In the forthcoming report from Marvell Technology, Inc. (MRVL), Wall Street analysts project quarterly earnings of $0.40 per share, representing a 29.6% plunge from the same period in the previous year. Revenue forecasts also suggest undulations as takings are expected to come in at $1.40 billion, a year-over-year drop of 8.9%. Economic fluctuations and a lackluster enterprise market have put a damper on demand for Marvell's chips and networking hardware.

Companies are holding off on upgrades to their technology infrastructure as an uncertain economic outlook clouds future prospects. Moreover, MRVL’s recovery in China has been weak as American legislation restricted the exports of certain chips to the country last year.

Due to the weakening of the global economy amidst persistent macroeconomic tensions and geopolitical issues, enterprises have deferred their large-scale tech expenditure plans. This hesitation will likely have had a detrimental impact on Marvell's overall financial performance in the upcoming reporting quarter.

The company projects revenue of $1.40 billion, plus or minus 5%, for the third quarter, the lower end of which is below analyst expectations, while EPS is expected to be 40 cents, plus or minus 5 cents for the quarter, in line with expectations.

In an additional development, Mitchell Gaynor, Executive Vice President and Chief Administrative Officer for MRVL, sold 8,000 shares of the company in October. Given the overall history of these transactions within the company, the recent sell is raising concerns. Over the past year, there have been 29 reported insider sells and zero reported insider purchases.

Owing to near-term uncertainties, one may consider looking for a better entry point in the stock. To further understand the situation, a detailed analysis of its key financial metrics is suggested.

Analyzing Marvell Technology Group's Performance: A Detailed Study of Financials from 2021-2023

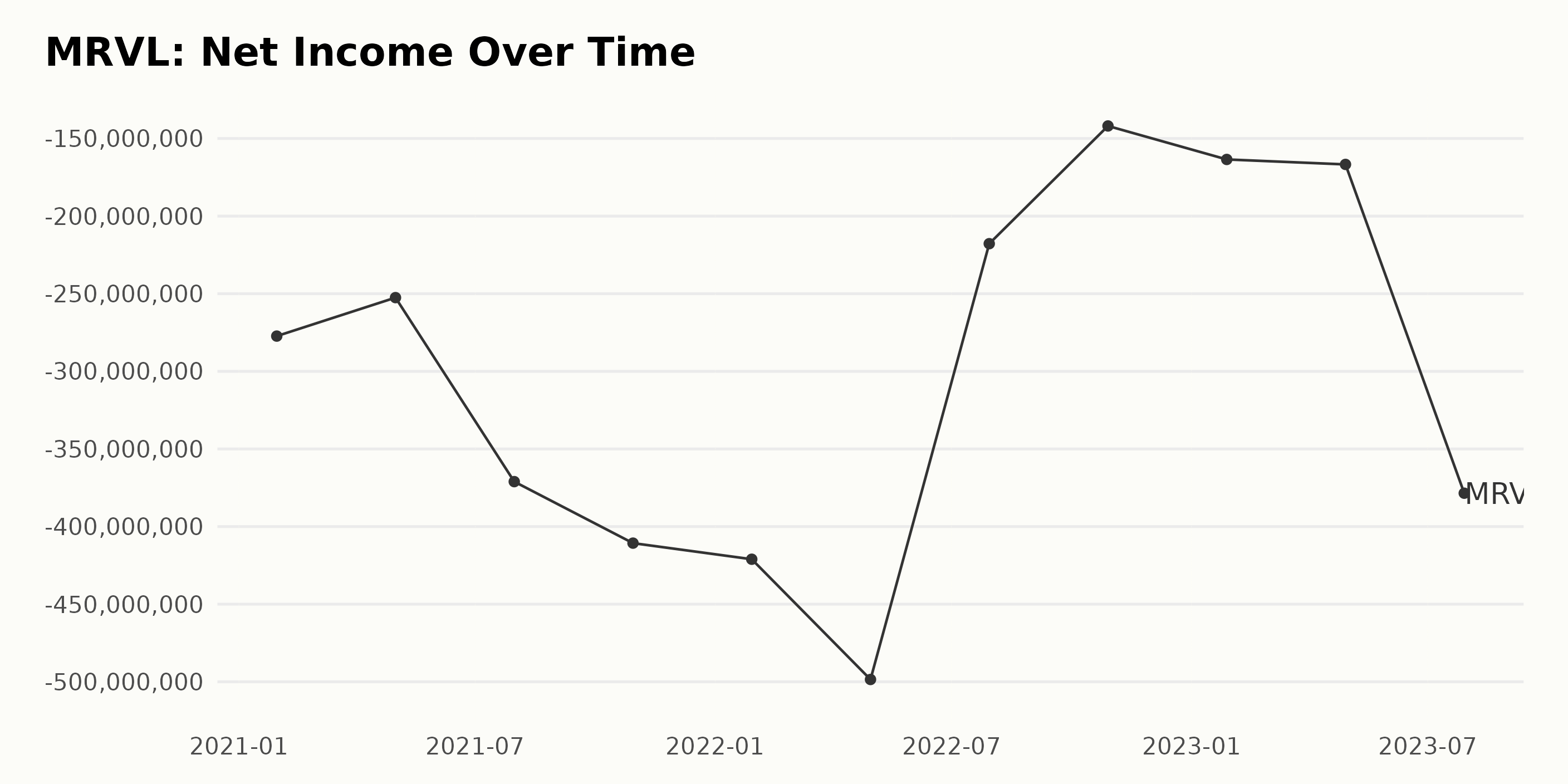

The trailing-12-month Net Income of MRVL has exhibited a fluctuating trend over the period from January 2021 to July 2023. Here are some of the significant points:

- Net income fell significantly, from -$277.3 million in January 2021 to -$421 million in January 2022. However, it then started to show some improvement.

- From January 2022 to April 2022, there was a dip of -$77.5 million with net income falling to -$498.5 million in April 2022.

- There was a considerable improvement in the company's financials following that, as net income recovered impressively, reaching -$141.9 million by October 2022, a significant recovery from its April 2022 low.

- In late January 2023, the net income slightly declined again to -$163.5 million but remained relatively stable until April 2023 at -$166.7 million.

- However, in July 2023, we see another substantial dip with net income plunging to -$378.5 million.

In conclusion, the overall trend shows a decrease in net income from -$277.3 million in January 2021 to -$378.5 million in July 2023, accounting for a growth rate of approximately -36.49% through this period. Despite several recoveries in between, the most substantial dip occurred in July 2023. Thus, MRVL's net income situation needs close monitoring towards the end of this timeline, as the sharp drop might indicate possible financial challenges.

