Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Zillow (NASDAQ: ZG) and the best and worst performers in the real estate services industry.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 12 real estate services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was 0.8% below.

Thankfully, share prices of the companies have been resilient as they are up 5.5% on average since the latest earnings results.

Zillow (NASDAQ: ZG)

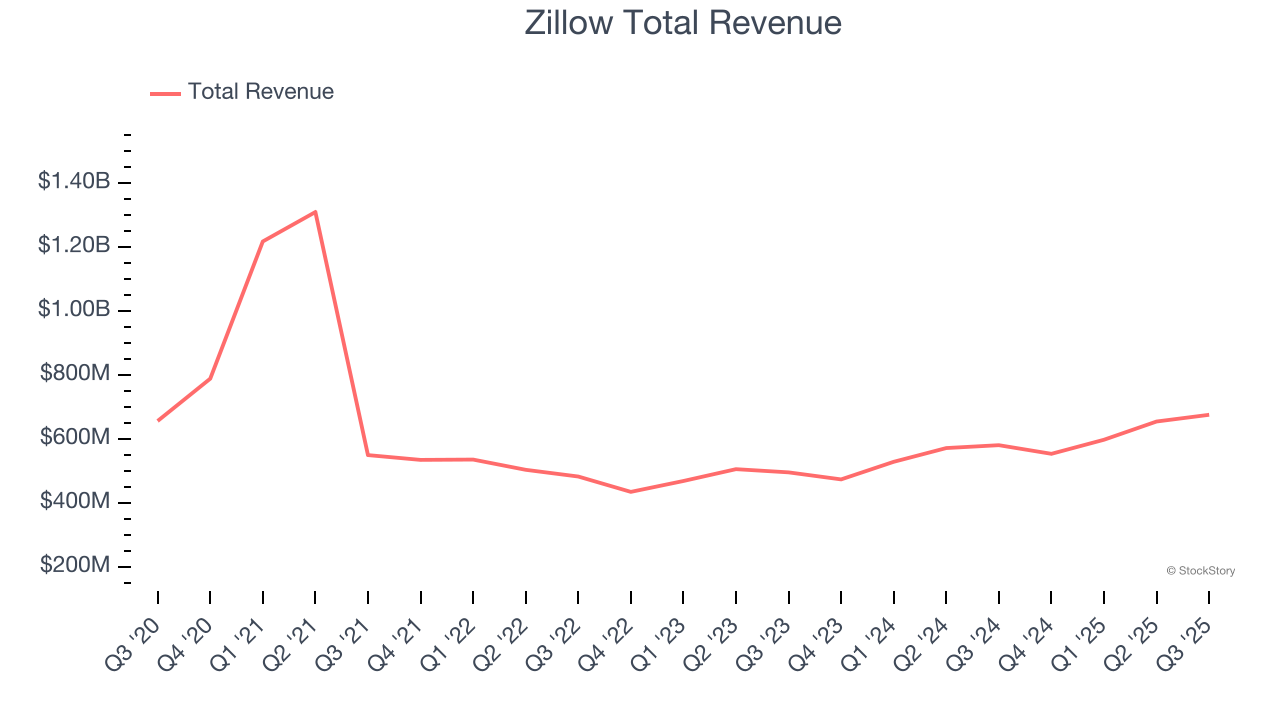

Founded by Expedia co-founders Lloyd Frink and Rich Barton, Zillow (NASDAQ: ZG) is the leading U.S. online real estate marketplace.

Zillow reported revenues of $676 million, up 16.4% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ adjusted operating income estimates and revenue guidance for next quarter slightly topping analysts’ expectations.

Interestingly, the stock is up 1.4% since reporting and currently trades at $69.77.

Is now the time to buy Zillow? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: The Real Brokerage (NASDAQ: REAX)

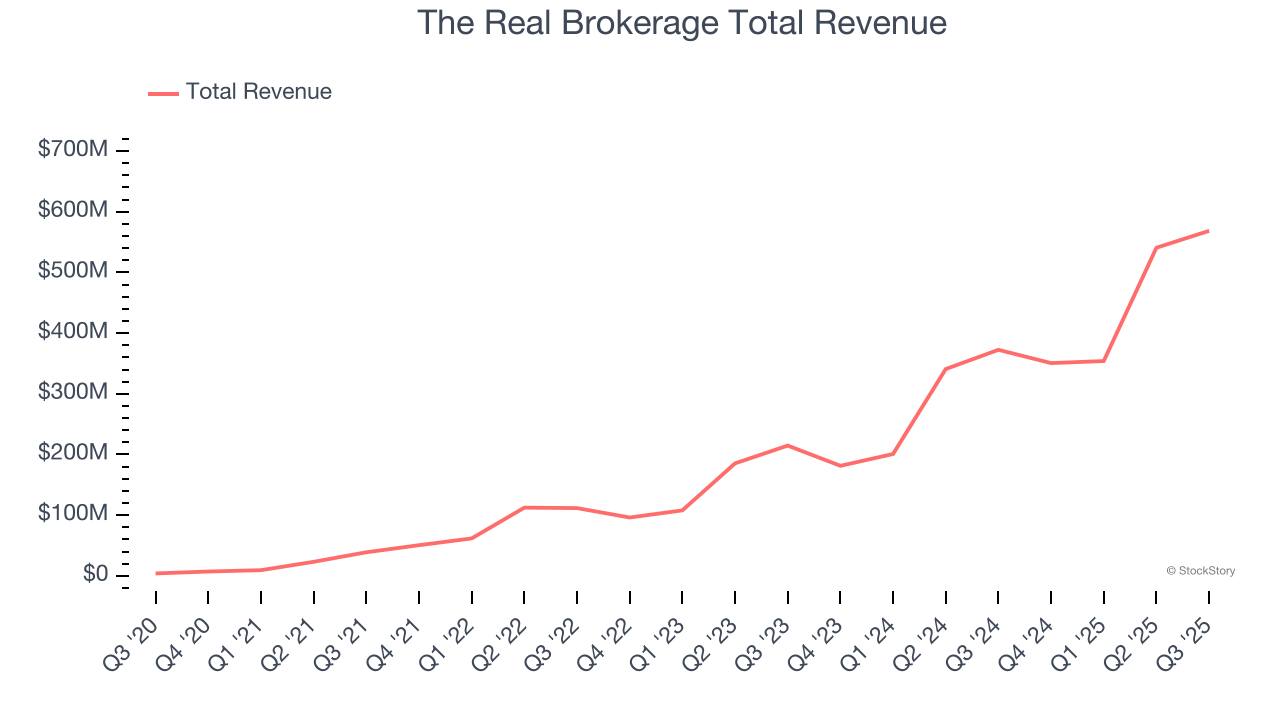

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ: REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $568.5 million, up 52.6% year on year, outperforming analysts’ expectations by 6.5%. The business had a stunning quarter with EPS in line with analysts’ estimates and a solid beat of analysts’ EBITDA estimates.

The Real Brokerage achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 12% since reporting. It currently trades at $4.01.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Offerpad (NYSE: OPAD)

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE: OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Offerpad reported revenues of $132.7 million, down 36.2% year on year, falling short of analysts’ expectations by 5.1%. It was a disappointing quarter as it posted a miss of analysts’ homes purchased estimates and a miss of analysts’ homes sold estimates.

Offerpad delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 6.1% since the results and currently trades at $2.18.

Read our full analysis of Offerpad’s results here.

eXp World (NASDAQ: EXPI)

Founded in 2009, eXp World (NASDAQ: EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

eXp World reported revenues of $1.32 billion, up 6.9% year on year. This number surpassed analysts’ expectations by 5.9%. It was a strong quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ transactions estimates.

The stock is up 13% since reporting and currently trades at $10.96.

Read our full, actionable report on eXp World here, it’s free for active Edge members.

CBRE (NYSE: CBRE)

Established in 1906, CBRE (NYSE: CBRE) is one of the largest commercial real estate services firms in the world.

CBRE reported revenues of $10.26 billion, up 13.5% year on year. This result beat analysts’ expectations by 2.1%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ adjusted operating income estimates and a beat of analysts’ EPS estimates.

The stock is down 7.6% since reporting and currently trades at $151.46.

Read our full, actionable report on CBRE here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.