All News about 7-10 Year Treasury Bond Ishares ETF

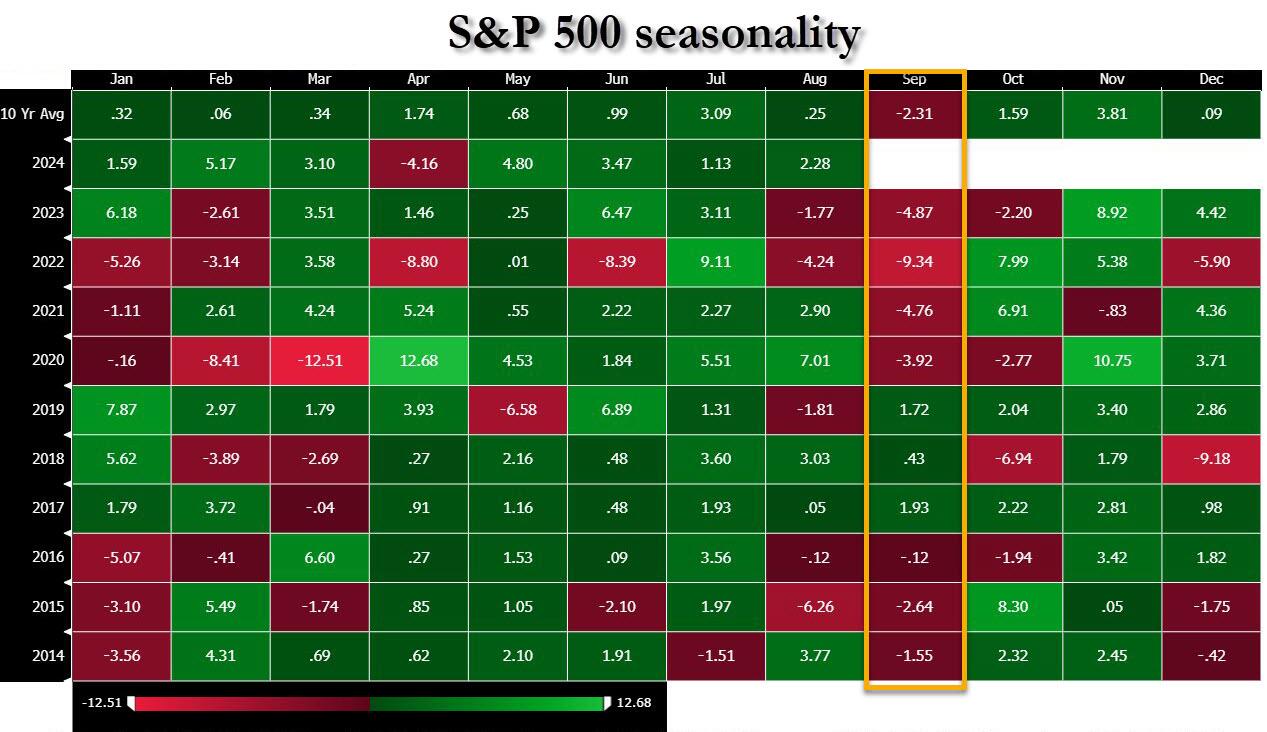

Stocks Rally Back In A Roller Coaster Session

September 11, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

The Stocks Markets One Day Rally Appears To Be Over

September 10, 2024

Via Talk Markets

Consolidative Tuesday: Sept 10

September 10, 2024

Via Talk Markets

Bull Steepening Is Bearish For Stocks – Part Two

September 08, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Speculator Extremes: Ultra T-Bonds, Yen, 5-Year & Cotton Lead Bullish & Bearish Positions

