Energy and construction materials company MDU Resources (NYSE:MDU) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 5% year on year to $1.05 billion. Its GAAP profit of $0.32 per share was also 3.2% above analysts’ consensus estimates.

Is now the time to buy MDU Resources? Find out by accessing our full research report, it’s free.

MDU Resources (MDU) Q3 CY2024 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.00 billion (4.9% beat)

- EPS: $0.32 vs analyst estimates of $0.31 (3.2% beat)

- EBITDA: $65 million vs analyst estimates of $156.8 million (58.5% miss)

- Gross Margin (GAAP): 20%, up from 17.7% in the same quarter last year

- Operating Margin: 8.6%, in line with the same quarter last year

- EBITDA Margin: 6.2%, down from 13.8% in the same quarter last year

- Market Capitalization: $3.46 billion

"The successful spinoff of Everus Construction Group on October 31, following last year's Knife River Corporation spinoff, marks the completion of our strategic initiatives," said Nicole A. Kivisto, president and CEO of MDU Resources.

Company Overview

Founded to provide electricity to towns in Minnesota, MDU Resources (NYSE:MDU) provides products and services in the utilities and construction materials industries.

Energy Products and Services

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

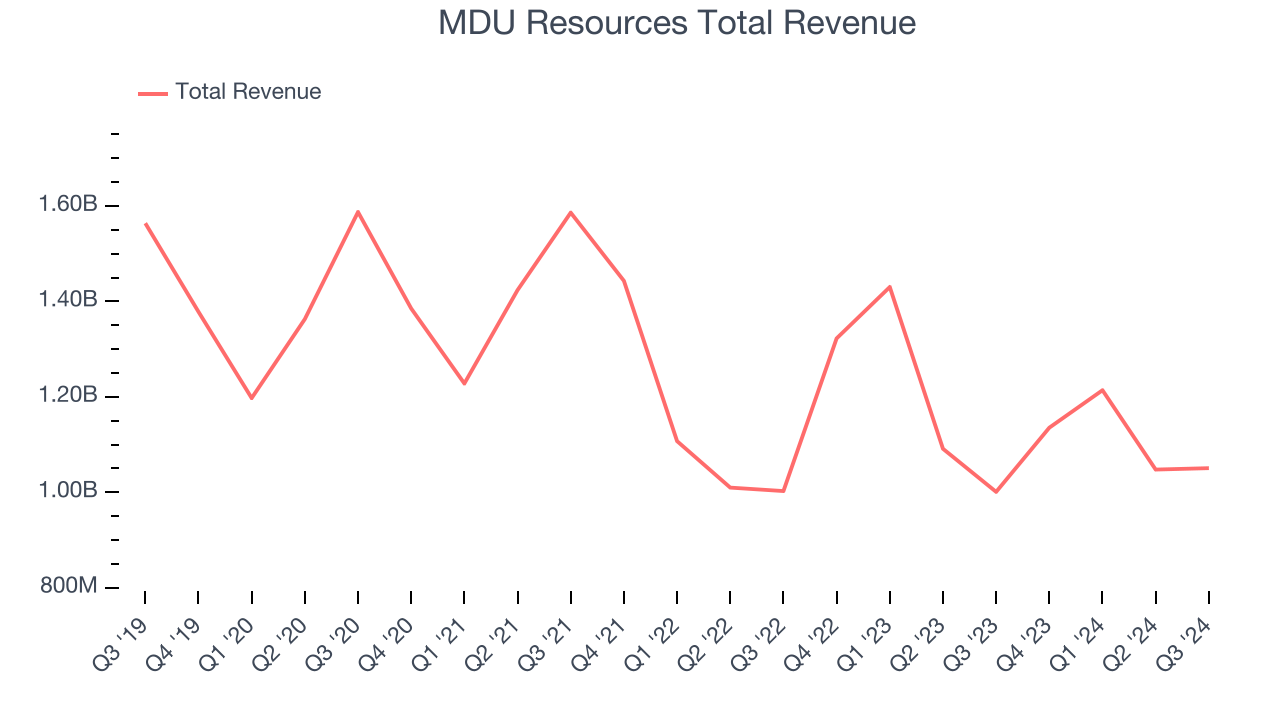

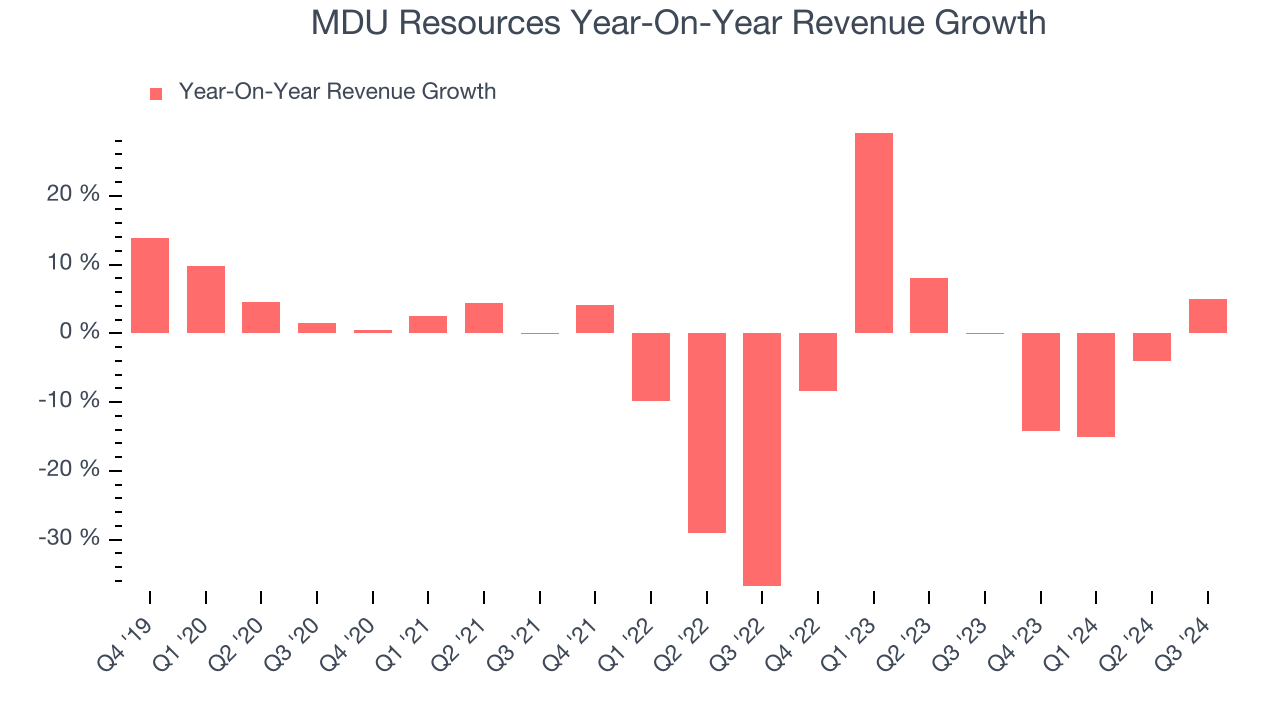

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. MDU Resources struggled to generate demand over the last five years as its sales dropped by 3% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. MDU Resources’s annualized revenue declines of 1.3% over the last two years suggest its demand continued shrinking.

This quarter, MDU Resources reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 4.9%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

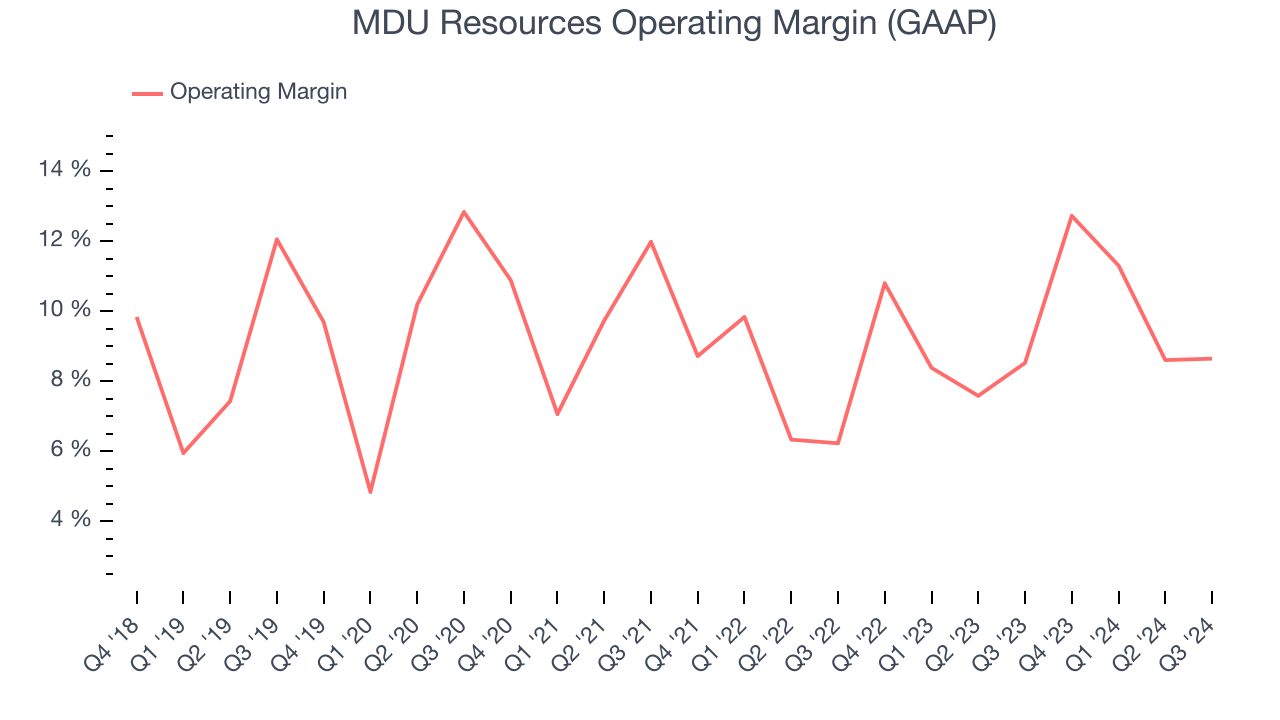

Operating Margin

MDU Resources has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.4%, higher than the broader industrials sector.

Looking at the trend in its profitability, MDU Resources’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years. Shareholders will want to see MDU Resources grow its margin in the future.

This quarter, MDU Resources generated an operating profit margin of 8.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

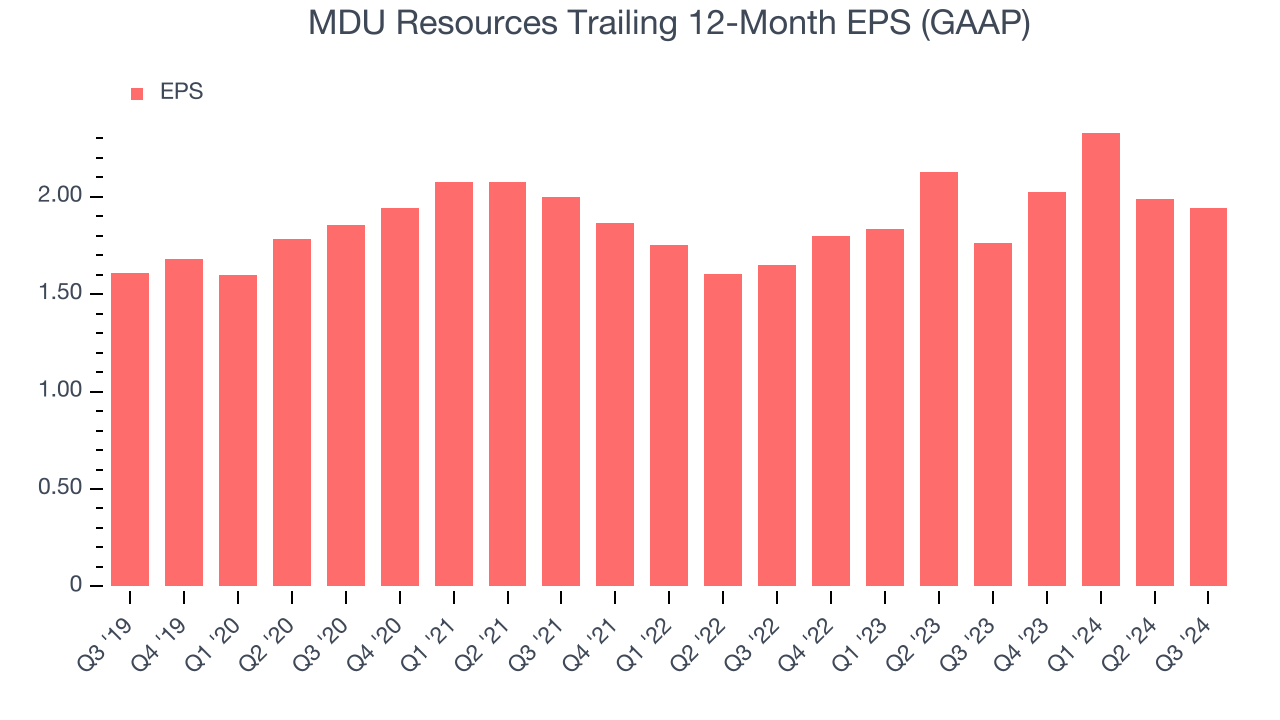

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

MDU Resources’s EPS grew at a weak 3.8% compounded annual growth rate over the last five years. This performance was better than its 3% annualized revenue declines but doesn’t tell us much about its business quality because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. MDU Resources’s two-year annual EPS growth of 8.6% was decent and topped its two-year revenue performance.

In Q3, MDU Resources reported EPS at $0.32, down from $0.36 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.2%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from MDU Resources’s Q3 Results

We were impressed by how significantly MDU Resources blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Zooming out, we think this was a decent quarter featuring some areas of strength. The stock traded up 4.5% to $17.71 immediately after reporting.

So should you invest in MDU Resources right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.