Joby Aviation (JOBY) is slowly but surely moving closer to becoming a commercial success as they have entered the final testing phase of approval for their all-electric vertical take-off and landing (eVTOL) aircraft from the FAA. Reaching this point is one of the most essential milestones before mass production, and it shows that finally, Joby's plans for air taxis might soon become a reality.

Timing-wise, this is a critical point for the broader electric vehicle sector, as governments around the world call for a decarbonized transport system and future mobility solutions. With its FAA Type Inspection Authorization (TIA) testing underway and its manufacturing program on track in the U.S. and Japan, Joby is poised now as one of the first competitors likely to attain full certification, the spark that could help kickstart its stock price and this still nascent market sector as well.

About Joby Aviation Stock

Joby Aviation is a developer of eVTOL aircraft based in Santa Cruz, California, and has a market capitalization of close to $13 billion, placing it at the forefront of efforts aimed at commercializing advanced air mobility solutions on the civilian and military fronts. Joby Aviation is determined to transform urban mobility through its quiet and environmentally clean air taxis, intended for short-range passenger travel.

JOBY stock has ranged from a low of $4.87 to a high of $20.95 within a period of 52 weeks, indicating market volatility as investors continue weighing market opportunities and market hurdles. So far this year, shares have appreciated by about 75% as compared to the S&P 500 Index's ($SPX) 14% return and other industrial shares, as market optimism about electric aviation increases.

As of now, valuation is more of a projection, especially considering that Joby is still at a pre-revenue stage. Being valued at a price/book value of approximately 14x, this indicates that investors are more than willing to project future value as opposed to valuing based on present statistics. Although having a return on equity of -71.3% and a profit margin of -434,400%, Joby is still operating at a loss, though it has built up a considerable amount of cash of close to a billion dollars due to increased certification and production efforts.

Joby Aviation Almost Reaches FAA Certification Milestone

Joby Aviation has recently initiated power-on flights of its inaugural series of aircraft that meet Federal Aviation Administration (FAA) Type Inspection Authorization (TIA). Coming on the heels of other milestones achieved by Joby Aviation, this is one of the final hurdles that this player has to clear before receiving its final Type Certification for operation. According to Didier Papadopoulos, president of Joby's Aircraft OEM, this is crucial as it validates that we can design a safe aircraft and produce it reliably.

The TIA is a rigorous testing phase that is undertaken jointly with FAA authorities, aimed at ascertaining whether Joby’s aircraft conforms to strict standards of flight safety and capability. As of this month, Joby is expected to undertake its first “for credit” flight testing, a historic initiative because, for the first time, FAA pilots will be testing its flight capability directly. Even test flights by FAA pilots have been scheduled for 2026.

Operationally, Joby’s reporting on its Q3 of 2025 reflected positively on its progress on many fronts. First, they have already completed more than 600 flights this year, and they have undertaken a point-to-point flight test between Marina and Monterey, as well as two weeks of commercial demonstration flights at World Expo 2025, held in Osaka, Japan. All these events demonstrate that Joby is indeed prepared for commercial flights and can coexist within shared airspace.

Additionally, the firm is expanding its production infrastructure and has more than 100 jobs involved in this expansion, increasing the production of propellers at its Dayton, Ohio, site as the company aims for mass production as soon as it secures FAA approval. Its recently purchased Passenger Air Mobility Service has reported that it has carried 40,000 passengers within this period and is available on the Uber (UBER) app, indicating that Joby is aiming for end-to-end connections between its air and ground mobility solutions.

What Do Analysts Expect for JOBY Stock?

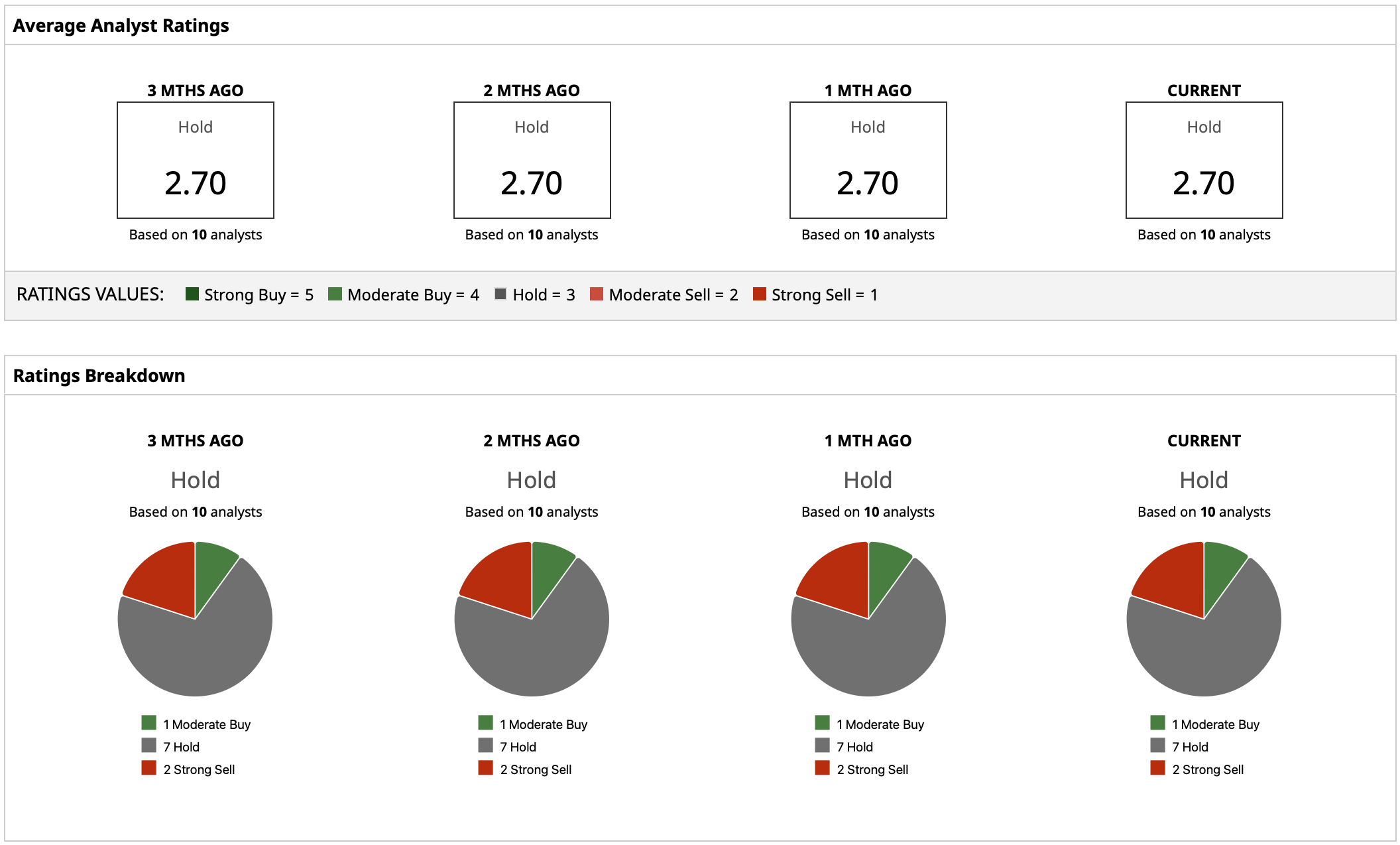

JOBY has a “Hold” rating consensus, and a median target price of $12.33 from analyst estimates implies about 13.5% downside. Its high target price of $22 indicates extremely positive analyst forecasts, and its low target price of $6 portrays skepticism about its timing of achieving profit and certification milestones.

On the date of publication, Yiannis Zourmpanos had a position in: JOBY . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart