Electric vehicle (EV) stocks have been a roller coaster. Some names have surged, others have stumbled. Tesla (TSLA) sits at the center of that debate, viewed by many as more than just an automaker.

Tesla Chair Robyn Denholm said shareholder approval of key items on Nov. 6, including director elections, employee awards, and Elon Musk’s compensation plan, reinforced backing for the company’s so-called Master Plan Part IV. The vote, she added, signals confidence in the board’s long-term direction.

Denholm said Tesla is moving into “the age of autonomy” with projects such as Robotaxi and Optimus, and the company suggested it may be approaching what could become its “largest value-creation event” yet. That shifts the narrative from cars to artificial intelligence, robotics, and other new potential revenue streams.

For investors weighing whether to buy the stock now, the key questions are execution, margin expansion, and whether autonomy actually materializes at scale.

About Tesla Stock

Tesla is a global leader in electric vehicles, energy storage, and AI-driven robotics. It builds high-end EVs, such as the S, 3, X, and Y, and the Cybertruck, as well as solar and battery products, while investing heavily in self-driving software and humanoid robots (Optimus). Under CEO Elon Musk, Tesla is the largest automaker by market value, with a roughly $1.5 trillion market cap.

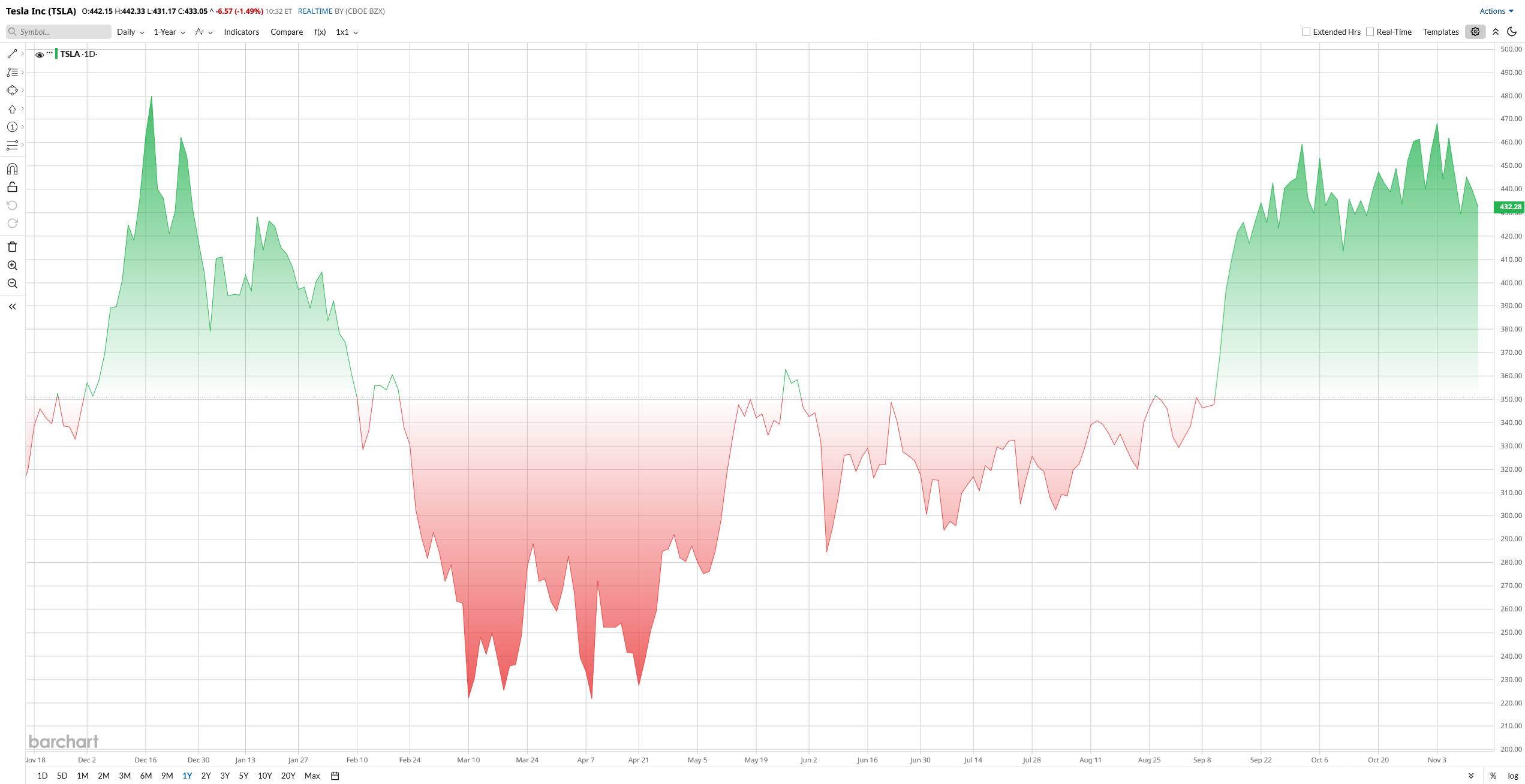

TSLA stock has had quite a ride in 2025. After bottoming out in April, TSLA nearly doubled by late summer before easing off slightly. The rally was powered by delivery figures and growing investor enthusiasm around Tesla’s new product lineup and AI ambitions. Shares even tested fresh highs following the shareholder vote on Musk’s pay package. Despite some profit-taking since then, the stock remains well above its early-year levels, up roughly 8% year-to-date (YTD).

Valuation, however, is where things get tricky. Tesla now trades at eye-popping multiples. Its forward price-earnings (P/E) ratio sits above 370x. On a price-sales (P/S) basis, Tesla also looks pricey, at 15x. Toyota (TM) trades at a P/S ratio of just 0.86x, for comparison.

In short, Tesla’s valuation remains in a league of its own, reflecting massive growth expectations. Most Wall Street analysts agree on one thing. While the story is compelling, the stock is anything but cheap.

