5.5% . That's where morgage rates are this morning – up from 2.5% last year. If you have a home with a $400,000 mortgage at 3% interest rate, your monthly payment (not including taxes, etc) is $1,687. If you have a $400,000 mortgage at 5.5%, your monthly payment is $2,271, $584 (34.6%) higher. Not a lot of families can just snap their fingers and come up with an extra $7,000/yr to pay for their homes – especially with taxes and other home-related costs also rising sharply. States and towns MUST balance their budgets and they too are getting hit by higher labor costs, fuel costs, materials costs, etc. and fiscal budgets are usually June to June so it's right now, in your towns, that these costs are about to be passed on to you, the taxpayer. This is another one of those inflationary surprises that no one has taken into account yet and it's yet another one of those things the Economorons will say " no one could have seen coming ". Property tax increases could easily outpace inflation, especially in areas where businesses were given tax-free incentives to locate in your area – meaning they will not be shouldering the burden of the increased costs. Not only are the tax RATES going to increase but, thanks to inflation, the taxable value of your home will increase as well – hitting homeowners with a double whammy. https://www.texasmonthly.com/news-politics/high-property-tax-home-appraisals/ https://www.inquirer.com/news/philadelphia/property-assessments-taxes-philadelphia-increase-20220515.html https://www.seattletimes.com/business/real-estate/king-county-property-values-rise-at-unprecedented-rates-tax-hikes-likely/ https://theaugustapress.com/column-the-ugly-truth-about-local-property-tax-increases/ It's everywhere, that just gives you an idea. The bigger problem is, if you are an old person who simply can't afford to pay more money for the same house – moving is now very expensive and so is a new mortgage and so are apartments and so are nursing homes, etc. Generally, you are screwed. What's the solution? Well, according to the 1930s playbook, you can start getting that room your kids just moved out of ready for your parents to move into but leave some room for your kids to boomerang back as well as 17% of 25-34 year-olds are already living at home and that number is climbing fast! JPM's Jamie Dimon says US Consumers have 6-9 …

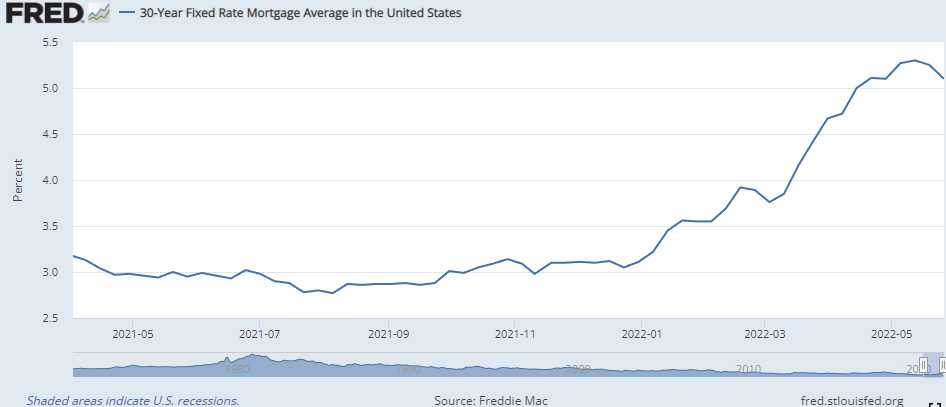

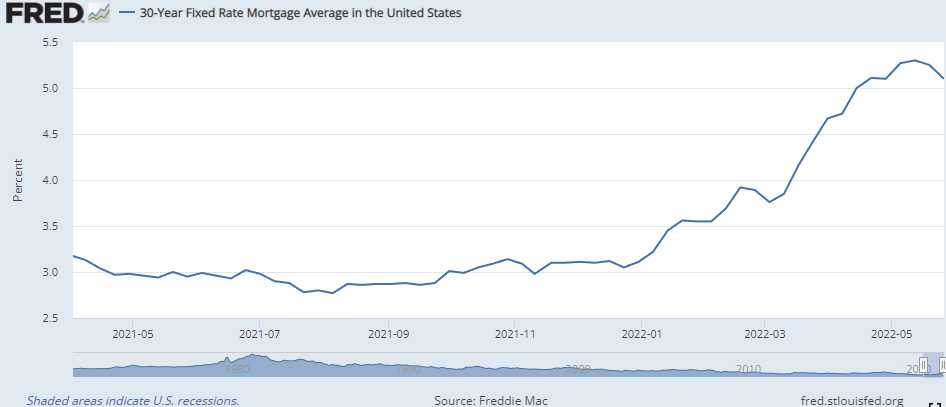

5.5%.

5.5%.

That's where morgage rates are this morning – up from 2.5% last year. If you have a home with a $400,000 mortgage at 3% interest rate, your monthly payment (not including taxes, etc) is $1,687. If you have a $400,000 mortgage at 5.5%, your monthly payment is $2,271, $584 (34.6%) higher. Not a lot of families can just snap their fingers and come up with an extra $7,000/yr to pay for their homes – especially with taxes and other home-related costs also rising sharply.

States and towns MUST balance their budgets and they too are getting hit by higher labor costs, fuel costs, materials costs, etc. and fiscal budgets are usually June to June so it's right now, in your towns, that these costs are about to be passed on to you, the taxpayer. This is another one of those inflationary surprises that no one has taken into account yet and it's yet another one of those things the Economorons will say "no one could have seen coming".

Property tax increases could easily outpace inflation, especially in areas where businesses were given tax-free incentives to locate in your area – meaning they will not be shouldering the burden of the increased costs. Not only are the tax RATES going to increase but, thanks to inflation, the taxable value of your home will increase as well – hitting homeowners with a double whammy.

https://www.texasmonthly.com/news-politics/high-property-tax-home-appraisals/

https://www.inquirer.com/news/philadelphia/property-assessments-taxes-philadelphia-increase-20220515.html

https://www.seattletimes.com/business/real-estate/king-county-property-values-rise-at-unprecedented-rates-tax-hikes-likely/

https://theaugustapress.com/column-the-ugly-truth-about-local-property-tax-increases/

It's everywhere, that just gives you an idea. The bigger problem is, if you are an old person who simply can't afford to pay more money for the same house – moving is now very expensive and so is a new mortgage and so are apartments and so are nursing homes, etc. Generally, you are screwed.

What's the solution? Well, according to the 1930s playbook, you can start getting that room your kids just moved out of ready for your parents to move into but leave some room for your kids to boomerang back as well as 17% of 25-34 year-olds are already living at home and that number is climbing fast!

What's the solution? Well, according to the 1930s playbook, you can start getting that room your kids just moved out of ready for your parents to move into but leave some room for your kids to boomerang back as well as 17% of 25-34 year-olds are already living at home and that number is climbing fast!

JPM's Jamie Dimon says US Consumers have 6-9…

5.5%.

5.5%.  What's the solution? Well, according to the 1930s playbook, you can start getting that room your kids just moved out of ready for your parents to move into but leave some room for your kids to boomerang back as well as 17% of 25-34 year-olds are already living at home and that number is climbing fast!

What's the solution? Well, according to the 1930s playbook, you can start getting that room your kids just moved out of ready for your parents to move into but leave some room for your kids to boomerang back as well as 17% of 25-34 year-olds are already living at home and that number is climbing fast!