September 08, 2024

Via Talk Markets

Exposures

Textiles

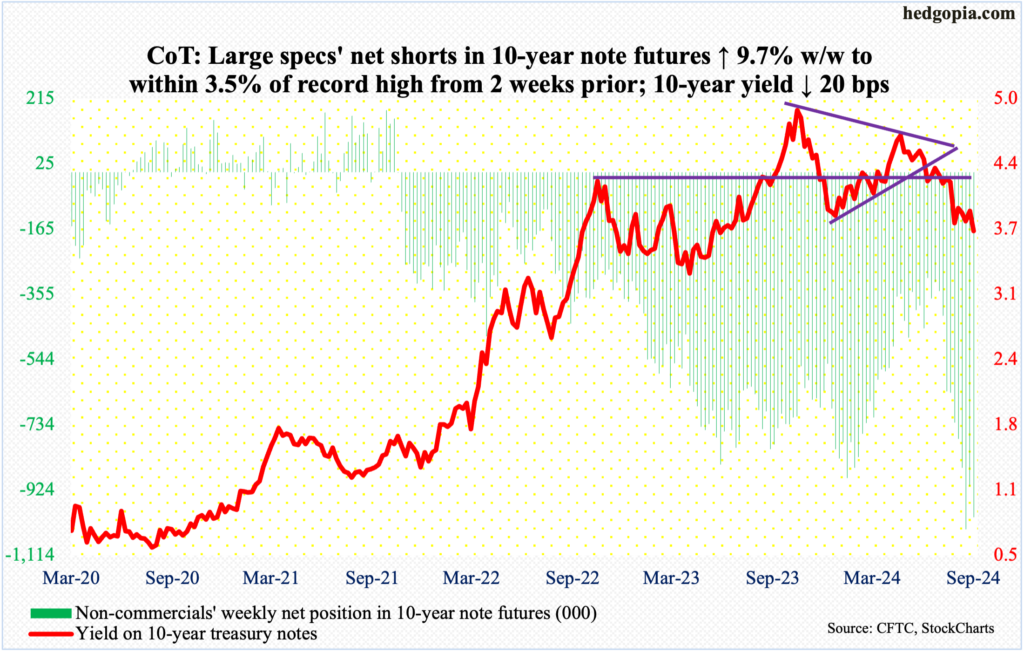

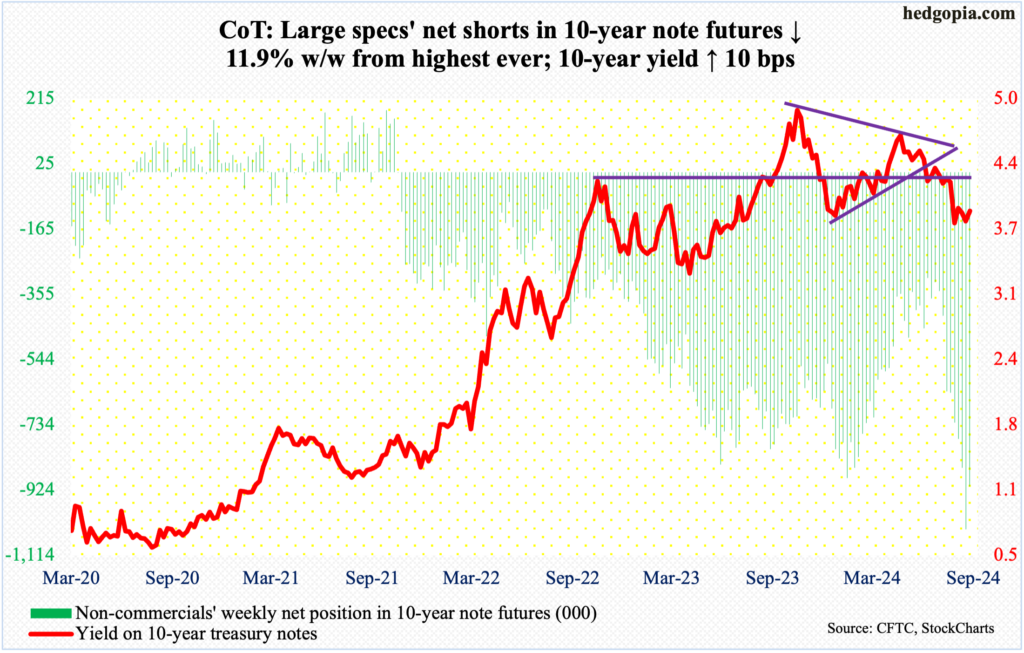

Peeking Into The Future Through CoT Report: Futures, Noncommercial Buyers, How Hedge Funds Are Positioned

