Even the most aggressive bull markets rarely move in straight lines, and while the gold bull has been firmly intact since 1999, the yellow precious metal is no exception. In my October 30, 2025, Barchart article warning caution on precious metals, I concluded with the following:

The epic rallies in precious metals signal that fiat currency values are deteriorating. Gold, the world’s oldest means of exchange, is now the second-leading reserve asset held by worldwide central banks, second only to the U.S. dollar, the world’s reserve currency. The bottom line is that the bull markets remain intact, which is a commentary on the purchasing power of fiat foreign exchange instruments in late October 2025. However, as precious metal prices rise, the odds of periodic corrections increase, which will be significant on a nominal basis but should remain within historical norms. New highs require caution. Buying the metals on rallies increases risks, as buying on price weakness has been optimal over the past months and years.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

The gold bull remains firmly intact in December 2025, but that does not mean it will continue its parabolic ascent.

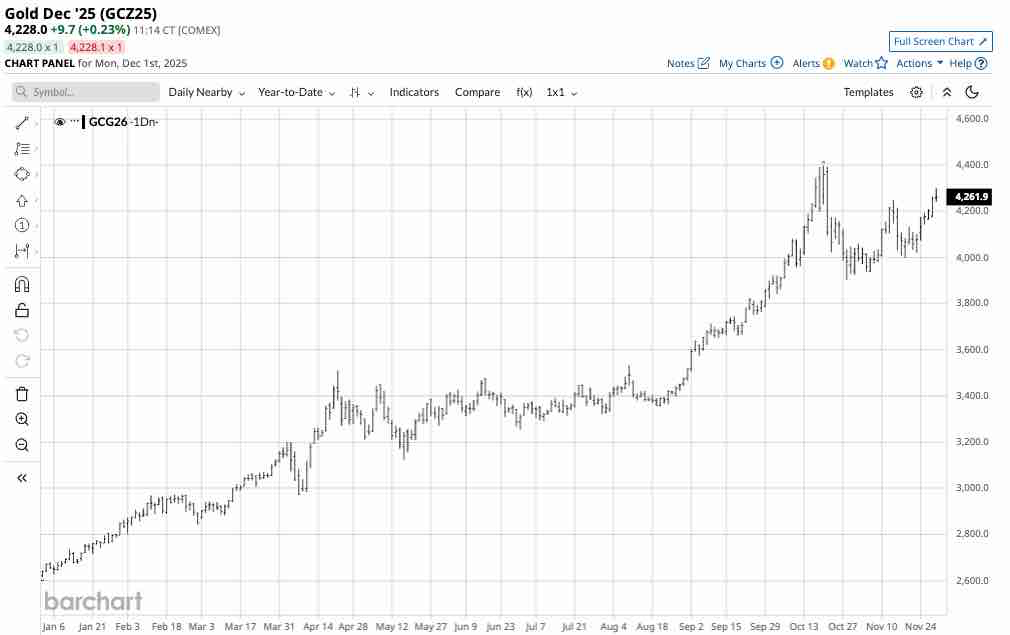

Gold has been consolidating below the October 2025 high

After reaching the October high, gold prices corrected.

As the daily year-to-date continuous contract chart highlights, gold’s price fell 11.3% from the October 20 high of $4,398 to the October 28 low of $3,901.30. Gold was trading above $4,200 in early December, with the midpoint of the recent high and low at $4,150 per ounce.

Central bank demand is critical for gold’s trend in 2026

According to a November 18, 2025, Kitco article, central banks have increased their gold reserves by approximately 1,000 tons each of the last three years. The World Gold Council forecasts that holdings could rise by another 950 metric tons in 2025.

Meanwhile, official-sector buying is likely understated, as China and Russia are among the world's leading gold producers. China and Russia consider gold holdings strategic reserves and national security matters. Over the past few years, the growing Chinese and Russian appetite for gold, driven by sanctions that avoid the dollar and other reserve currencies, has likely led to increased holdings through domestic production, which they do not necessarily report. Therefore, central bank and government gold accumulation could be higher than the current data.

Central bank gold buying has helped push prices higher for years, creating a self-fulfilling prophecy as the bullish trend has attracted retail and institutional buying, fueling gold’s parabolic price action over the past few years.

The bullish case for gold

The bullish case for gold includes:

- Gold is the world’s oldest means of exchange, dating back long before any of the current fiat currencies.

- The U.S. dollar remains the world’s reserve currency. Falling faith and credit in the U.S. currency have led central banks, governments, and monetary authorities to increase their gold holdings over the past few years.

- The euro currency was the second-leading global reserve currency. In 2025, gold replaced the euro as the second-largest reserve holding after the U.S. dollar among central banks.

- Central banks validate gold’s role in the global financial system.

- U.S. debt at over $38 trillion, Moody’s 2025 downgrade of U.S. sovereign debt, and political division in the U.S. have weighed on the dollar and U.S. government bonds, supporting gold demand and higher prices.

- Gold’s bullish trend has driven retail demand to rise, further accelerating the rally over the past few years. The bullish trend continues to make gold an attractive alternative investment, as the U.S. stock market is near record highs.

- The U.S. Fed Funds Rate declined by 1% in 2024 and by 50 basis points so far in 2025, with another 25 basis point cut likely at the December FOMC meeting. Falling short-term interest rates lower the cost of carrying long gold risk positions.

- The U.S. dollar index declined from around 110 in early 2025 to the 100 level. A falling U.S. dollar tends to support higher gold prices.

The bottom line is that many factors support gold’s bullish trend in late 2025.

The reasons for caution

The factors that could weigh on gold over the coming months are:

- The cure for high prices in any commodity is often those high prices. Gold has increased from $252.50 in 1999 to nearly $4,400 per ounce at its most recent high.

- Even the most aggressive bull markets rarely move in straight lines. Gold has experienced numerous corrections over the past twenty-six years on its path to the most recent price peak.

- After nine consecutive quarters of record highs, the long-term technical support for gold is far below the current price level at the April 2025 high of $3,509.90 and the October 2023 low of $1,823.50 per ounce. Therefore, gold has plenty of downside room that would not negate its over a quarter-century bullish trend.

Gold is now consolidating after the most recent price corrections. However, the parabolic rally over the past two years and the current price level could trigger further downside price action over the coming weeks and months.

Gold is a critical asset for a diversified portfolio, but loading up at new highs typically causes stress

Gold has been an asset and means of exchange for thousands of years. However, buying gold at the current lofty price level requires recognizing that there are additional downside risks. Loading up on gold at over $4,000 per ounce could cause significant indigestion if the price continues to correct. Gold has experienced several substantial pullbacks over the past two and a half decades, even though they have not negated the bullish trend. Therefore, buying gold at current prices involves significant risks.

Accumulating gold as a portfolio diversifier is a process that requires small purchases, leaving plenty of room to add on further declines. When speculating on a continuation of the parabolic rally, risk-reward dynamics are critical. Approach speculative positions with profit horizons and stops that offer a rational risk-reward profile.

In December 2025, we may have already seen the highs in gold for this year. Gold has made new highs in 9 consecutive quarters, including Q4 2025. Time will tell if the precious metal climbs to another new high in Q1 2026 to keep the bullish streak intact.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart