Colgate-Palmolive Company (CL) is a global leader in oral care, personal care, home cleaning and pet nutrition products, with a heritage dating back to 1806. Headquartered in New York City, it operates in over 200 markets worldwide. Colgate’s market cap of around $61.7 billion reflects its status as a large-cap stalwart in the consumer staples space.

The consumer goods giant’s shares have lagged behind the broader market, declining 18.2% over the past year and 15.8% on a year-to-date (YTD) basis. In contrast, the S&P 500 Index ($SPX) has surged 18.5% over the past year and 15.1% in 2025.

Narrowing the focus, the stock has underperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 5.5% dip over the past 52 weeks and 3.3% YTD.

The stock is being weighed down by a tougher operating environment as the company is facing weak consumer demand in key markets, especially in urban areas where households are under financial stress.

At the same time, it is grappling with inflation in raw materials and packaging, along with unfavorable currency and tariff effects that reduce flexibility and margins. And while efforts are afoot to drive innovation and premium positioning, investors appear cautious given the combination of slower growth and elevated uncertainty.

For the current fiscal year 2025, ending in December, analysts expect Colgate-Palmolive Company to report a 1.7% year-over-year increase in EPS to $3.66. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

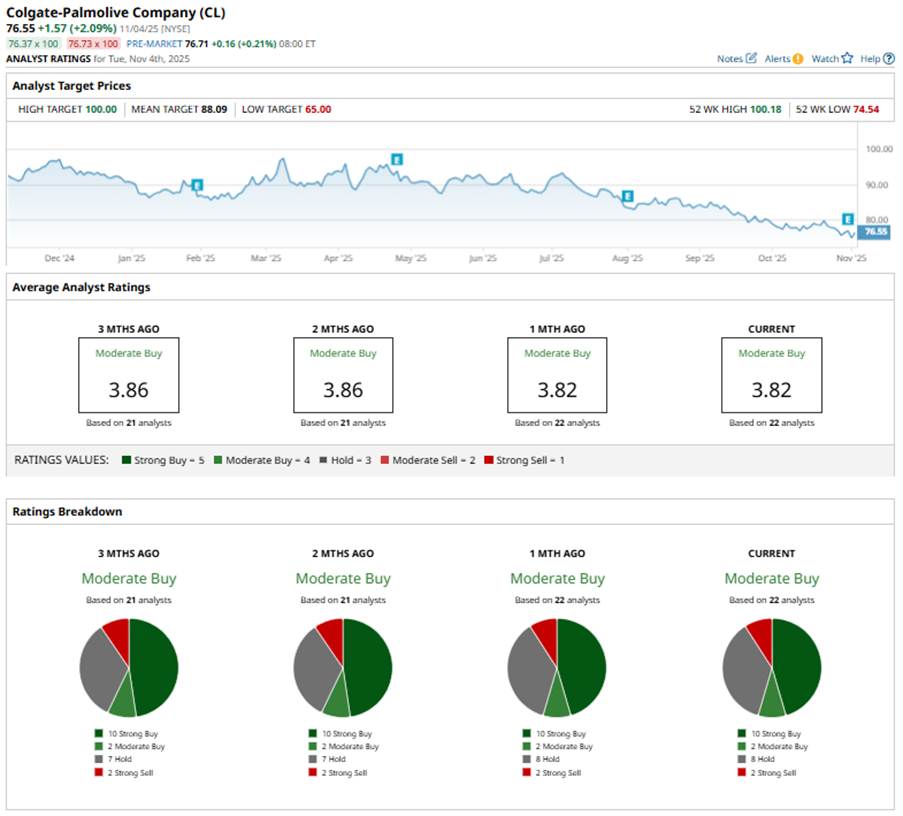

The stock holds a consensus “Moderate Buy” rating overall. Of the 22 analysts covering the CL stock, opinions include 10 “Strong Buys,” two “Moderate Buys,” eight “Holds,” and two “Strong Sells.”

This configuration has remained largely consistent over the past few months.

Last month, JPMorgan lowered its price target on CL to $88 from $95 while keeping an “Overweight” rating. The firm cited weaker category performance and soft organic sales.

Its mean price target of $88.09 suggests an upside of 15.1%. The Street-high price target of $100 implies a potential upside of 30.6% from the current price.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cisco Just Got a New Street-High Price Target. Should You Buy CSCO Stock Here?

- Palantir Just Got a New Street-High Price Target. Should You Buy PLTR Stock Here?

- Buy Nvidia Stock Now for the Next ‘Golden Wave’ of AI

- Super Micro Just Reported Its Lowest-Ever Gross Margin. Should You Ditch SMCI Stock Here?