SAN FRANCISCO - Nov. 30, 2021 - PRLog -- Since early July, Nvidia stock has experienced an unusual amount of options trading activity skewing in the positive direction. Many traders are buying call options far more often than puts, indicating considerable bullishness on the stock with the expectation that it will rise to greater heights.

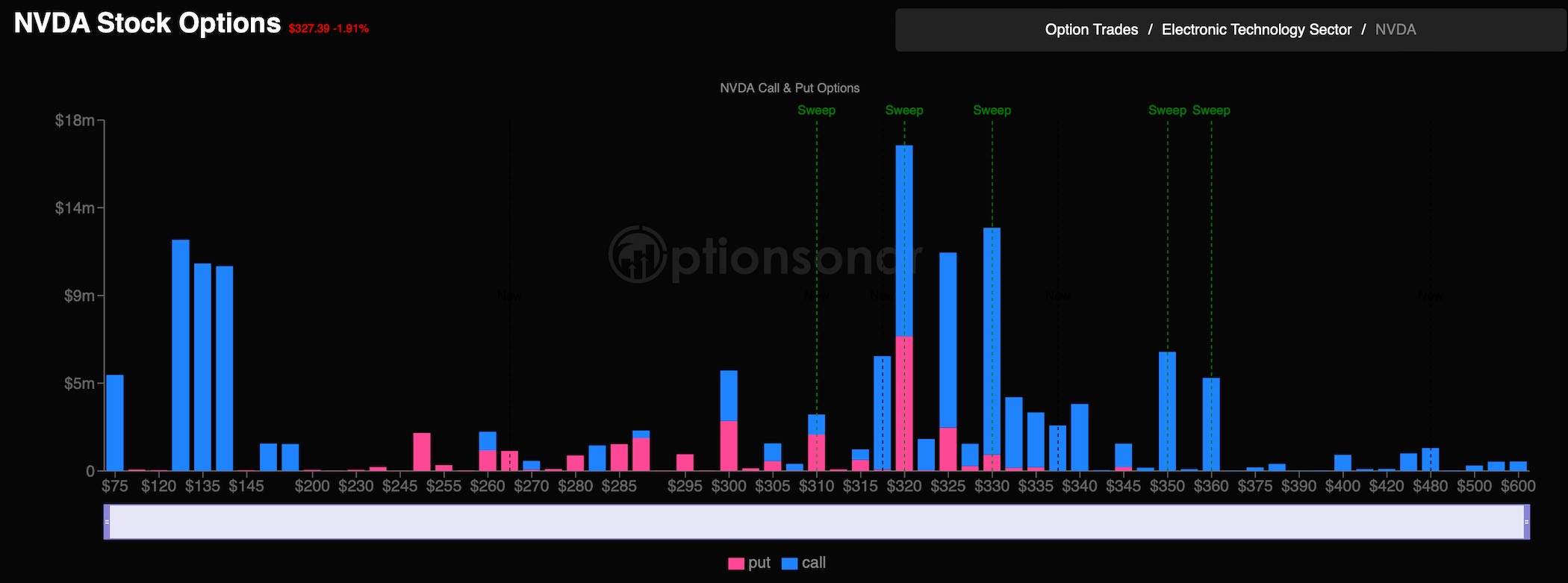

Traders bought nearly $6 million worth of call options on Nvidia's stock on November 29th, compared to $1.4 million worth of put options, a 4:1 ratio. Call options are purchased when a trader expects the price of a stock to go up, i.e., bullish, and put options when the expectation is that the price will go down, i.e., bearish. It shows a largely-positive bias in the expectation that Nvidia will grow further with 4x more buyers of Nvidia call options than puts.

Earnings

At this point, it is rational to be bullish rather than bearish on Nvidia's stock because the chipmaking giant is experiencing massive growth amid the pandemic. In its latest earnings report for the third quarter of 2021, Nvidia posted $7.1 billion in revenue, up 50% from the same period last year. Net income reached a record-breaking $2.5 billion as well.

What's driving Nvidia's growth?

Its primary revenue source is the sale of Graphical Processing Units (GPUs) for high-end gaming devices and data centers. The pandemic led to a massive increase in gaming activity worldwide, resulting in a surge in demand for gaming laptops. Nvidia sells the expensive GPUs that accompany gaming laptops, so it has been a major beneficiary of this surge.

Also, many services moved online. There was a need for more data center infrastructure to support online activities. Data center servers are powered by Nvidia CPU chips, so the company has benefited substantially from the boom in data centers.

Why pay attention to options activity?

The conventional reason for options trading is for investors to hedge their bets. However, option prices are good indicators of market sentiments, mainly when large blocks are traded. Most institutional investors have extensive capital trade options to capitalize on stock movements. Therefore, it's imperative to spot those big, unusual trades, often at asking prices. This is because they indicate high expectations from investors. Our proprietary artificial intelligence algorithms at Optionsonar, which constantly scan the options markets every day, allow us to spot these exact trades for retail traders.

Consider a trade of 10,000 calls with a bid and ask spread of $1.00 and $2.00, and the order was executed at $2.00 at a cost of $20k. This shows the buyer was not in a hurry to make the deal and did not see the need to bid below the asking price to save money. Only those with high expectations will do this. Investors follow this trend with Nvidia's stock, which signals a very positive sentiment.

Photos: (Click photo to enlarge)

Read Full Story - Call options activity on Nvidia stock is unusually high | More news from this source

Press release distribution by PRLog

Call options activity on Nvidia stock is unusually high

November 30, 2021 at 20:05 PM EST