Waste management company Republic Services (NYSE:RSG) fell short of the market’s revenue expectations in Q3 CY2024, but sales rose 6.5% year on year to $4.08 billion. Its GAAP profit of $1.80 per share was 12.6% above analysts’ consensus estimates.

Is now the time to buy Republic Services? Find out by accessing our full research report, it’s free.

Republic Services (RSG) Q3 CY2024 Highlights:

- Revenue: $4.08 billion vs analyst estimates of $4.12 billion (1% miss)

- EPS: $1.80 vs analyst estimates of $1.60 (12.6% beat)

- EBITDA: $1.30 billion vs analyst estimates of $1.26 billion (3.2% beat)

- Gross Margin (GAAP): 41.9%, up from 40.3% in the same quarter last year

- Operating Margin: 20.8%, up from 19% in the same quarter last year

- EBITDA Margin: 32%, up from 29.9% in the same quarter last year

- Free Cash Flow Margin: 13.8%, similar to the same quarter last year

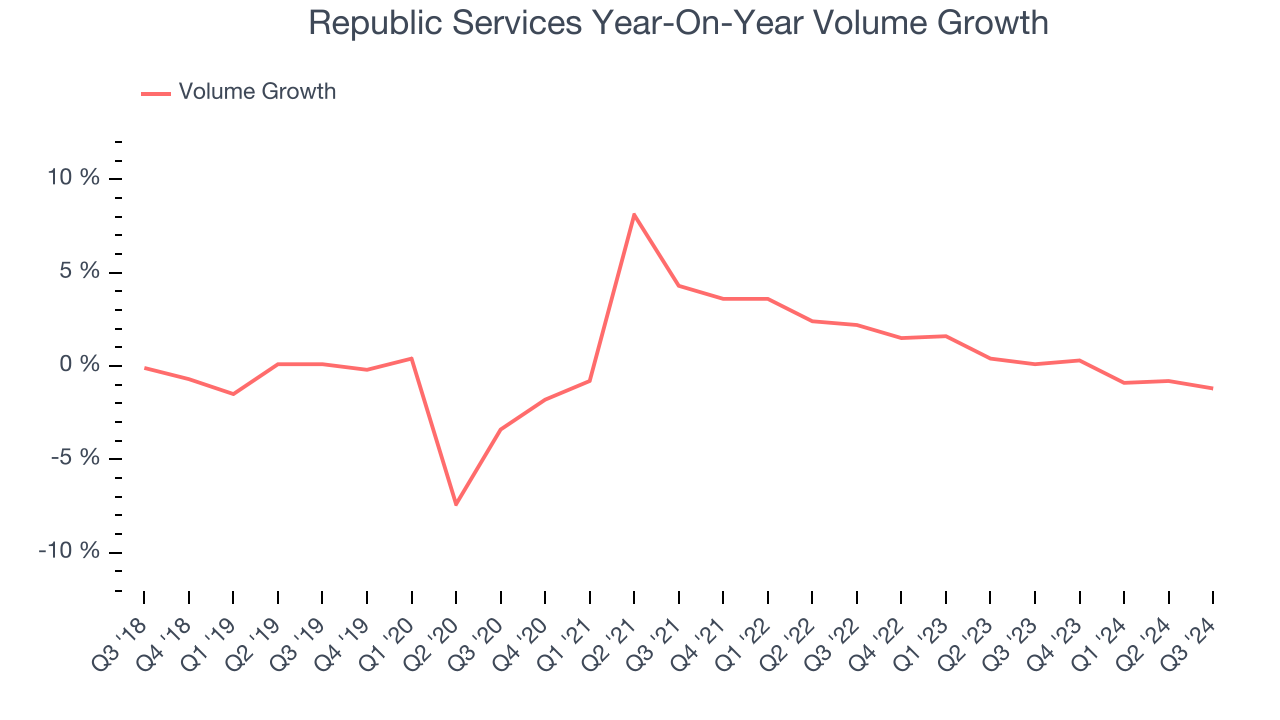

- Sales Volumes fell 1.2% year on year (0.1% in the same quarter last year)

- Market Capitalization: $62.95 billion

"Our strong performance during the third quarter is a direct result of executing our strategic priorities," said Jon Vander Ark, President and CEO.

Company Overview

Processing several million tons of recyclables annually, Republic (NYSE:RSG) provides waste management services for residences, companies, and municipalities.

Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Sales Growth

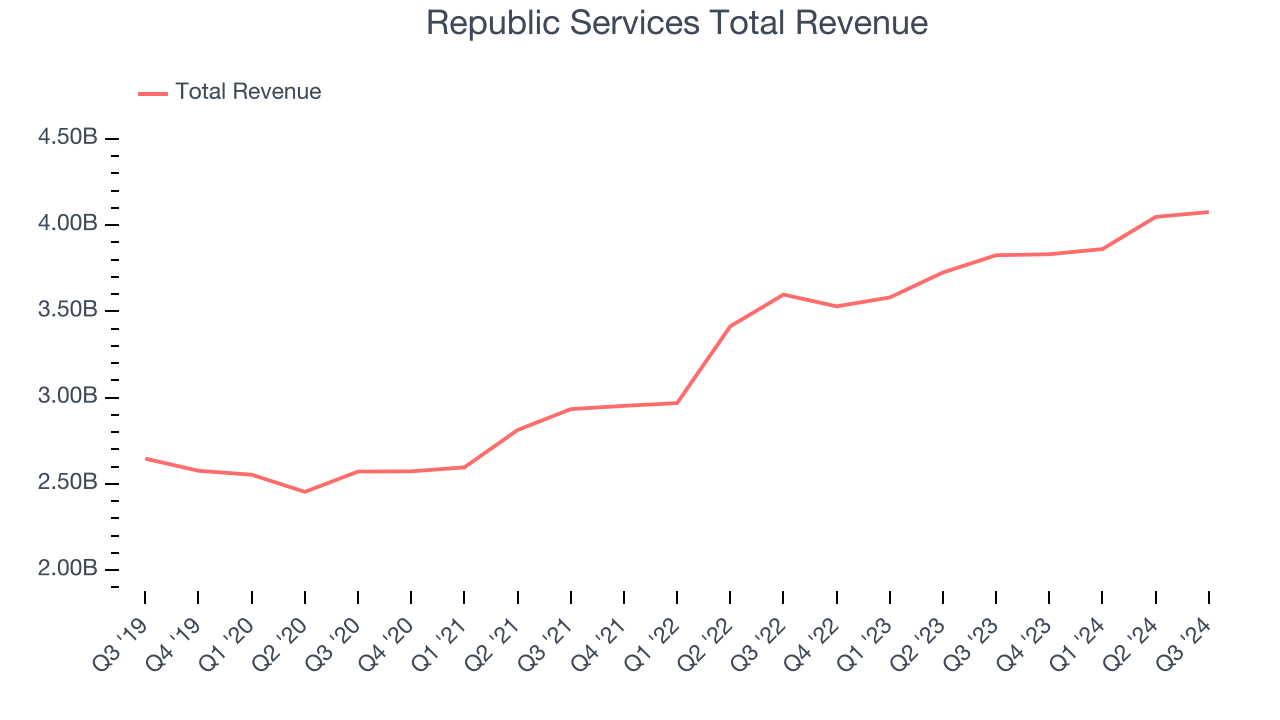

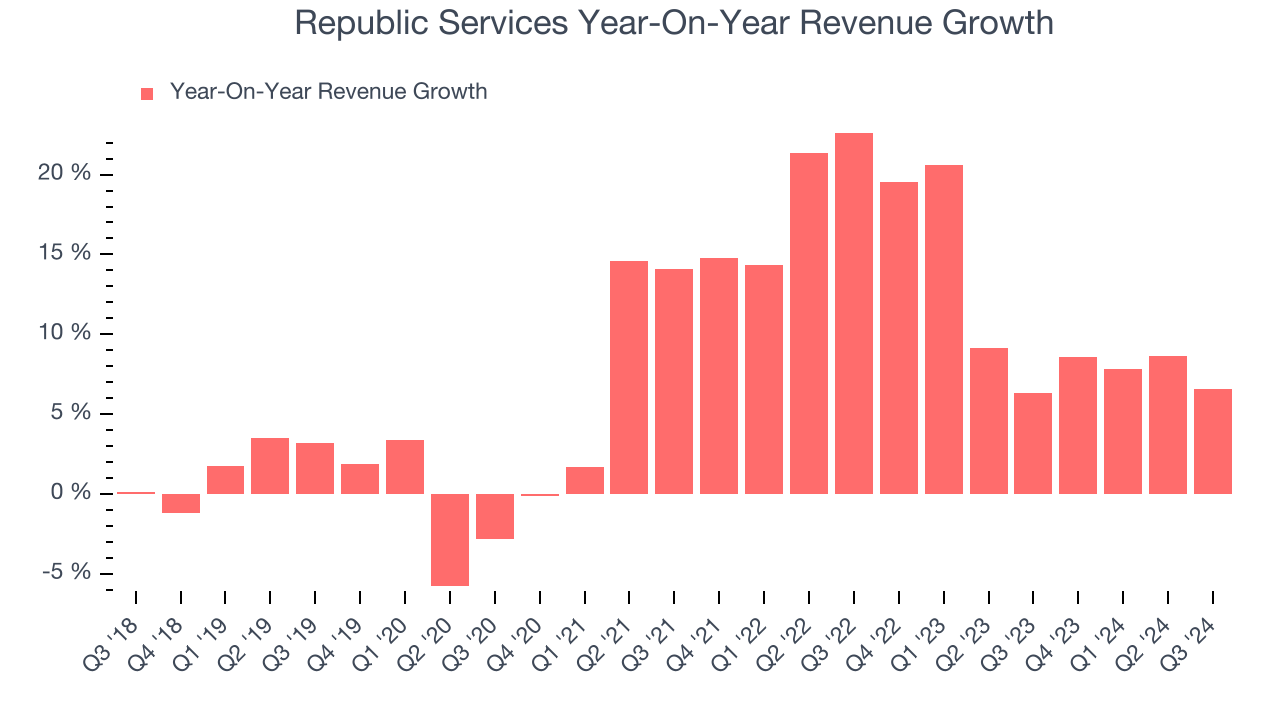

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Republic Services grew its sales at a solid 9.1% compounded annual growth rate. This is a good starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Republic Services’s annualized revenue growth of 10.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its sales volumes, which show how many products it was moving. Over the last two years, Republic Services’s sales volumes were flat. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Republic Services’s revenue grew 6.5% year on year to $4.08 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market thinks its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

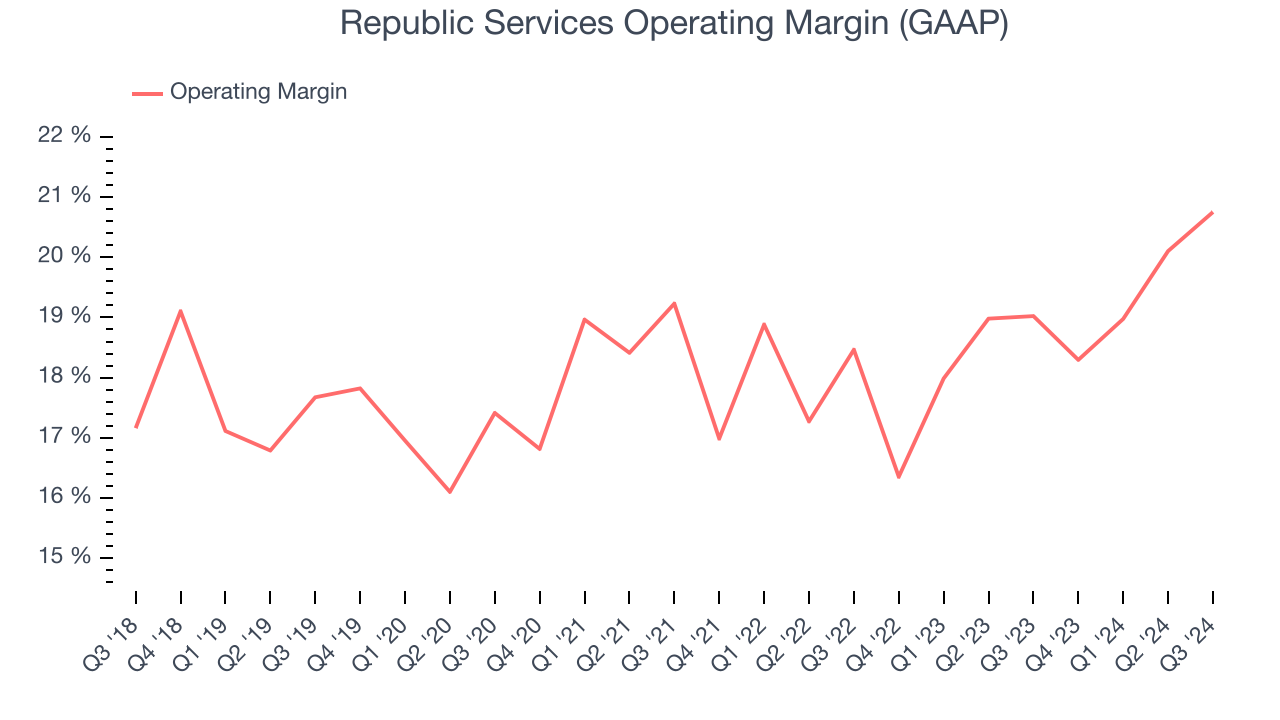

Republic Services has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Republic Services’s annual operating margin rose by 2.5 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Republic Services generated an operating profit margin of 20.8%, up 1.7 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

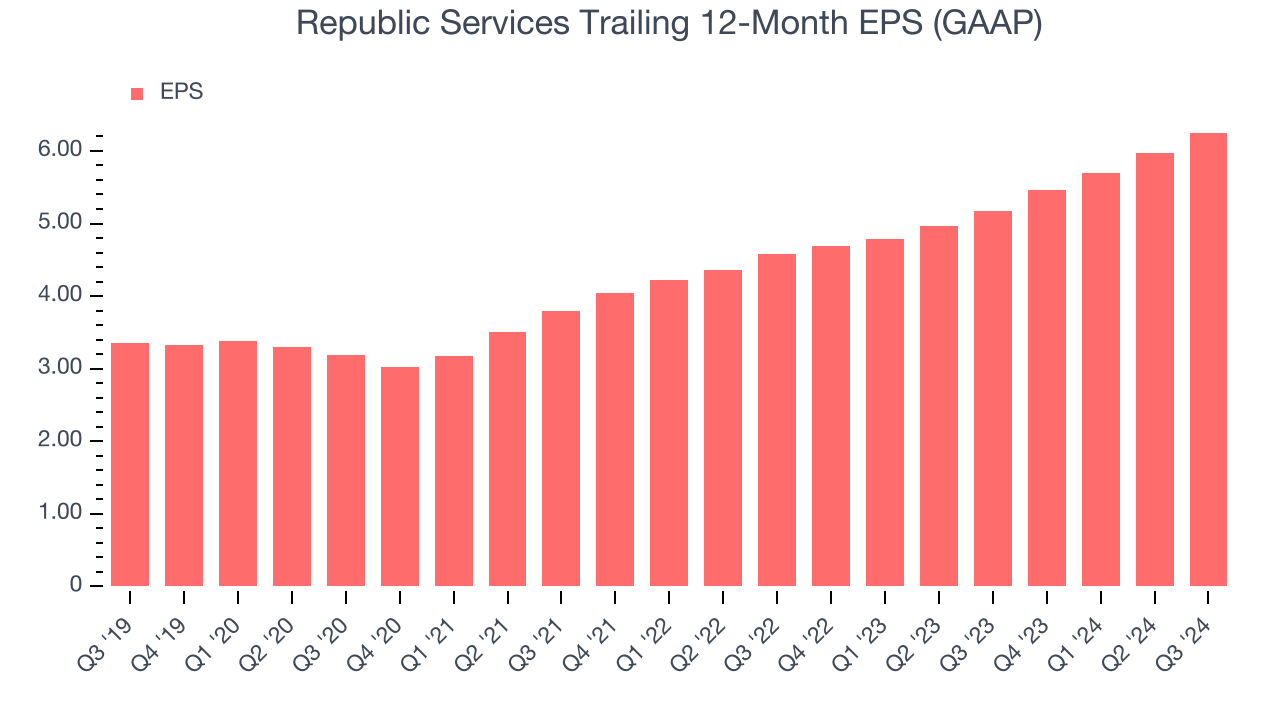

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

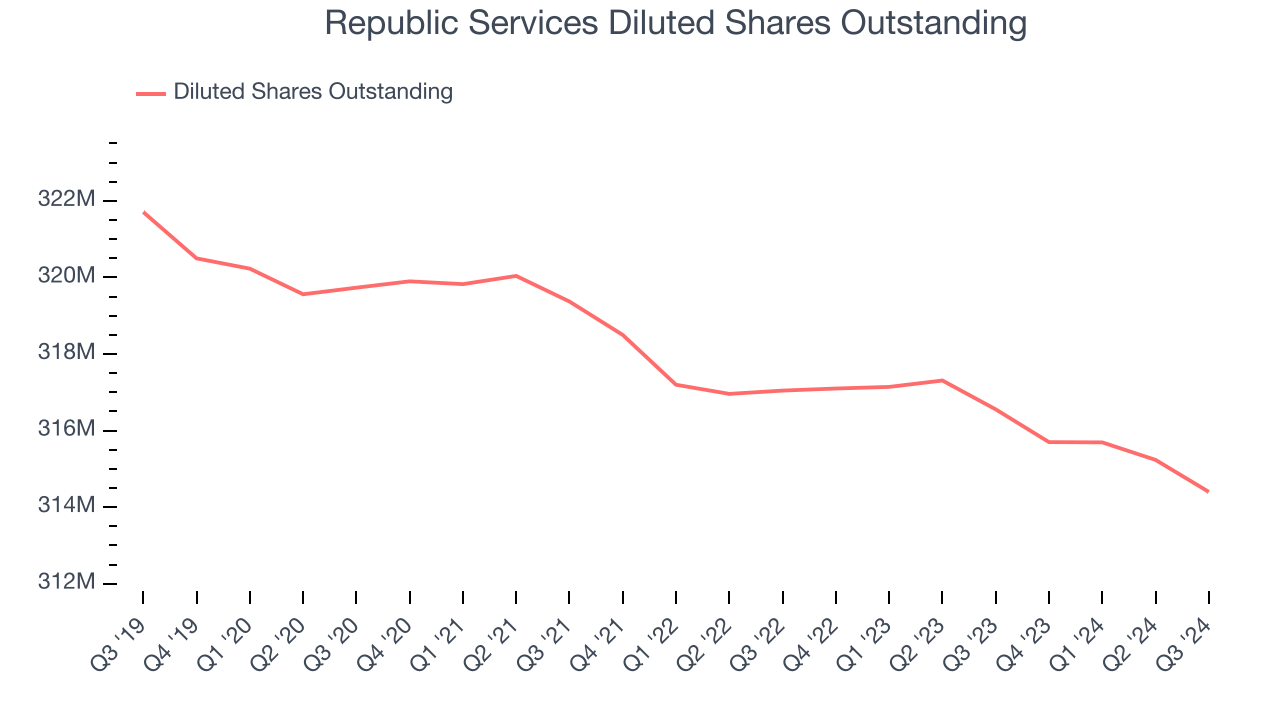

Republic Services’s EPS grew at a remarkable 13.3% compounded annual growth rate over the last five years, higher than its 9.1% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into Republic Services’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Republic Services’s operating margin expanded by 2.5 percentage points over the last five years. On top of that, its share count shrank by 2.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Republic Services, its two-year annual EPS growth of 16.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Republic Services reported EPS at $1.80, up from $1.52 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Republic Services’s full-year EPS of $6.25 to grow by 4.4%.

Key Takeaways from Republic Services’s Q3 Results

We enjoyed seeing Republic Services exceed analysts’ EBITDA and EPS expectations this quarter. On the other hand, its revenue unfortunately missed as its sales volumes fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $204.31 immediately following the results.

Big picture, is Republic Services a buy here and now?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.