Opendoor Technologies (OPEN) reported disappointing third-quarter results, which sent shares plunging about 10% as revenue declined and net losses widened substantially. OPEN stock has since rocketed back up almost 25%. The iBuying platform reported an adjusted EBITDA loss of $33 million, which is significantly below analyst estimates of $23.7 million and the company's own guidance. Q4 losses are expected to balloon to the high $40 million to mid $50 million range as the real estate technology company navigates a complex turnaround.

However, Opendoor rose more than 20% yesterday after J.P. Morgan analyst Dae Lee initiated coverage on OPEN stock with an “Overweight” rating and a price target of $8. Lee is optimistic about the company's transformation, given its new management team and strategic pivot. The analyst explained that Opendoor is reducing spreads and is focused on accelerating transaction volume, which should drive home acquisitions higher in Q4 and allow the company to report a breakeven net income by the end of next year.

New CEO Kaz Nejatian, who took the helm just over a month ago after joining from Shopify (SHOP), outlined an aggressive operational pivot centered on artificial intelligence and software automation during the earnings call. Nejatian declared Opendoor is rebuilding itself as a software and AI company, marking a decisive break from previous management that failed to believe in AI's transformative power.

The former Shopify chief operating officer criticized the prior leadership team for thinking like asset managers obsessed with predicting economic trends rather than leveraging technology capabilities where engineers writing code provide a competitive advantage.

The AI-driven turnaround strategy encompasses multiple dimensions, as Nejatian revealed that Opendoor has already launched over a dozen AI-powered products and features in his first month, demonstrating renewed velocity and engineering focus.

The technology will enable Opendoor to transact with more home sellers, strengthen unit economics through better algorithmic pricing and faster resale speeds, and drive operational efficiency by ruthlessly cutting expenses.

Management believes that this software-first approach will chart a clear path to achieving breakeven adjusted net income by the end of 2026, based on a 12-month forward projection. The operational strategy focuses on buying and selling a significantly higher volume of homes at a faster pace while eliminating wasteful spending.

Nejatian revealed weekly home purchase contracts doubled from 120 on his first day to 230 by late October. Notably, Opendoor is shelving what he called spray-and-pray marketing in favor of data-driven channels that provide measurable returns. Headcount has also been reduced from 1,400 to 1,100 employees, while payments to expensive consulting firms have been eliminated.

Management emphasized that Opendoor will function more like a market maker rather than a proprietary trading desk, buying homes quickly and flipping them for small profits with operational excellence, while expanding services to include mortgages, insurance, and warranties to boost per-customer value.

How Did Opendoor Perform in Q3 of 2025?

Opendoor reported third-quarter revenue of $915 million, declining 33.6% year-over-year (YoY) from $1.38 billion, though beating analyst consensus estimates of $851.7 million. Home sales volume dropped significantly to 2,568 units, compared with 3,615 units in the prior year's period, reflecting subdued acquisition activity and the liquidation of older inventory. The adjusted loss widened to $0.08 per share, compared to analyst expectations of a $0.07 loss and a $0.01 loss in the year-ago quarter.

Gross profit declined to $66 million from $105 million YoY, with gross margin slipping to 7.2% from 7.6%. Contribution profit fell sharply to $20 million from $52 million as contribution margin narrowed to 2.2% from 3.8%.

Management attributed near-term margin pressure to clearing older inventory and lower resale velocity while emphasizing the importance of improving pricing automation and AI-driven decision-making to enhance unit economics moving forward. The balance sheet showed improvement, with cash and equivalents rising to $962 million from $671 million at year-end 2024, supported by financing and equity raises.

Total liquidity, including restricted cash, stood at $1.45 billion. Long-term debt declined substantially to $1.34 billion from $2.30 billion YoY, reflecting deleveraging activities.

Opendoor reached an agreement to retire the majority of its 2030 convertible notes through equity conversion, avoiding a situation where it could have been forced to repay these in full before the end of 2025.

What Is The OPEN Stock Price Target?

Analysts tracking OPEN stock forecast sales to decline from $5.15 billion in 2024 to $4.53 billion in 2027. However, a focus on cost optimization should allow it to end 2027 with a free cash flow of $24 million, compared to an outflow of $620 million in 2024.

