Lennox International Inc. (LII) is a manufacturer and marketer of heating, ventilation, air-conditioning and refrigeration (HVACR) systems for residential and commercial uses. Headquartered in Richardson, Texas, the company designs, manufactures and sells a broad range of products, including furnaces, heat pumps, air-conditioners, packaged systems, indoor-air-quality equipment and related services under brands such as Lennox, Armstrong Air, Bohn, ADP and others. The company’s market capitalization is around $17.2 billion.

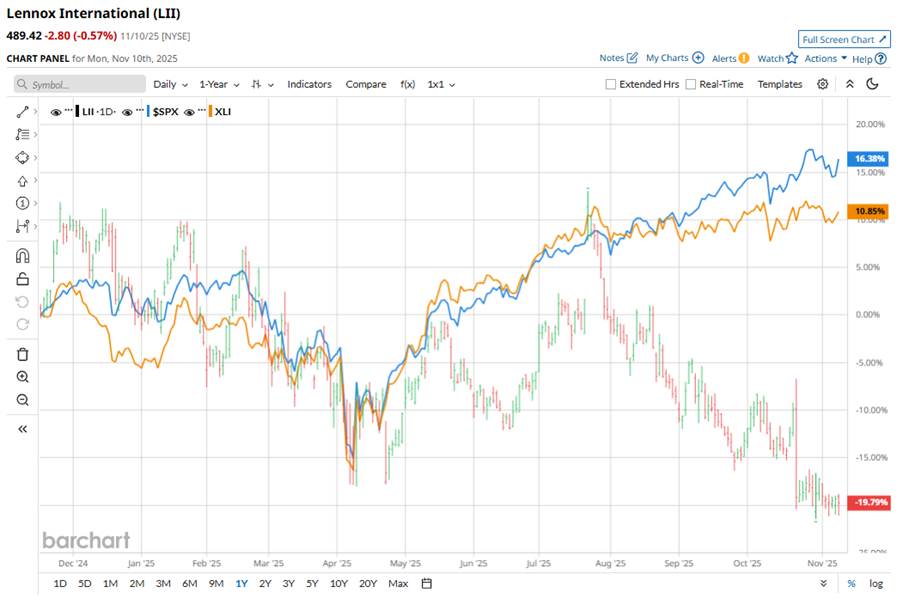

Shares of Lennox International have underperformed the broader market. Over the past 52 weeks, LII has declined 22.4%, while the broader S&P 500 Index ($SPX) has rallied nearly 14% over the same time frame. In 2025, LII stock is down 19.7%, compared to the SPX’s 16.2% rise on a YTD basis.

Narrowing the focus, LII’s underperformance is also apparent compared to the Industrial Select Sector SPDR Fund (XLI), which has gained about 8.5% over the past year. Moreover, the ETF’s 17% gains on a YTD basis outpaced LII.

Investors are growing cautious because demand in the residential heating, ventilation and air-conditioning industry has softened. For example, the company noted that its industry shipments have declined for many months, a sign that its core business is facing cyclical headwinds.

At the same time, some major analysts trimmed their price targets and expressed concerns about regulatory/tariff exposure and slower market momentum, which tends to dampen investor sentiment.

For the current fiscal year, ending in December, analysts expect Lennox International’s EPS to grow 1.8% to $22.99. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

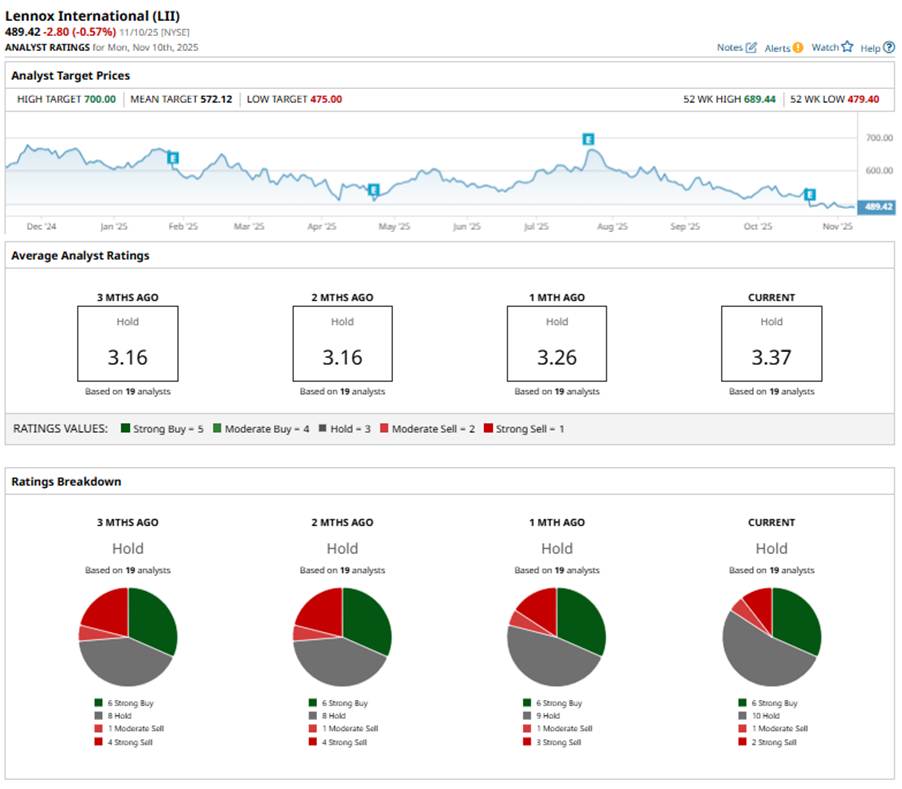

Wall Street’s take on LII is pretty balanced – neither overly bullish nor bearish. Among the 19 analysts covering the stock, the consensus is a “Hold.” That’s based on six “Strong Buy” ratings, 10 “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is slightly less bearish than two months ago, when there were four “Strong Sell” ratings.

Last month, UBS lowered its price target on LII to $560 from $610, maintaining a “Neutral” rating, citing weaker near-term demand and free cash flow headwinds.

The mean price target of $572.12 represents a 16.9% premium to LII’s current price levels. The Street-high price target of $700 suggests an ambitious upside potential of 43%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart