Online community and discussion platform Reddit (NYSE: RDDT) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 67.9% year on year to $584.9 million. On top of that, next quarter’s revenue guidance ($660 million at the midpoint) was surprisingly good and 3.3% above what analysts were expecting. Its GAAP profit of $0.80 per share was 53.8% above analysts’ consensus estimates.

Is now the time to buy Reddit? Find out by accessing our full research report, it’s free for active Edge members.

Reddit (RDDT) Q3 CY2025 Highlights:

- Revenue: $584.9 million vs analyst estimates of $550.4 million (67.9% year-on-year growth, 6.3% beat)

- EPS (GAAP): $0.80 vs analyst estimates of $0.52 (53.8% beat)

- Adjusted EBITDA: $236 million vs analyst estimates of $196.5 million (40.3% margin, 20.1% beat)

- Revenue Guidance for Q4 CY2025 is $660 million at the midpoint, above analyst estimates of $638.8 million

- EBITDA guidance for Q4 CY2025 is $280 million at the midpoint, above analyst estimates of $259.8 million

- Operating Margin: 23.7%, up from 2% in the same quarter last year

- Free Cash Flow Margin: 31.3%, up from 22.2% in the previous quarter

- Domestic Daily Active Visitors: 116 million, up 67.8 million year on year

- Market Capitalization: $39.45 billion

“Reddit provides something rare on the Internet,” said Steve Huffman, Reddit Co-Founder and CEO.

Company Overview

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE: RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

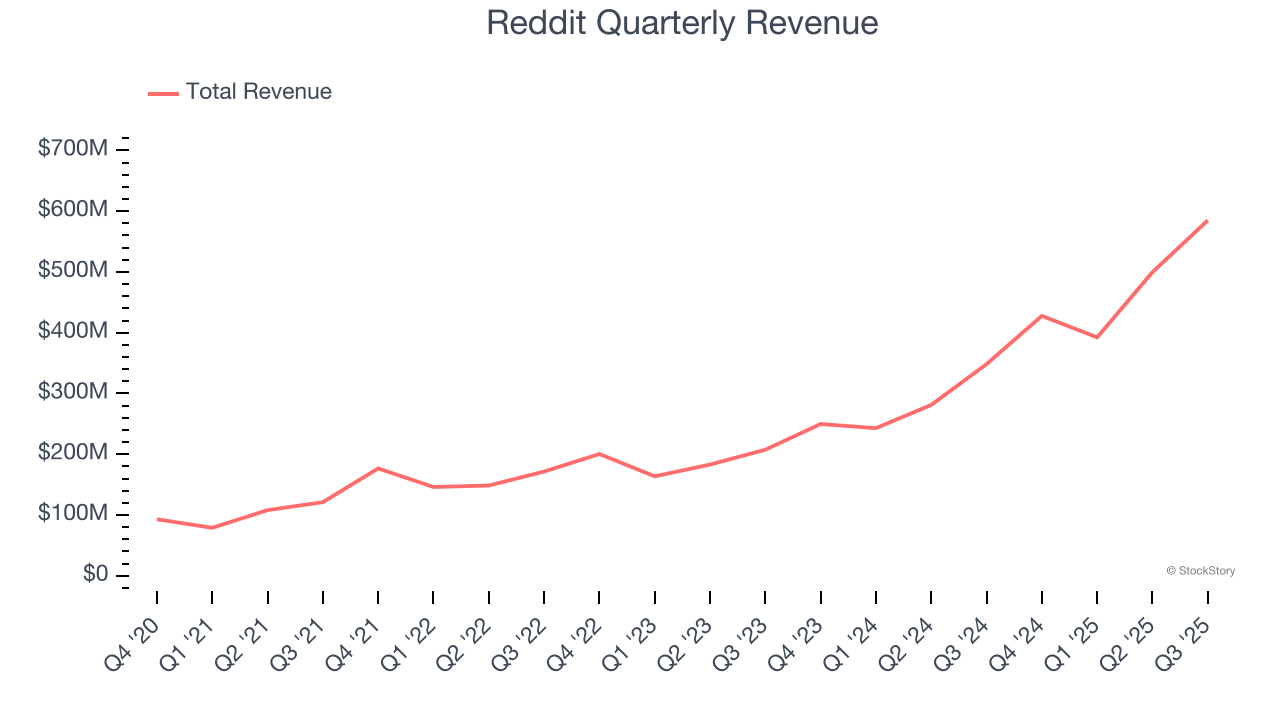

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Reddit’s sales grew at an incredible 43.6% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Reddit reported magnificent year-on-year revenue growth of 67.9%, and its $584.9 million of revenue beat Wall Street’s estimates by 6.3%. Company management is currently guiding for a 54.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 36.1% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is commendable and indicates the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

