S&P 500 Ishares Core ETF (NY: IVV )

572.81

-9.86

(-1.69%)

Streaming Delayed Price

Updated: 2:03 PM EDT, Oct 31, 2024

Add to My Watchlist

All News about S&P 500 Ishares Core ETF

Via Talk Markets

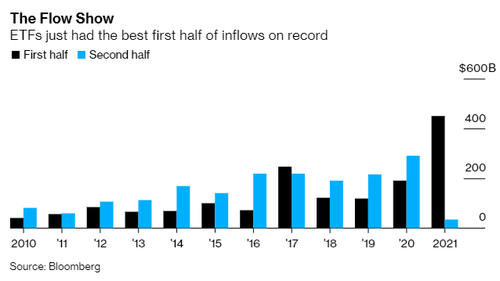

Are Equally Weighted Portfolios Intrinsically Superior To Cap Weighted Portfolios? - A Case Study Using S&P 500 ETFs

August 17, 2021

Via Talk Markets

Topics

Stocks

Exposures

US Equities

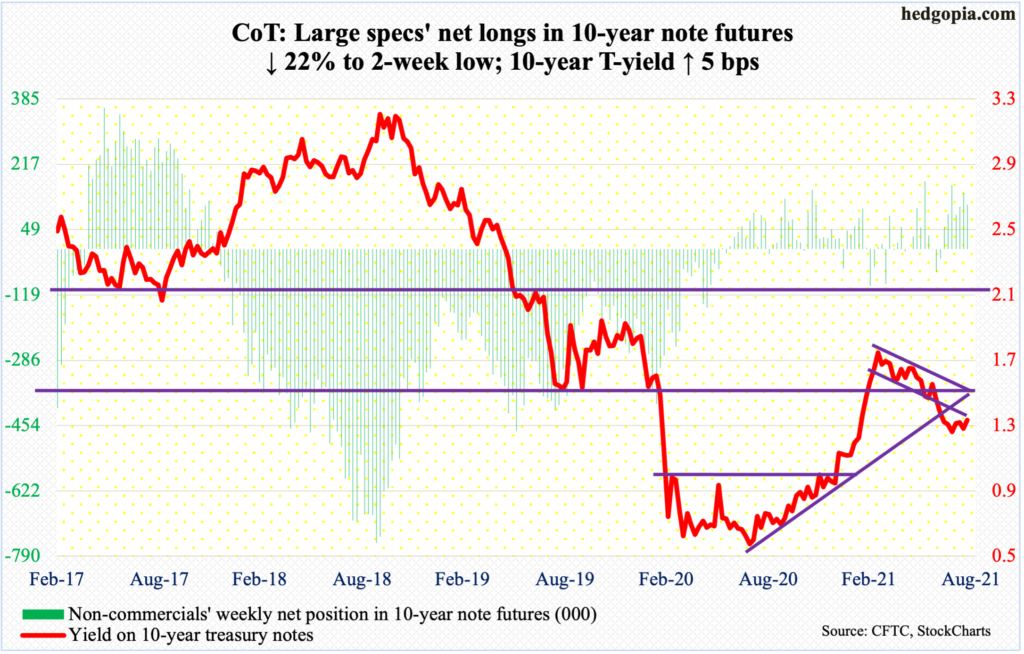

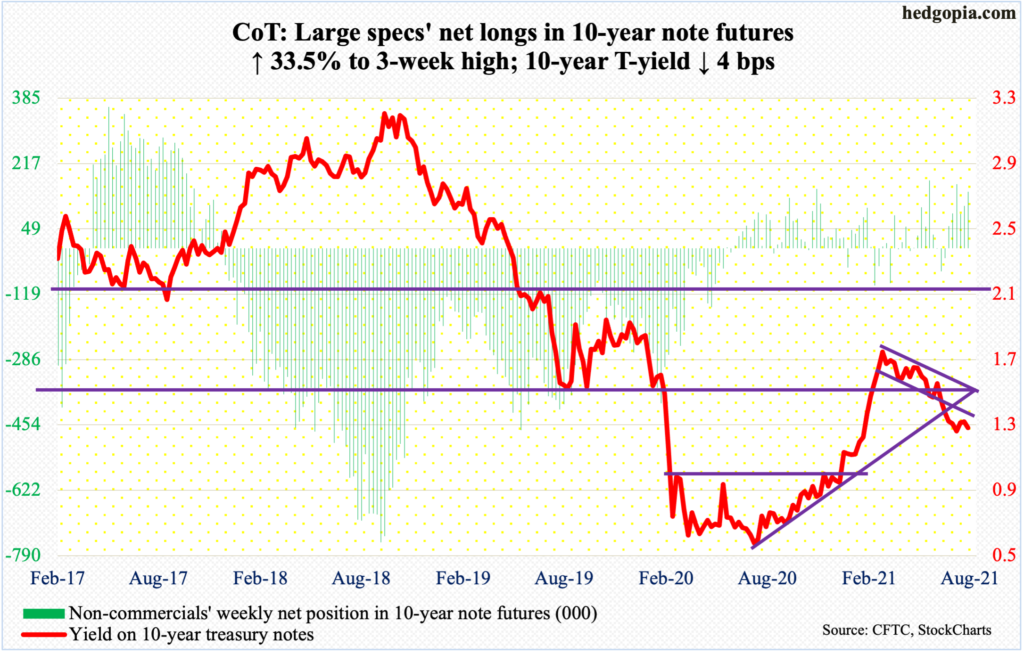

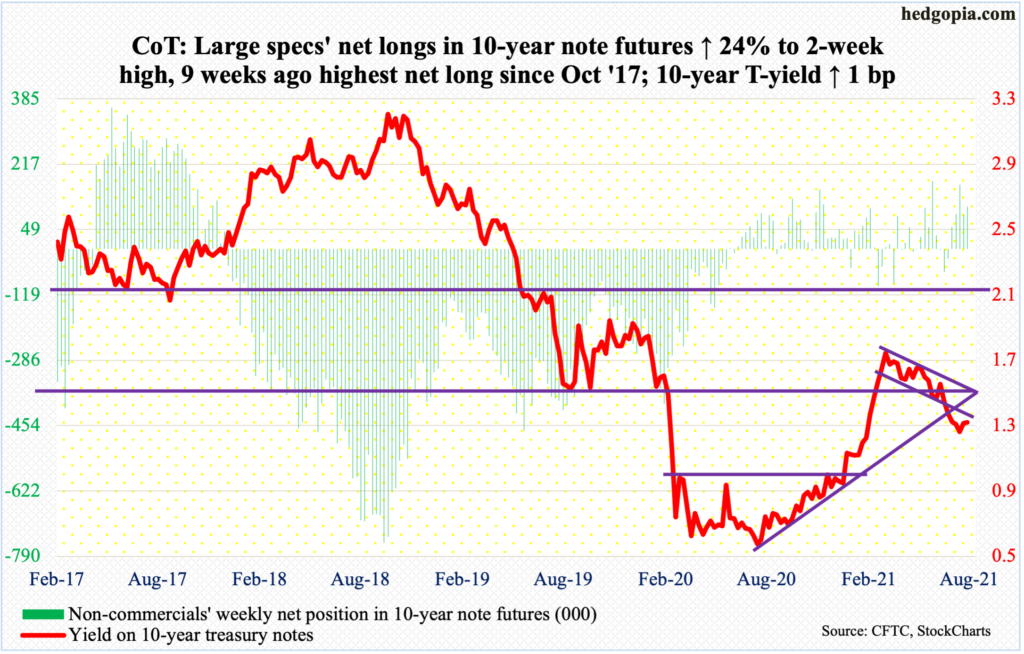

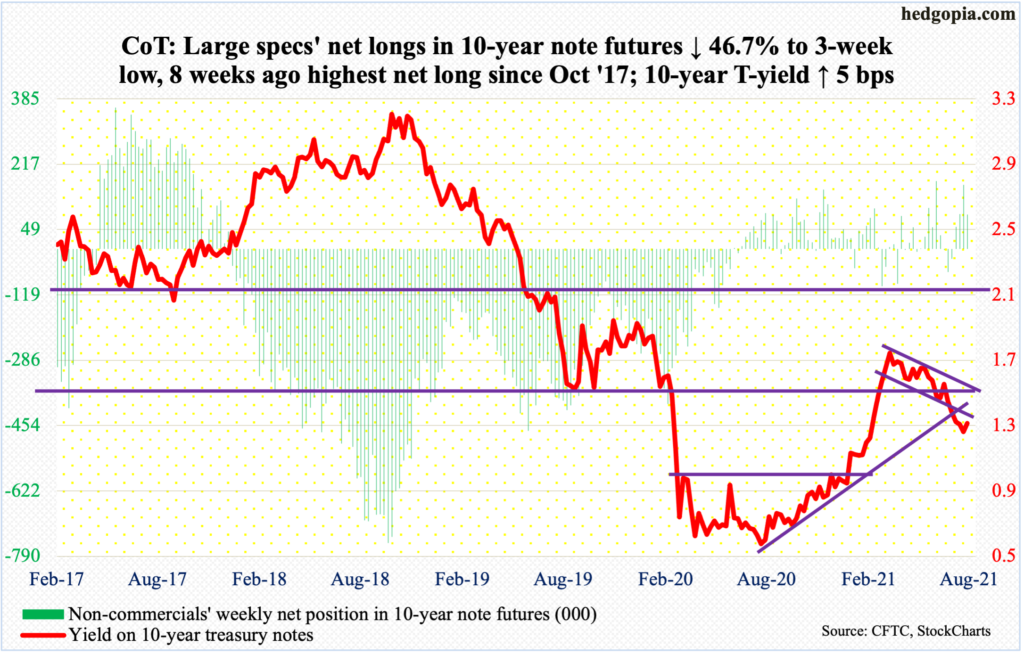

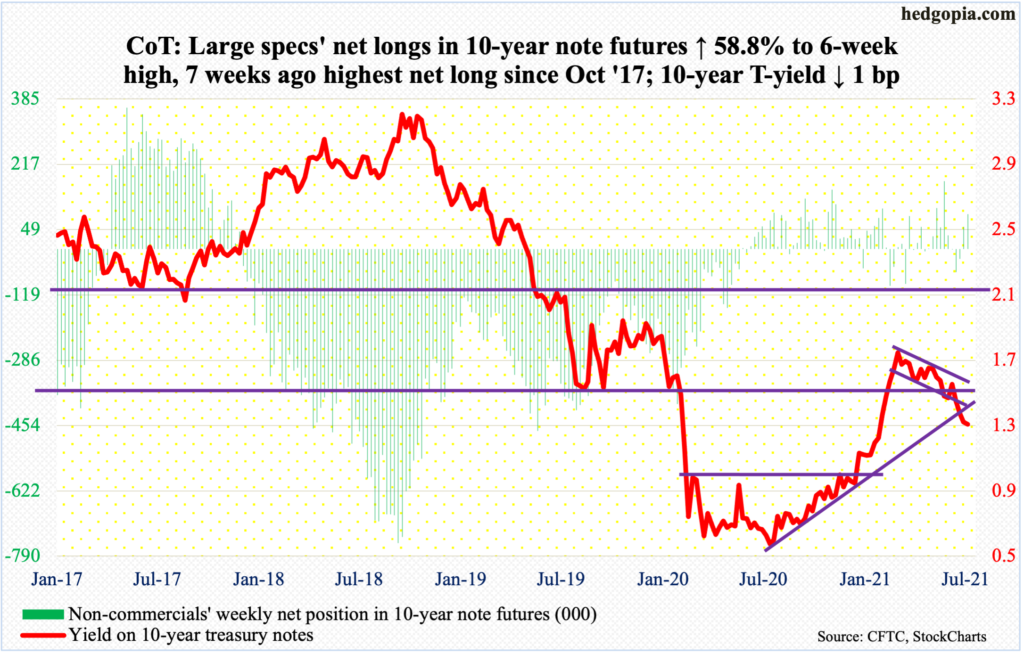

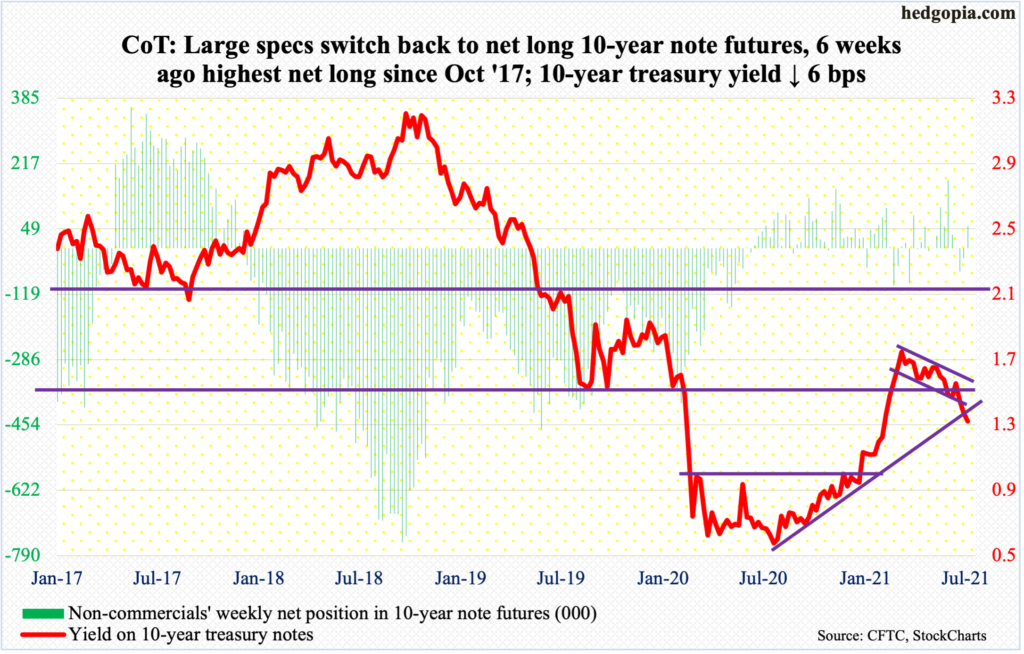

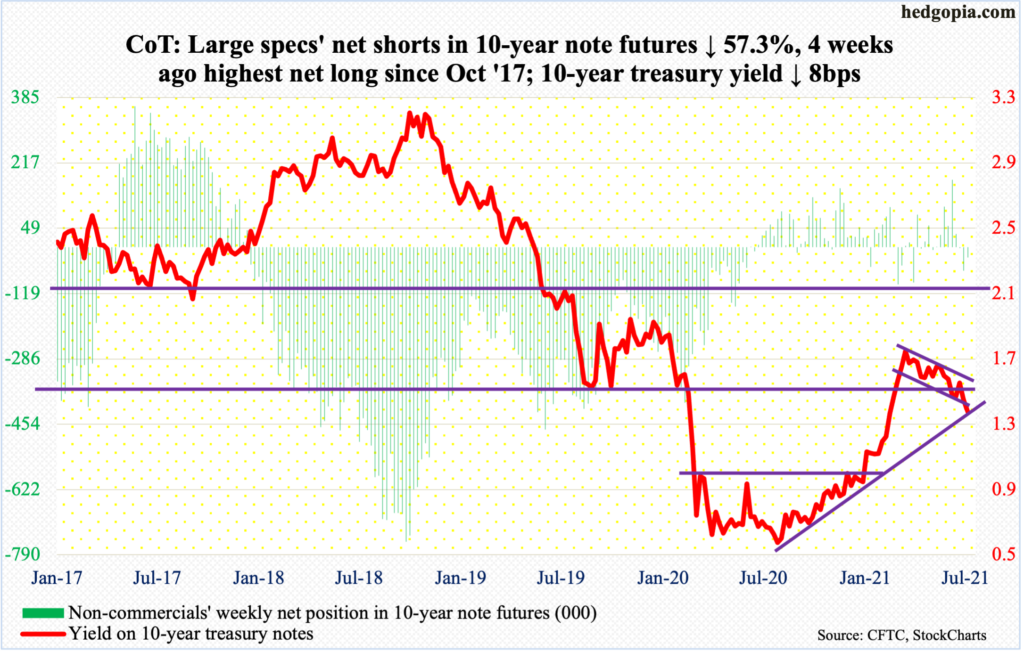

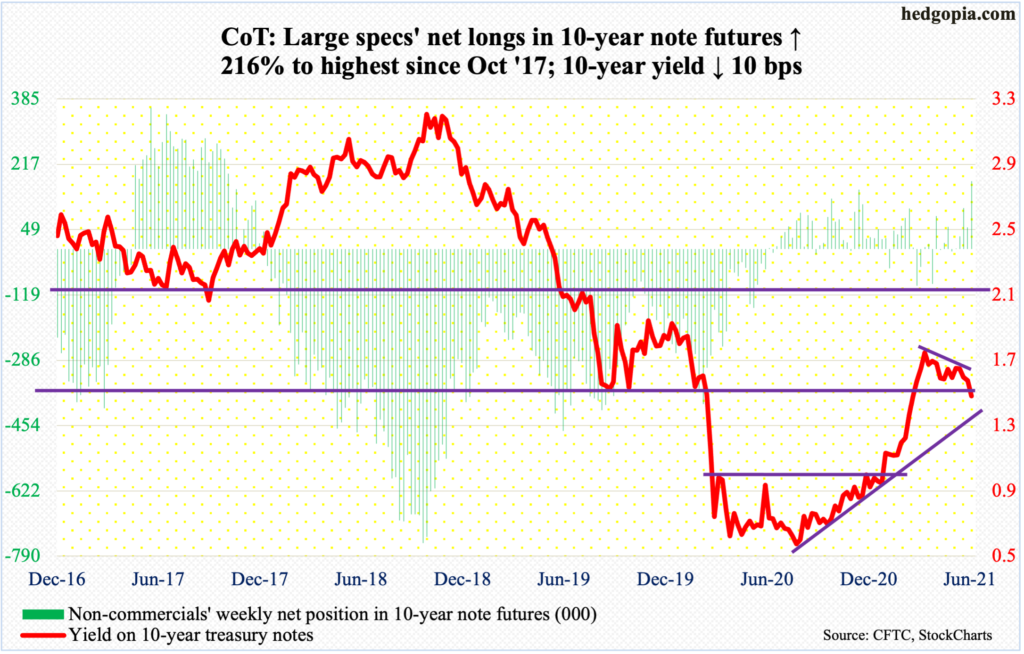

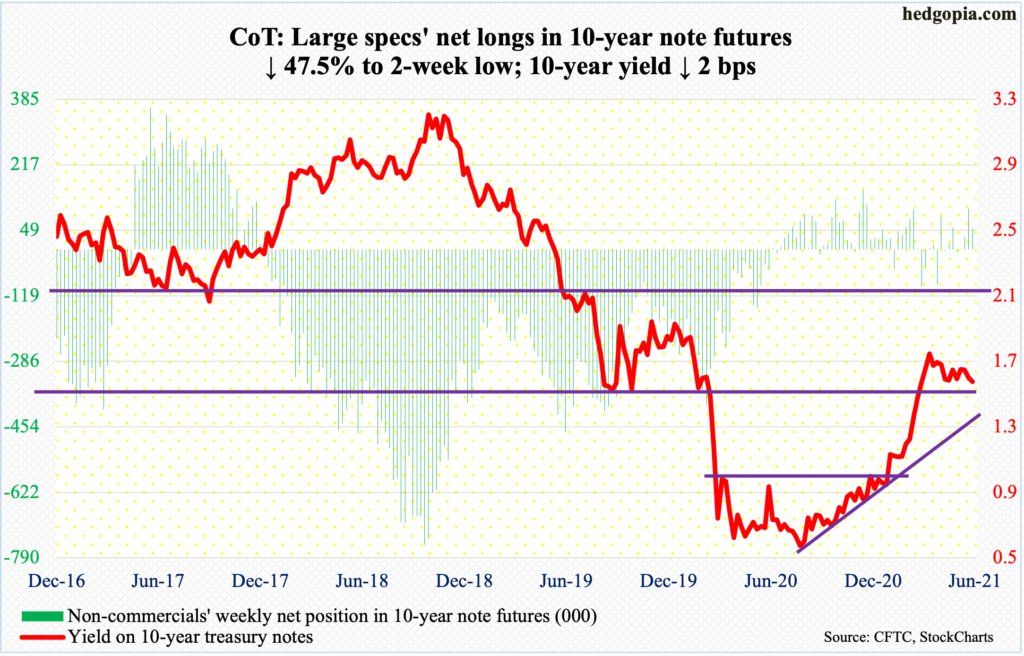

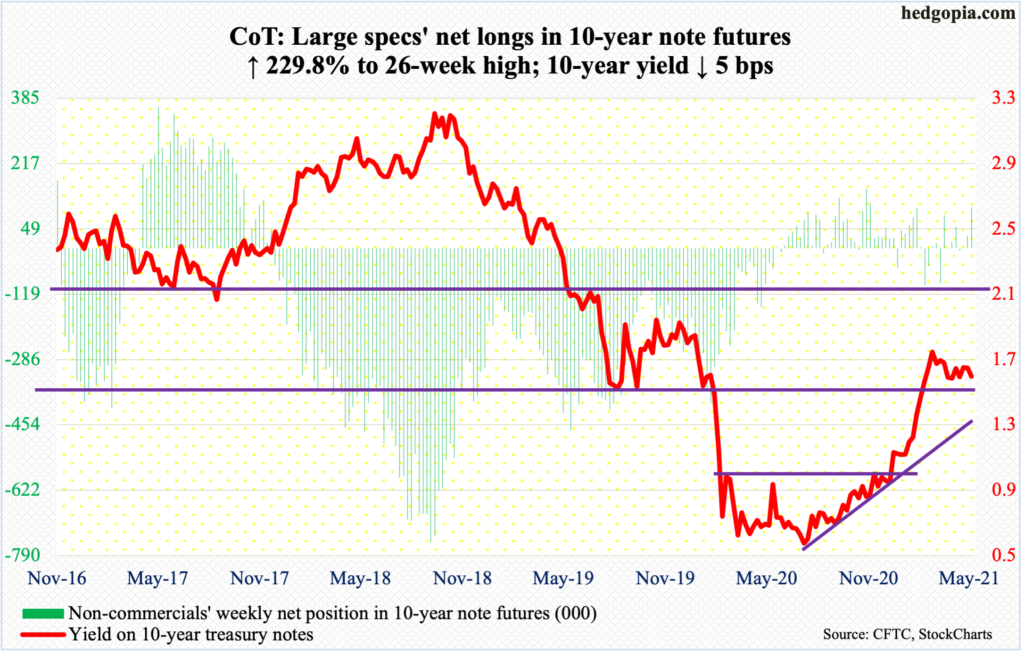

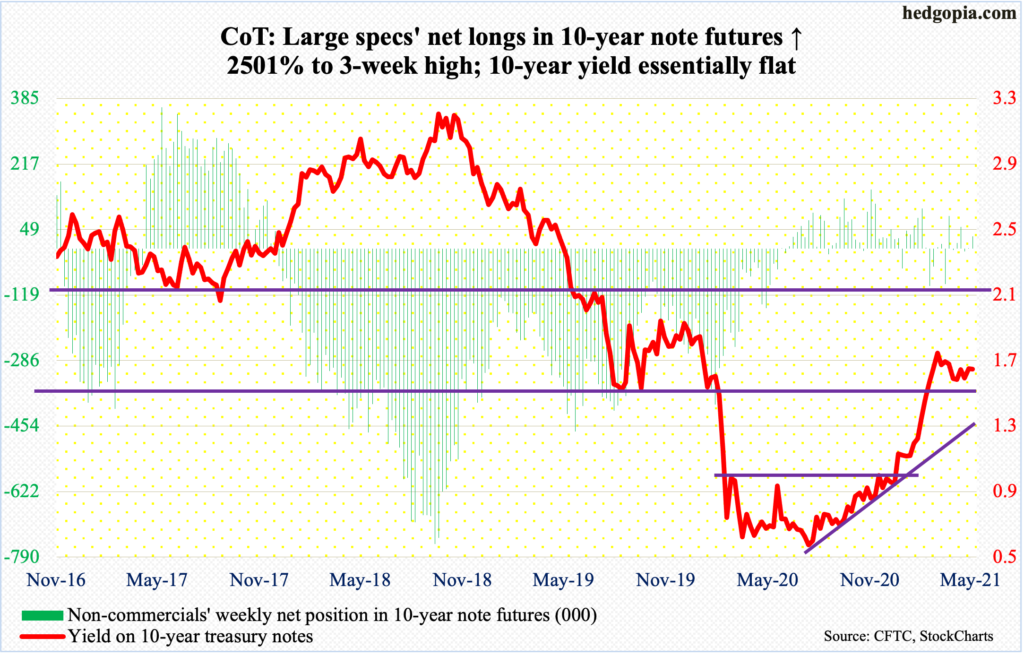

