So many traders and investors are always looking to get rich quick without any effort. Most never find it. They simply shuttle from one guaranteed get rich quick scheme to the next in the eternal quest for gold.

Ultimately, they always end up with fool’s gold…

Let me be the first to burst the bubble and tell you that the ‘Fountain of Youth’ doesn’t exist. You can’t lose weight without diet and exercise. Making money requires hard work.

Luckily, however, there are ways to have someone else do most of the heavy lifting for you. Two of the best ways I found are the StockNews POWR Ratings and Market Club’s Trade Triangles.

Using these two together pairs the fundamental strength of the POWR Ratings with the technical prowess of the Trade Triangles leading to serious outperformance.

Then I add in my 30 plus years of trading experience to uncover highly rated quality stocks that are on the brink of a breakout.

Combining all these into one trading program results in the POWR Breakouts Portfolio I manage.

A brief description of each of the components is shown below. I use each of these in my daily trading decisions for the POWR Breakouts Portfolio.

The Fundamentals - StockNews POWR Ratings

StockNews created the proprietary POWR Ratings model to put the odds of investing success firmly in your favor.

This is truly one of the most complete stock ratings systems available to investors today. In fact, we analyze 118 different factors for every stock, each of them contributing a little to the stock’s likelihood of outperformance.

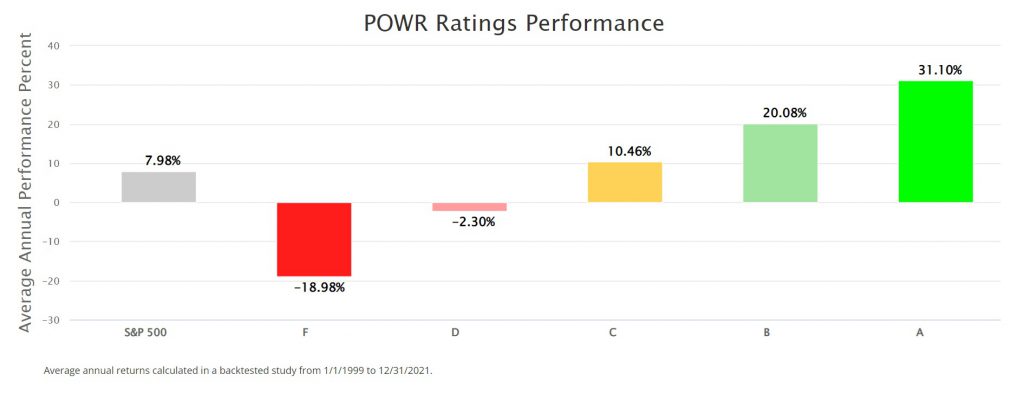

The combination of all these factors is what leads to the +31.10% annualized return for the “A” rated stocks, outperforming the S&P 500 by almost 4X since 1999.

Don’t worry…. you won’t need to analyze all 118 factors for each stock. We have simplified the process by narrowing it all down to an overall POWR Rating that clearly identifies whether the stock is likely to outperform (A & B rated).

The Technicals - Market Club’s Trade Triangles

Know exactly when to get in and out of the market!

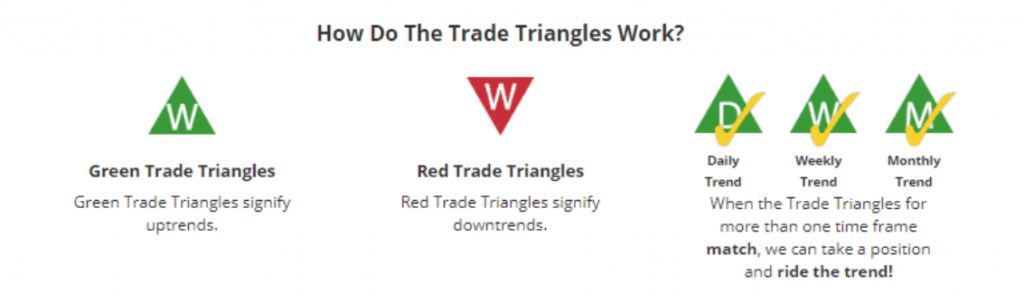

This complex analysis hides behind easy-to-use, easy-to-understand signals – giving you the answers to make confident investment decisions.

Instead of finding just one trend, they confirm trends for multiple time periods to put the mathematical odds in your favor that you will be on the winning side of that swing.

These signals are not intended to catch tops and bottoms. Instead, the signals help members find the majority of a swing trend.

Green Triangles suggest positive trends

Red Triangles suggest negative trends

Monthly Triangles determine trend and possible entry points.

Weekly Triangles determine timing exits, entries, and re-entries.

Interesting to note that both services (POWR Ratings and Trade Triangles) don’t claim to have a foolproof formula. Far from it. They do a lot of hard work to generate the results.

Instead of a magic bullet, they both state that they look to put the odds in your favor.

At the end of the day, trading is about probability, not certainty. There will be some losses, but the winners should more than outweigh the losers.

Trading is difficult and requires time, hard work, and discipline. There is no easy way to make money. The key is to have the computers do the heavy lifting.

For realistic traders and investors looking to realize above market type returns, using the combined efforts of the fundamental foundation of the POWR Ratings with the technical acumen of the Trade Triangles can help boost your odds.

Factor in the management by an industry veteran who isn’t afraid to take small losses and let winners run, and the probability of long-term success jumps even higher.

What To Do Next?

Discover my 7 hand picked stocks ready to burst higher even in the midst of the turbulent 2022 stock market. Plus 2 more picks are coming this Monday morning.

All you need to do is start a 30 day trial to POWR Breakouts to start enjoying more winning trades in the days and weeks ahead.

Start 30 Day Trial to POWR Breakouts >

Here’s to good trading!

Tim Biggam

Editor, POWR Breakouts Newsletter

SPY shares fell $0.84 (-0.21%) in after-hours trading Friday. Year-to-date, SPY has declined -13.34%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post How to Stack the Odds in Your Favor… appeared first on StockNews.com