Realty Income Corporation (O), headquartered in San Diego, California, is a real estate partner to the world's leading companies. With a market cap of $52.9 billion, the company owns and manages a portfolio of commercial properties located across the U.S. Realty Income focuses on acquiring single-tenant retail locations, leased to regional and national chains, and under long-term net lease agreements.

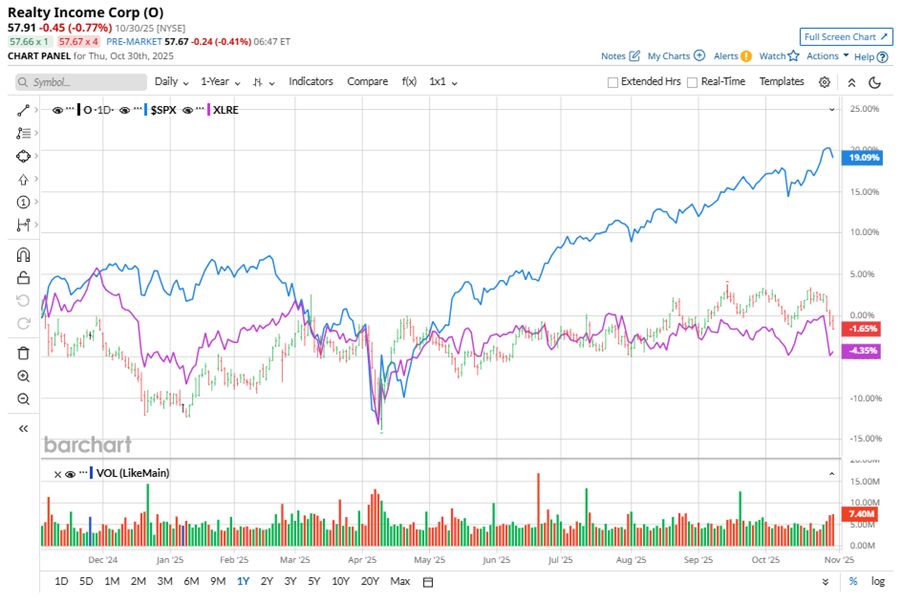

Shares of this REIT giant have underperformed the broader market considerably over the past year. O has declined 4.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.4%. In 2025, O stock is up 8.4%, compared to the SPX’s 16% gains on a YTD basis.

Narrowing the focus, O’s outperformance is apparent compared to the Real Estate Select Sector SPDR Fund (XLRE). The exchange-traded fund has declined about 7% over the past year. Moreover, O’s single-digit returns on a YTD basis outshine the ETF’s marginal gains over the same time frame.

On Aug. 6, Realty Income posted mixed Q2 results, with shares closing slightly higher in the subsequent trading session. The company's AFFO per share of $1.05 was down marginally from the year-ago quarter and missed estimates. However, revenue rose 5.3% year-over-year to $1.4 billion, beating analyst expectations. This revenue outperformance likely offset concerns over AFFO, resulting in a slight increase in share price.

For the current fiscal year, ending in December, analysts expect O’s FFO per share to grow 1.9% to $4.27 on a diluted basis. The company’s FFO surprise history is mixed. It matched the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

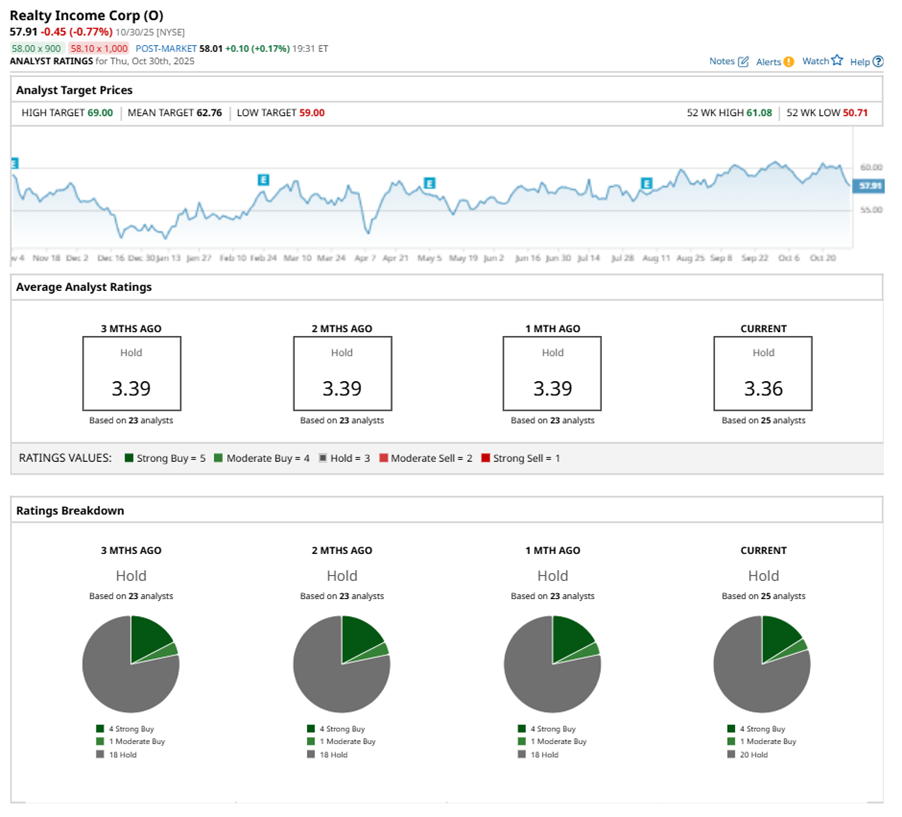

Among the 25 analysts covering O stock, the consensus is a “Hold.” That’s based on four “Strong Buy” ratings, one “Moderate Buy,” and 20 “Holds.”

The configuration has been reasonably stable over the past three months.

On Oct. 28, Ronald Kamdem from Morgan Stanley (MS) maintained a “Hold’ rating on O with a price target of $62, implying a potential upside of 7.1% from current levels.

The mean price target of $62.76 represents an 8.4% premium to O’s current price levels. The Street-high price target of $69 suggests an upside potential of 19.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart