The broader market has been moving with a restless kind of energy lately, shifting from the usual mega-cap tech darlings toward those powering the next wave of computing. Everywhere we look, long-duration cloud and colocation deals are piling up, hinting that the real action is not solely in artificial intelligence (AI) models. But is in the infrastructure that keeps them alive, and that’s where the story suddenly tilts toward CleanSpark (CLSK).

Once seen primarily as a high-efficiency Bitcoin (BTCUSD) miner, CleanSpark is now steering itself into a much bigger lane. The company is freeing up premium, power-rich sites near major metros for high-performance computing while shifting its mining operations to more remote, cost-friendly regions. With the industry locking in major, multi-year HPC commitments, its transition toward becoming a full-blown data center operator feels far more strategic than speculative.

So, when JPMorgan (JPM) upgraded the stock to “Overweight” and reiterated its $14 target, it was not just routine praise. CleanSpark’s evolving footprint finally aligns with the market's momentum. But with the stock catching fresh attention, does this upgrade make it a buy right now?

About CleanSpark Stock

CleanSpark is a Nevada-based operator of data centers and power assets, blending old-school infrastructure roots with the new world of digital commodities. Founded in 1987, the company has evolved into a major force supporting Bitcoin and emerging compute workloads. With a market cap near $4 billion, it is now shaping the next wave of energy-driven computing.

CLSK’s price performance has been anything but boring lately, carving out a story that feels part recovery arc, part momentum chase. The stock is still up 52.72% year-to-date (YTD), even after a sharp comedown from its $23.61 high on Oct. 15 – a drop of 67.7% from peak to now. Yet the medium-term trend remains strong. Shares are up 63% in six months and 48.5% over the past three months. And what’s impressive was this past week’s rally, with CLSK jumping 48.14% in just five sessions, with volumes swelling as traders rushed back in. The double-digit surge came as Bitcoin bounced, along with CleanSpark’s fiscal 2025 results, and analysts rolling out fresh bullish notes.

Technically, the setup is mixed. The 14-day RSI slipped into oversold territory last Friday but snapped higher quickly, hinting at revived buying strength.

But there’s a caution flag, too. The MACD is flashing a more cautious undertone beneath the recent rebound. The yellow MACD line has slipped below the blue signal line and continues to angle downward, signaling fading momentum despite the price surge. Adding to this, the histogram remains firmly negative, indicating that bearish pressure has not fully released. Until the MACD curls higher, the trend still carries a warning tag.

CleanSpark’s valuation still feels like a quiet bargain in a loud market. With a forward P/E under 20x and a trailing P/E near 12x, both sitting below sector averages, the stock screens as meaningfully undervalued. That’s before even factoring in the premium investors typically assign to AI-focused data center players. If CleanSpark’s data center shift gains real traction, the market could easily reset its expectations, giving both long-term holders and short-term traders plenty to play for.

A Snapshot of CleanSpark’s Fiscal 2025 Results

CleanSpark’s fiscal 2025 results landed earlier this week, and it was a mixed bag. GAAP EPS rose to $1.12 from a loss of -$0.69 per share in fiscal 2024, and missed estimates. Revenue of $766.3 million grew by a scorching 102% year-over-year (YOY) but still came shy of expectations.

The company generated revenue of $223.7 million in Q4, up 12.6% sequentially, missing estimates. Still, margins held up. Adjusted EBITDA hit $181.8 million in Q4, with normalized adjusted EBITDA coming in at $97 million, a 25% sequential increase and normalized margins touching 43%. Their digital asset management arm chipped in as well, generating $9.3 million in premiums and unlocking another $7 million by monetizing a BITMAIN option.

Traders did not love the hiccup, and shares slipped 3.4% in after-hours. But by the next morning, the mood flipped. A sharp rebound in crypto and upbeat analyst calls sparked a nearly 14% surge in CleanSpark’s shares, as if the market suddenly snapped back to the bigger story at play.