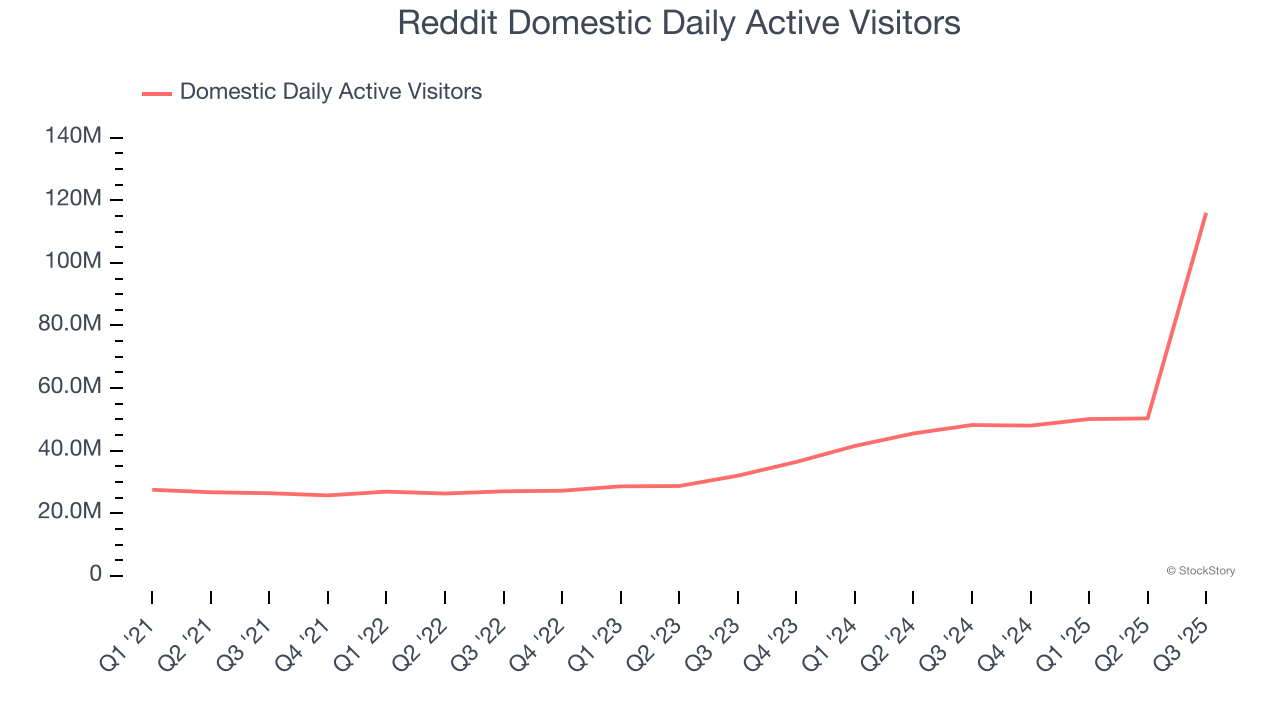

Domestic Daily Active Visitors

User Growth

As a social network, Reddit generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Reddit’s domestic daily active visitors, a key performance metric for the company, increased by 49% annually to 116 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q3, Reddit added 67.8 million domestic daily active visitors, leading to 141% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

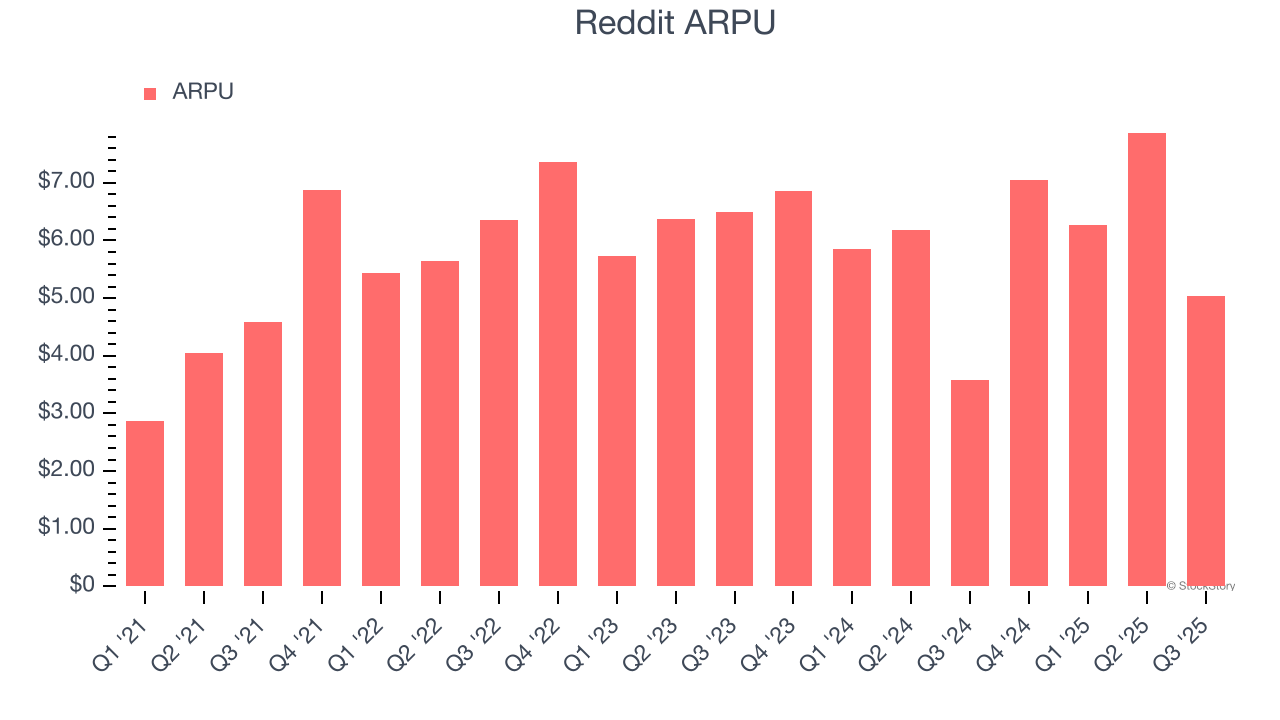

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Reddit’s audience and its ad-targeting capabilities.

Reddit’s ARPU growth has been mediocre over the last two years, averaging 3.2%. This isn’t great, but the increase in domestic daily active visitors is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Reddit tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Reddit’s ARPU clocked in at $5.04. It grew by 40.8% year on year, slower than its user growth.

Key Takeaways from Reddit’s Q3 Results

We were impressed by Reddit’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 2.7% to $199.81 immediately after reporting.

Reddit had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.