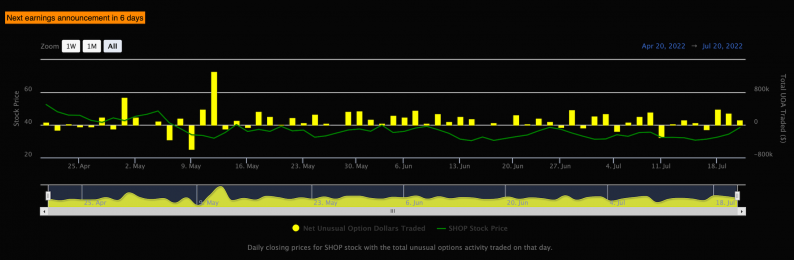

SAN FRANCISCO - July 20, 2022 - PRLog -- Shopify is expected to report earnings on Wednesday, July 27.

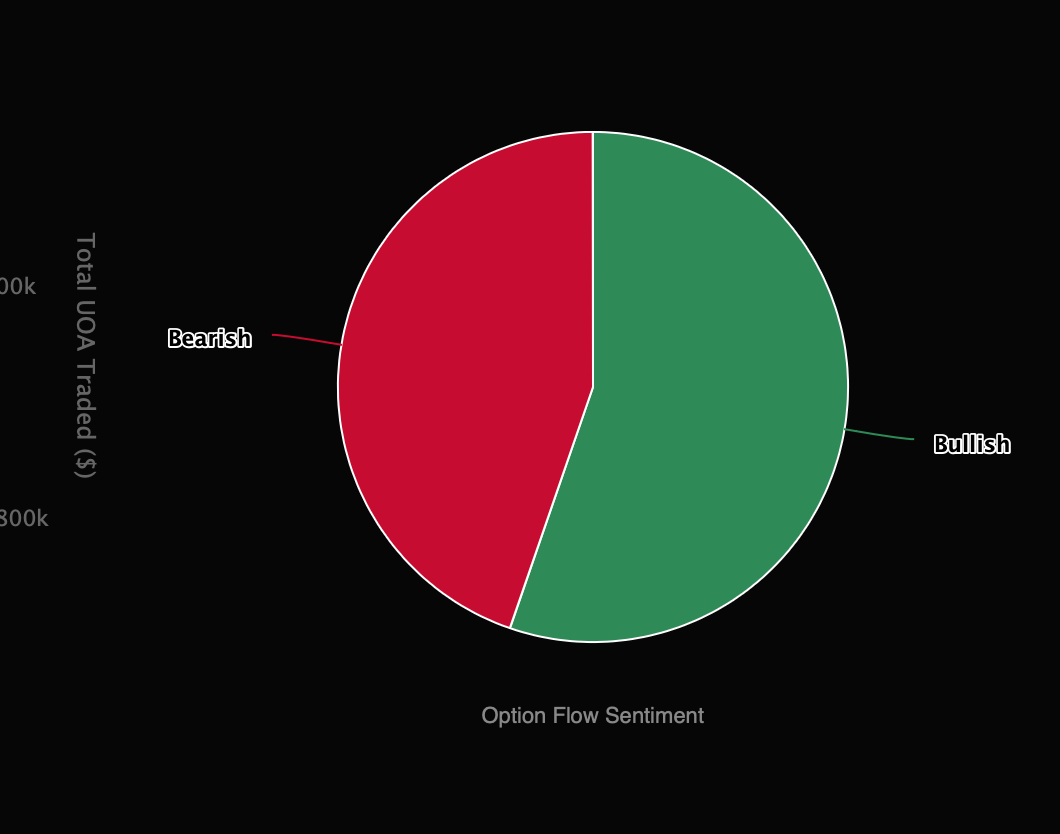

The options market is not looking at this event favorably, with the stock down over 60% since their last earnings release. In fact, traders have been buying put options and put option spreads betting that the stock will further decline in price.

The options market is usually a good indicator of how investors feel about a company's prospects. As you know, when an investor buys a call option he or she pays a premium for the right to buy stocks at a certain price by a certain date. If the stock price moves higher than what was expected by the investor then it would be more expensive for them to exercise their call option and buy shares of the stock at that price. On the other hand, if the investor feels the shares will fall below his purchase price then he should sell those shares short rather than buy them long because then he can make money when prices go down instead of up!

Why pay attention to options activity?

Investors often trade options to hedge their bets. However, options are a good indicator of market sentiment, especially when large blocks are traded. It's important to note unusual trades, often at the asking price, because they're a good gauge of expectations among institutional investors with extensive capital. With Optionsonar's state-of-the-art machine learning and artificial intelligence, this process is incredibly easy for retail investors to discover unusual options.

Photos: (Click photo to enlarge)

Read Full Story - Option traders expect further decline in Shopify stock | More news from this source

Press release distribution by PRLog

Option traders expect further decline in Shopify stock

By:

PRLog

July 20, 2022 at 19:09 PM EDT

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.