Contango ORE, Inc. (“CORE” or the “Company”) (OTCQB: CTGO) announced today three significant updates outlined below. For further information, please visit our website at www.contangoore.com.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210429005368/en/

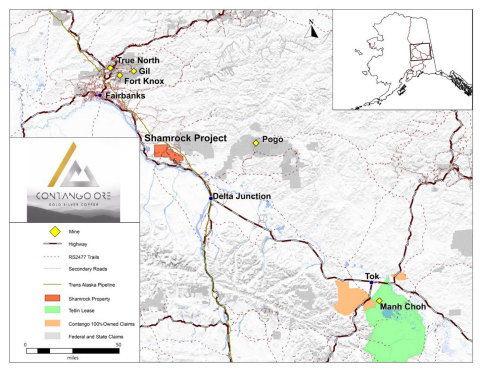

Figure 1. Location map for the Shamrock Project, Alaska. (Graphic: Business Wire)

- Change of Project Name from Peak Gold to Athabascan Name – Manh Choh

- Receipt of Resource Report Regarding the Company’s 30% Interest in the Manh Choh Project

- Acquisition of Shamrock - a New Exploration Stage Project Located in the Richardson Mining District of Alaska

Manh Choh Project

The Company is pleased to announce that the Tetlin Tribal Council has approved of a new name for the Peak Gold Project. From now on the project will be referred to as the Manh Choh Project. The renaming was a result of close consultation with the local Upper Tanana Athabascan Village of Tetlin, on whose land the project is situated. The name ‘Manh Choh’ (“mon-CHO”) was chosen by the Village of Tetlin Tribal Council and can be translated from the Upper Tanana Athabascan language to ‘Big Lake,’ referring to the nearby Tetlin Lake, a site of high cultural and subsistence significance for the community. Chief Michael Sam said: “We look forward to the safe and responsible development of the project and the positive benefits it is expected to generate for our community.”

In other news on the Manh Choh project, the Company is happy to report that the Peak Gold LLC (joint venture company with Kinross 70% and CORE 30%) approved $18 million 2021 program budget (CORE’s 30% share is $5.4 million) is in full swing with three drill rigs currently operating around the clock. Drilling is focused on in-fill drilling to upgrade indicated and inferred resources to the measured and indicated categories as well as water monitoring wells for environmental baseline. Drilling to support further metallurgical test work and pit geotechnical studies is also being completed. Environmental baseline and community outreach efforts also continue. All work underway is to support initiation of permitting for the Manh Choh Project expected to begin in the second half of 2021, and the completion of a Feasibility Study in 2022.

Resource Report Received Regarding Company’s Interest in the Manh Choh Project

The Company is pleased to report that it has received a Resource Report for the Main Peak and North Peak deposits on the Manh Choh Project (formerly Peak Gold Project). The Company obtained the Resource Report in connection with its upcoming requirement to comply with new Subpart 1300 of Regulation S-K (“S-K 1300”). The report was completed by John Sims of Sims Resources LLC, a “qualified person” under S-K 1300 who provided a similar resource report for Kinross Gold under Canadian disclosure rules commonly known as NI 43-101. The two resource estimates in the two reports are identical. As background, the United States Securities and Exchange Commission (“SEC”) adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) include S-K 1300 and will replace the historical property disclosure requirements for mining registrants that are included in SEC Industry Guide 7. The Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules until its annual report for its first fiscal year beginning on or after January 1, 2021, unless earlier compliance is otherwise required. A copy of the Resource Report can be reviewed on the Company’s website site at www.contangoore.com/investors/overview.

Table 1 summarizes a mineral resource1 estimate for the Project effective December 31, 2020 held by Peak Gold LLC (100% basis), while Table 2 shows CORE’s 30% attributable ownership of the Project.

