While Cardiol Therapeutics (NasdaqCM: CRDL) (TSX: CRDL) stock may have given back some of its gains to profit-taking, investors holding since the new year have little to complain about. After all, since the turn to 2023, CRDL stock is higher by over 58%. Indeed, that's an impressive gain compared to weakness throughout the micro and smallcap universe and a stark contrast to the returns in the smallcap Russell 2000 index, which turned negative for the year on Monday. But CRDL isn't only trouncing the returns of the smallcap indexes; it's handily beating the Nasdaq Composite as well, with its 58% increase easily eclipsing the 24.77% YTD gains from that group. (* share price from 01/03/23 - 10/09/23, $0.51 - $0.81, 11:38 AM EST, Yahoo! Finance)

The better news for CRDL investors- those YTD gains could be the precursor to more appreciable increases, a bullish sentiment supported by CRDL being better positioned than at any time in its history to accelerate its clinical ambitions and, as importantly, deliver a better, safer, and effective way to treat certain cardiovascular diseases. The even better news- that can happen faster than many think, especially from the precedent set by potential category rival Kiniksa Pharmaceuticals' (NasdaqGS: KNSA) permission to jump from its mid-Phase II clinical trial directly to Phase III. Potential competitor, maybe. Does this expedited KNSA trial bode potentially well for CRDL? - absolutely.

Cardiol Therapeutics leadership is in that camp. They are on record saying CRDL could earn similar trial respect, pointing toward that possibility happening by the year's end. If so, CRDL's valuation could surge. That's not overzealous speculation, either; it's a warranted assumption knowing that the difference investors are willing to pay for a company in a Phase III clinical trial compared to those in Phase II can be substantial. There's more driving the value proposition.

Value Drivers, Milestones, And Catalysts in The Crosshairs

Indeed, while the possibility of having two Phase III trials progressing by the end of 2023 are certainly value drivers, they aren't the only ones. Adding support to an already bullish case, CRDL's latest SEC filing shows them to be virtually debt-free and, most importantly, well-capitalized to achieve corporate milestones through 2026. The value proposition doesn't end with that, either. Ironically, despite the advancing pipeline, solid balance sheet, and expedited pathway toward getting a potentially game-changing cardiovascular disease treatment drug to market, CRDL's market cap is only modestly above its cash on hand. However, that disconnect could close sooner than later as micro and smallcap fund managers and retail investors re-position to mitigate risk by purchasing shares in companies whose prospects aren't just bright but near term.

Remember, most funds are internally mandated to stay invested in stocks. Yes, they hold cash, but for the most part, it amounts to about 4% or less of the fund's total value. In other words, managers need to find strong companies that are fundamentally and operationally strong, two boxes that CRDL definitely checks. And word is spreading about this $0.81 stock. In fact, CRDL management isn't the only team optimistic about its near-term potential. Analysts are as well.

The four covering CRDL are bullish regarding the expected share price trajectory. Current price models forecast CRDL shares to reach between $2.21 and $6.00, with the median target at $3.47, 328% higher than its current price. The bullish appraisals share a common theme, which is the expectation for CRDL's lead treatment candidate, CardiolRx™, to earn the front-line designation and serve as the new standard of care to treat certain cardiovascular diseases, which, as a whole, cause over 17 million deaths globally each year. Of course, revenues matter, especially their duration, when analysts construct forward-looking pricing models.

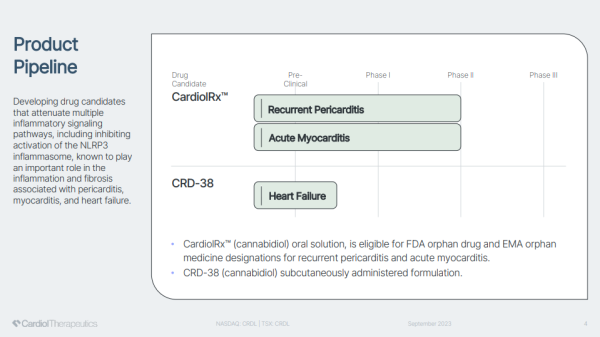

CRDL checks the long end of that, a premise supported by CRDL's drug candidate earning more than a potential front-line position. Orally administered CardiolRx™ is also on a pathway toward achieving FDA orphan drug and EMA orphan medicine designations, providing seven years of market exclusivity to protect potentially significant revenue streams. Those designations can be worth billions over time.

Accelerating Through Phase II With Milestones In-Play

CardiolRx™, with its anti-inflammatory and anti-fibrotic properties to treat particular cardiovascular diseases, is headed in that direction. In its immediate treatment crosshairs, Cardiol Therapeutics targets delivering better solutions for patients with recurrent pericarditis and acute myocarditis. To date, there's only excellent news to report, which CRDL is doing by posting an unparalleled data scorecard showing unique ability in fighting against my pericardial diseases, including recurrent pericarditis, acute myocarditis, and heart failure.

Success to date isn't just a clinical morale builder; it supports the bullish proposition, knowing that milestones reached by CRDL can become catalysts to expedite tapping into multi-billion dollar treatment market opportunities. Three are currently in play. The first relates to its Phase II Recurrent Pericarditis Study, with CRDL potentially announcing completed enrollment, interim analysis, and a move to Phase III clinical trial this year.

Cardiol is also expected to complete enrollment and report topline data from its Phase II acute myocarditis study. That one could also jump directly to Phase III based on its data supporting the need for this drug candidate to get to patients quickly. A third milestone relates to its advancing research for CRD-38, with the company expecting to complete IND-enabling (Investigational New Drug Application) studies, submit the IND, and initiate the Phase I Clinical Program. Positive updates from any of the above could have a material impact on CRDL's share price. With expectations for updates to be published this quarter, trading ahead of them may be a wise consideration.

Fighting Recurrent Pericarditis In Unique Fashion

Keep in mind that expected announcements are likely to further validate that CRDL's drug candidates can do what others can't- fight effectively against myopericardial diseases due to their anti-inflammatory and anti-fibrotic properties. Those latter differences are more than distinctions; they are proving to be significant advantages compared to drugs developed by Big Pharma, including Novo Nordisk (NYSE: NVO), Eli Lilly (NYSE: LLY), and Novartis (NYSE: NVS). Comparatively, most of those include patients needing to take immunosuppressants, sometimes for several years, creating side effects that can be worse than the cardiovascular condition targeted. While sometimes a necessary evil, immunosuppressants inhibit or decrease the intensity of the immune response in the body, leaving patients susceptible to infection, treatment rejection, and other conditions that can lead to death. CRDL intends to change the practice of making dosing them a condition of getting additional treatment.

And they are getting plenty of collaborative help to make sure that happens. Cardiol Therapeutics has joined forces with world-class researchers and clinicians to better understand inflammation and fibrosis, drug development processes, and clinical trial protocols that can lead to expedited approvals. The list of collaborators comprises an enviable Who's Who list of heart disease research contributors, including Cleveland Clinic, Mayo Clinic, Houston Methodist DeBakey Heart & Vascular Center, VCU Health, and UVA Health. Internationally, CRDL is working with Tecnológico de Monterrey, UPMC, Charité, University of Ottawa Heart Institute, Tel-Aviv Sourasky Medical Center, McGill University Health Centre, and InCor HCFMUSF Ciência e Humanismo.

Those relationships are fueling progress, likely expediting a Phase II study evaluating CardiolRx™'s tolerability, safety, and efficacy in patients with recurrent pericarditis. Pericarditis is the membrane inflammation surrounding the heart, which leads to fluid accumulation and pericardial thickening. It becomes recurrent if symptoms reappear after a symptom-free period of 4-6 weeks. The symptoms of pericarditis include chest pain, shortness of breath, and depression. Severe cases affect quality of life and physical activity abilities and can even lead to emergency department visits or hospitalizations. It touches many lives.

Pericarditis affects 38,000 Americans and leads to 18,000 hospitalizations annually. While bad enough, recurrent pericarditis is much worse, usually lasting anywhere from 4-6 years in difficult-to-treat cases. If granted FDA orphan and/or EMA approval, CardiolRx™ could fill an unmet medical need for an oral drug that treats patients intolerant to therapy, colchicine resistant, or corticosteroid dependent.

Current pharmacotherapy solutions include NSAIDs or aspirin that don't contain colchicine and corticosteroids for patients with continued recurrence. Moreover, the one FDA-approved therapy that shows some benefit costs over $150,000/year, which gets multiplied to patients with repeated occurrences of pericarditis. That's only part of the cost. Pericarditis often results in a 6-8 day stay in the hospital, adding upwards of $20,000-$30,000 to get treatments needed. Since roughly 30% of the estimated 160,000 annual cases will experience a recurrence, the combined cost to get a currently imperfect treatment can be devastating financially.

