With a market cap of $12.2 billion, Healthpeak Properties, Inc. (DOC) is a self-administered REIT focused on owning, operating, and developing high-quality healthcare real estate across the United States. The company’s diversified portfolio spans outpatient medical, lab, and continuing care retirement community (CCRC) properties, totaling interests in 703 assets as of September 30, 2025.

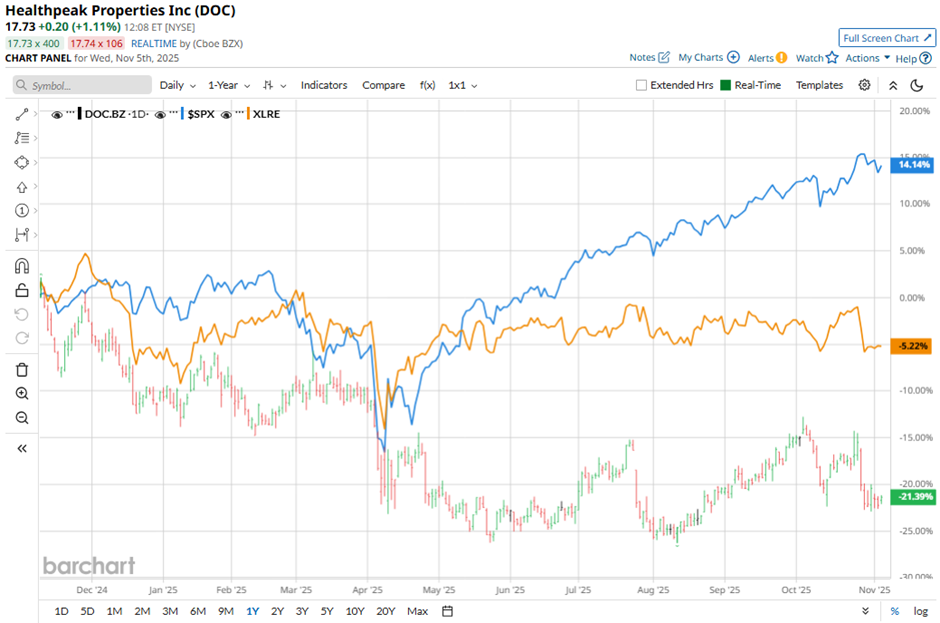

Shares of the Denver, Colorado-based company have lagged behind the broader market over the past 52 weeks. DOC stock has declined 21.6% over this time frame, while the broader S&P 500 Index ($SPX) has increased 17.7%. Moreover, shares of the company are down nearly 13% on a YTD basis, compared to SPX’s 15.7% rise.

Zooming in further, the stock’s underperformance becomes more evident when compared to the Real Estate Select Sector SPDR Fund’s (XLRE) 6.9% decrease over the past 52 weeks.

Shares of DOC rose 1.2% following its Q3 2025 results on Oct. 23 as AFFO of $0.46 per share and revenue of $705.9 million surpassed expectations. The company also reported 0.9% year-over-year growth in total merger-combined same-store cash NOI, driven by gains of 2.0% in outpatient medical and 9.4% in CCRC segments. Additionally, Healthpeak reaffirmed its 2025 FFO guidance of $1.81 per share - $1.87 per share.

For the fiscal year ending in December 2025, analysts expect Healthpeak Properties’ AFFO per share to rise 1.1% year-over-year to $1.83. The company’s earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

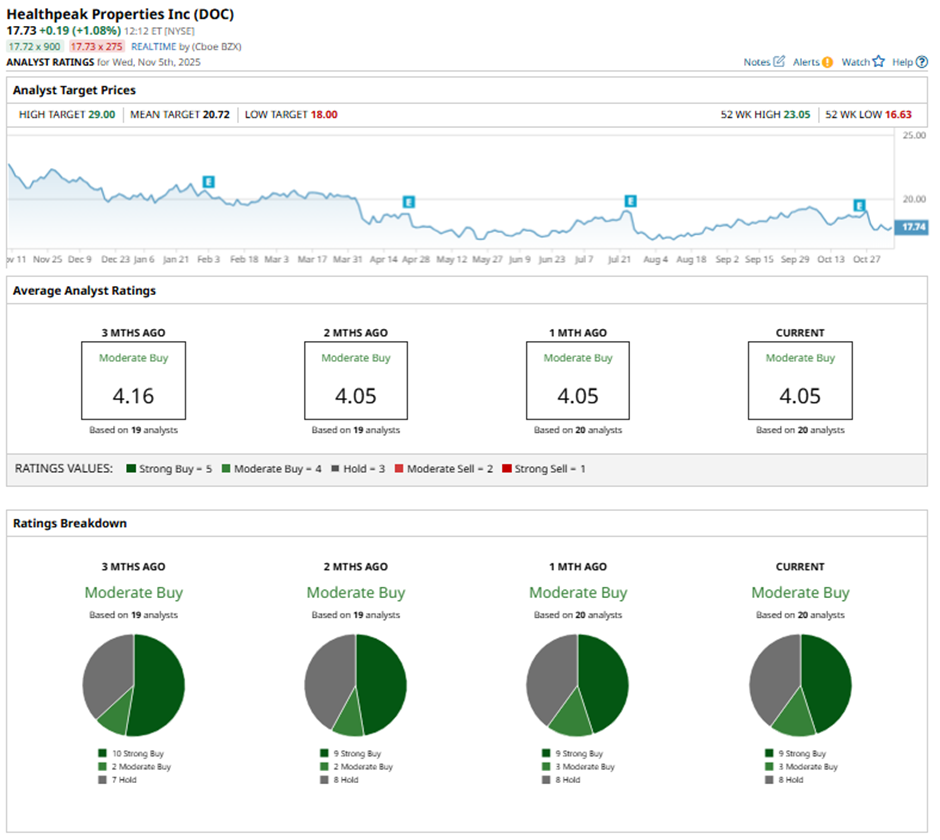

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, three “Moderate Buys,” and eight “Holds.”

This configuration is slightly less bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Oct. 28, RBC Capital’s Michael Carroll reaffirmed a “Buy” rating on Healthpeak Properties and maintained a $21 price target.

The mean price target of $20.72 represents a 16.9% premium to DOC’s current price levels. The Street-high price target of $29 suggests a 63.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart