All News about Russell 2000 Ishares ETF

AskSlim Market Week - Friday, Sept 6

September 06, 2024

Via Talk Markets

Wall Street Sighs In Relief As August Jobs Numbers Ease Recession Fears: Small Caps Outperform, Dollar Trims Weekly Losses

September 06, 2024

Via Benzinga

Topics

Economy

Exposures

Economy

Postcards: Yes, The Market Game Is Rigged - The S&P 500 Goes Red For An Hour

September 04, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Semis Slaughtered As September Starts Off With Carnage Everywhere

September 03, 2024

Via Talk Markets

Traders Bet Aggressively On Rate Cuts Ahead Of Jobs Data: 5 ETFs To Watch This Week

September 03, 2024

Via Benzinga

Topics

ETFs

Wall Street Tumbles, Yen Surges, Oil Sinks Below $70, VIX Spikes As Traders Brace For Volatile Month: What's Driving Markets Tuesday?

September 03, 2024

Via Benzinga

Topics

Stocks

Exposures

US Equities

Bullish Week Ahead On Dow Breakout

September 01, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

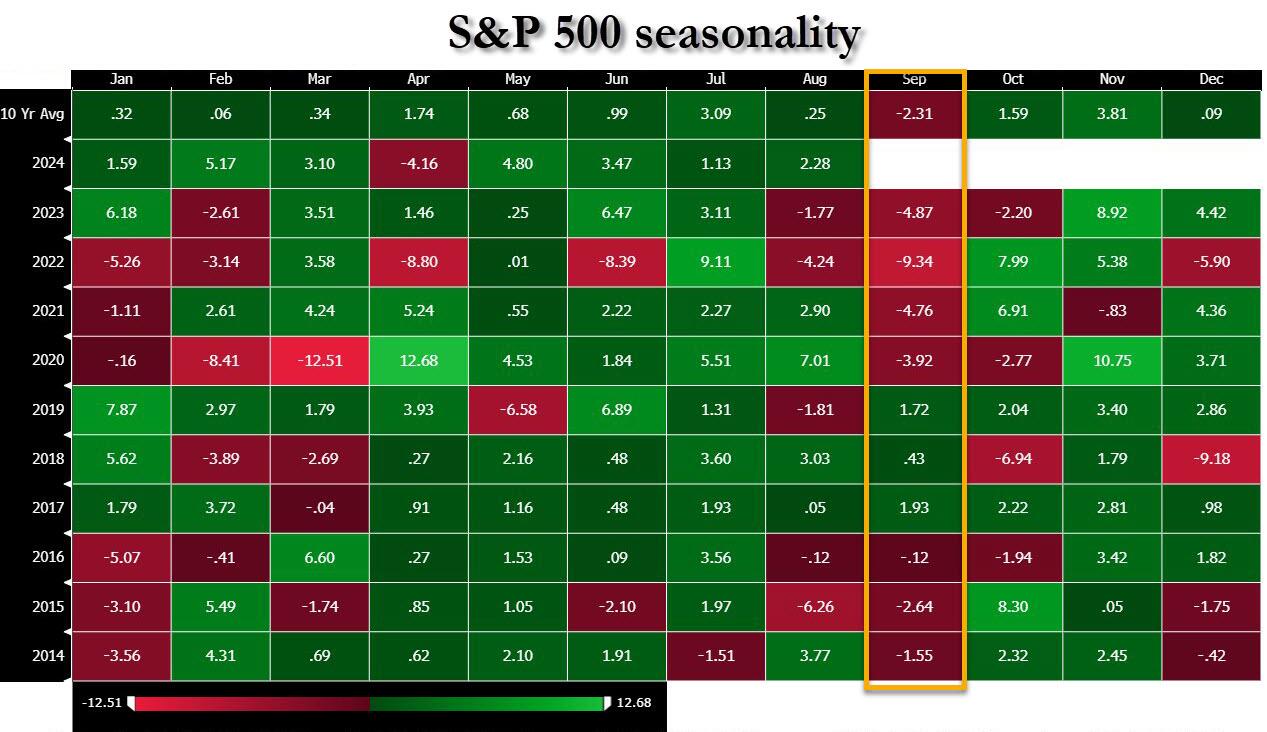

We Are in the Period of Hot Air and Blue Skies, But the Month of September is Ahead!

September 01, 2024

Via Talk Markets

Topics

Economy

Exposures

Economy

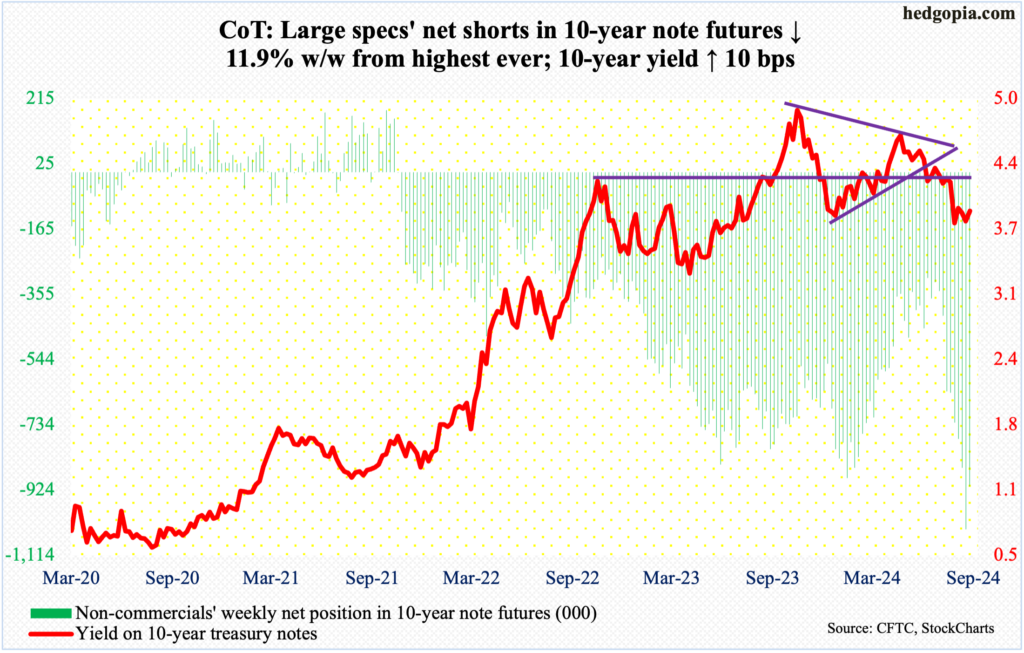

Hedge Funds Positions, Noncommercial Buying - How CoT Peeks Into The Future

September 01, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

Chipmakers Tick Up As Nvidia Halts Sell-Off, Dollar Rises As Traders Revise Fed Wagers: What's Driving Markets Friday?

August 30, 2024

Via Benzinga

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.