All News about Swiss Franc Trust Currencyshares

Via Talk Markets

Switzerland Is Seeing A Sharp Decline In Inflation

February 14, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

FX Daily: Dollar Set To Hold Gains Through February

February 14, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

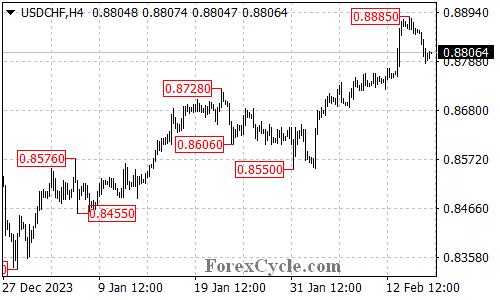

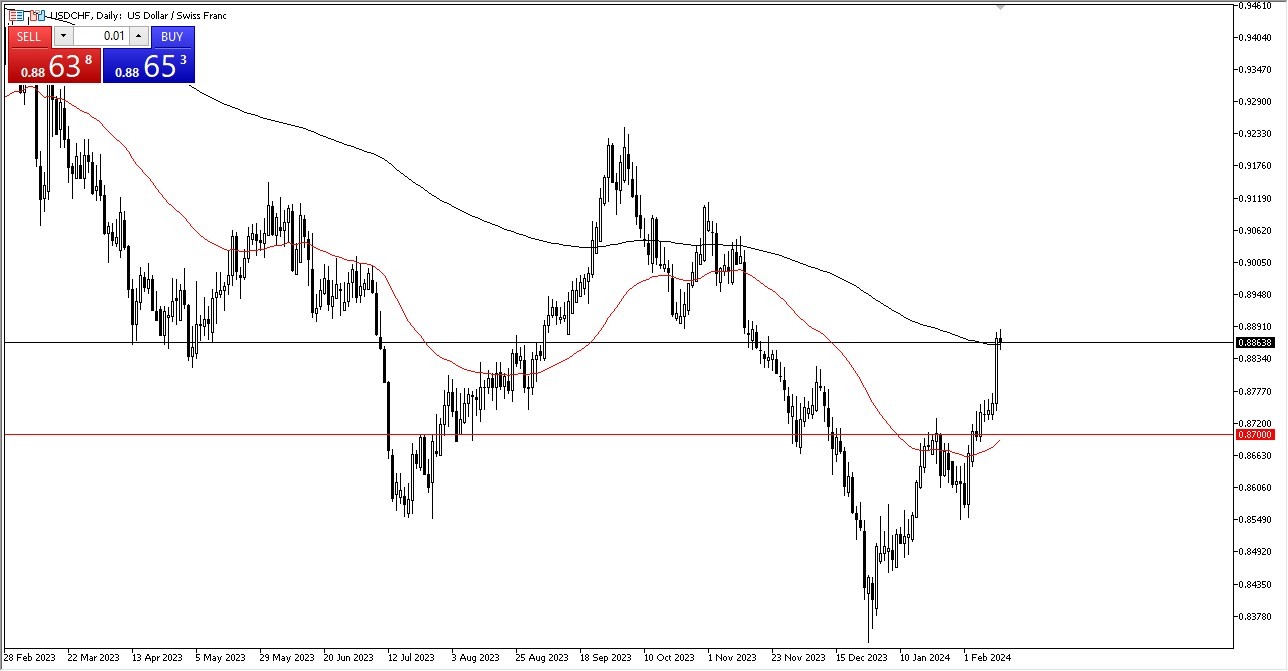

USD/CHF Rallies To 0.8800 On Soft Swiss Inflation Data, US CPI Eyed

February 13, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

USD/CHF: Swiss Franc On Edge As SNB Rate Cut Bets Rise

February 13, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

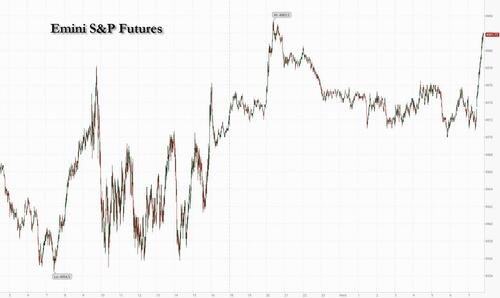

Market Divergences Are Growing Insanely Wide

February 07, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Technical Updates On Stocks, Rates And The Dollar

February 07, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Futures Rebound To Session High After NY Community Bank Reverses Overnight Rout; Record 10Y Auction Looms

February 07, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

Japanese Yen Speculators Add To Their Bearish Bets As Yen Falls

February 04, 2024

Via Talk Markets

FX Daily: Fed Cancels The Free Lunch

January 25, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Via Talk Markets

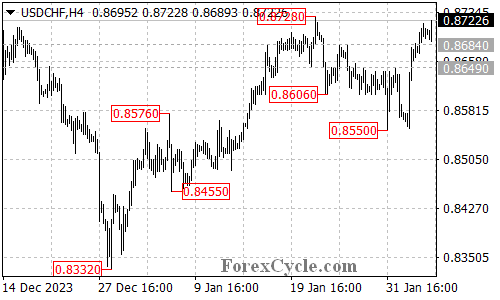

FX Daily: UK Markets Demo Sticky Inflation Playbook

January 18, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

USD/CHF Looks To Surpass The Psychological Level Of 0.8600, Awaits Fed Waller’s Speech

January 16, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.