September 08, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Asia Morning Bites For Thursday, Sept 5

September 05, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

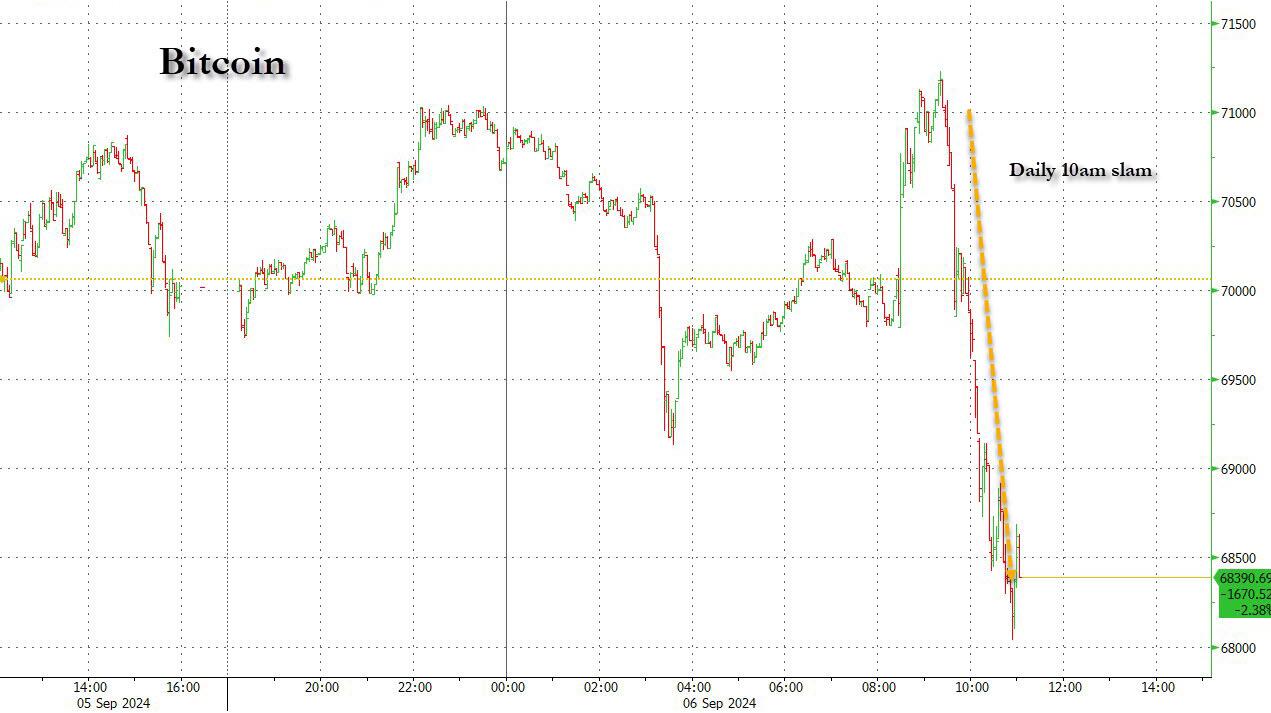

Semis Slaughtered As September Starts Off With Carnage Everywhere

September 03, 2024

Via Talk Markets

COT Speculator Extremes: Yen, Gold & Brazil Real Lead Bullish & Bearish Positions

September 01, 2024

Via Talk Markets

Hedge Funds Positions, Noncommercial Buying - How CoT Peeks Into The Future

September 01, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.