Just when you think it’s safe to “get back in the water,” Intel (NASDAQ: INTC) comes out with an earnings report that has every semiconductor name from Micron (NASDAQ: MU) to KLA Corporation (NASDAQ: KLAC) moving lower. The takeaway from the Intel report is that weakness in all segments, not just the core segment, was compounded by inventory bloat that points to troubled times for the entire semiconductor industry.

The takeaway in this instance is that upgrading, expansion and shifts toward next-gen technology are still going on and supporting business for the likes of KLA Corporation and other semiconductor infrastructure stocks.

"The December quarter marked another strong period of growth and profitability, as we navigated through marketplace volatility and supply chain challenges. As the semiconductor industry manages capacity adjustments in calendar 2023 following three years of substantial growth, KLA is well positioned to maintain our technology leadership through continued investment in next-generation products that help enable our customers' technology roadmaps," said Rick Wallace, president and CEO of KLA Corporation.

KLA Corporation Beats And Guides For Stability

KLA Corporation not only beat the consensus estimates on the top and bottom line but it is guiding for a modicum of stability in a very uncertain world. The company’s $2.98 billion in net revenue is up 26.8% versus last year and beat the Marketbeat.com consensus estimate by more than 500 basis points as well.

That is well above the S&P 500 average in the earnings cycle and puts KLA Corporation in a good position in this regard.

The margins were pressured and slightly more than expected but not by much and not enough to offset the top-line strength. The company’s net income margin contracted about 180 basis points sequentially and 100 bps YOY but left the adjusted EPS up YOY and well ahead of the consensus.

The great news is the $7.38 in adjusted EPS is up 32% YOY due to the combination of top-line strength and share repurchases.

KLA Corporation Is Generating Cash And Giving It To Shareholders

Share repurchases and capital returns will support this stock moving forward. The company’s cash flow is relatively unimpeded, resulting in high FCF and capital returns. The company’s FCF in Q2 was 19.95% of revenue; almost 90% of that was returned to shareholders through dividends and share repurchases.

The company paid about $184 billion in dividends for an annualized yield of 1.2%, which is relatively low but compounded by nearly double that amount in share repurchases. This company is a dividend grower as well, so it should be expected to increase the payout in 2023.

The guidance for Q3 is somewhat mixed but in line with the consensus estimates. The guidance for revenue and earnings is mixed because the range brackets the consensus nicely and is very wide. This leaves much room for under and over-performance, although the bias is toward the upside given the Q2 strength.

If earnings come in on the weakside, they shouldn’t impact the dividend or growth. The company can always cut back on share repurchases to free up capital.

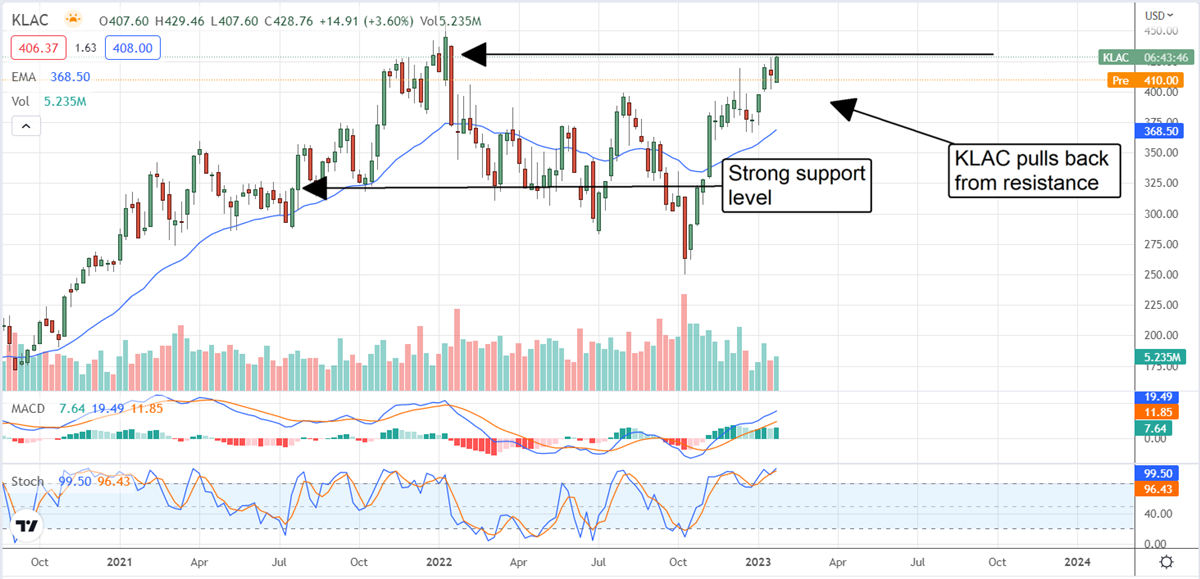

The Technical Outlook: KLA Corporation Pulls Back From Resistance

KLA Corporation was on the verge of moving up to a new high but is now confirming the presence of resistance at these levels. The stock is down about 2.0% in premarket trading and may move lower, but there are many support targets between $410 and $300 where firm support should be expected.

Once the stock shows a bottom, it will become a buy. Until then, it looks like a hold-em-if-you-got-em situation that pays 1.2% and is buying back shares like mad.