Construction Equipment Market size worth $155 Bn by 2027

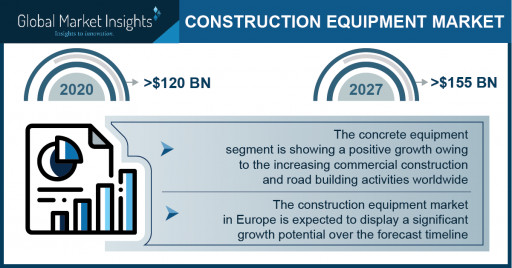

Construction Equipment Market size is set to surpass USD 155 billion by 2027, according to a new research report by Global Market Insights, Inc.

Global Market Insights Inc. has recently added a new report on the construction equipment market which estimates the market valuation for construction equipment will cross US$ 155 billion by 2027. The market is anticipated to show significant growth owing to the rising development and construction of residential and commercial infrastructures globally. The increasing demand and deployment of construction equipment to reduce the labor cost and manual efforts are also contributing to the market growth.

The outbreak of COVID-19 in 2020 showed a negative impact on the construction equipment industry, leading to numerous challenges. The lockdown imposed by governments across the globe temporarily halted the construction activities. Additionally, the restriction on domestic and international trade has reduced the sales of construction equipment, hampering the market growth. However, the market is anticipated to show steady growth by 2021 as the governments are uplifting the lockdown restrictions owing to the reduction in COVID-19 cases.

Request a sample of this research report @ https://www.gminsights.com/request-sample/detail/2803

The concrete equipment segment is showing positive growth owing to the increasing commercial construction and road-building activities worldwide. The concrete equipment segment is further classified into asphalt pavers, crushers, batching plants, transit mixers, and concrete pumps. The demand for mixers and pavers is increasing in road construction as this equipment assists in quick and timely completion of projects, driving the market.

The construction equipment market in Europe is expected to display a significant growth potential over the forecast timeline owing to rising government investments in the development of transport infrastructure across Europe. For instance, in March 2019, the European Commission invested around USD 500 million in endorsing digitalization and enhancing road safety, which will increase the demand for the construction equipment market.

The players active in the construction equipment market are CNH Industrial, Volvo Construction Equipment, Komatsu Ltd., Hitachi Construction Machinery, XCMG Group, Terex Corporation, Sany Group, Caterpillar, Inc., Liebherr, and Kobelco Construction Machinery Co. The companies are emphasizing organic and inorganic strategies to enhance their market position. For instance, in September 2019, LiuGong launched New-Generation F-Series Excavators. The new F-series excavators are mainly designed for Western Europe, North America, and China, considering the emerging markets.

Some major findings in the construction equipment market report include:

- Rising industrialization and urbanization across Asia Pacific and Middle East are increasing the demand for construction equipment.

- The growing investments in Latin America due to developments in the agriculture sector and mining are showing a positive impact on the market.

- The construction companies are demanding advanced construction equipment to reduce accidents, improve the overall safety of workers, and enhance the working capabilities to reduce the work time.

- Increasing development of smart cities, road construction, airports, commercial, and residential complexes owing to private and public investments in supporting the demand for the construction equipment market across the globe.

- Key players operating in the construction equipment market include Terex Group, XCMG, Hitachi Construction Company, Komatsu, Ltd., Sany Group, Zoomlion, Liebherr, and Kobelco Construction Machinery Co.

- The market players in the construction equipment industry are aiming on strategic acquisitions and partnerships to enhance their market position and focus on the development of new products.

Request customization of this research report at https://www.gminsights.com/roc/2803

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Construction equipment industry 360° synopsis, 2016 - 2027

2.1.1 Business trends

2.1.2 Regional trends

2.1.3 Product trends

Chapter 3 Industry Insights

3.1 Industry segmentation

3.2 Impact of COVID-19 on construction equipment industry landscape

3.2.1 Global outlook

3.2.2 Regional impact

3.2.2.1 North America

3.2.2.2 Europe

3.2.2.3 Asia Pacific

3.2.2.4 Latin America

3.2.2.5 MEA

3.2.3 Industry value chain

3.2.3.1 Research & development

3.2.3.2 Manufacturing

3.2.3.3 Marketing

3.2.3.4 Supply

3.2.4 Competitive landscape

3.2.4.1 Strategy

3.2.4.2 Distribution network

3.2.4.3 Business growth

3.3 Industry ecosystem analysis

3.3.1 Component suppliers

3.3.2 Technology providers

3.3.3 Manufacturers

3.3.4 End use landscape

3.3.5 Distribution channel analysis

3.3.6 Vendor matrix

3.4 Technology & innovation landscape

3.4.1 IoT & AI

3.4.2 Telemactis

3.4.3 Autonomous construction machinery

3.5 Regulatory landscape

3.5.1 ISO standards

3.5.1.1 ISO 4310

3.5.1.2 ISO 8686

3.5.1.3 ISO 10245-1:2008

3.5.1.4 ISO 12480-1

3.5.1.5 ISO 23815-1

3.5.1.6 ISO 12482

3.5.1.7 ISO 23814

3.5.1.8 ISO 19432:2012

3.5.2 North America

3.5.3 Europe

3.5.4 Asia Pacific

3.5.5 Latin America

3.5.6 MEA

3.6 Industry impact forces

3.6.1 Growth drivers

3.6.1.1 Introduction of new technologies for construction machinery

3.6.1.2 Rising infrastructure investments globally

3.6.1.3 Positive outlook of construction industry in India and China

3.6.1.4 Increasing construction equipment rental demand in Europe and North America

3.6.1.5 Growing population migration toward urban areas globally

3.6.1.6 Increasing construction and industrial development projects in Russia

3.6.1.7 Rising worker safety concerns on construction sites in India

3.6.1.8 High investments in refurbishment and maintenance activities in Japan

3.6.1.9 Rapid growth in infrastructure development in BRIC countries

3.6.1.10 Growing number of public infrastructure development projects in Latin America

3.6.1.11 Proliferation of in mining projects in Middle Eastern and Latin American countries

3.6.1.12 Increasing smart city development and public private partnership projects in MEA

3.6.2 Industry pitfalls & challenges

3.6.2.1 Cyclic nature of application industries

3.6.2.2 Unavailability of qualified & skilled operators

3.6.2.3 High capital investments to procure new construction equipment

3.6.2.4 Fluctuations in oil prices

3.6.2.5 High cost of maintaining construction equipment

3.7 Growth potential analysis

3.8 Porter's analysis

3.8.1 Supplier power

3.8.2 Buyer power

3.8.3 Threat of new entrants

3.8.4 Threat of substitutes

3.8.5 Internal rivalry

3.9 PESTEL analysis

About Global Market Insights

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights, Inc.

Phone: 1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Press Release Service by Newswire.com

Original Source: Construction Equipment Market to Hit $155 Bn by 2027; Global Market Insights, Inc.