According to at least one analyst, Tesla (TSLA) stock is poised to create significant value for shareholders, with autonomous driving technology at the forefront of its growth plans.

Recently, Melius Research analyst Rob Wertheimer took a bullish stance on Tesla, setting a price target of $525. This view was largely based on the fact that Tesla is extending its lead in autonomous driving technology over traditional automakers, who are falling behind in the autonomous driving race with little chance of catching up.

About Tesla Stock

Tesla has been a pioneer in the electric vehicle (EV) industry. Over the years, the company has proven skeptics wrong and created value for shareholders. One of the key factors that gives Tesla an edge over its peers is its significant focus on innovation-driven growth.

For Q3 2025, Tesla delivered more than 497,000 vehicles. The company also highlighted that it deployed 12.5 GWh of energy storage products. Further, for the quarter, Tesla reported $28.1 billion in revenue, a 12% increase year-over-year.

It’s worth noting that even amid macroeconomic headwinds and intense competition, TSLA stock trended higher by 24% over the last six months. This upside can be attributed to the company’s big potential in the autonomous driving market.

Strong Fundamentals to Support Growth

In the early days after going public, Tesla faced significant cash burn. However, as the business has scaled up, the company has become a cash-flow machine.

To put things into perspective, Tesla reported operating and free cash flow (FCF) of $6.2 billion and $4 billion, respectively, for Q3 2025. This implies an FCF potential of $16 billion, and at a time when the company faces margin pressure.

Additionally, Tesla ended Q3 with a cash buffer of $41.6 billion. The company’s cash buffer will likely continue to swell, providing ample flexibility for investment in innovation.

The Big Robotaxi Potential

Autonomous driving technology is likely to be a major value creator for Tesla in the coming years. Tesla has already launched ride-hailing services using robotaxi technology.

According to estimates, each vehicle in the robotaxi fleet is likely to generate $67,000 in net profit in the first year, with profit increasing to $94,000 by the fifth year. Given this potential, S&P Global believes that Tesla robotaxi could drive 45% of automotive sales by 2030. The potential is therefore significant and will drive upside in cash flow.

At the same time, Tesla has a strong product pipeline. In 2026, the company will begin volume production for Cybercab, Tesla Semi, and Megapack 3. As production ramps up, it’s likely that revenue growth will accelerate.

Tesla has also made significant progress developing advanced AI chips. AI5 chip design completion is expected in 2026 with volume production in 2027. Further, AI6 chip is due for production in 2028. Besides Tesla cars, these chips will find application in data centers and medical care, among others.

The overall view on growth acceleration is also underscored by the point that economic headwinds have impacted growth. With expansionary monetary policies globally, GDP growth will likely accelerate in 2026 and beyond.

What Analysts Say About TSLA Stock

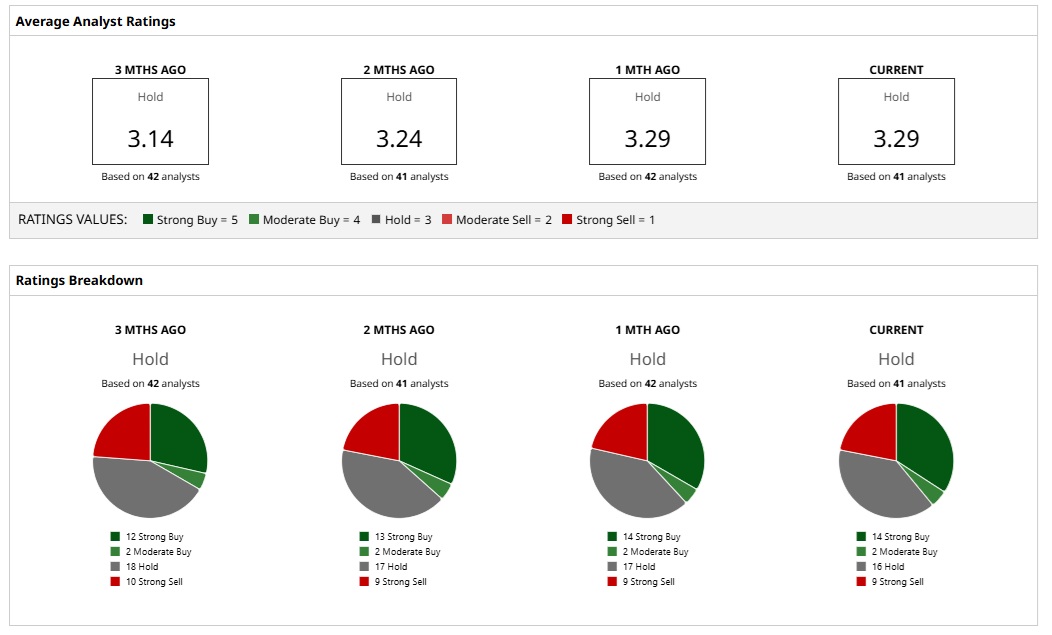

Based on 41 analyst ratings, TSLA stock is a consensus “Hold.”

While 14 analysts give a “Strong Buy” rating, there are two “Moderate Buy” and 16 “Hold” ratings. On the bearish side, nine analysts suggest that TSLA stock is a “Strong Sell.”

Overall, based on the ratings, analysts have a mean price target of $385.69. This implies downside potential of 10.3%. However, the most bullish price target is $600 and would imply upside potential of 39.5%.

An important point to note is that for FY 2025, analysts estimate an earnings decrease of 44.1% for Tesla. However, a strong turnaround is likely in FY 2026, with analyst estimates pointing to earnings growth of 64.9%. This is a potential catalyst for TSLA stock trending higher.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Go on Cathie Wood’s ARK ETF Diet?

- Dan Ives Is Betting Big on CoreWeave Stock as an AI Winner. Should You Buy CRWV Too?

- Analysts Say AWS Will Drive ‘Significant Upside’ for Amazon. Should You Buy AMZN Stock Now?

- This Analyst Predicts Tesla Stock Will Crush Traditional Automakers, ‘They Had Plenty of Warning Time’