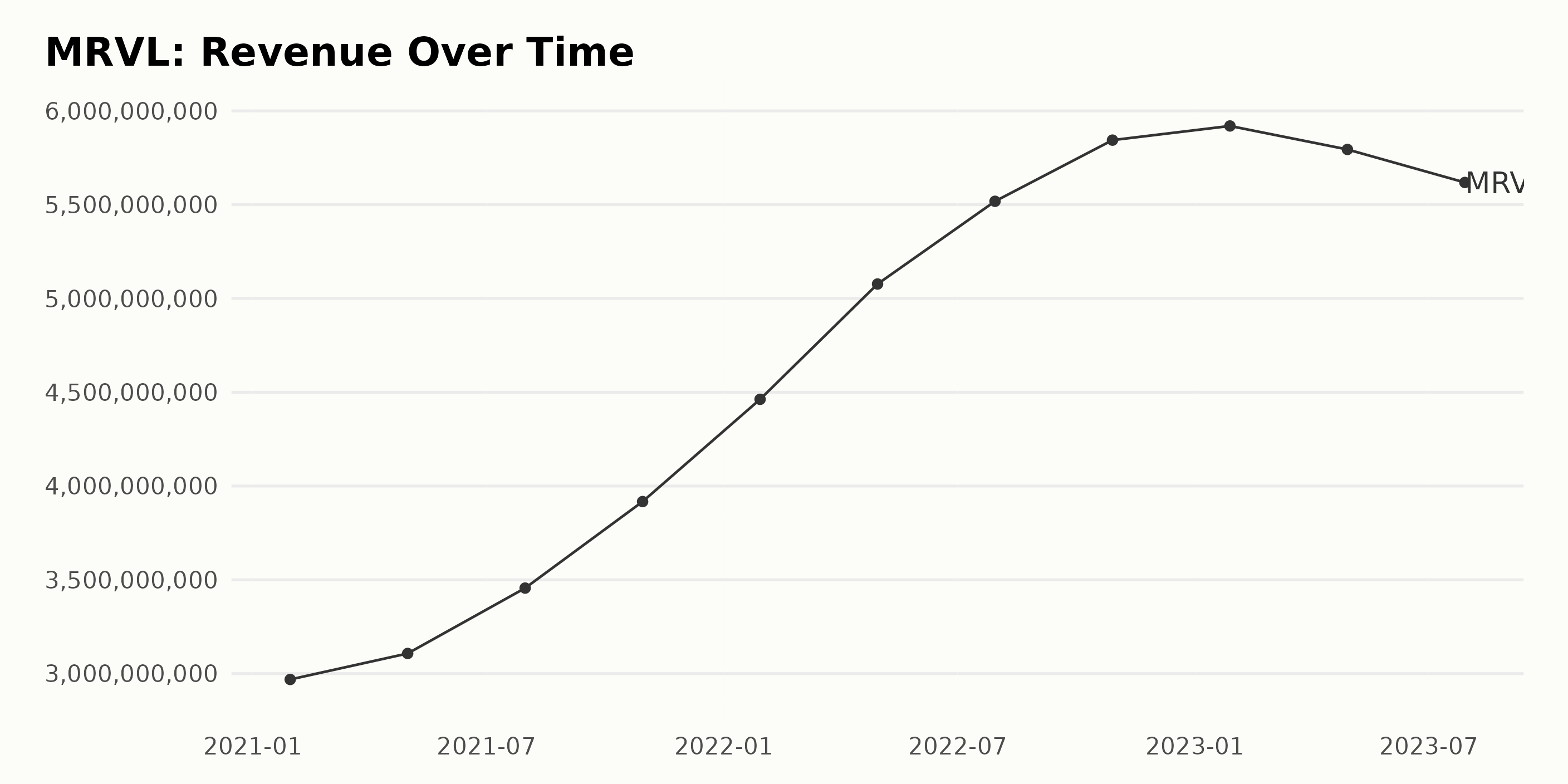

Marvell Technology Group Ltd. (MRVL) reported an overall upward trajectory for its trailing-12-month revenue until January 2023, followed by a declining trend. Here is a brief summary highlighting the major points:

- Start of 2021: MRVL began seeing an increase in revenue during this period. Specifically, in January 2021, they reported a revenue of $2.97 billion. This increased steadily to $3.1 billion by May 2021.

- Middle of 2021: The Revenue showed significant growth, reaching $3.46 billion and $3.92 billion, respectively, in July and October 2021.

- Start of 2022: A strong forward momentum was seen with the revenue reaching $4.46 billion by January, $5.08 billion by April, reaching a peak of $5.52 billion by July.

- End of 2022: Despite slight contraction to $5.84 billion in October 2022, it still showcased a remarkable improvement on a year-over-year basis.

- Start of 2023: There was a slight uptick in January 2023, pushing revenue marginally higher to $5.92 billion. However, after attaining this peak, there were signs of reversal in the trend.

- Mid of 2023: By April and July 2023, MRVL’s revenue had decreased significantly to $5.79 billion and $5.62 billion, respectively.

The growth rate from the start of the data set (January 2021) to end (July 2023) indicates an increase of approximately 88.9%. Even though the revenue showed a declining trend in the last quarter, its essential to consider the significant growth that occurred from the beginning of the series.

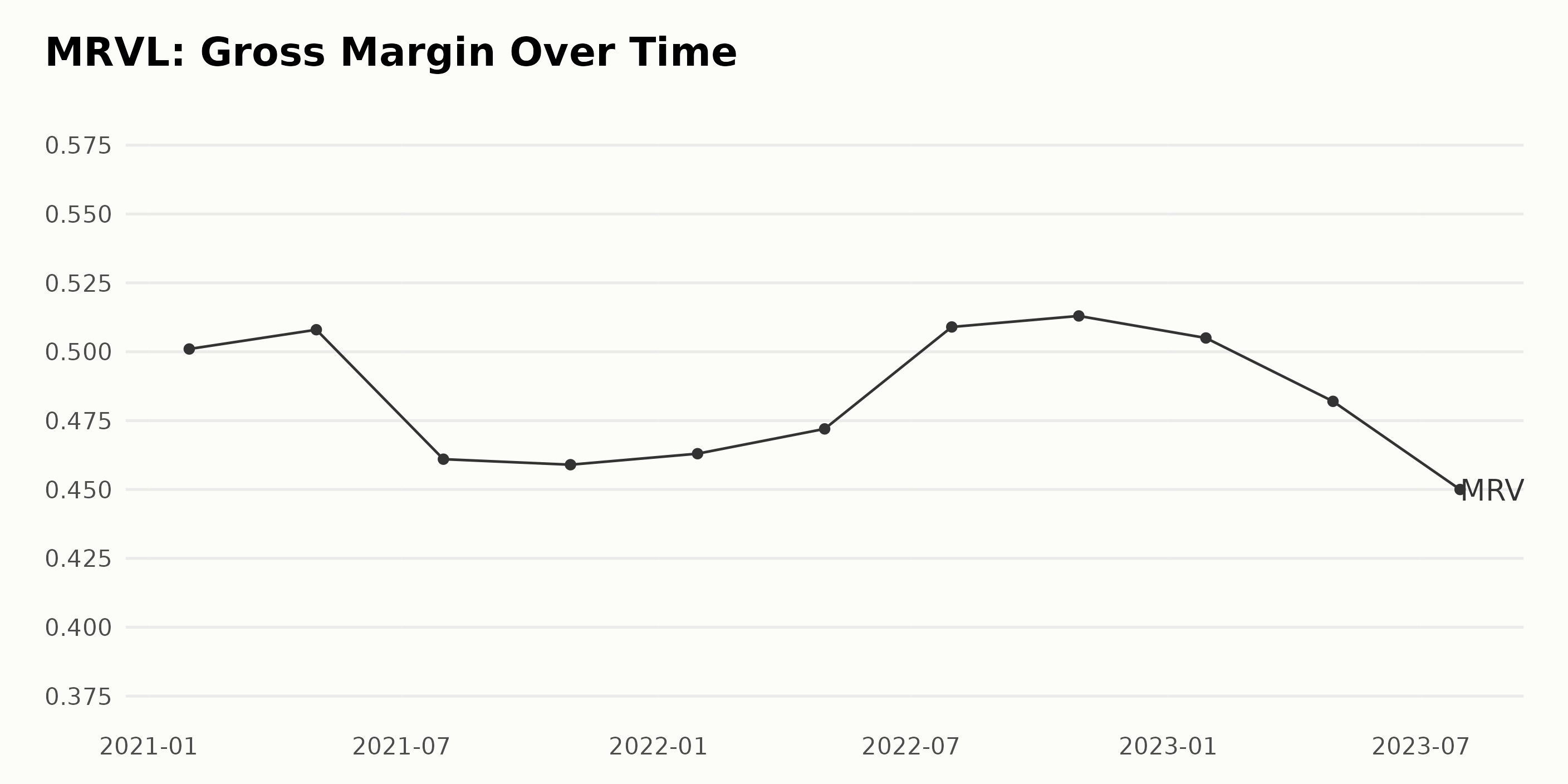

Looking at the gross margin of MRVL in your provided data, the following trends and fluctuations can be observed:

- Starting out at 50.1% in January 2021, there has been an overall increase to 45.0% till July 2023.

- The gross margin peaked at 51.3% in October 2022, which was an increase from 45.9% in the same month the previous year.

- The largest drop occurred between April 2023 and July 2023 when the gross margin fell from 48.2% to 45.0%.

- Notably, in a year-to-year comparison, the margin dropped from 50.8% in May 2021 to 47.2% in April 2022 before rising again to 50.9% in July 2022.

The calculation of the growth rate, measured from the first to the last value, shows a decline of 5.1%. This suggests that although there have been periods of growth within the period, the general trend is downward. This highlights important variations in MRVL's gross margin over this period, with significant increases followed by notable decreases. It is crucial for the company to look into factors contributing to this decline, especially given the downturn in more recent data.

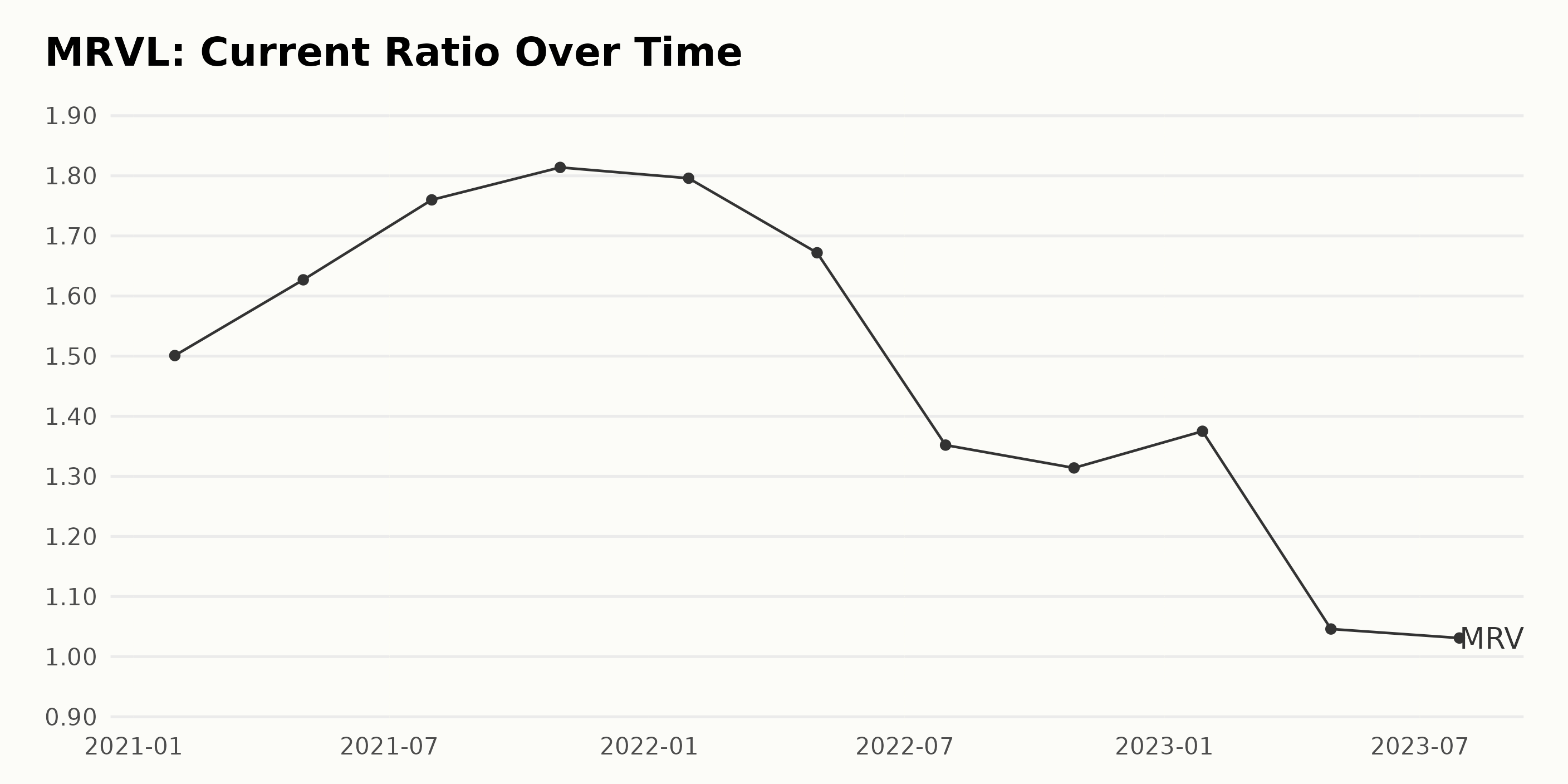

The Current Ratio of the MRVL demonstrated both a rising and declining trend over the years, exhibiting profound fluctuations.

