Looking back on discount retailer stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Ross Stores (NASDAQ:ROST) and its peers.

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

The 5 discount retailer stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

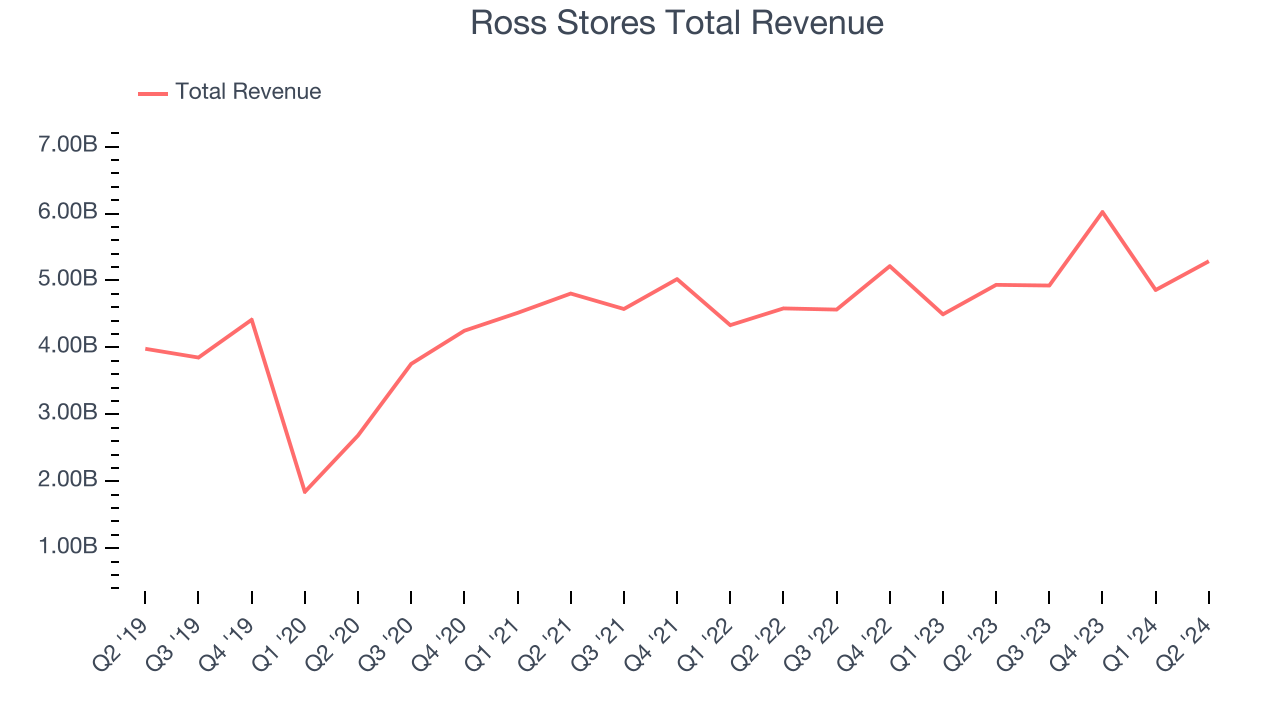

Ross Stores (NASDAQ:ROST)

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ:ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Ross Stores reported revenues of $5.29 billion, up 7.1% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ earnings estimates.

Ross Stores delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 9.4% since reporting and currently trades at $138.31.

Is now the time to buy Ross Stores? Access our full analysis of the earnings results here, it’s free.

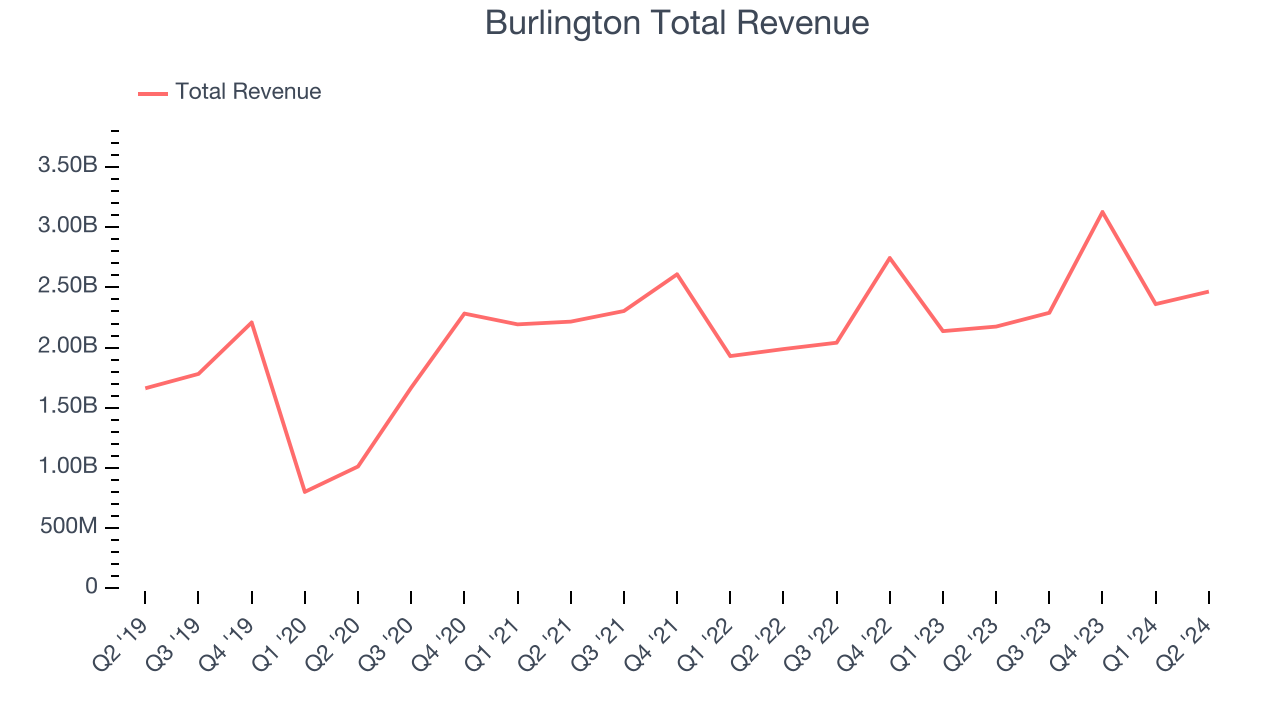

Best Q2: Burlington (NYSE:BURL)

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE:BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

Burlington reported revenues of $2.47 billion, up 13.4% year on year, outperforming analysts’ expectations by 2%. The business had an exceptional quarter with optimistic earnings guidance for the next quarter and an impressive beat of analysts’ EBITDA estimates.

Burlington delivered the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5.8% since reporting. It currently trades at $257.

Is now the time to buy Burlington? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Five Below (NASDAQ:FIVE)

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ:FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Five Below reported revenues of $830.1 million, up 9.4% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a solid beat of analysts’ EBITDA estimates but a miss of analysts’ gross margin estimates.

Five Below delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 17.9% since the results and currently trades at $93.

Read our full analysis of Five Below’s results here.

Ollie's (NASDAQ:OLLI)

Often located in suburban or semi-rural shopping centers, Ollie’s Bargain Outlet (NASDAQ:OLLI) is a discount retailer that acquires excess inventory then sells at meaningful discounts.

Ollie's reported revenues of $578.4 million, up 12.4% year on year. This number surpassed analysts’ expectations by 3%. More broadly, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but a miss of analysts’ gross margin estimates.

Ollie's scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 3.3% since reporting and currently trades at $91.07.

Read our full, actionable report on Ollie's here, it’s free.

TJX (NYSE:TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $13.47 billion, up 5.6% year on year. This result topped analysts’ expectations by 1.1%. Taking a step back, it was a mixed quarter as it also recorded a decent beat of analysts’ EBITDA estimates but underwhelming earnings guidance for the next quarter.

TJX had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $113.24.

Read our full, actionable report on TJX here, it’s free.

Market Update

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.