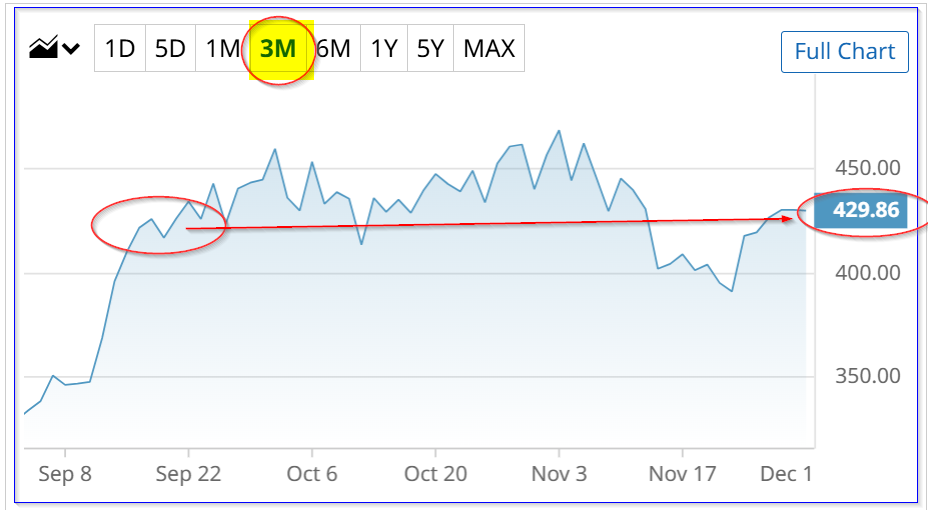

Tesla, Inc. (TSLA) stock has been flat over the last 3 months. Shorting out-of-the-money (OTM) puts has been a winning strategy, as premiums are high. For example, investors can earn a 2.5% yield at the $400 put option expiring Jan. 2.

TSLA is at $430.27, about where it was 2 months ago on Oct. 3, at $429.83. Also, last month, when I wrote in Barchart about shorting OTM puts in Tesla on Oct. 26, it was at $433.

That makes it worthwhile to sell short out-of-the-money (OTM) puts in one-month expiry puts.

For example, in the Oct. 26 Barchart article ("Tesla's Strong FCF Margins Could Imply TSLA Stock is Worth Over $500"), I discussed shorting the $400.00 put (7.7% below the trading price at the time) expiring on Nov. 28 for an $11.95 premium.

That provided the short seller an immediate yield of 3.0% (i.e., $11.95/$400.00 = 0.029875 = 3.0%). As it turned out, TSLA closed at $430.17 on Nov. 28.

So, the investor doing this had no obligation to buy 100 shares at $400. That produced a clean 3.0% return for the month.

I showed why TSLA stock could be worth over $501 per share in the article. And some analysts have maintained their price targets well over this, as seen at AnaChart.com.

So, it makes sense to repeat this trade for January 2026.

Shorting TSLA Puts for Jan. 2026

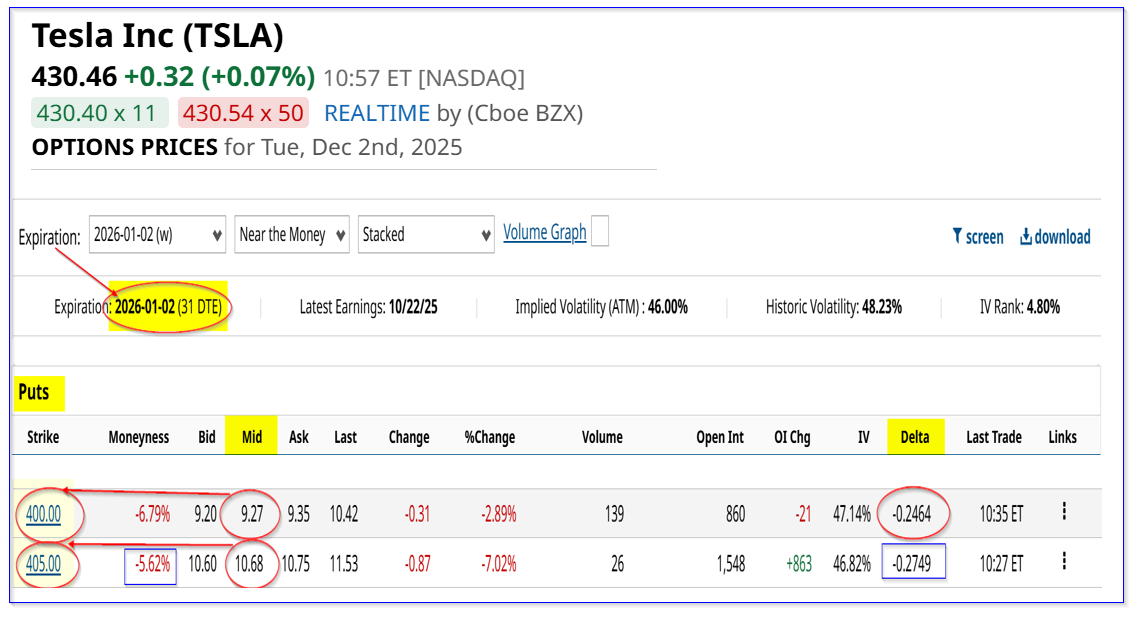

For example, look at the Jan. 2, 2026, option expiry chain. It shows that the $405.00 strike price put contract has a midpoint premium very high at $10.68 per put contract.

That strike price is5% or so below today's price, so it provides some downside protection for the short-seller.

The yield is high at 2.6370% (i.e., $10.68/$405.00).

Moreover, for more risk-averse investors, the $400.00 put strike price has a $9.27 premium at the midpoint. That provides an immediate yield of 2.3175% (i.e., $9.27/$400.00).

So, on average, an investor who does both of these short put plays, could make about a 2.5% yield:

(2.6637% + 2.3175%)/2 = 2.477%

That is the same as making $9.975 (i.e., ($10.68+$9.27)/2) on an average investment of $402.50, or 2.478%.

The point is that this is a very high yield for one month, especially for a stock that has essentially been flat.

What's more, over the past two months, the investor would have made a total of about 5.5%:

3.0% last month short put yield + 2.477% next month = 5.477% expected return

In other words, compared to owning shares at $430.00 starting last month, the investor would have made the equivalent of a gain of $21.93, or $451.93 per share:

$11.95 + $9.975 = $21.93

$430.00 +21.93 = $451.93

That is 5% higher than today's price. That shows that it's better to short OTM puts than to own TSLA stock, at least for the short term.

And even if TSLA falls to the $405 strike price, the investor's breakeven point is $21.93 lower, given the income already received.

The bottom line is that TSLA stock is cheap here, but put option premiums are still high. That presents a good shorting opportunity for value investors.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart