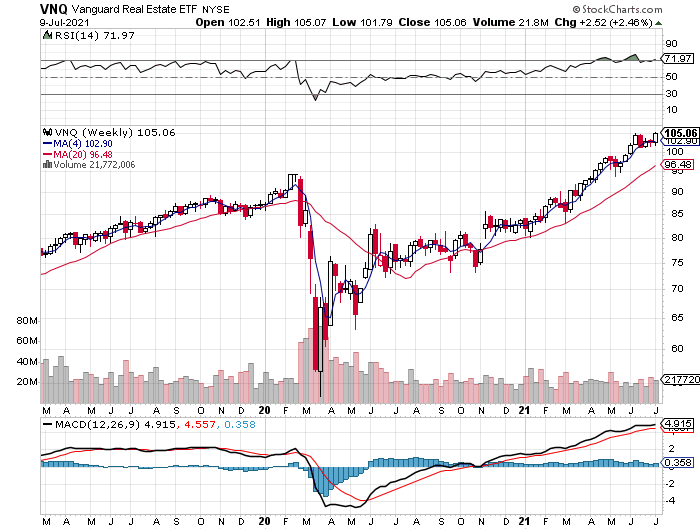

Property, Commodities Led Rebound In Global Markets Last Week

October 18, 2021

Via Talk Markets

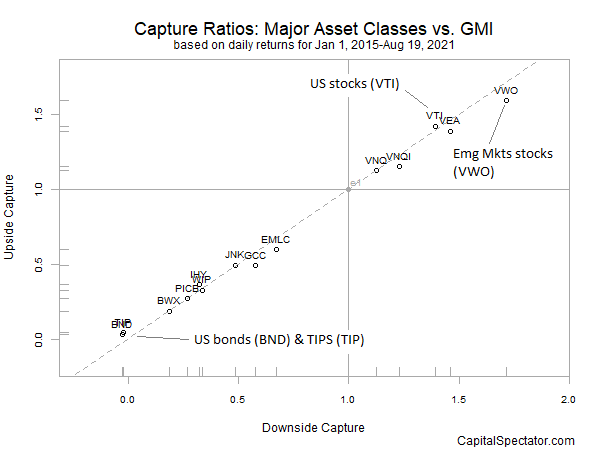

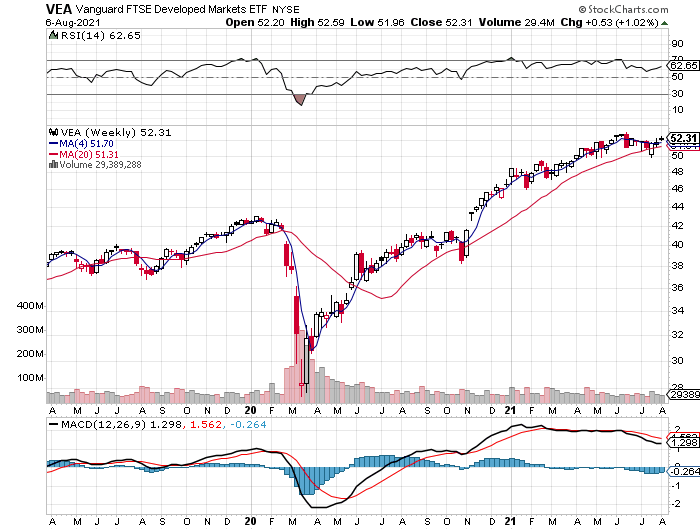

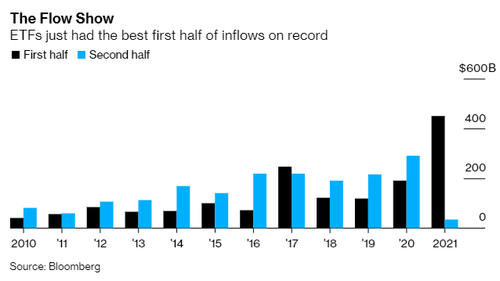

Broad-Based Rallies Last Week Lifted Most Asset Classes

August 30, 2021

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

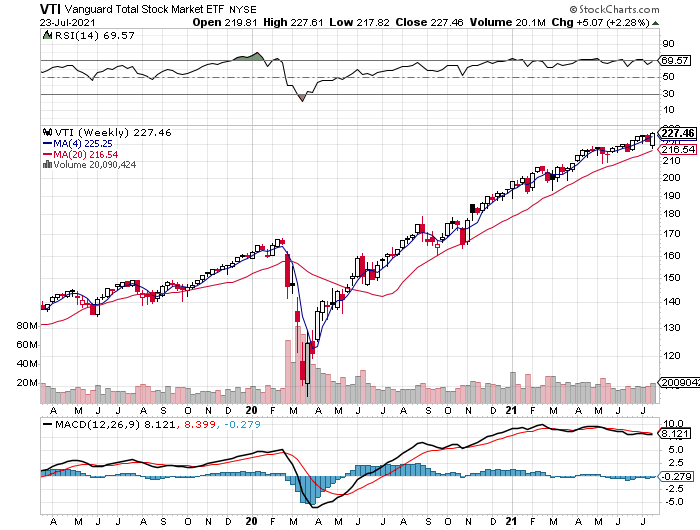

ETF Update: S&P 500 Sectors Rise, Big Changes Coming To Social Security, Plus Huge News

July 24, 2021

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Widespread Losses Weighed On Global Markets Last Week

June 21, 2021

Via Talk Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.