Interactive entertainment restaurant operator Dave & Buster's Entertainment, Inc. (NASDAQ: PLAY) is proving that its possible to mitigate both inflationary pressures and falling consumer discretionary spending. They are in a sense the last man standing when it comes to stand-alone video game arcades combined with dining.

While movie theaters like AMC Entertainment Holdings, Inc. (NYSE: AMC), Cinemark Holdings, Inc. (NYSE: CNK) and Cineworld Group plc (OTCMKTS: CNNWF) are struggling to rebound back to pre-pandemic levels due to the migration to streaming movies at home, Dave & Busters is purely an experience that can only be had away from home.

They have pioneered the concept of huge, bold, blaring, bright, action-packed carnival-like video game entertainment with prizes, a sports bar, pool tables, skeeball, and a restaurant all packed into one huge coliseum-sized location. It overwhelms the senses the moment you step into Dave & Buster’s as if entering another world.

It’s the experiential factor that has driven their business back up through pre-pandemic levels. Rather than a pullback during normalization, the pent-up demand has actually cemented a higher baseline proving that consumers will still spend on truly experiential entertainment and dining.

A Beautiful Union

On June 29, 2022, Dave & Busters acquired dining and entertainment franchise Main Event Entertainment based out of Dallas, TX, for $835 million. They expect to generate up to $25 million in cost synergies as the complementary businesses target the full demographic of customers from kids to Gen-X-ers. Dave & Busters has been around for over 40 years and understands the concept of generational customers.

The Gen-X-ers that grew up with them now have children they can bring into the restaurants. While Dave & Busters itself caters more to the sports bar and older gaming crowd, Main Event caters to families and younger children. This makes the union between Dave & Busters and Main Event a logical and synergistic match-up.

Truly Experiential

Unlike movie theater chains, Dave & Busters doesn’t rely on third-party content suppliers like movie studios including The Walt Disney Company (NYSE: DIS) , Comcast Corporation (NASDAQ: CMCSA) or Warner Bros Discovery, Inc. (NYSE: WBD) for big releases to draw people to their locations. It’s even worse when they’re competing with the very same studios for eyeballs as they release their movies on streaming even quicker now. While the movie theater experience can be emulated at home with ever cheaper 4K LED televisions and sound bars, Dave & Busters has to be experienced away from home. It’s truly an experiential dining concept that has stood the test of time and economic backdrops.

Descending Triangle Looms

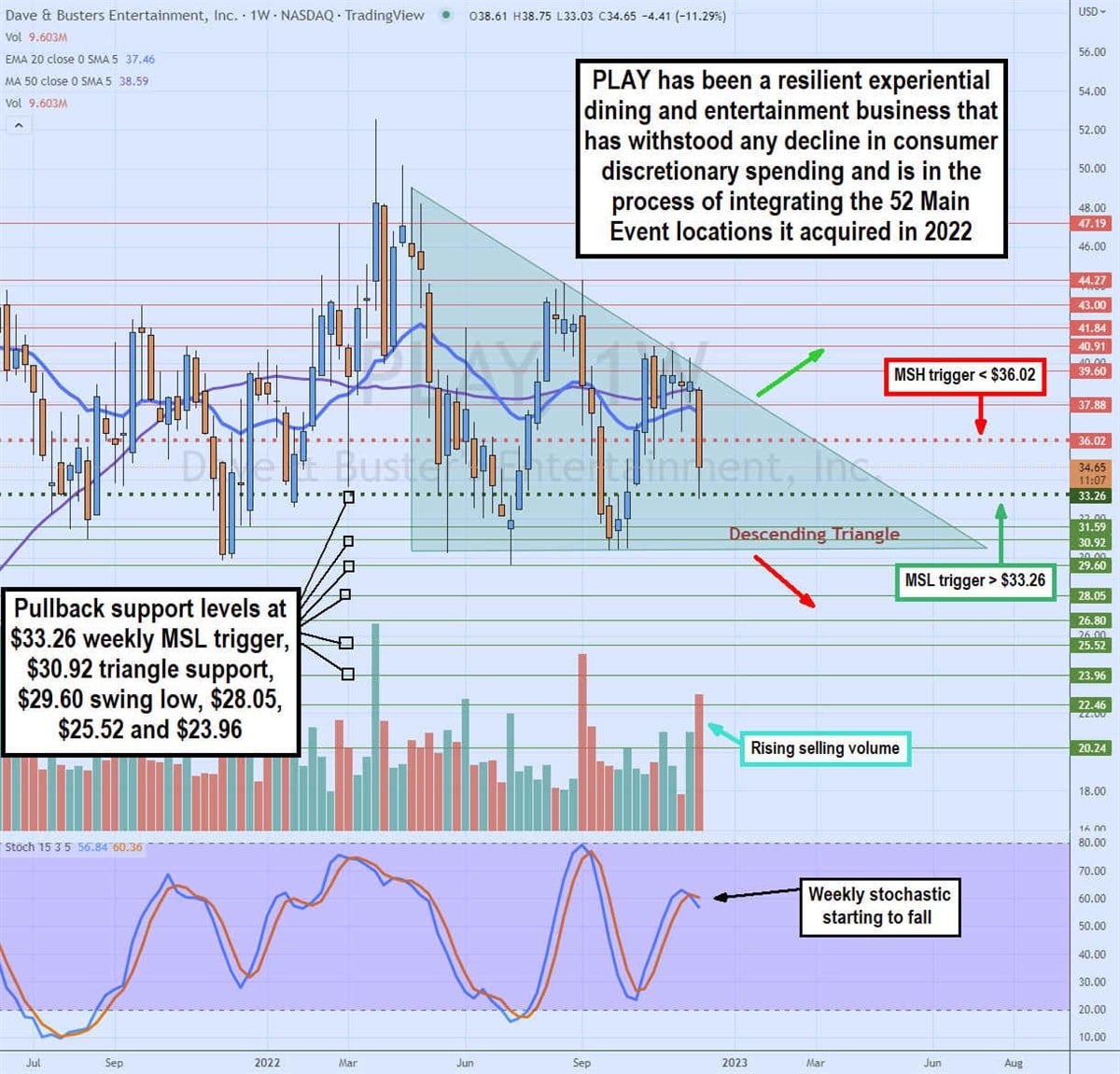

The weekly candlestick chart on PLAY stock shows progressively lower highs on bounces against a flat low on falls. This sets up a descending triangle where the lower highs is the unstoppable force versus the immoveable object of the flat lows near the $30.50 baseline. As the range gets closer to the apex point, shares will eventually either breakdown through the $30 level making new 52-week lows or breakout through the falling trend line.

The 20-period exponential moving average (EMA) has been choppy at $37.46 along with the weekly 50-period MA at $38.59. The weekly stochastic is starting to cross over back down as selling volume was heavy after its Q3 2022 earnings release. The market structure high (MSH) sell triggers under $36.02 and the market structure low (MSL) buy triggers above $33.26, which also happened to be the support level it bounced off during the earnings sell-off.

Pullback support areas sit at the $33.26 weekly MSL trigger, $30.92 triangle support, $29.60 swing low, $28.05, $25.52, and $23.96.

Record Sales and Cost Savings Growing

On Dec. 6, 2022, Dave & Buster’s released its third-quarter fiscal 2022 results for the quarter ending October 2022. The Company reported an earnings-per-share (EPS) profit of $0.04 excluding non-recurring items. Revenues rose 51.3% year-over-year (YoY) to $481.21 million and beating consensus analyst estimates for $470.78 million. Pro forma comparable sales at Dave & Buster’s and combined Main Event locations rose 13.3% YoY and 17.5% compared to same quarter 2019 pre-covid.

Dave & Busters is on track to realize its $25 million annual cost synergy savings having already implemented $17 million to date. The Company opened 3 new locations in California. The Company ended the quarter with $599.3 million in liquidity including $108.2 million in cash and $491.1 million in $500 million revolver.

Dave & Buster’s CEO Chris Morris commented, “We are pleased to report strong financial results for the third quarter. We delivered record revenue driven by double-digit comparable sales growth, resulting in record Adjusted EBITDA.” He concluded, “The future is incredibly bright for this new organization, and I am excited about sharing our progress with you over the next few years.”

A Sneak Peek at Q4 2022

As has been a custom lately, Dave & Buster’s provided a sneak peek into the first five-weeks of Q4 2022. Comparable store sales during the period rose 3.1% YoY and 9.2% over Q4 2019. Pro forma comparable combined walk-in store sales fell (-2.4%) YoY but was up 15.7% over Q4 2019. Pro forma Special Events comparable sales rose 65.3% YoY but fell (-21.7%) versus Q4 2019.