All News about Emrg Mkts Ishares MSCI ETF

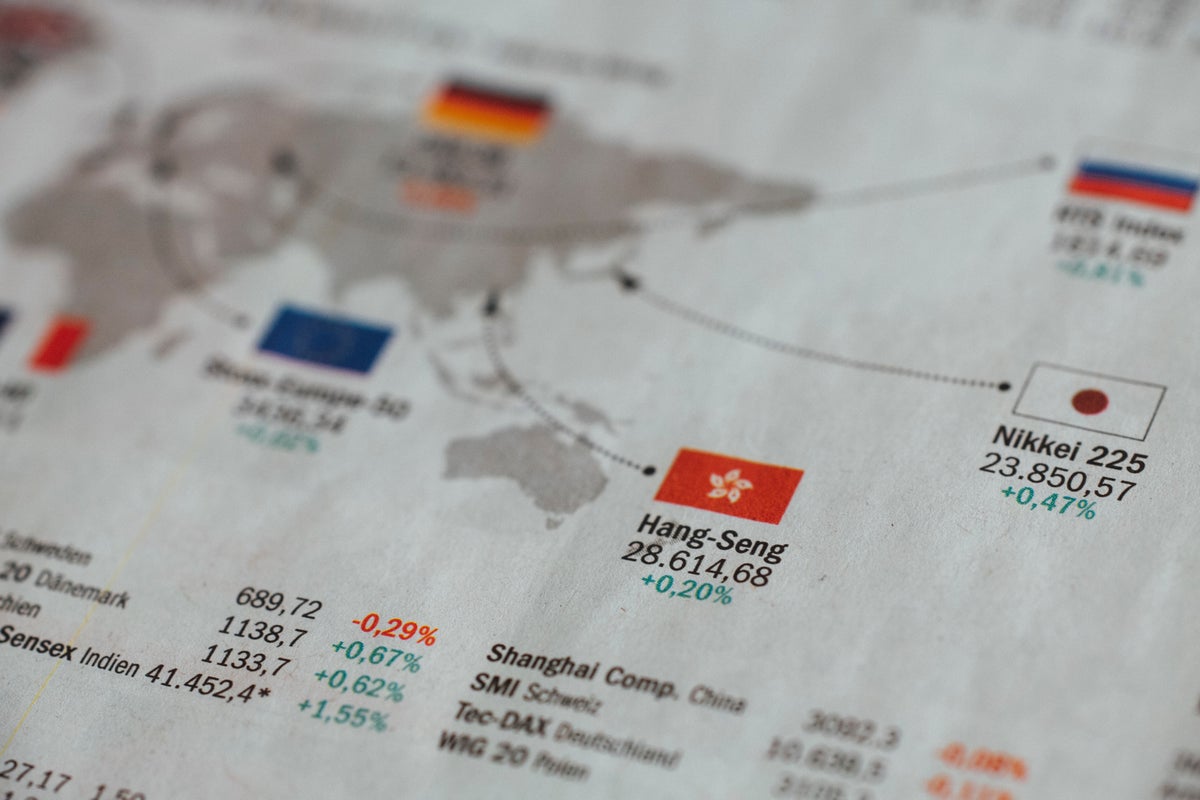

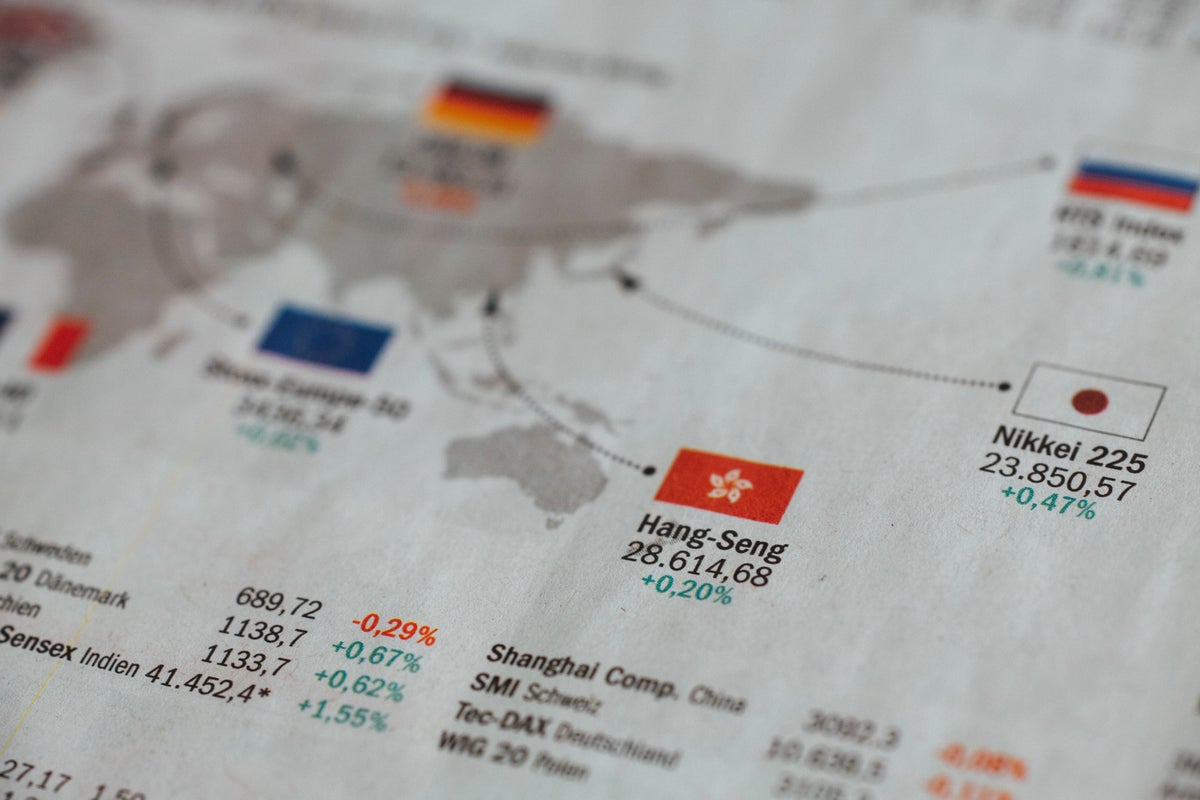

Asian Markets Close Lower, European Markets Trade In Red While Commodities Gain - Global Markets Today While US Was Sleeping

September 08, 2023

Via Benzinga

Topics

Economy

Exposures

Interest Rates

Asia Closes in Red, Europe Trades Lower Along with Commodities - Global Markets Today While US Was Sleeping

September 05, 2023

Via Benzinga

Topics

Economy

Exposures

Economy

7 Equity ETFs Excel In Goldilocks Scenario While Market Ponders Fed Rate Hike Outcome

September 01, 2023

Via Benzinga

Exposures

Interest Rates

The Leading Emerging Markets For Market-Beating Gains in 2024

August 25, 2023

Via MarketBeat

.jpeg?width=1200&height=800&fit=crop)

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.