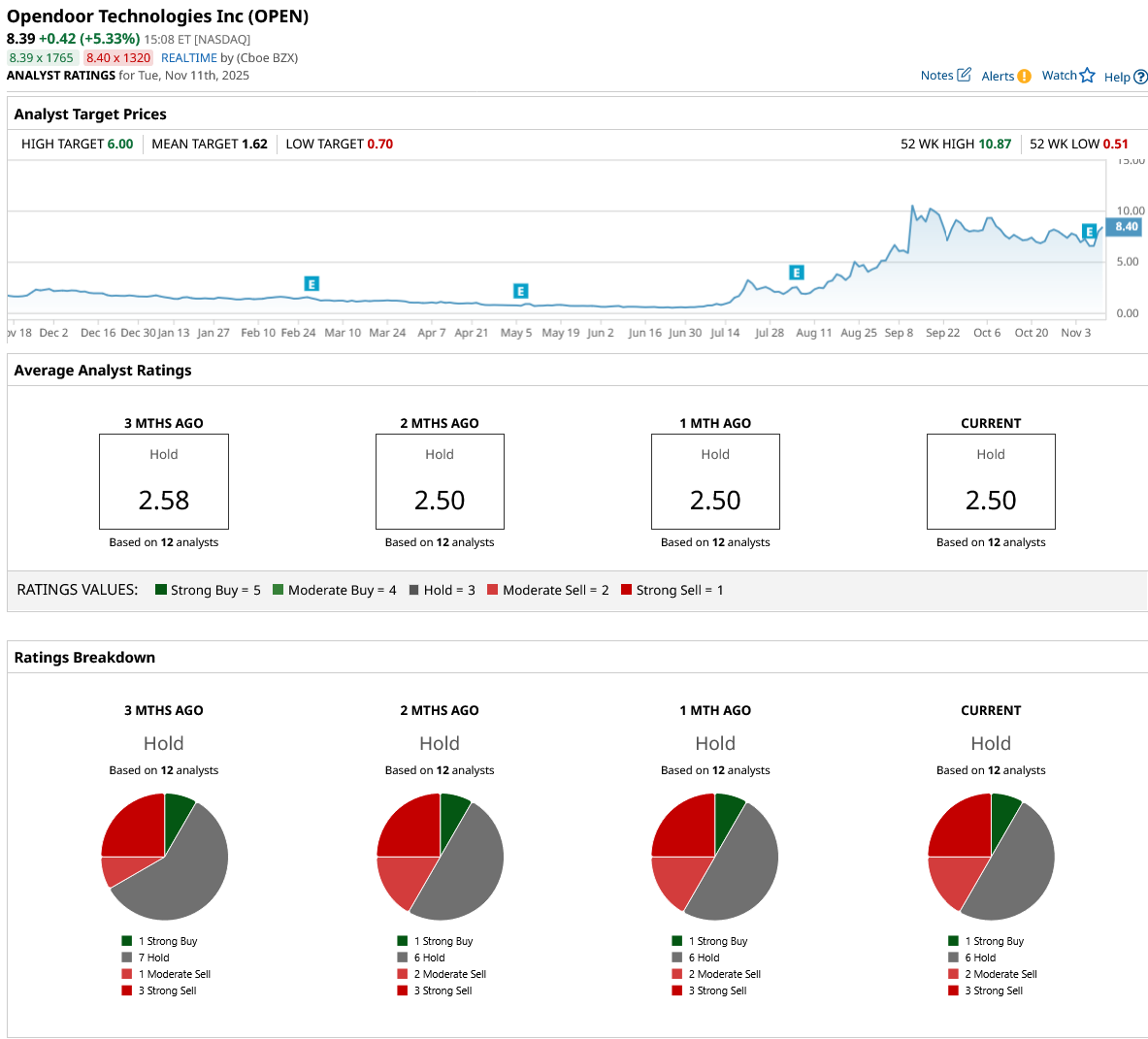

Out of the 12 analysts covering OPEN stock, one recommends “Strong Buy,” six recommend “Hold,” two recommend “Moderate Sell,” and three recommend “Strong Sell.” The average OPEN stock price target is $1.62, well below the current price of $8.39. OPEN stock is even above its high target of $6.00.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Just Lost Its Cybertruck Leader. Should You Buy, Sell, or Hold TSLA Stock?

- Palantir Achieved ‘Eye-Popping Growth’ and Is a Buy Through Year-End, According to Wedbush

- Down 40% in the Past 6 Months, Should You Buy, Sell, or Hold MicroStrategy Stock in November 2025?

- Opendoor Is Betting That It Can Become an AI Company. Does That Make OPEN Stock a Buy, or Should You Stay on the Sidelines Here?