Healthcare apparel company Figs (NYSE:FIGS) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 1.5% year on year to $140.2 million. Its non-GAAP loss of $0.01 per share was also 26.7% below analysts’ consensus estimates.

Is now the time to buy Figs? Find out by accessing our full research report, it’s free.

Figs (FIGS) Q3 CY2024 Highlights:

- Revenue: $140.2 million vs analyst estimates of $143.3 million (2.1% miss)

- Adjusted EPS: -$0.01 vs analyst expectations of -$0.01 (26.7% miss)

- EBITDA: $4.8 million vs analyst estimates of $8.34 million (42.5% miss)

- Lowered full year revenue growth and EBITDA margin guidance

- Gross Margin (GAAP): 67.1%, down from 68.4% in the same quarter last year

- Operating Margin: -6.2%, down from 7% in the same quarter last year

- EBITDA Margin: 3.4%, down from 17.2% in the same quarter last year

- Free Cash Flow Margin: 13.1%, down from 32.3% in the same quarter last year

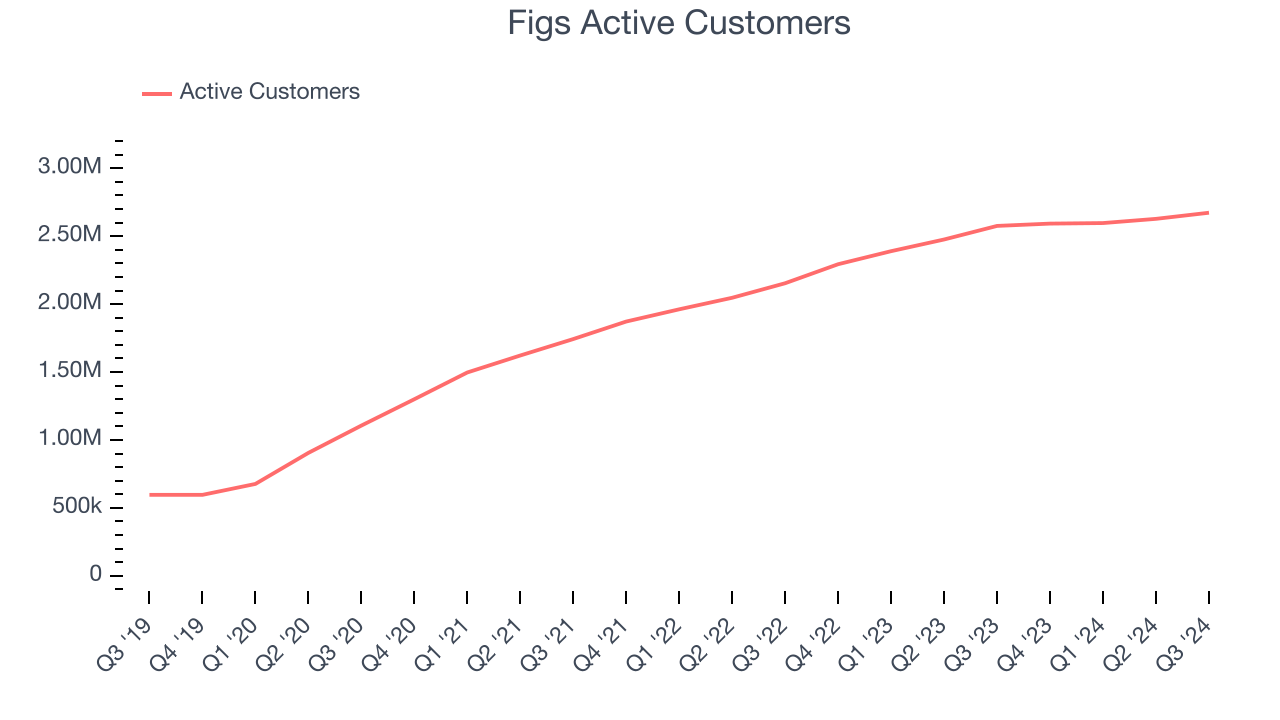

- Active Customers: 2.67 million, up 97,000 year on year

- Market Capitalization: $1.10 billion

“The third quarter included several key investments to support and scale FIGS, highlighted by our incredible Olympics campaign with the Team USA Medical Team and the completed transition of our fulfillment center to a state-of-the-art, highly-automated facility,” said Trina Spear, Chief Executive Officer and Co-Founder.