Table 1 Summary of Mineral Resources as of December 31, 2020 – Peak Gold LLC’s 100% Ownership |

||||||||||||||

Category |

Tonnage

|

Grade

|

Contained Metal

|

Grade

|

Contained Metal

|

Grade

|

Contained Metal

|

|||||||

Measured |

473 |

6.4 |

97 |

16.7 |

254 |

6.6 |

101 |

|||||||

Indicated |

8,728 |

4.0 |

1,111 |

14.1 |

3,945 |

4.2 |

1,168 |

|||||||

Total Measured + Indicated |

9,201 |

4.1 |

1,208 |

14.2 |

4,199 |

4.3 |

1,267 |

|||||||

|

|

|

|

|

|

|

|

|||||||

Inferred |

1,344 |

2.7 |

116 |

16.1 |

694 |

2.9 |

126 |

|||||||

1 The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” as used in this press release are defined terms under S-K 1300. The estimation of measured resources and indicated resources are not reserves. Resources have greater uncertainty as to their existence and the legal and economic feasibility of extraction than the estimation of proven and probable reserves. Conversion of mineral resources to proven and probable mineral reserves requires a further economic study, such as a preliminary feasibility study or definitive feasibility study. Investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into mineral reserves. |

| Table 2 Summary of Mineral Resources as of December 31, 2020 – CoRE’s 30% Attributable Ownership | ||||||||||||||

Category |

Tonnage

|

Grade

|

Contained Metal

|

Grade

|

Contained Metal

|

Grade

|

Contained Metal

|

|||||||

Measured |

142 |

6.4 |

29 |

16.7 |

76 |

6.6 |

30 |

|||||||

Indicated |

2,618 |

4.0 |

333 |

14.1 |

1,183 |

4.2 |

350 |

|||||||

Total Measured + Indicated |

2,760 |

4.1 |

362 |

14.2 |

1,260 |

4.3 |

380 |

|||||||

|

|

|

|

|

|

|

|

|||||||

Inferred |

403 |

2.7 |

35 |

16.1 |

208 |

2.9 |

38 |

|||||||

| Notes for Tables 1 and 2: | |||

1. |

The definitions for Mineral Resources in S-K 1300 were followed for Mineral Resources. |

||

2. |

Mineral Resources are estimated at a cut-off value of US$28 NSR/t and US$30 NSR/t. |

||

3. |

Mineral Resources are estimated using a long-term gold price of US$1,400 per ounce Au, and US$20 per ounce Ag. |

||

4. |

Metallurgical recoveries were 90% Au and 52% Ag for the Main+West Zone and 94% Au and 60% Ag for the North Zone. |

||

5. |

Silver equivalents are reported using a ratio of 70. |

||

6. |

Bulk density is 2.75 t/m3 |

||

7. |

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability |

||

8. |

Numbers may not add due to rounding. |

||

New Shamrock Project

The Company is also pleased to announce that it has staked a new property, called Shamrock, in the Richardson Mining District located in central Alaska along the Alaska Highway corridor approximately 70 miles (113 kilometers) from Fairbanks, Alaska. The property includes a total of 368 Alaska State mining claims covering approximately 52,920 acres (see Figure 1) and gives the Company a dominant land position in the Richardson district. The property has excellent infrastructure being right along the Alaska Highway and adjacent to the Trans-Alaska Pipeline with several gravel roads and ATV trails providing good access to the entire property. In addition, a high-voltage power line traverses along the southern property boundary. This electrical grid provides power to the Pogo gold mine operated by Northern Star Resources Limited which produced approximately175,000 ounce of gold in 2020 and is located approximately 50 miles (80 kilometers) to the northeast of the Shamrock property.

Placer gold was discovered in the Richardson District on Tenderfoot Creek in 1905 and alluvial mining has continued intermittently until as recently as 2010. The Richardson District produced over 120,000 ounces of gold since the early 1900s (Athey, 2016). The Richardson District is characterized by gentle slopes and broad, alluvium-filled valleys. The area is unglaciated but largely overlain by windblown loess, generally a few meters in thickness but locally up to 50 meters thick (see Alaska Division of Geological and Geophysical Surveys (ADGGS) Report #55, published in 1977 and Mining and Minerals in the Golden Heart of Alaska, Fairbanks-North Star Borough publication in 1985).

The Shamrock property is underlain by a series of metamorphic schists and gneisses (see Geologic Map – Figure 2) which make up the Lake George Subterrane of the more broadly distributed Yukon Tanana Terrane across interior Alaska and the Yukon, which is host to a number of large gold deposits (see Figure 3). Peak metamorphism occurred around 110 million years ago. Retrograde metamorphism resulted in cooling, gneiss dome formation and a transition from ductile deformation of the metamorphic fabric to brittle deformation, as well as a series of low-angle shears across the region. Mid-Cretaceous extension resulted in regional uplift and denudation of the metamorphic gneiss domes. Post-uplift plutonic activity often occurs along the margins of these domes where zones of extreme thinning are common. Two ages of intrusive activity are noted at 105ma and 85ma. Both mid-Cretaceous intrusive rocks are genetically related to lode gold mineralization.

There are three gold deposit types that CORE intends to explore for on the Shamrock property: 1) Gold in the low angle quartz veins characterized as “Pogo Type” mineralization; 2) Intrusive Related Gold deposits (IRG) associated with igneous intrusions where they intersect deep seated crustal structures (“Fort Knox Type”); and 3) high level rhyolite intrusive dikes with associated clay and silica alteration which occurs in the Democrat and Banner Dikes area of the property.

The property was previously owned by Coeur Mining which inherited the property as a result of acquiring North Empire Resources for their Sterling Gold Project located in Nevada. Coeur deemed the Richardson property (as it was referred to by Coeur) as non-core and dropped their claims in 2020. Based on historic work, CORE determined that there are a number of well-defined soil anomalies with limited drilling that remain under-explored. The Company plans to compile all previously acquired geochemical sampling, drilling and geophysical surveys completed on the Shamrock property and develop an exploration program for the 2021 field season.

Please see Company website for more details on the Peak Gold project and Peak Gold: https://www.contangoore.com/project/peak-gold.

References

Athey, J.E., Werdon, M.B., Twelker, Evan, and Henning, M.W., 2016, Alaska's mineral industry 2015: Alaska Division of Geological & Geophysical Surveys Special Report 71.

ABOUT CORE

CORE engages in exploration in Alaska for gold and associated minerals through a 30% interest in Peak Gold, LLC, which leases approximately 675,000 acres from the Tetlin Alaska Native Tribe for exploration and development, and through Contango Minerals Alaska, LLC, its wholly owned subsidiary, which owns the exploration and development rights for State mining claims totaling approximately 168,000 acres. Additional information can be found on our web page at www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding CORE that are intended to be covered by the safe harbor “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995, based on CORE’s current expectations and includes statements regarding future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using words such as “expects”, “projects”, “anticipates”, “plans”, “estimates”, “potential”, “possible”, “probable”, or “intends”, or stating that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those, reflected in the statements. These risks include, but are not limited to: the risks of the exploration and the mining industry (for example, operational risks in exploring for, developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by CORE or Peak Gold LLC; ability to realize the anticipated benefits of the recent transactions with an affiliate of Kinross; disruption from the transactions and transition of the Joint Venture Company’s management to an affiliate of Kinross, including as it relates to maintenance of business and operational relationships; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; CORE’s inability to retain or maintain its relative ownership interest in the Joint Venture; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; the extent of disruptions caused by the COVID-19 outbreak; and the possibility that government policies may change, political developments may occur or governmental approvals may be delayed or withheld, including as a result of the recent presidential and congressional elections in the U.S. or the inability to obtain mining permits. Additional information on these and other factors which could affect CORE’s exploration program or financial results are included in CORE’s other reports on file with the U.S. Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. CORE does not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210429005368/en/

Contacts

Contango ORE, Inc.

Rick Van Nieuwenhuyse

(713) 877-1311

www.contangoore.com