What Happened: Shareholder Vote and Outlook

Recently, Tesla’s Nov. 6 shareholder meeting approved key proposals that included the election of a slate of directors, a stock award plan for employees, and Musk’s performance-based pay plan. When votes were tallied, the board celebrated the results in a public letter.

Denholm thanked investors for supporting Tesla’s long-term vision and for “back[ing] the people who have been in the room since the earliest days, fighting for the mission…” She framed the vote as a “vote of confidence” in Musk and Tesla’s future. Crucially, she declared that we are entering a new era. “The age of autonomy is no longer approaching—it is here,” with robotaxis and Optimus “bringing AI into the physical world.” Her concluding line about being “on the cusp of what could be the largest value-creation event in Tesla’s history” has drawn both cheers and raised eyebrows.

In practical terms, these proclamations signal Tesla’s pivot from a pure-play automaker toward a multi-platform technology firm. The board is betting that future products like a network of self-driving taxis and humanoid robots will unlock huge profits.

If Musk and Tesla can deliver truly mass-market autonomous fleets or robotics at scale, it could indeed dwarf current earnings. However, skeptics note these are aspirations far in the future.

For now, Tesla still earns nearly all its revenue from car sales. Any monumental “value-creation” event remains hypothetical until hard execution milestones are hit. Meanwhile, near-term growth faces hurdles like competition, economic cycles, and legal challenges.

Revenue Hits Record, Margins Under Pressure

Tesla’s third-quarter 2025 results, reported on Oct. 22, showed record revenue growth but weaker margins. Total revenue rose 12% year-over-year (YoY) to $28.1 billion, driven by growth across all major segments. Automotive revenue reached $21.2 billion, energy storage $3.4 billion, and services and other $3.5 billion.

Profitability remained under pressure from higher costs and stock-based compensation. GAAP net income was $1.37 billion, while operating income declined about 40% to $1.62 billion, reflecting a 5.8% margin.

