Shares of Advanced Micro Devices (AMD) have gained significantly in value, surging 111% so far this year. The rally stems from AMD’s growing share in the data center market, rapid adoption of its hardware portfolio, and strategic alliances that strengthen its long-term growth trajectory.

Confidence in AMD’s outlook received another boost when management outlined strong growth projections for the next three to five years at its recent Financial Analyst Day. The company’s upbeat guidance strengthened optimism around its future performance, pushing AMD stock higher.

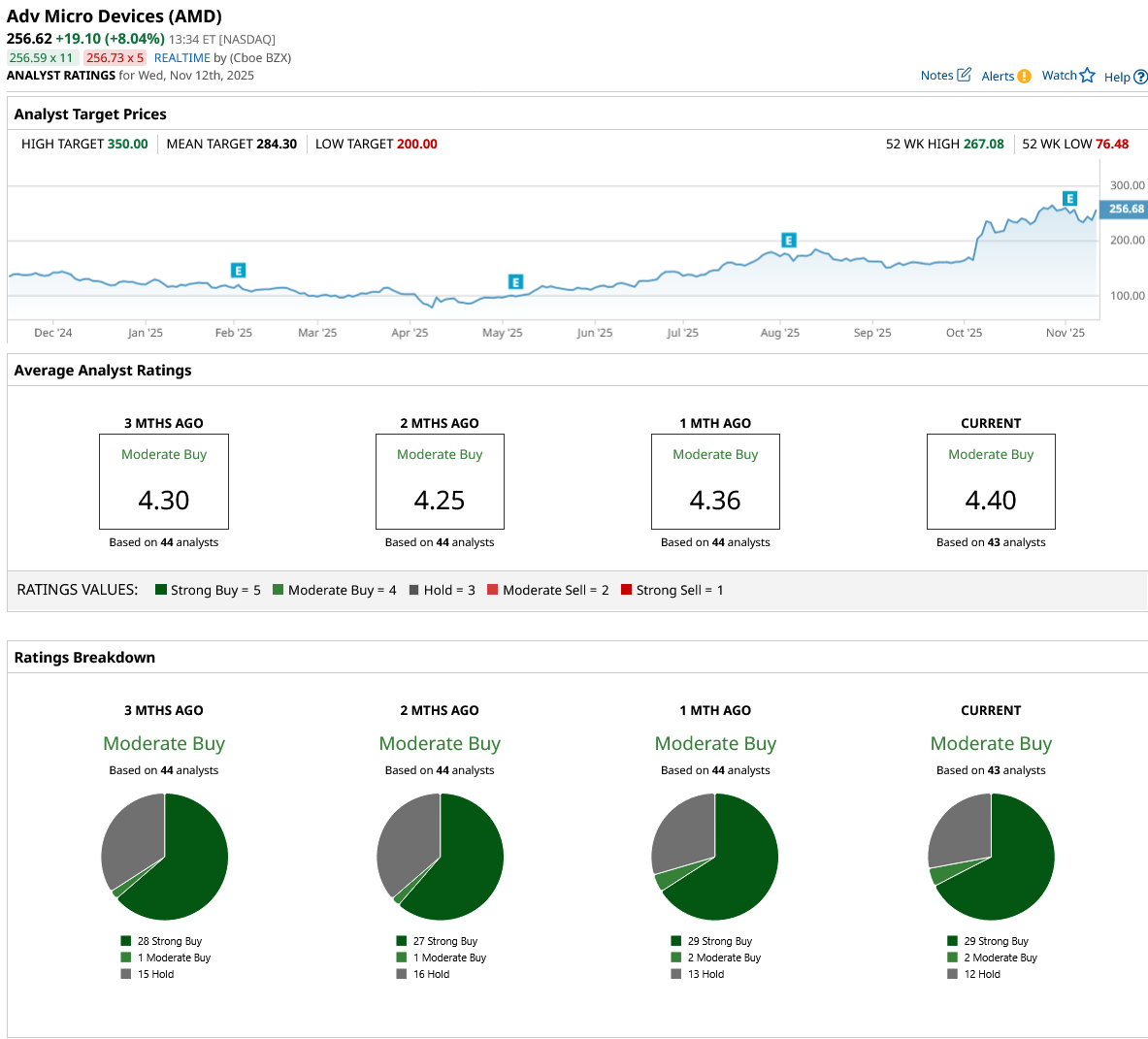

As AMD’s growth prospects remain solid, at least one Wall Street analyst projects that AMD shares could reach $350, the Street's highest price target, within the next 12 months. It indicates a potential upside of over 35% from current levels.

Still, with the stock already having nearly doubled in 2025, does AMD have enough momentum left to extend its rally? Let's take a closer look.

AMD Stock Positioned for Long-Term Growth in the AI Era

AMD has transformed into a key player in data centers and the AI space. The company’s data center division has become the primary growth engine, driven by robust demand for its EPYC processors and Instinct GPUs. These chips power everything from cloud servers to high-performance computing and AI workloads. Strategic partnerships with major industry players such as OpenAI and Oracle (ORCL) have only strengthened AMD’s momentum, further enhancing investor confidence.

At its recent Financial Analyst Day, AMD’s management struck an optimistic tone about the company’s long-term outlook. They projected total revenue could grow at a compound annual growth rate (CAGR) exceeding 35% over the next three to five years, supported by accelerating demand for its products in the high-performance and AI computing segments. Management also expects adjusted operating margins to exceed 35% and earnings per share (EPS) to surpass $20 within the same period. These figures suggest not only strong growth but also solid profitability.

A key driver of this expansion is AMD’s data center business, which is expected to deliver annual revenue growth exceeding 60%. The data center segment’s growth is likely to be driven by the company’s increasing market share in server CPUs and the rapid adoption of its AI accelerators. AMD’s multi-generational EPYC roadmap aims to capture over half of the global server CPU market, while its Instinct GPU lineup continues to gain traction among hyperscale cloud providers. In the AI segment specifically, AMD anticipates revenue growth of more than 80%, reflecting surging demand for its next-generation Instinct processors.

The company’s Instinct MI350 Series GPUs have already seen widespread deployment across leading cloud platforms. The momentum is set to continue with the upcoming Helios systems, powered by MI450 Series GPUs and slated for launch in the third quarter of 2026. These systems promise industry-leading rack-scale performance and bandwidth, setting the stage for even greater adoption. Looking further ahead, AMD’s MI500 Series, expected to debut in 2027, will aim to redefine the upper limits of AI performance and efficiency.

In parallel, AMD is expanding its server CPU lineup with its next-generation Venice processors, designed to deliver both exceptional performance and energy efficiency across AI and general-purpose workloads. Complementing this are AMD’s networking solutions, which provide the bandwidth and flexibility required to support large-scale AI infrastructures.

Beyond data centers, AMD continues to strengthen its presence in the client and gaming markets. The Ryzen processor family is witnessing rising adoption among enterprises. Moreover, its market share is expected to exceed 40% in the client segment.

AMD’s adaptive and embedded computing businesses are also expanding rapidly. The company expects to secure more than 70% of the adaptive computing market and sees further opportunities in embedded x86 and semi-custom silicon solutions.

AMD’s Bull Run May Be Far From Over—$350 Within Reach

With a diversified portfolio, accelerating demand for its EPYC processors and Instinct GPUs, and a multi-year growth roadmap, AMD is solidifying its leadership position in the high-performance and AI computing segment.

The company’s financial targets reflect its potential for sustained, profitable expansion. Strong partnerships with AI leaders and hyperscale cloud providers further validate AMD’s competitive edge and long-term relevance in the AI space.

As the stock has gained significantly in value, analysts maintain a “Moderate Buy” consensus rating. However, the growth catalysts ahead suggest that AMD’s momentum is far from over. As AI-related demand continues to accelerate, the case for AMD shares climbing toward the $350 mark over the next year appears within reach.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rivian Wants to Be the Next Tesla With Huge Pay Package for CEO RJ Scaringe. Should You Buy RIVN Stock?

- AMD Strengthens Its Bull Case. Can the Stock Hit $350 in a Year?

- Is GOOG Stock a Buy or Sell as Michael Burry Accuses Hyperscalers of ‘Fraud’?

- Western Digital Stock Soars 280% This Year. Is WDC Worth Chasing Now?