With a market cap of $17.7 billion, C.H. Robinson Worldwide, Inc. (CHRW) is a leading provider of freight transportation, logistics, and supply chain services across the United States and internationally. It operates through its North American Surface Transportation and Global Forwarding segments, offering truckload, intermodal, air, and ocean freight services, along with fresh produce distribution under the Robinson Fresh brand.

Shares of the Eden Prairie, Minnesota-based company have significantly outperformed the broader market over the past 52 weeks. CHRW stock has jumped 37.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.2%. Moreover, shares of the company are up 44.7% on a YTD basis, compared to SPX’s 15.3% decline.

Focusing more closely, shares of the trucking company have outpaced the Industrial Select Sector SPDR Fund’s (XLI) 7.5% return over the past 52 weeks.

Despite reporting weaker-than-expected Q3 2025 revenue of $4.14 billion on Oct. 29, C.H. Robinson’s shares surged 19.7% the next day because its adjusted EPS of $1.40 beat analyst expectations, reflecting strong cost control. Operating expenses dropped 12.6%, and headcount declined 10.8%, boosting margins despite soft freight demand. Investors reacted positively to these efficiency gains and management’s progress in streamlining operations, including exiting its European Surface Transportation business.

For the fiscal year, ending in December 2025, analysts expect C.H. Robinson’s adjusted EPS to grow 10.2% year-over-year to $4.97. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

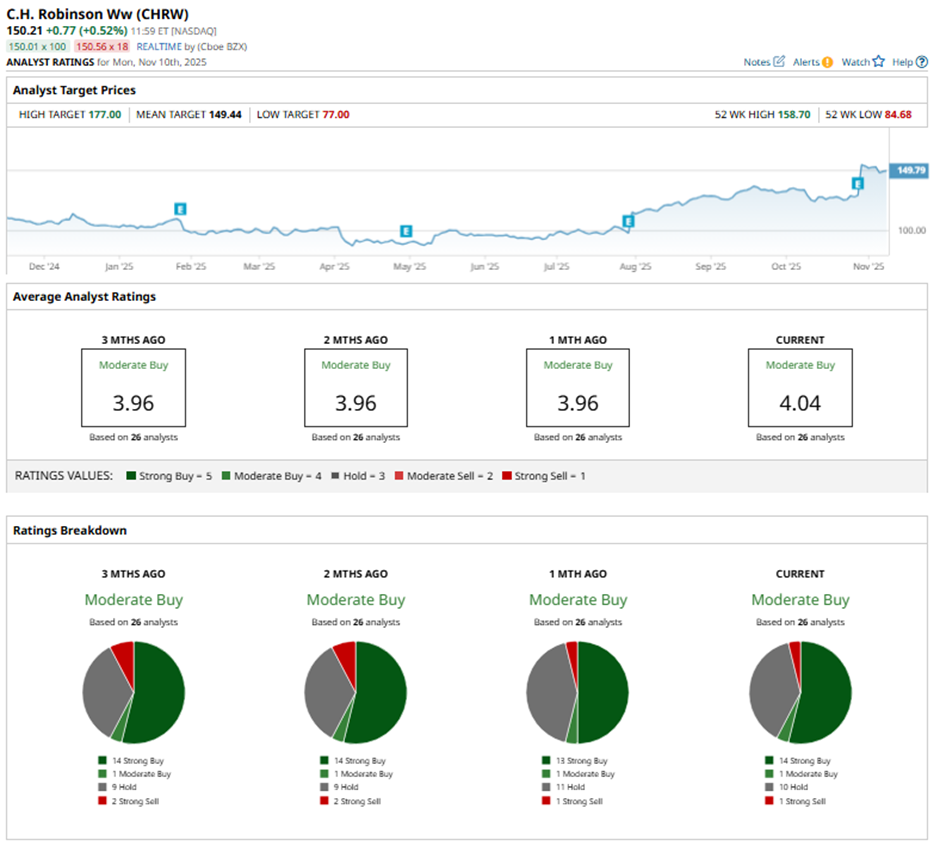

Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and one “Strong Sell.”

On Oct. 30, Goldman Sachs analyst Jordan Alliger raised the price target for C.H. Robinson to $131 while maintaining a “Neutral” rating.

As of writing, the stock is trading above the mean price target of $149.44. The Street-high price target of $177 suggests a 17.8% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 30,000 Reasons It May Be Time to Sell Amazon Stock Now

- Airbnb Keeps Generating Strong FCF and FCF Margins and Could Be 15% -20% Too Cheap

- IonQ Is Advancing Its DARPA Collaboration. Should You Buy the Quantum Computing Stock Here?

- Despite an Earnings Miss, Super Micro Computer’s (SMCI) Options Flow Points to a Potential Reversal