- From January 2021 to October 2021, the Current Ratio increased steadily from 1.50 to 1.81. This denotes a sound asset-liability balance and financial health of MRVL.

- However, significant decline was experienced from October 2021. As of April 2022, the Current Ratio dropped off to 1.67 from its peak at 1.81 (October 2021), and even plunged further to 1.31 by October 2022.

- Interestingly, in the start of 2023, a slight recovery was observed with the ratio rising to 1.37 by January.

- Unfortunately, this was short-lived as the Current Ratio plummeted again to reach a low of 1.03 by July 2023. Focusing more on the recent data, by July 2023, the Current Ratio was at 1.03, dropping considerably as compared to 1.50 in January 2021, marking a decrease of approximately 31.3%.

In conclusion, whilst MRVL began the period with a steady increase in Current Ratio indicating better financial health, it clearly faced some financial pressures in managing short-term liabilities during late 2021 and 2023. Despite a few recoveries, the overall trend is downward.

Marvell Technology Group's Market Performance: A Six-Month Share Price Analysis

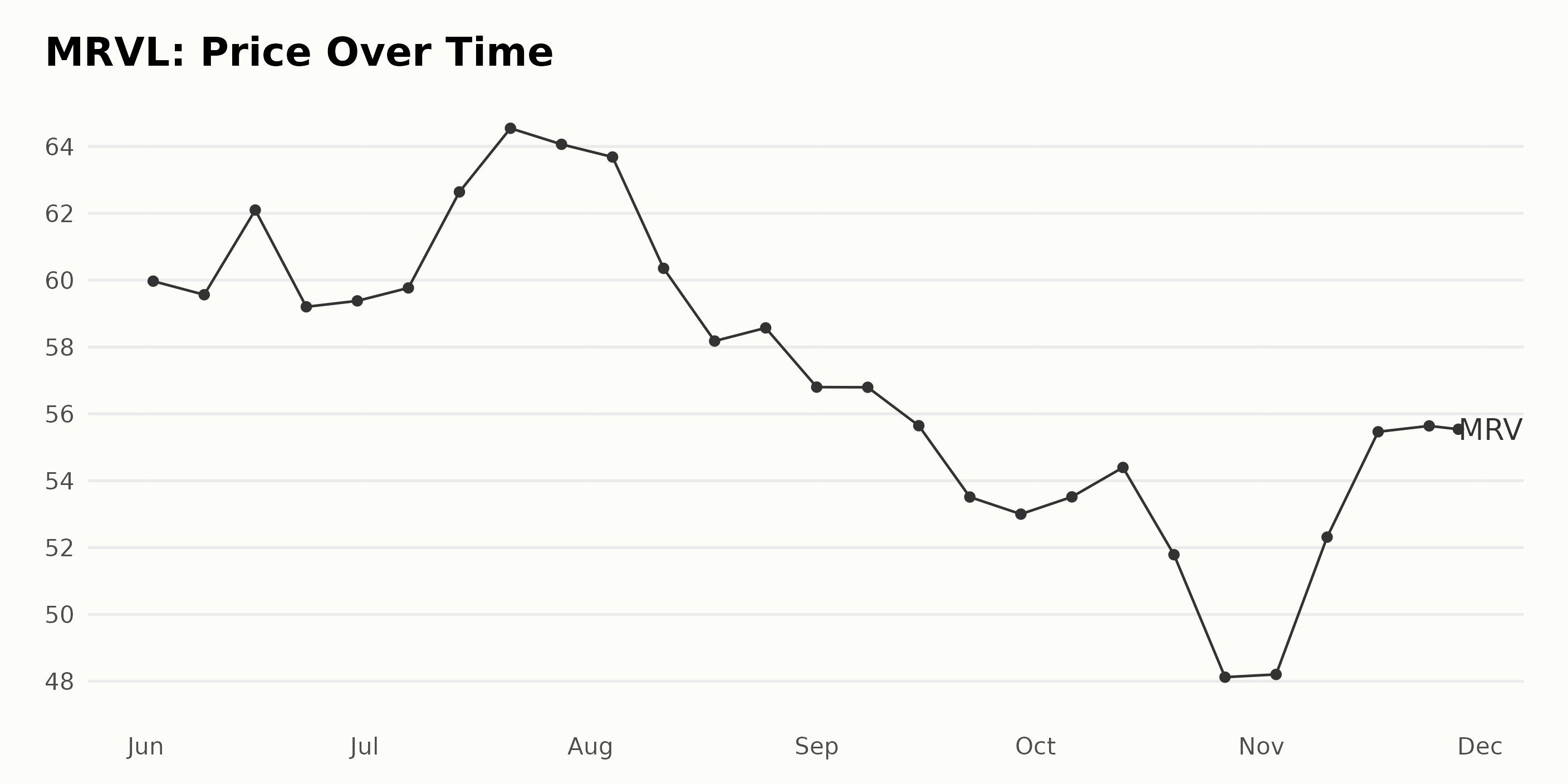

Analyzing the share price data of Marvell Technology Group Ltd. (MRVL) from June to November 2023 leads to the following key insights:

- On June 2, 2023, the share price was at $59.97. By the end of June, it showed a slight decrease, closing at $59.38 on June 30.

- In July 2023, the stock grew significantly, opening at $59.77 on July 7 and hitting a high of $64.54 on July 21. Since then, the stock saw a minor decline, closing at $64.06 on July 28.

- The trend continued into early August with the price dropping to $63.68 by August 4. Mid-August brought a more substantial decrease, with the price going down to $58.18 by August 18. A small recovery occurred by the end of the month, with the close at $58.57 on August 25.

- September 2023 saw a downward trend in MRVL's share prices. The stock opened at $56.80 on September 1, eventually closing lower at $53.00 by September 29.

- October showed some volatility, with the price fluctuating between a high of $54.40 on October 13 till a dip of $48.12 by October 27.

- November brought about recovery as the price increased from $48.20 on November 3 to $55.64 by November 24. Although there was a marginal decrease to $55.54 on November 28.

Based on the data, from June till November 2023, the share cost of the Marvell Technology Group Ltd. (MRVL) has been fluctuating with periods of both rise and fall. However, overall, it represents a deceleration in price, starting with $59.97 in June and closing at $55.54 by the end of November. Here is a chart of MRVL's price over the past 180 days.

Analyzing Marvell Technology's 2023 Financial Outlook Through POWR Ratings

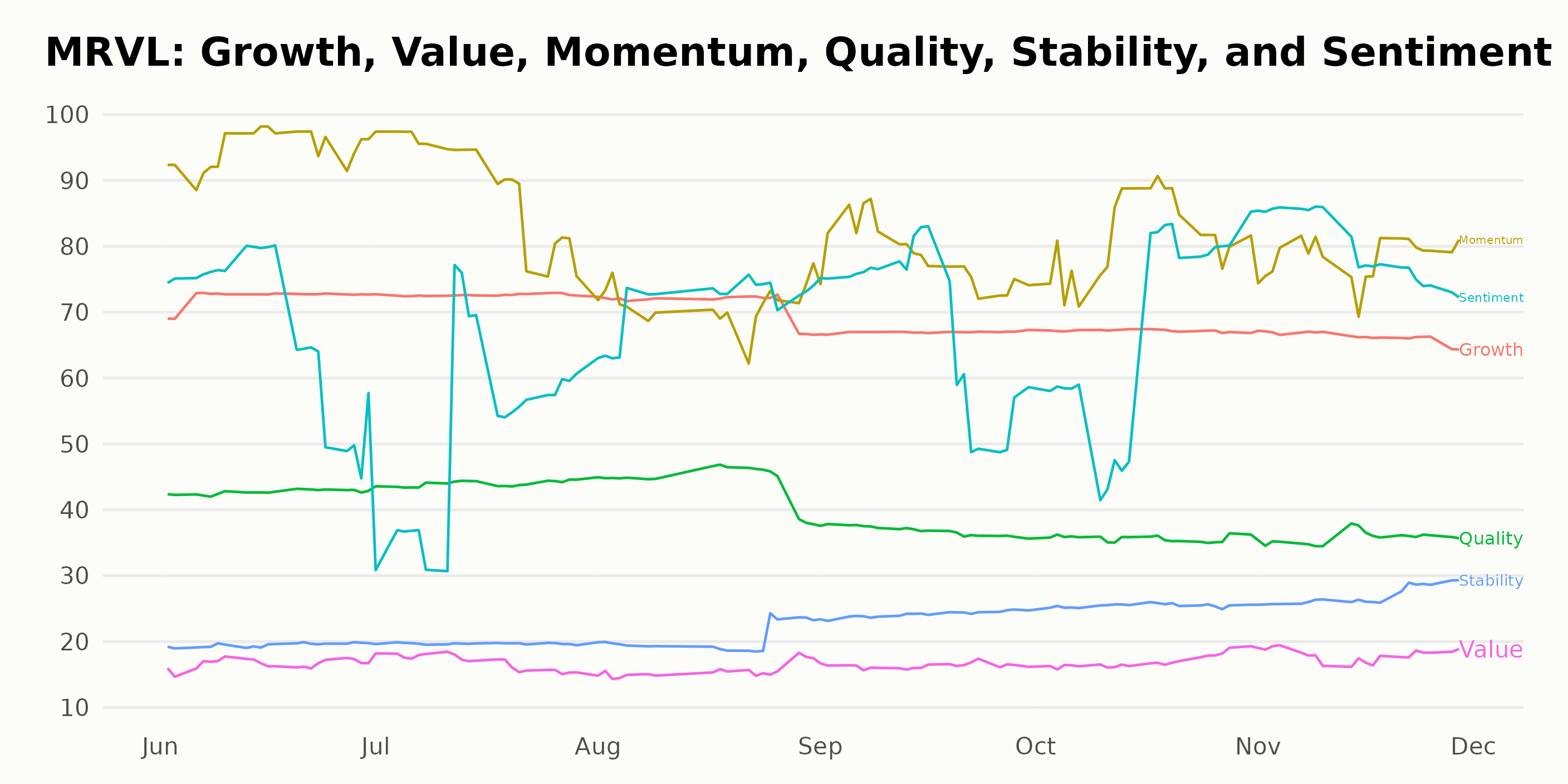

MRVL has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #71 out of the 92 stocks in the Semiconductor & Wireless Chip category.

The POWR Ratings for Marvell Technology Group Ltd. (MRVL) suggest three dimensions of particular note: Growth, Momentum, and Sentiment.

Growth:

- In June 2023, the growth dimension was rated at 72.

- Over the subsequent months, it showed a slight increase, reaching 73 in July 2023 before starting to trend downwards, reaching a lower rating of 66 by November 2023.

Momentum:

- The momentum dimension showed significant prominence with the highest rating of 95 as of June 2023.

- Despite an initial decrease to 90 in July 2023 and a substantial dip to 71 by August 2023, a recovery trend was observed, with the rating increasing to 82 in October, before steadying at 78 in November 2023.

Sentiment:

- In June 2023, the sentiment dimension was rated at 68.

- Considerable fluctuations can be observed in this dimension, with a drop to 52 in July 2023, followed by an increase to 71 in August 2023 and 80 in November 2023.

These trends contribute insights to the evolving financial outlook for Marvell Technology Group Ltd. as derived from these key dimensions of the POWR ratings.

How does Marvell Technology Group Ltd. (MRVL) Stack Up Against its Peers?

Other stocks in the Semiconductor & Wireless Chip sector that may be worth considering are ChipMOS TECHNOLOGIES INC. (IMOS), Everspin Technologies Inc. (MRAM), and STMicroelectronics N.V. (STM) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

MRVL shares were trading at $56.36 per share on Wednesday afternoon, up $0.78 (+1.40%). Year-to-date, MRVL has gained 52.96%, versus a 20.53% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Marvell Technology (MRVL) Earnings Watch: A Chip Stock to Watch? appeared first on StockNews.com