A 6.13% drop in market value probably wasn’t what Adobe (ADBE) had in mind when it announced an expanded partnership with Alphabet’s (GOOG, GOOGL) Google Cloud to deliver the next generation of artificial-intelligence-powered creative technologies. Still, contrarian speculators may have an enticing opportunity on their hands.

According to a press release, at Adobe Max — the world’s largest creativity conference — the two tech giants announced the partnership, which will bring together Adobe’s decades of creative expertise with Google’s advanced AI models to usher in a new era of creative expression. However, investors were mostly skeptical, sending ADBE stock sharply downward.

While AI has been a boon for several enterprises, Adobe hasn’t enjoyed much like converting the innovation into capital gains; in fact, it’s been quite the opposite situation. Since the start of the year, ADBE stock has dropped 24% of value. In the past 52 weeks, it’s down almost 31%. And over the past five years, the security has been below parity to the tune of over 24%.

In fairness, Wall Street analysts remain optimistic about ADBE stock, rating it a consensus Moderate Buy. However, the assessment is somewhat tenuous. Over the past three months, the consensus saw one more Strong Sell included and one Strong Buy rating taken out.

Adding to the skepticism, the Barchart Technical Opinion indicator rates ADBE stock as an 88% Strong Sell, with a decisively bearish short-term outlook. In the derivatives market, options flow — which focuses exclusively on big block transactions — shows net trade sentiment at $897,800 below parity, thus favoring the bears.

By seemingly most measures, ADBE stock appears risky, subject to further downside. However, for the adventurous, Adobe could offer a statistically sweet discount.

Using S&R Tactics to Potentially Extract Profits from ADBE Stock

When it comes down to brass tacks, trading in the financial market — especially in the options arena — is very much like search-and-rescue (S&R) tactics. In both cases, you’re dealing with an environment of limited resources while trying to extract a favorable outcome: either finding a missing person or (not intended to pun a competitor) seeking alpha.

Further, because of the limited resources, you can’t just bet on every outcome. Searchers can’t possibly cover every square inch of a major national park and you can’t bet on every vertical spread due to the heavy costs involved. In both cases, you have to use data science, a form of probability mapping that best estimates where a missing hiker could go or where a stock may end up at a particular point in time.

Given that the equities market can be influenced by exogenous factors, it’s never fully predictable. However, that doesn’t mean we can’t use quantitative data to better estimate where a security may head next. We know through GARCH (Generalized AutoRegressive Conditional Heteroskedasticity) studies that the diffusional properties of volatility are clustered and are thereby dependent on prior incidences of volatility.

By logical deduction, we can infer that different market stimuli yield different market responses. This is the very reason why I convert the continuous scalar signal of share prices into the discrete signals of sequencing logic.

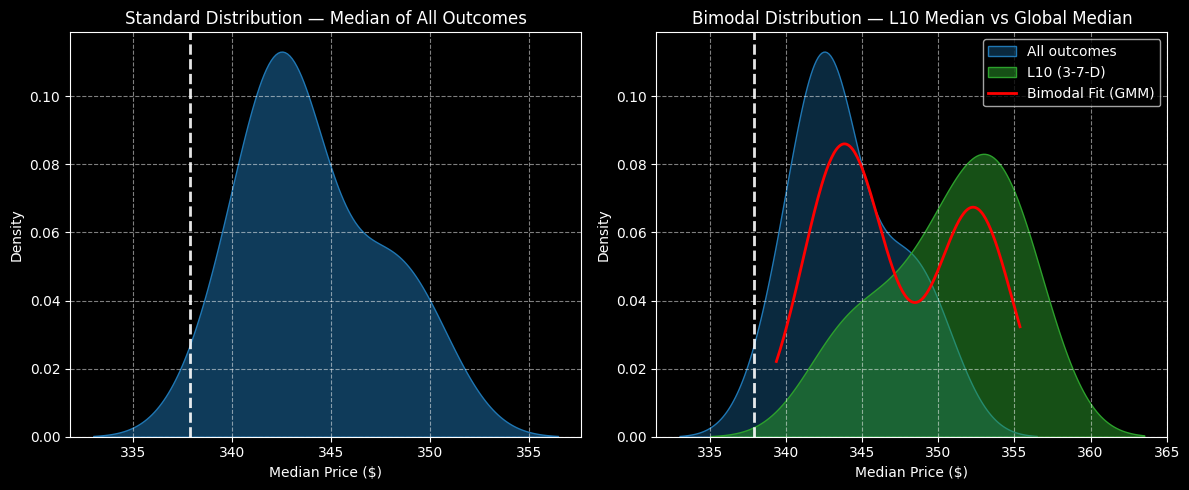

Now, as a baseline or homeostatic condition, the projected 10-week outcomes form a skewed distributional curve, with median prices ranging from roughly $332 to $355 (assuming an anchor of $337.86, Wednesday’s close). Further, price clustering is predominant at around $342.

However, we’re currently not in a homeostatic state. Instead, in the past 10 weeks, ADBE stock has been structured in a 3-7-D formation: three up weeks, seven down weeks, with an overall downward slope. This distributive-heavy sequence features a forward outcome ranging between $335 and $365, with prices expected to cluster predominantly at $353.

In other words, there’s a 3.22% positive delta in price density dynamics that market makers are not pricing in. Potentially, we can use this mismatch to our advantage.

Two Trades to Consider

Based on the market intelligence above, there are two vertical spreads that stand out. First, the most aggressive strategy is the 345/350 bull call spread expiring Nov. 21. This trade will require ADBE stock to rise through the second-leg strike ($350) at expiration, leading to a maximum payout of over 138%.

The second trade, which is a bit more forgiving on the time aspect, is the 340/350 bull spread expiring Dec. 19. It’s the same principle as the prior trade: ADBE stock will need to rise through the second leg at expiration. Of course, the main benefit here is the extra time. Do keep in mind, though, that the payout is “only” 117.39%.

With both trades, we’re taking advantage of the positive delta in price density. Statistically, under 3-7-D conditions, ADBE stock will likely cluster around $350 over the next 10 weeks. Keep in mind that the terminal price could be different from week to week. But in both the November and December monthly option chains, you should have a solid chance of triggering the max payout.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ashes to Alpha: Adobe’s (ADBE) Implosion Offers an Opportunity for a Rebound

- It's 'Going to Be Like a Shockwave' When Tesla's AI Innovations Hit. Should You Buy TSLA Stock First?

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Stocks Fall Before the Open After Mixed Big Tech Earnings, Trump-Xi Summit