Amid the intense focus on artificial intelligence, machine learning, and large language models, a burgeoning problem is emerging: how will AI developers have enough computing power to train and run AI programs when thousands of companies are seeking to build or use AI products?

Morgan Stanley analysts are projecting that there will be a cumulative shortfall of 47 gigawatts of computing power through 2028—and the next phase of AI investing will not be who’s building the best GPUs, but who can best provide data center infrastructure and the power to use them.

A solution may be the business model provided by Iren Limited (IREN), an Australian miner of Bitcoin (BTCUSD) that has expanded its offerings to deliver next-generation data centers and large-scale GPU clusters for AI training and inference. Iren recently signed Microsoft (MSFT) to a five-year lease for computing power—a short-term arrangement that Morgan Stanley says may be a powerful model for investors to consider in the future.

Is Iren really a key part of what Morgan Stanley analysts identify as the next generation of AI investing?

About Iren Stock

Based in Sydney, Australia, Iren makes most of its money by mining Bitcoin, but its data centers are also available for rent for developers and companies that want to train and run AI models. That’s the model that Iren used last month to sign a $9.7 billion deal with Microsoft for cloud computing services, using Nvidia (NVDA) GPUs. As part of the deal, Iren announced that it entered into an agreement with Dell Technologies (DELL) to purchase $5.8 billion of GPUs and ancillary equipment.

The company has three data centers in Canada and one in Texas, which will supply the computing power for the Microsoft deal. It’s also in the process of building a second data center in Texas.

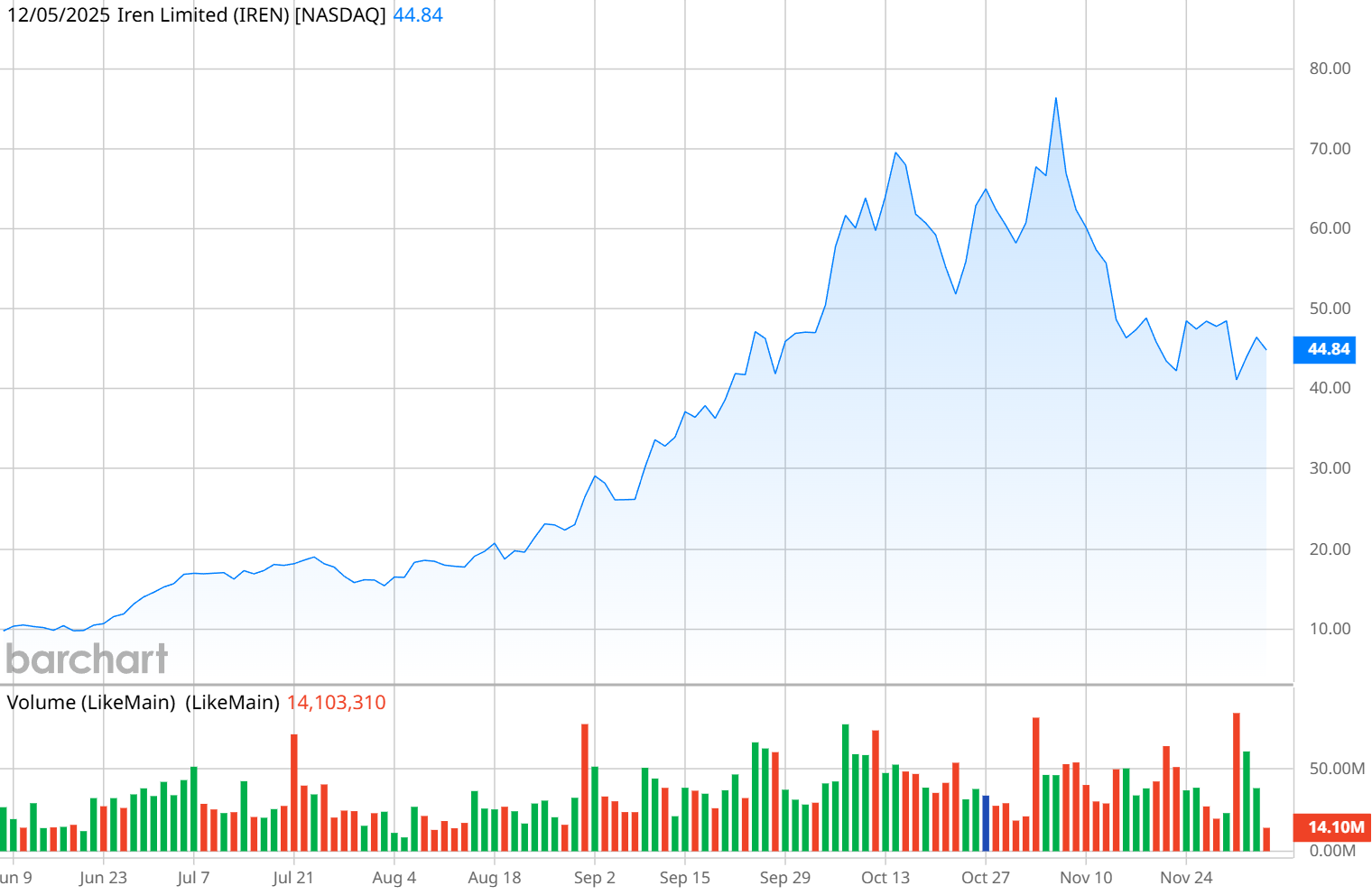

The growing interest in data center capacity has been a major tailwind for IREN stock, which, despite its recent weakness (down 40% in the past month), is up nearly 355% so far this year, helping to push its market capitalization over $13 billion.

But despite the stock price growth, IREN stock is still surprisingly affordable, with a trailing price-to-earnings ratio of only 25.2 and a forward P/E of 37.6. Iren has a lower P/E than Nvidia, which is the biggest company in the world by market capitalization. And competitors Nebius Group (NBIS) and CoreWeave (CRWV), which also offer data center services, aren’t profitable yet.

Iren Misses on Earnings, But There’s a Good Reason

While the company is growing quickly, its first-quarter earnings report for fiscal 2026 was a bad miss. The company posted a loss of $0.34 per share, while analysts had expected a gain of $0.14 per share.

However, it's just a paper loss and not operational. Iren posted a $665 million unrealized loss tied to the revaluation of financial instruments connected to its convertible notes. The loss reflects mark-to-market swings and not a change in Iren’s business performance.

Revenue of $240.3 million was up 355% from a year ago, and net income of $384.56 million—before taking into account the $665 million charge—was an improvement over the company’s net loss of $51.7 million in the first quarter of fiscal 2025. Bitcoin mining revenue brought in $232.9 million, while AI cloud services revenue was $7.3 million.

“Iren continues to execute with discipline, delivering record results this quarter and meaningful progress in our AI cloud expansion,” Co-CEO Daniel Roberts said. “We secured several new multi-year contracts, including a landmark partnership with Microsoft, which solidifies Iren’s position as a leading AI cloud service provider and expands our reach into new hyperscale customer segments.”

What Do Analysts Expect for IREN Stock?

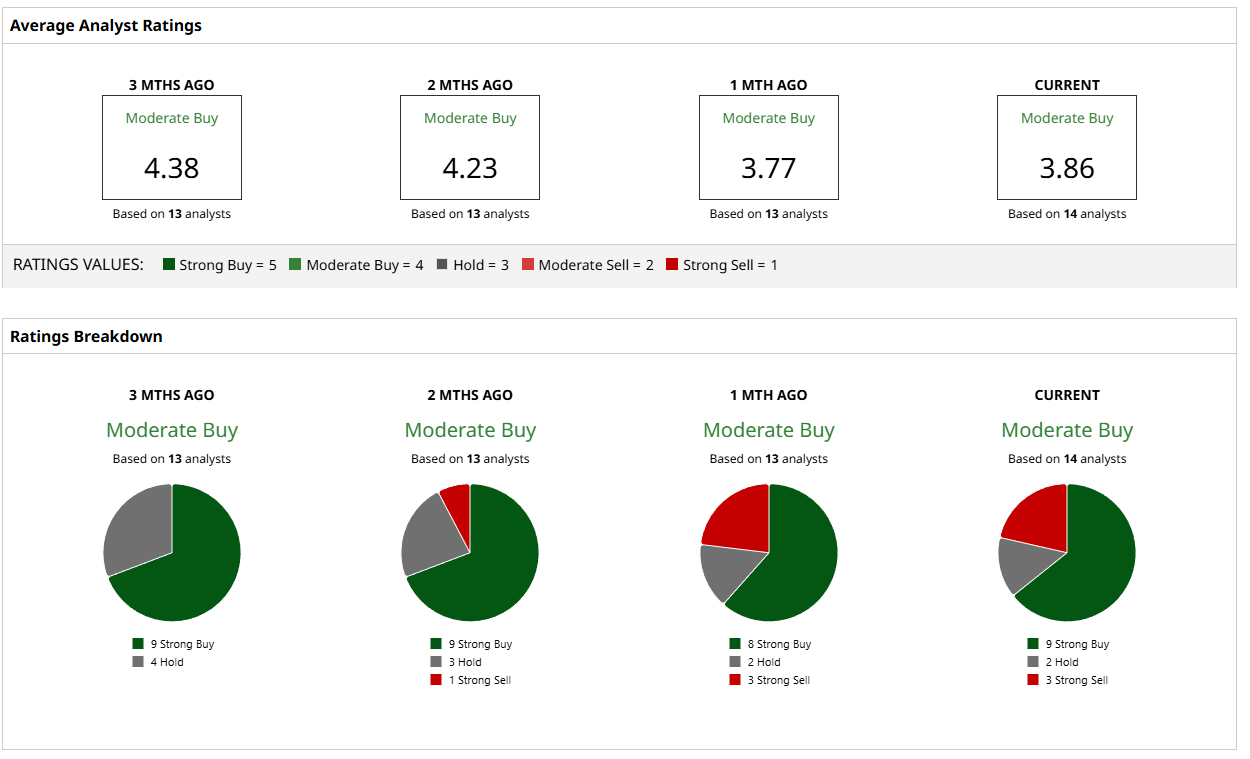

We already know that Morgan Stanley is bullish. The consensus rating from other analysts isn’t quite as strong, with some growing concern in recent weeks.

Nine of 14 analysts surveyed by Barchart have Iren stock as a “Strong Buy,” with two suggesting investors hold the stock and three others calling it a “Strong Sell.” But three months ago, there were no “sell” ratings at all—the trend of cautious sentiment is slowly building.

The mean price target of $85.45 is a whopping 86% increase from today’s price, and the most bullish call of $136 forecasts a possible 200% jump. The low price target indicates a possible fall of 15%.

On the date of publication, Patrick Sanders had a position in: NVDA , NBIS . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Stock Breaks Below Key Moving Averages on $1.5B Offering. Should You Buy the Dip?

- Netflix Is Buying Warner Bros. Discovery. Should You Buy NFLX Stock?

- Amazon Just Released Its Graviton5 CPU. Should You Buy, Sell, or Hold AMZN Stock Here?

- Tesla, Netflix, and ON Semiconductor: 3 Unusually Active Cash-Secured Put Options to Sell Now