Microsoft (MSFT) was seen dropping close to 3% to $525.97 on new earnings and litigation headlines, but analysts see an opportunity to buy in any downturn in the market. The company is further cementing leadership in the areas of cloud technology and artificial intelligence, with multiple companies boosting price targets in the wake of increased adoption of Azure and the initial success of AI Foundry technology.

Within the larger market, AI-related infrastructure spending is red-hot, with hyperscalers growing spending on capital by well into double digits. The company’s well-leveraged play in the larger trend, with a strong balance sheet, 36% profit margin, and 32% return on equity, has further reinforced market confidence in the face of the coming new year in 2026.

About Microsoft Stock

The Microsoft Corporation has its roots in Redmond, Washington, and is the largest software firm in the world in terms of market capitalization, standing at $3.89 trillion. The company operates in the areas of cloud computing, its Azure product, productivity software in the form of Microsoft 365, and AI technology. The company enjoys one of the broadest moats in the technology industry because of its extensive offerings in the consumer and business ecosystems.

Within the last 52 weeks, the range of MSFT has been $344.79 to $555.45, with about 23% growth so far in the year; it is only a few percentage points above the S&P 500's ($SPX) growth of 16%. Despite pulling back 3% in the last week, MSFT is close to reaching record highs due to expected growth from AI adoption.

Taking valuation metrics into consideration, it can be noted that Microsoft has a forward price/earnings ratio of 35.2 in addition to a price/sales ratio of 14.3, indicating it to be relatively high in comparison to the industry average ratio of 26x for the S&P 500 technology industry peers. The company has recorded a net income margin of 36.15% along with an asset return ratio of 18.2%.

The company is somewhat overvalued in terms of earnings strength, but it has recorded good earnings performance in the past.

Microsoft Beats on Earnings

Microsoft has managed to outperform market expectations in the fiscal first quarter of 2026 yet again. The company has experienced an 18% growth in revenue to $77.7 billion, while the revenue growth in the operating income category was recorded at 24% to $38 billion. The company has posted an EPS of $3.72 in the GAAP category, an increase of 13%, while the non-GAAP EPS has experienced substantial growth of 23% to $4.13.

The management was proud of the resilience of the Microsoft Cloud, which was continuing to benefit from the adoption of Copilot and AI agent technology in the ecosystem. Meanwhile, Microsoft CEO Satya Nadella revealed that the company was running “a planet-scale cloud and AI factory.”

Foraying ahead, the company has stuck to full-year guidance but has increased forecasts on capital expenditure by 15–20% because of strong demand in Azure and GPU supply constraints. The current phase with heavy investments upfront portrays strong optimism on monetization in AI. The next earnings call is expected in late January 2026.

What Do Analysts Predict for MSFT Stock?

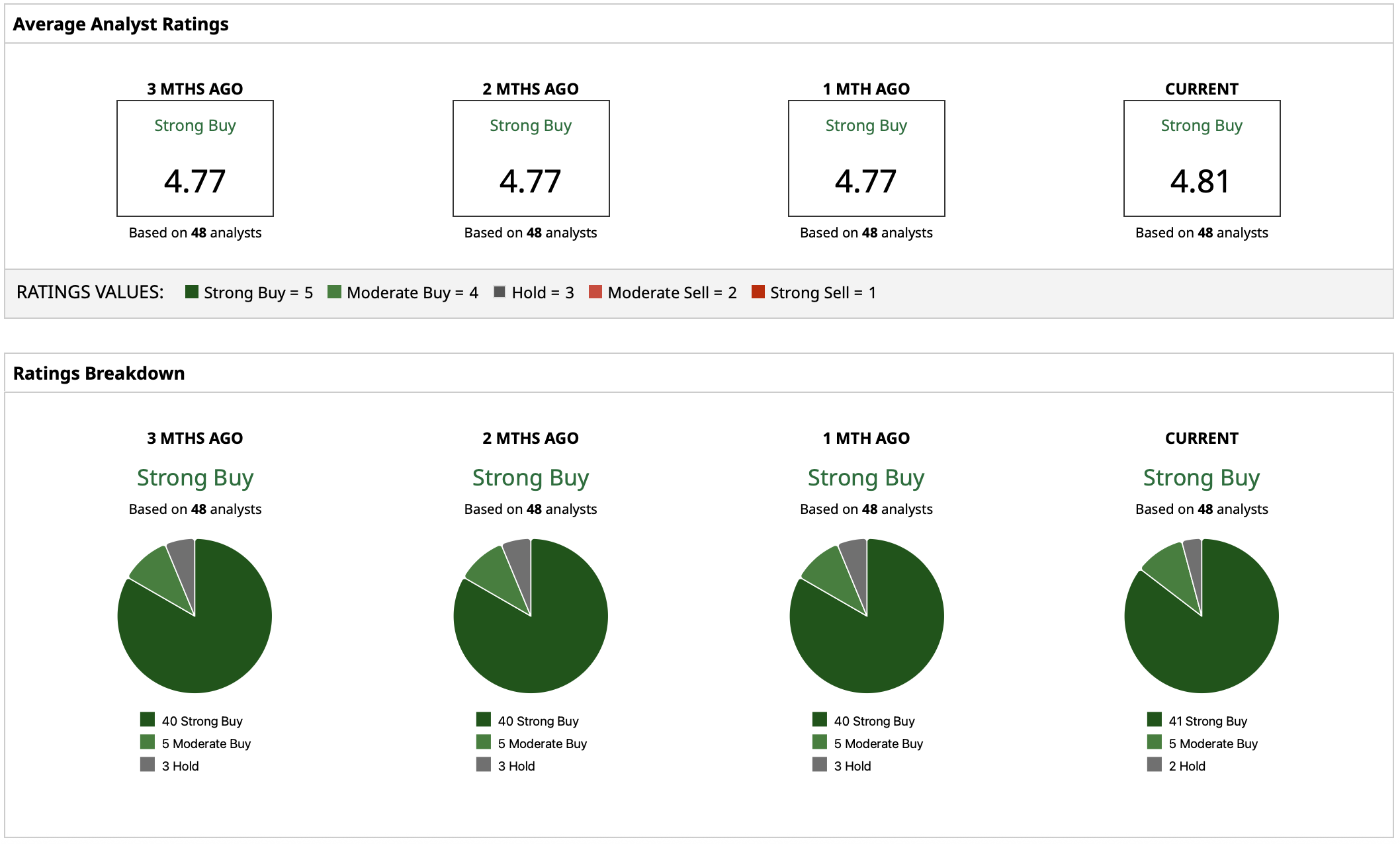

Analysts continue to be very optimistic about the future prospects of Microsoft with a “Strong Buy” rating consensus. MSFT stock's average price target of $630.20 indicates possible growth of close to 21% from the current market price, while the highest price target of $682 indicates possible growth of over 31%.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Pair of New 2X ETFs Goes Double or Nothing on Big Tech. Should You Chase the Volatility in Apple, Nvidia, and Microsoft Now?

- Analysts Say You Should Ignore ‘Short-Term Blips’ and Keep Buying Microsoft Stock

- This Penny Stock Just Reported a 1,000% Increase in Revenue. Should You Buy It Here?

- Netflix Just Announced a 10-for-1 Stock Split. Should You Buy NFLX Stock Here?