The Battle Against Acute Myocarditis

Battling acute myocarditis can be equally devastating to a patient's health and finances. Acute myocarditis is an inflammatory heart muscle condition, often resulting from a viral infection. Symptoms include chest pain, impaired heart function, arrhythmia, and conduction disturbances. Most troubling about this condition is that it generally affects young adults from adolescence to mid-thirties. Still, while the affliction age is wide, most cases are recorded in patients in their early twenties, with acute and fulminant heart failure occurring in young adults. In fact, acute myocarditis is a leading cause of sudden cardiac death in people under the age of 35. Athletes, despite being in top physical condition, have died from this. Thus, diet and exercise won't stop an attack. But a better therapy could save lives.

CRDL believes CardiolRx™ can be that provider and, at the same time, benefit the company financially by having significant potential to earn FDA orphan drug and EMA approvals for treating acute myocarditis. That condition also takes a personal and financial toll. An estimated 46,000 Americans are impacted by acute myocarditis annually. Hospitalizations can be upwards of 7 days and tally $110,000 or more in hospital charges. Intensive care is often the case, noting that complications of this condition include heart failure, cardiogenic shock, arrhythmia, or cardiac arrest. In the most severe cases, ventricular assist devices, extracorporeal oxygenation, or a heart transplant may be needed. Even if patients escape the worst, acute myocarditis can and often does lead to further future health complications.

Thus, a treatment to address problems early on would benefit patients significantly. As importantly, an approved therapy from CRDL could fill a clear unmet medical need for a well-tolerated therapeutic that targets myocardial inflammation. There are no FDA-approved therapies for acute myocarditis, only guideline-directed therapies and management. These therapies include decreasing cardiac workload, reducing congestion, and improving how blood flows through arteries and veins and the forces that affect a patient's blood flow. Currently, corticosteroids are used to treat inflammation. However, the issue with those drugs is that they are widely intolerable, can have adverse side effects, and have an inconsistent record of optimal dosing.

Attracting Attention For The Right Reasons

Combining the known with near-term expectations, suggesting that CRDL's share price fails to appropriately represent intrinsic value, much less inherent potential, is more than warranted; it's justified. In fact, four respected analysts conclude that CRDL stock will more likely be at least 174% higher on the low estimate, 640% on the high, and 328% in the middle. In other words, at $0.81, CRDL stock is more than a ground-floor opportunity; it's a bargain basement one.

Remember, the bullish case isn't wishful thinking. It's evidence-based by CRDL being timely to a massive market and treatment opportunity, having excellent candidates with intrinsic strength and inherent potential to change the treatment landscape for specific cardiac diseases, and value from collaborative relationships that can help accelerate monetization timelines. All that combines to make the value proposition presented by CRDL stock simply too attractive to ignore. With over six million people over 20 years old currently living with symptoms of heart failure, one can bet they aren't. Nor is the medical system, which is strained by the over 1.9 million physician visits, 414,000 emergency department visits, and an estimated 1.2 million hospitalizations annually.

Thus, CRDL is earning the attention it deserves. And on the precipice of shifting into a late-stage Phase III clinical trial company for potentially two indications, much more could be on its way. If so, and with a potential best therapy to treat patients in a sector worth billions, anything less than the most conservatively modeled 174% increase would be disappointing. Frankly, even the forecast for a 328% increase may still leave considerable value unaccounted.

Disclaimers: Hawk Point Media Group, Llc. (HPM) is responsible for the production and distribution of this content. Hawk Point Media Group, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by Hawk Point Media Group, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors do NOT buy and sell securities before and after any particular article, report and publication. HPM holds ZERO shares and has never owned stock in Cardiol Therapeutics. In no event shall Hawk Point Media Group, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by Hawk Point Media Group, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, HPM, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. Hawk Point Media Group, LLC. has been compensated three-thousand-dollars cash via wire transfer from Trending Equities, Inc. to produce and syndicate content for Cardiol Therapeutics for a period of one month beginning on 10/09/23 and ending on 11/07/23. This compensation is a major conflict of interest in our ability to be unbiased regarding our alerts. Therefore, this communication should be viewed as a commercial advertisement only. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. As part of all content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. Contributors reserve the right, but are not obligated to, submit articles for fact-checking prior to publication. Contributors are under no obligation to accept revisions when not factually supported. Furthermore, because contributors are compensated, readers and viewers of this content should always assume that content provided shows only the positive side of companies, and rarely, if ever, highlights the risks associated with investment. Thus, readers and viewers should accept the content as an advertorial that highlights only the best features of a company. Never take opinion, articles presented, or content provided as a sole reason to invest in any featured company. Investors must always perform their own due diligence prior to investing in any publicly traded company and understand the risks involved, including losing their entire investment.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email: info@hawkpointmedia.com

Country: United States

Website: https://hawkpointmedia.com/