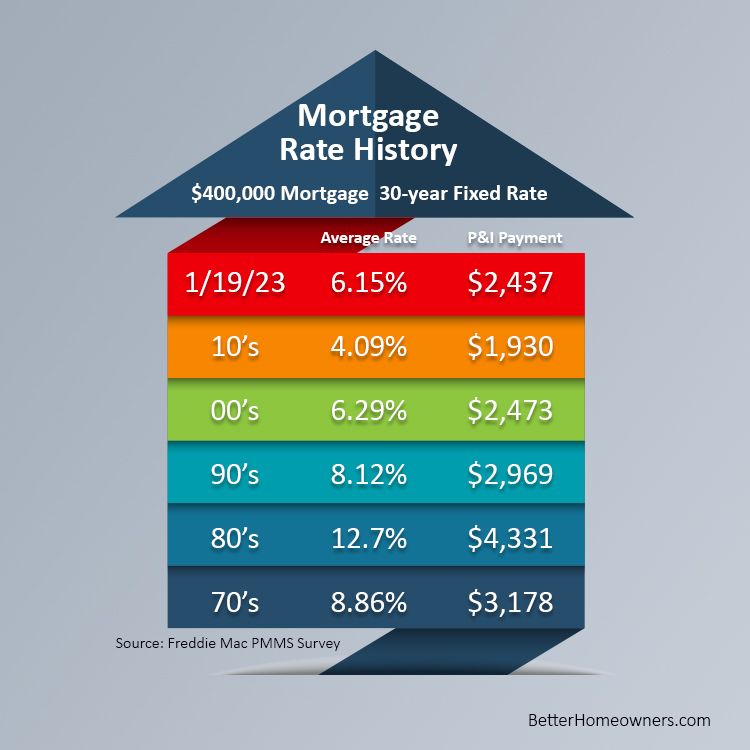

Did you know that even in todays interest rate environment, we are still below the 30 year & 40 year average(s) for interest rates, on home mortgages?

GILLETTE, Wyo. - Feb. 7, 2023 - PRLog -- The new normal may find its level between 5.5 and 6.5% in 2023. The 2.25-3% rates at their lowest level were unusual and partially driven by politics, pandemic, & unhealthy economic times; and we may never be see these rates again. As The Federal Reserve continues to raise the Prime Interest Rate, borrowers looking to get mortgages to buy a home are pushing back. Thus, we have recently seen interest rates for home mortgages start to settle, and are lower than the 7-7.25% rates we seen in late 2022. Remember, mortgage interest rates are not directly tied to the Prime Interest Rate, so investors and mortgage brokers have some flexibility when home buying actions start to lessen. Buyer affordability, & Supply and Demand are currently the two largest considerations for both Buyers and Sellers currently navigating our local real estate market. Sellers may find here in 2023 that they haven't yet missed the top of the market! As demand remains high and inventory remains lower than average, prices will remain higher than expected. For example, those homeowners that have a mortgage, with an interest rate less than 4%, for example, are choosing not to sell. This is one factor limiting the amount of "for sale" inventory coming into the housing pipeline. For more tips and information, visit our Facebook page or Youtube page. Be sure to follow us, or subscribe here!

Contact

Jason Walker

jasonwalker@jasonwalker.realtor

307-686-6360

Photos: (Click photo to enlarge)

Read Full Story - U.S. Home Mortgage Rate History | More news from this source

Press release distribution by PRLog

U.S. Home Mortgage Rate History

February 07, 2023 at 11:15 AM EST