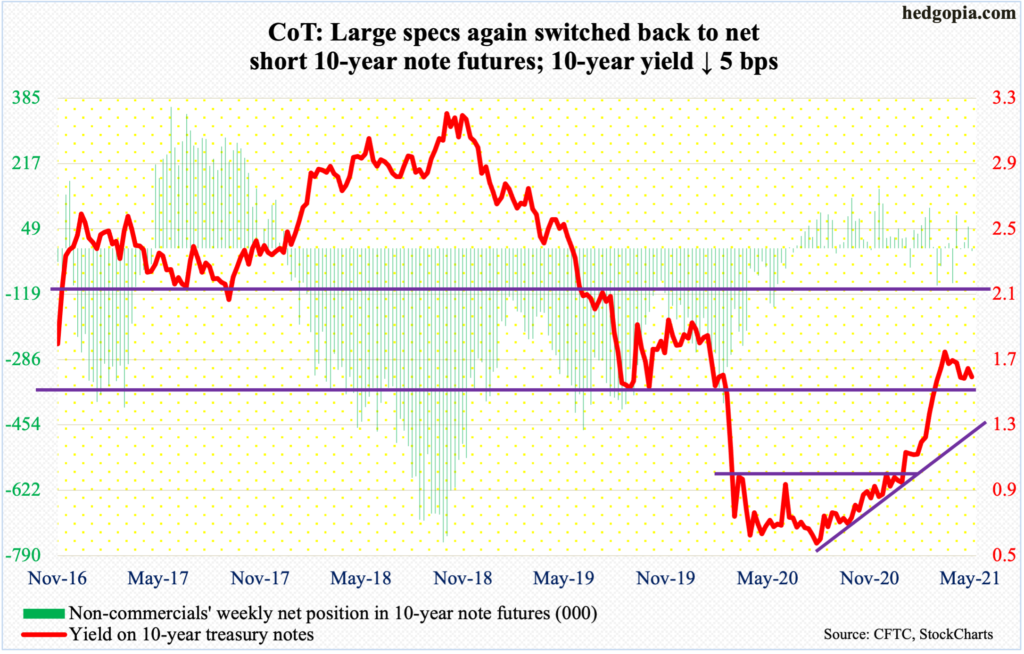

CoT: Learning From The Futures Positions Of Non-Commercials

August 08, 2021

Via Talk Markets

Big US Stocks’ Q2’21 Fundamentals

August 06, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

S&P 500 ETF (IVV) Hits A New 52-Week High

June 26, 2021

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.