Business automation software provider Upland Software (NASDAQ: UPLD) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 10% year on year to $66.69 million. The company expects next quarter’s revenue to be around $68.9 million, coming in 1.8% above analysts’ estimates. Its non-GAAP profit of $0.42 per share was 150% above analysts’ consensus estimates.

Is now the time to buy Upland? Find out by accessing our full research report, it’s free.

Upland (UPLD) Q3 CY2024 Highlights:

- Revenue: $66.69 million vs analyst estimates of $66.79 million (in line)

- Adjusted EPS: $0.42 vs analyst estimates of $0.17 ($0.25 beat)

- EBITDA: $14 million vs analyst estimates of $13.5 million (3.7% beat)

- Revenue Guidance for Q4 CY2024 is $68.9 million at the midpoint, above analyst estimates of $67.71 million

- Gross Margin (GAAP): 70.5%, up from 69.1% in the same quarter last year

- Operating Margin: -5%, up from -10.4% in the same quarter last year

- EBITDA Margin: 21%, in line with the same quarter last year

- Free Cash Flow Margin: 6.3%, down from 7.5% in the previous quarter

- Market Capitalization: $60.53 million

"In Q3, we met our revenue and Adjusted EBITDA guidance midpoints, welcoming new customers across our portfolio, including for our Generative AI solutions," said Jack McDonald, Upland's chairman and chief executive officer.

Company Overview

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ:UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

Sales Growth

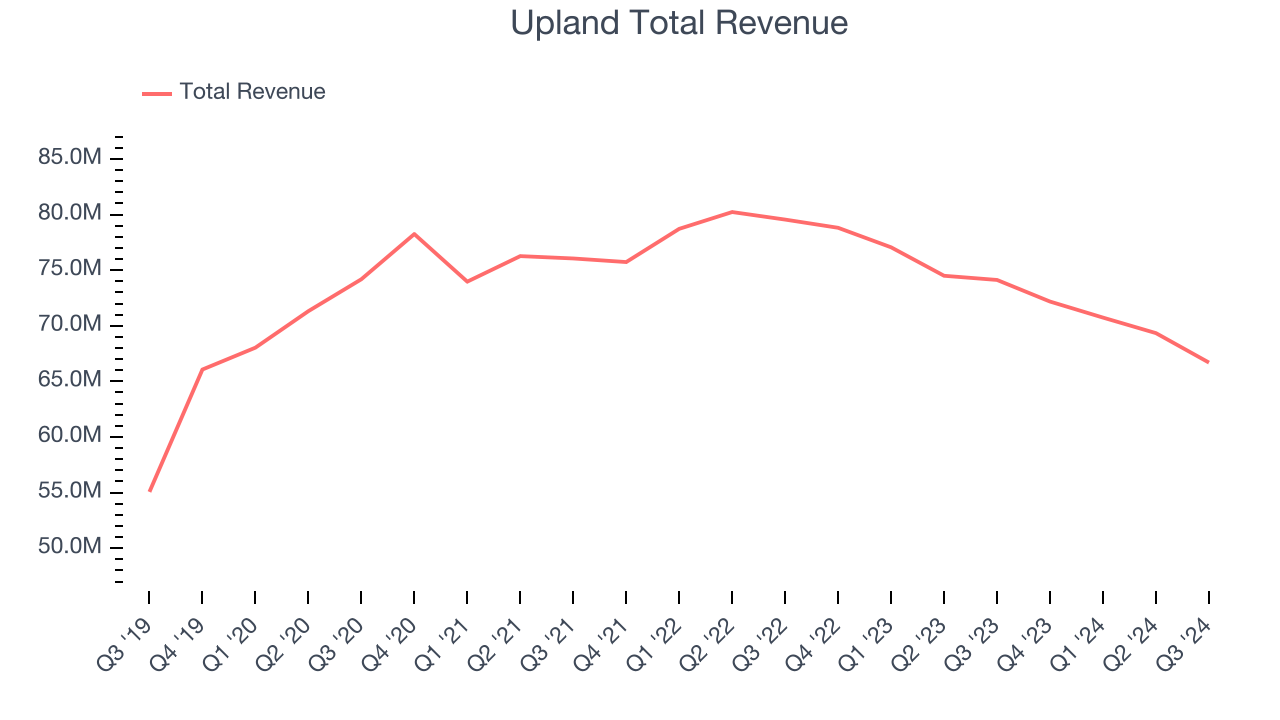

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Upland struggled to generate demand over the last three years as its sales dropped by 2.9% annually, a rough starting point for our analysis.

This quarter, Upland reported a rather uninspiring 10% year-on-year revenue decline to $66.69 million of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 4.5% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to decline 3.6% over the next 12 months, similar to its three-year rate. This projection is underwhelming and illustrates the market thinks its newer products and services will not accelerate its top-line performance yet.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s very expensive for Upland to acquire new customers as its CAC payback period checked in at -42.3 months this quarter. The company’s inefficiency indicates a highly competitive environment with little differentiation between Upland’s products and its peers.

Key Takeaways from Upland’s Q3 Results

It was good to see Upland beat analysts’ EBITDA expectations this quarter. We were also glad next quarter’s revenue guidance came in higher than Wall Street’s estimates. On the other hand, its revenue missed analysts’ expectations. Overall, this quarter was solid and the market is focused on positives such as guidance. The stock traded up 4.9% to $2.34 immediately after reporting.

Big picture, is Upland a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.