Meanwhile, CleanSpark mined 7,873 Bitcoin in fiscal 2025, up nearly 11% YOY, and enjoyed an average revenue per Bitcoin of approximately $98,000, a 55% jump, thanks to stronger market prices. Costs climbed too, more than doubling to $42,956 per coin, underscoring the capital-heavy nature of modern mining.

Operationally, 2025 was the year CleanSpark hit escape velocity. Management bragged, rightfully, about reaching 50 exahash per second (EH/S) as of Oct. 31, 2025, without issuing new shares, while locking in a 285-MW Texas site designed to become a full-blown AI factory. The company is already deploying 19,000 S21 XP immersion units and closing in on its biggest transformation yet – shifting select metro-adjacent sites into high-performance computing hubs while moving Bitcoin mining to more remote, cost-efficient regions.

Financially, the balance sheet shows both ambition and muscle. Cash climbed to $43 million, long-term debt sits at $644.6 million, and the team pulled off a $1.15 billion 0% convertible note alongside a hefty $460 million buyback that trimmed share count by over 10%.

Looking ahead, CleanSpark’s management is not shy about the direction it is heading. Costs will rise as the AI strategy ramps, but management sees the future clearly – stable, high-margin AI data center revenue that will smooth out Bitcoin’s boom-bust cycles. With tenant discussions underway in Sandersville and Houston, and the first AI customer feeling more like a “when” than an “if”, CleanSpark’s next chapter looks far bigger than mining blocks.

Meanwhile, analysts monitoring CleanSpark anticipate that down the road, the outlook could turn a bit more complicated. Fiscal 2026 EPS is expected to be $0.33, down 53.32% YOY. Then the trajectory shifts even more sharply. By fiscal 2027, forecasts point to earnings sliding by another 257.58% annually into the red, landing at a projected -$0.52 loss per share.

What Do Analysts Expect for CleanSpark Stock?

JPMorgan’s (JPM) outlook for CLSK highlights CleanSpark’s ongoing transformation story, in which a former pure-play BTC miner is methodically reshaping itself into a heavyweight in HPC. The bank reaffirmed its “Overweight” rating after what it called “clean” fiscal Q4 25 results, pointing to a management team that is executing with clarity while navigating volatile mining economics.

The investment bank’s optimism stems from the sheer depth of CleanSpark’s power footprint. The company now controls more than 400 MW of potential HPC capacity outside Atlanta, with its 230-MW Sandersville site already drawing interest for long-term inference workloads. Add the newly purchased 285-MW Texas site near Houston, a prime corridor for AI infrastructure, and JPMorgan sees CleanSpark positioned in coveted Tier-1 data center markets, a strategic edge as many miners retreat to cheaper, remote regions.

Yet, it is not without concerns. Rising costs weighed on results – power expenses climbed, SG&A expanded, and stock-based compensation spiked sharply. BTC production slipped slightly, and total cost per coin rose 12%. Still, JPMorgan views the decision not to issue ATM shares as a sign of financial discipline.

Other analysts echo the confidence. H.C. Wainwright’s Mike Colonnese kept a “Buy” rating on CLSK, noting the company may land a multibillion-dollar HPC/AI colocation deal sooner than expected. He highlights management’s plan to repurpose the 250-MW Sandersville site, with 200 MW of critical IT capacity and strong Georgia attributes, capable of generating roughly $400 million in annual recurring revenue. He also points to CleanSpark’s 13,000+ Bitcoin stack, solid balance sheet, and deep infrastructure expertise.

Needham’s John Todaro, who raised his target to $25, sees accelerating HPC momentum and higher odds of multiple lease signings by year-end, keeping the stock attractively valued.