Free cash flow reached a record $3.99 billion, supported by $6.24 billion in operating cash flow and $2.25 billion in capital expenditures. Cash and investments rose to $41.6 billion by quarter-end, providing ample liquidity for upcoming projects.

Tesla delivered 497,099 vehicles, up 7% YoY, and deployed 12.5 GWh of energy storage, an 81% increase. Management highlighted continued investment in full self-driving software, robotics, and new vehicle platforms, with the Cybercab and Semi programs on track for 2026.

Analysts expect fiscal 2025 revenue to be near $97 billion and EPS of $1.15, reflecting margin compression compared with last year’s $2.04 EPS.

Analyst Outlook and Price Targets

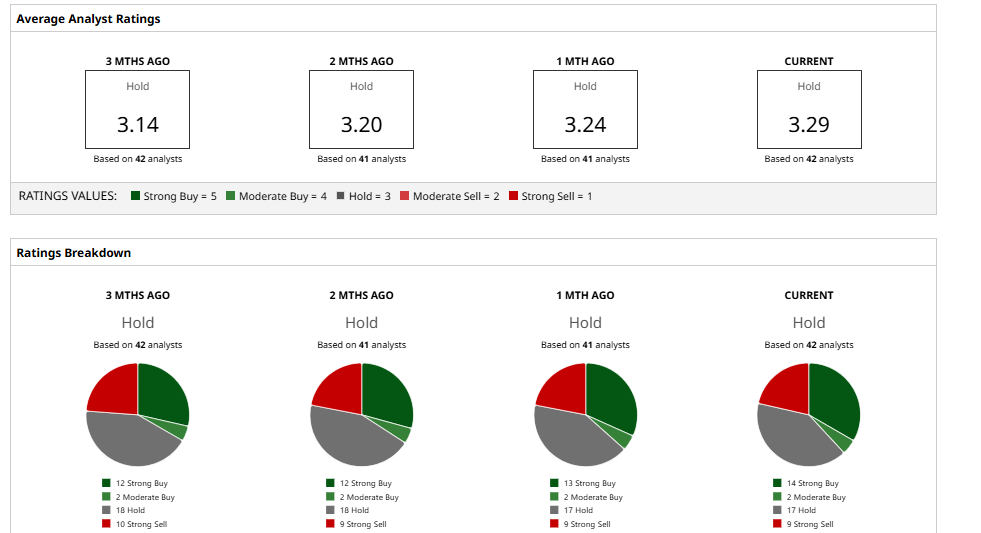

Wall Street is still split on Tesla’s future as analysts consider its decision to move to the realm of artificial intelligence and self-driving applications.

Analyst Dan Ives of Wedbush Securities has continued to rate TSLA stock as a “Buy” with a Street-high price target of $600, which he described as conservative, citing the fact that Tesla has an opportunity to become a leader in autonomous and AI-driven vehicles.

Deutsche Bank reinstated its “Buy” rating and increased its price target to $440, citing the continued contribution of Musk and forthcoming software and full self-driving (FSD) upgrades as triggers.

Overall, Wall Street analysts tracked by Barchart assign a “Hold” rating with an average price target near $385, which implies the stock may drop 12% from current levels.

Should You Buy TSLA Stock Now?

It depends on your viewpoint.

If you are a long-time supporter of autonomy and robotics, the road ahead might seem positive. Tesla management is ambitious, and some mega-projections (Robotaxi, Optimus) can actually open the cash flow in the future. However, when you look at the near-term fundamentals and valuations, Tesla is being accorded historically high prices as a result of the uncertainty. I believe that Tesla is still a high-risk, high-reward name. Its approaches are gigantic, and so are its problems.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As C3.ai Explores a Sale, Should You Buy, Sell, or Hold AI Stock?

- D-Wave’s Contracts Could Be Worth ‘Millions of Dollars.’ Should You Buy QBTS Stock Now?

- Bargain Buy or Risky Bet? Bath & Body Works Slides to 52-Week Low

- Michael Burry Accuses Meta Platforms of ‘Common Fraud’ and Inflated Earnings. Should You Still Buy META Stock Now?