Beauty products company Coty (NYSE: COTY) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 1.8% year on year to $1.67 billion. Its non-GAAP profit of $0.15 per share was 18.3% below analysts’ consensus estimates.

Is now the time to buy Coty? Find out by accessing our full research report, it’s free.

Coty (COTY) Q3 CY2024 Highlights:

- Revenue: $1.67 billion vs analyst estimates of $1.67 billion (in line)

- Adjusted EPS: $0.15 vs analyst expectations of $0.18 (18.3% miss)

- EBITDA: $360.1 million vs analyst estimates of $359.9 million (small beat)

- EBITDA guidance for the full year is $1,190 at the midpoint, lowered from prior and below analyst estimates of $1.18 billion

- Management lowered its full-year Adjusted EPS guidance to $0.50 at the midpoint

- Gross Margin (GAAP): 65.5%, up from 63.5% in the same quarter last year

- Operating Margin: 14.2%, up from 12% in the same quarter last year

- EBITDA Margin: 21.5%, in line with the same quarter last year

- Free Cash Flow was -$7.9 million, down from $124 million in the same quarter last year

- Market Capitalization: $6.54 billion

Company Overview

With a portfolio boasting many household brands, Coty (NYSE: COTY) is a beauty products powerhouse with offerings in cosmetics, fragrances, and skincare.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

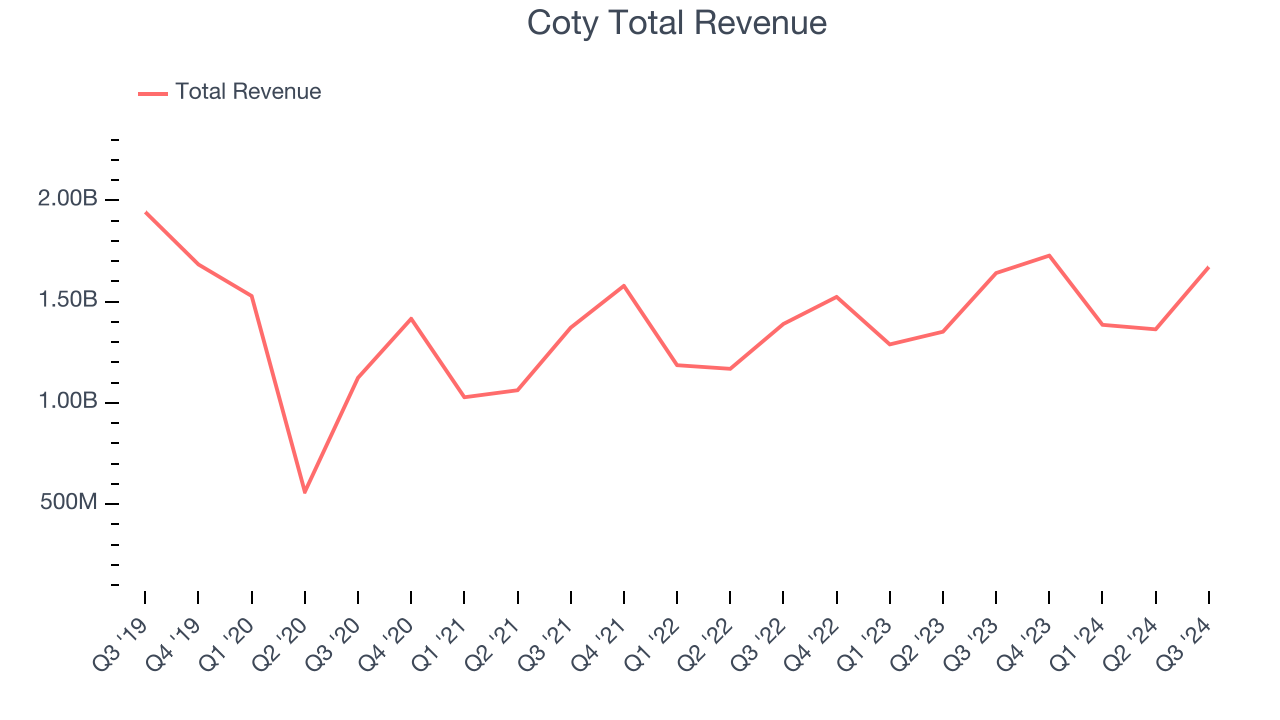

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Coty carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Coty grew its sales at a decent 8% compounded annual growth rate over the last three years. This shows there was demand for its offerings, a useful starting point for our analysis.

This quarter, Coty grew its revenue by 1.8% year on year, and its $1.67 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and illustrates the market believes its products will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

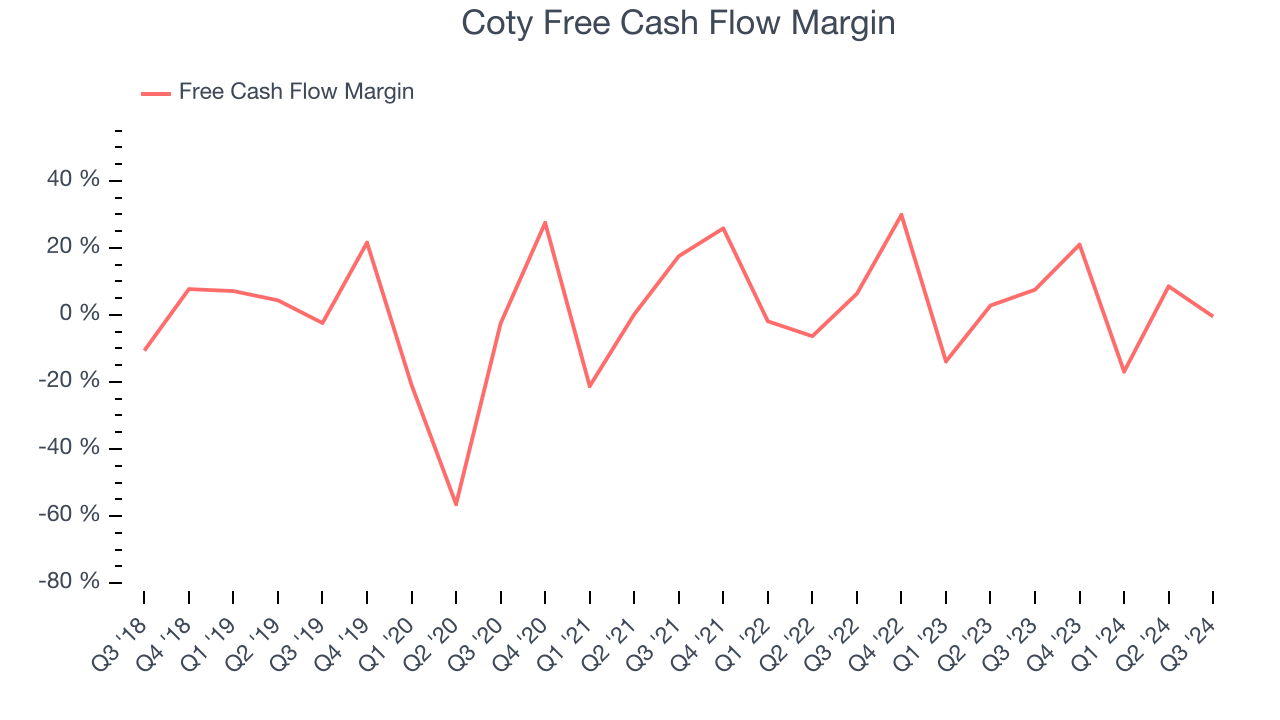

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Coty has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.7% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that Coty’s margin dropped by 3.7 percentage points during that time. Coty’s two-year free cash flow profile was compelling, but shareholders are surely hoping for its trend to reverse. Continued declines could signal that the business is becoming more capital-intensive.

Coty broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 8 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Coty’s Q3 Results

It was good to see Coty beat analysts’ gross margin expectations this quarter. On the other hand, its EPS missed analysts’ expectations and its EPS guidance for the full year was lowered and fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $7.49 immediately after reporting.

Big picture, is Coty a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.