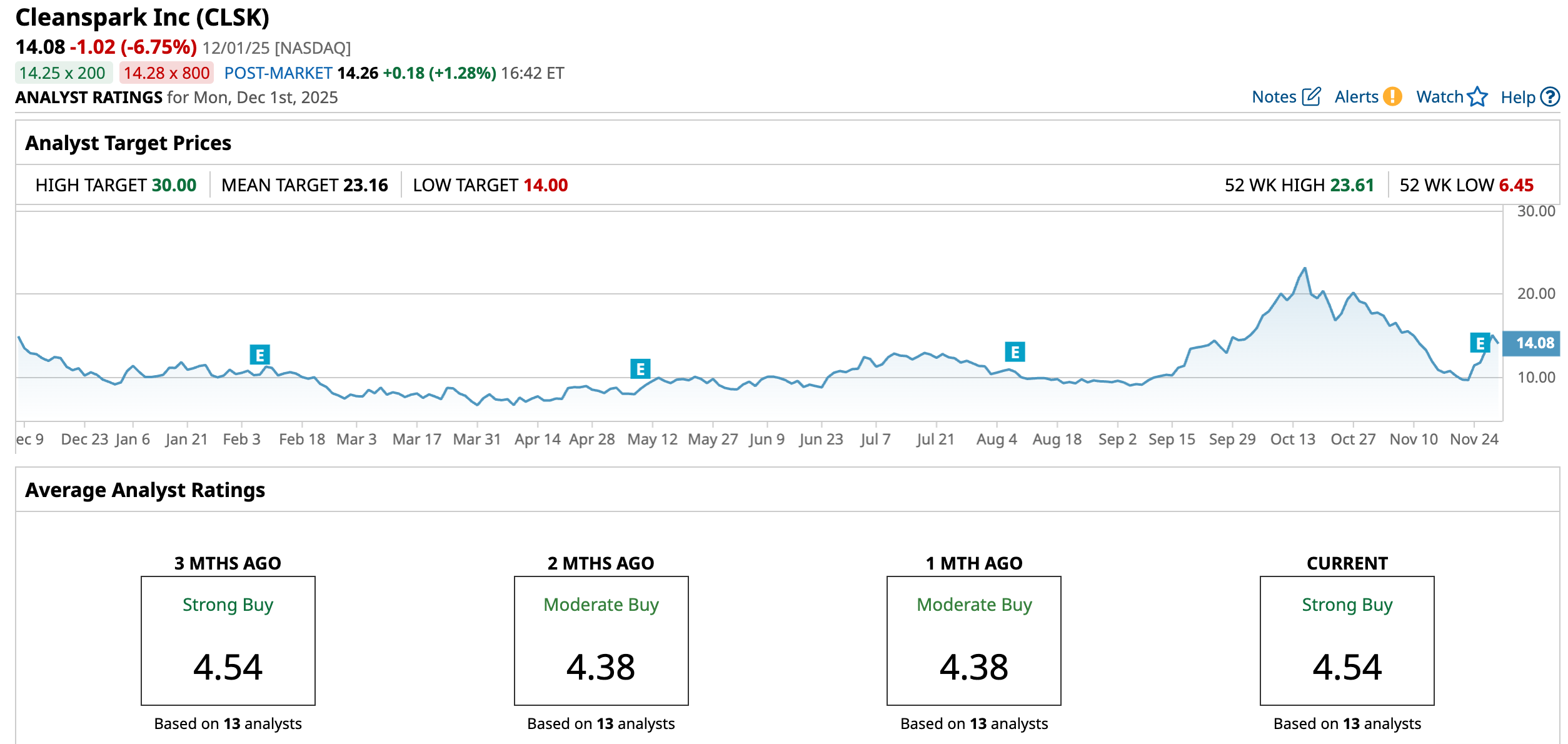

CLSK has a consensus “Strong Buy” rating overall – an upgrade from the “Moderate Buy” rating a month back. Out of the 13 analysts offering recommendations for the stock, nine suggest a “Strong Buy,” two advise a “Moderate Buy,” and the remaining two give a “Hold” rating.

CLSK’s average price target of $23.16 implies a rebound potential of 64.5%. Chardan Capital’s Street-high target of $30 still suggests the stock could rally as much as 113% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart