All News about DB Agriculture Fund Invesco

Via Talk Markets

The Songs of the 50 States

February 22, 2022

Via Talk Markets

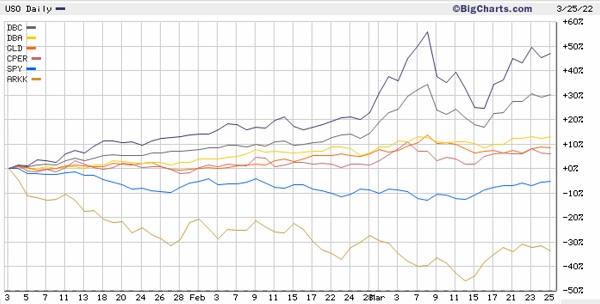

A Rare Moment In The Markets When Those That Pay Attention Win

February 21, 2022

Via Talk Markets

Support and Resistance Levels to Watch for Thursday’s Trading Session

February 09, 2022

Via Talk Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.