Key facts

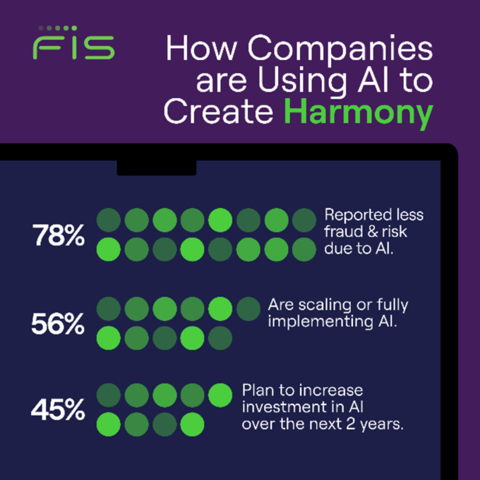

- 78% of global business and technology leaders reported that their use of artificial intelligence (AI) has helped improve fraud detection and risk management.

- 56% said they are scaling or fully implementing AI, and 45% plan to increase investment over the next two years.

- High implementation and maintenance costs and lack of in-house expertise are slowing wider adoption.

Global business and technology leaders are already seeing benefits from the use of AI and automation, with over three-quarters (78%) reporting measurable improvements in the ability to detect fraud and manage risk after their organization’s integration of the technology. This is according to “The Harmony Gap: Finding the Financial Upside in Uncertainty” report, published in full today by global financial technology leader FIS® (NYSE: FIS) in collaboration with Oxford Economics.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250515135384/en/

Global businesses are leaning into AI to combat fraud.

With a preview of the findings released on April 10, the full report delves further into the use of AI by businesses to combat the sources of financial, operational and technological disharmony, defined as disruptions and inefficiencies across the money lifecycle.

To combat this disharmony, businesses across a range of industries are adopting AI, with 56% of the leaders surveyed reporting that their firms are either scaling or fully implementing AI to support financial processes. Encouraged by early results, particularly in fraud mitigation, nearly half of the businesses surveyed are planning to double down: 45% of respondents say their firm intends to increase their investment in AI over the next two years, signaling strong, long-term confidence in the technology’s value.

Yet barriers to AI adoption remain. High implementation and maintenance costs are the top concern, cited by 73% of respondents, while 64% say there is a lack of in-house expertise and a further 58% report difficulty integrating the technology with existing systems. These financial and strategic challenges are preventing broader integration of AI across organizations, despite interest in using AI and growing awareness of its potential, according to the study.

Firdaus Bhathena, chief technology officer at FIS, commented: "As threat actors adopt AI to commit fraud, it becomes increasingly important for businesses to employ AI to combat these sophisticated threats across the money lifecycle to help drive efficiency and bolster security. While AI can have benefits, challenges in adoption such as financial and leadership hurdles are slowing down scalability despite optimism, based upon early uses in areas like fraud detection.”

“Ultimately, overcoming these barriers and harnessing AI’s potential requires strategic investment, rigorous cybersecurity, empowered employees and strong leadership,” added Bhathena. “It’s about moving from acknowledging AI’s value to embedding it into the fabric of daily business operations.”

Learn More

The Harmony Gap report can be found here.

About the Research

In partnership with FIS, Oxford Economics conducted two separate surveys, each involving 501 C-suite executives and business leaders at organizations directly involved in financial technology decision-making in the U.S., the U.K., and Singapore, spanning the financial services, technology, fintech, insurance, government and other sectors. A pulse survey was conducted in October and November 2024 to identify tensions – “disharmony” – stemming from issues such as fraud, cyberthreats, human errors, operational inefficiencies and regulatory complexities, while also exploring the potential growth opportunities these challenges might present. The second survey, conducted in November and December 2024, collected detailed insights into how organizations are implementing strategies to mitigate disharmony. Data for both surveys was collected using computer-assisted telephone interviewing (CATI) and online methodologies.

FIS is a financial technology company providing solutions to financial institutions, businesses, and developers. We unlock financial technology to the world across the money lifecycle underpinning the world’s financial system. Our people are dedicated to advancing the way the world pays, banks and invests, by helping our clients to confidently run, grow, and protect their businesses. Our expertise comes from decades of experience helping financial institutions and businesses of all sizes adapt to meet the needs of their customers by harnessing where reliability meets innovation in financial technology. Headquartered in Jacksonville, Florida, FIS is a member of the Fortune 500® and the Standard & Poor’s 500® Index. To learn more, visit FISglobal.com. Follow FIS on LinkedIn, Facebook and X.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250515135384/en/

Contacts

For More Information

Kim Snider, 904.438.6278

Senior Vice President

FIS Global Marketing and Communications

kim.snider@fisglobal.com