Company Overview

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

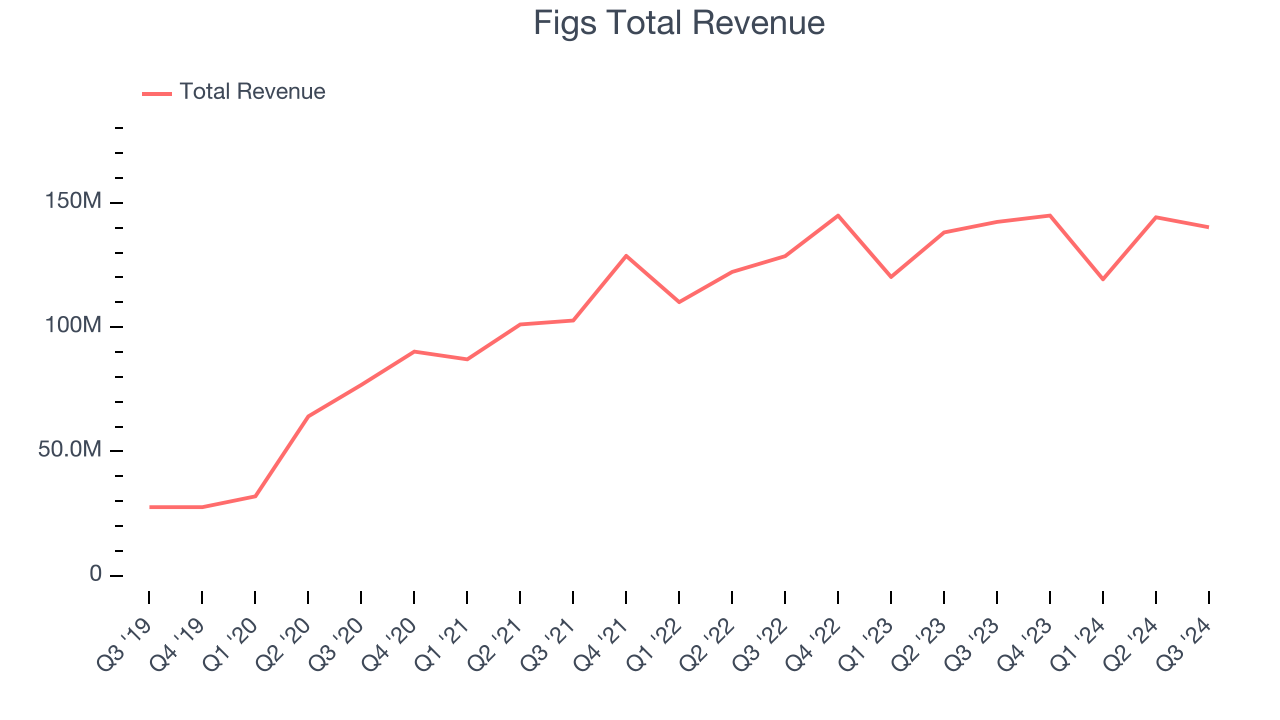

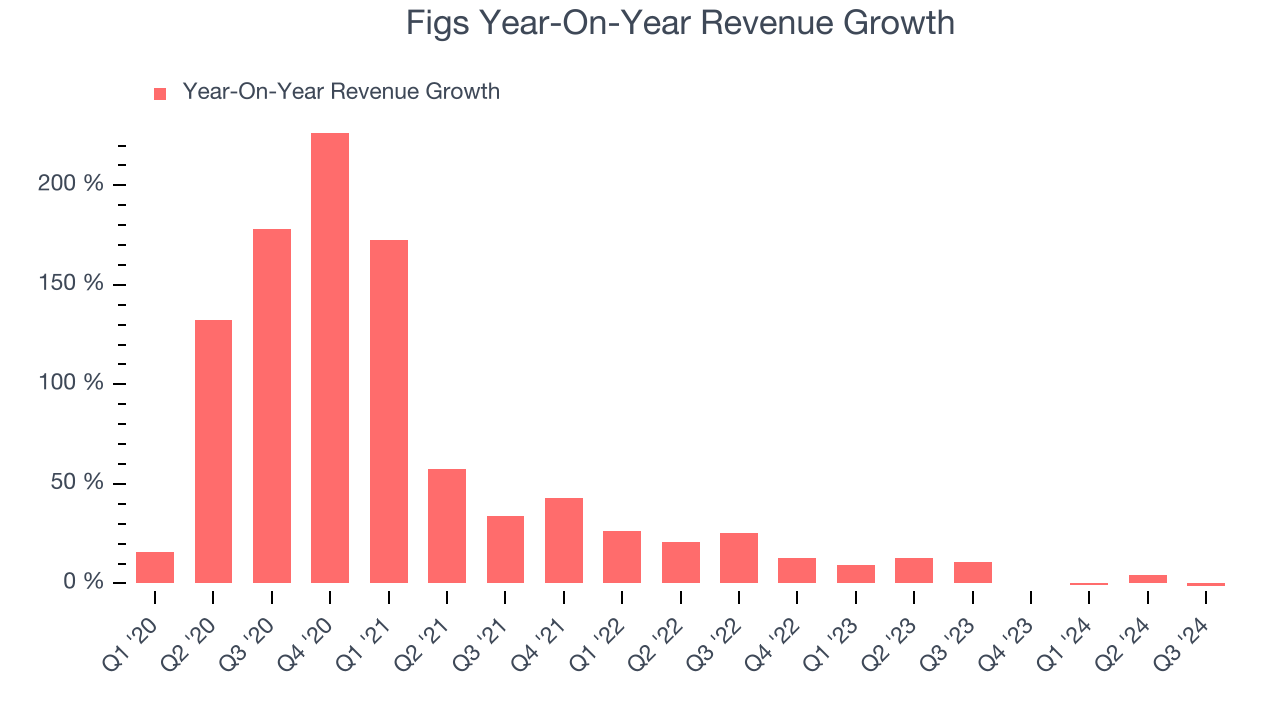

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, Figs’s sales grew at an incredible 37.3% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Figs’s recent history shows its demand slowed significantly as its annualized revenue growth of 5.9% over the last two years is well below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its number of active customers, which reached 2.67 million in the latest quarter. Over the last two years, Figs’s active customers averaged 14.6% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Figs missed Wall Street’s estimates and reported a rather uninspiring 1.5% year-on-year revenue decline, generating $140.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and illustrates the market thinks its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

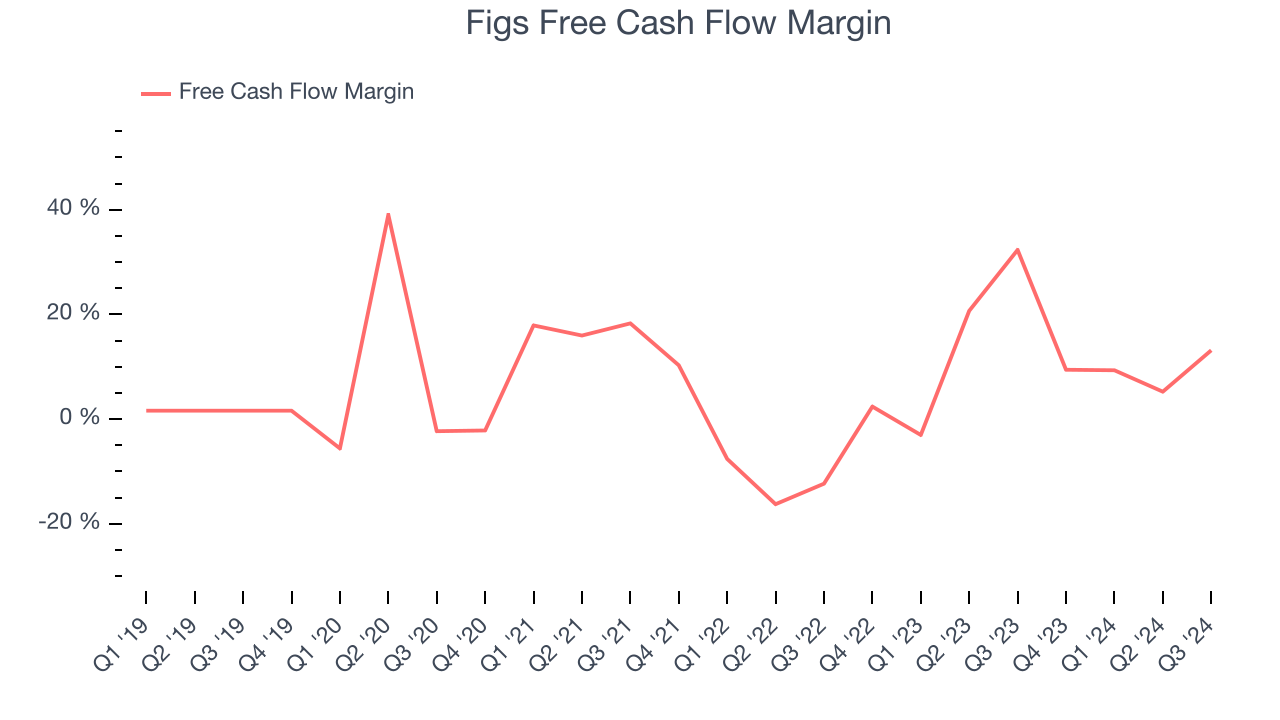

Figs has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.4% over the last two years, slightly better than the broader consumer discretionary sector.

Figs’s free cash flow clocked in at $18.42 million in Q3, equivalent to a 13.1% margin. The company’s cash profitability regressed as it was 19.2 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Key Takeaways from Figs’s Q3 Results

We struggled to find many strong positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. The company also lowered its full year revenue growth and EBITDA margin guidance, which is always a worrisome sign. Overall, this quarter could have been better. The stock traded down 16% to $5.60 immediately following the results.

Figs didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.