Headline News about SPDR Bloomberg Short Term High Yield Bond ETF

Via Talk Markets

Amidst Global Conflict, Investors Flood ESG-Focused Fund - ETF Winners And Losers: Mid-Cap Flows

October 12, 2023

Via Benzinga

Topics

ETFs

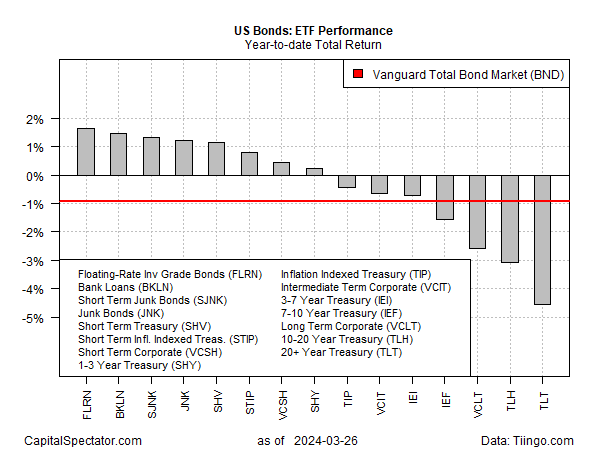

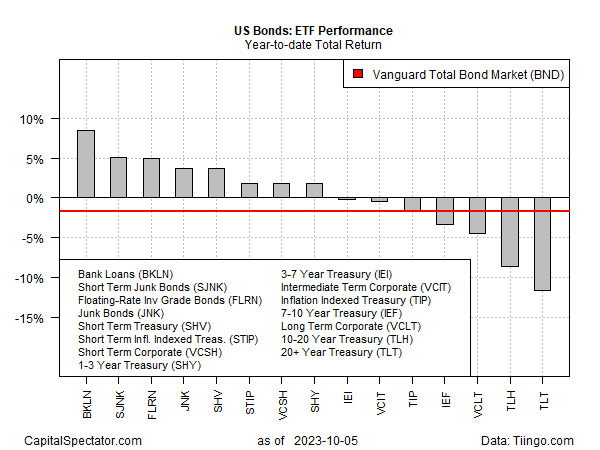

Bank Loans And Junk Bonds Are Having A Good Year

September 21, 2023

Via Talk Markets

Junk Bonds Continue To Lead US Fixed Income Markets In 2021

April 28, 2021

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.